この記事は、私(@mifsee)が個人的に勉強しながら企業分析を行っており、それらのアウトプットしたものです。

あくまでも個人の分析記録のため。内容には、一部間違いや事実と異なる点が含まれている場合があるかもしれません。ご覧になる場合は予めご了承ください。

投資助言や株式購入を促すものではありません。

- はじめに

- アドバンスド・マイクロ・デバイセズ(AMD)は何の会社?

- AMDの代表的な製品は?

- AMDのセグメント別の売上比率は?

- AMDの顧客層は?

- AMDの取引市場は?

- AMDのセクター、業種、属するテーマは?

- AMDの会社設立と上場したのはいつ?

- 配当は?

- AMDが属する業界の規模と成長性は?

- AMDの競合企業は?

- AMDの競合との差別化要素と優位性は?

- AMDの今後の展開は?

- Instinct MI300とは?

- APUとは?メリットは?

- AMDの業績について

- AMDの株価、現在価格

- AMDの成長戦略は?

- AMDのCPU市場のマーケットシェアは?

- AMDがザイリンクスを買収したことで得られるメリット・デメリットは?

- 半導体セクター全体の動きは?

- AMDの今後の展開と将来性は?

- AMDの2023年度Q3決算サマリー

- AMDの2023年度Q2決算サマリー

- AMDの2023年度Q1決算サマリー

- AMDの株を買える証券会社は?

- まとめ

はじめに

投資や財務、決算に関する基礎知識がない方にも理解しやすい内容で、アドバンスド・マイクロ・デバイセズ(AMD)の各ビジネスセグメントのパフォーマンス、新製品のリリース、そして市場全体の状況とのAMDの今後の将来性について詳しく見ていきます。

AI市場がChatGPTのリリースにより一躍注目の的となり、その中心にあるのが半導体セクターです。

AIの動作を支える根幹技術として、このセクターは業界内外から熱い視線を集めています。

特に、半導体業界のキープレイヤーであるアドバンスド・マイクロ・デバイセズ(AMD)に焦点を当て、その企業分析から業績、そして将来の成長見通しに至るまで、詳細にわたり掘り下げていきます。

投資や財務に関する専門知識がない読者の方々にも分かりやすく、AMDの各ビジネスセグメントの成績、最新製品のリリース、今後の展望と将来性について見ていきます。

アドバンスド・マイクロ・デバイセズ(AMD)は何の会社?

- アドバンスド・マイクロ・デバイセズ(AMD)は、半導体を設計・製造するアメリカの多国籍企業。

- AMDは、マイクロプロセッサ(特にパソコンやサーバー向けのもの)、グラフィックス、組み込みプロセッサなどの製品を提供。

- その製品は、ゲーム、データセンター、自動車、航空、防衛などの広範な分野で使用されている。

- AMDは、マイクロプロセッサ市場ではIntel、グラフィックスプロセッサ市場ではエヌビディアが主要な競合他社となる。

- AMDは世界初のx86アーキテクチャをベースにした8コアデスクトッププロセッサを発表、高性能なグラフィックスカードのRadeonシリーズを開発しシェアを伸ばしている。

- これらの技術は、パソコン、ゲーム機、データセンター、スーパーコンピューターなど、デジタルデバイスとインフラの幅広い分野で使用されている。

- AMDの製品は、高性能コンピューティング、3Dグラフィックス、仮想現実、人工知能などの応用に不可欠な部品要素となっている。

AMDの会社概要は以下

- 会社名: アドバンスド・マイクロ・デバイセズ(Advanced Micro Devices, Inc.)

- 設立年:1969年

- 本社所在地:カリフォルニア州サンタクララ

- 創業者:ジェリー・サンダース(Jerry Sanders)および他の共同創業者

- CEO:リサ・スー(Lisa Su)

リサ・スー博士は、2014年10月からAMDのCEOを務めており、そのリーダーシップのもとでAMDは半導体業界において顕著な成長と革新を遂げている。

AMDの代表的な製品は?

CPU(Central Processing Unit)

AMDは、高性能なデスクトップ、ノートパソコン、サーバー向けのCPUを製造している。

- Ryzen:デスクトップとノートブックの市場における主要な製品。ゲーム、クリエイティブな作業、一般的な生産性向けのタスクに適している。

- Threadripper:AMDの高性能デスクトップ向けCPU。高度でクリエイティブな作業やデータ解析に適している。

- EPYC:サーバーとデータセンター向けに設計され、高度なセキュリティ機能と業界をリードする多コア性能を持つ。

GPU(Graphics Processing Unit)

AMDは、Radeonブランドの下で高性能なグラフィックカードを製造している。

これらのカードは、ゲーム、ビデオ編集、3Dレンダリングなどの高度なグラフィックに使用されます。また、AMDはRadeon Proというプロフェッショナル向けのGPUも提供している。

APU(Accelerated Processing Unit)

APUは、CPUとGPUを1つのチップに統合したもの。

RyzenやAthlonのブランド名で販売。特にモバイルデバイスや予算を重視する消費者に人気がある。

AMDのセグメント別の売上比率は?

AMDの2023年第1四半期の収益報告によると、AMDの総収益は54億ドル。

主要な製品セグメントの収益とその比率は以下の通り。

- データセンターセグメント:収益12億9500万ドル。24%

- クライアントセグメント:収益7億3900万ドル。14%

- ゲームセグメント:収益17億5700万ドル。33%

- 組み込みセグメント:収益15億6200万ドル。29%

AMDの顧客層は?

- エンドユーザー:

AMDの製品は、ゲームやクリエイティブを専門とする個人ユーザーに広く使われている。

これらのユーザーは、AMDのRyzen CPUやRadeon GPUを使って、ゲーム、ビデオ編集、3Dレンダリングなどのパフォーマンスが求められるタスクを行っている。 - パソコンメーカー:

パソコンメーカーが製造するためにAMDのCPUとGPUを大量に使用する。

Dell、HP、Lenovoなどの大手パソコンメーカーは、AMDの製品を使用したパソコンを提供している。 - サーバーとデータセンター:

AMDのEPYCサーバーCPUは、データセンターや、Amazon Web Services(AWS)、Microsoft Azureなどのクラウドサービスで広く使われている。

これらの企業は、高性能で効率的なデータ処理が必要なため、AMDの製品を採用している。 - ゲームソフトメーカー:

SonyのPlayStationとMicrosoftのXboxで、カスタムのCPUとGPUを提供している。 - 組み込みシステムメーカー:

組み込みシステム向けのプロセッサは、ネットワーク機器、デジタルサイネージ、医療機器など、専門的な分野で使用されている。 - 教育と研究機関:

大学や研究機関は、高性能計算(HPC)やAI研究のために、AMDの高性能CPUとGPUを使用している。

AMDの取引市場は?

AMDは、NASDAQ市場で取引されている。

AMDのセクター、業種、属するテーマは?

セクターは「Technology」に分類され、「半導体 」の業種に属している。

主要な株式テーマとしては、以下に属している

- 半導体関連

- ChatGPT関連

- メタバース関連

- ブロックチェーン関連

AMDの会社設立と上場したのはいつ?

- AMD(Advanced Micro Devices)は、1969年にサニーベール、カリフォルニアで設立。

- 設立者は、ジェリー・サンダースとその7人の同僚で、彼らは全員フェアチャイルドセミコンダクターの出身。

- AMDは、1972年にNASDAQ(ナスダック)で上場。

- 成長を続け、2000年代には、パソコン向けの高性能マイクロプロセッサで市場をリードする企業の一つとなる。

配当は?

実施せず

AMDが属する業界の規模と成長性は?

AMDは半導体業界に属しており、特にプロセッサ(CPU)およびグラフィックスプロセッサ(GPU)の市場に重点を置く。

半導体製品は、パソコン、スマートフォン、サーバー、ネットワーク機器、消費者向け電子機器、産業用機器などが含まれ、テクノロジーの進歩、デジタル化の加速、データセンターの拡大、AIと機械学習への需要増加、5GとIoTの普及など、多くの要因により成長が見込まれる。

AMDの競合企業は?

- インテル(Intel):

インテルは、マイクロプロセッサ(CPU)市場のリーダーで、AMDと長い間競争を続けている。 - エヌビディア(NVDA):

エヌビディアは、グラフィックスプロセッサユニット(GPU)の開発と製造が中心。

NVIDIAのGPUは、ゲーム、BIツール等のプロフェッショナルビジュアライゼーション、データセンターなど、幅広いアプリケーションで使用されている。AMDとNVIDIAは、特にゲームとAIアプリケーション向けのGPU市場で競争している。 - ARMホールディングス(ARM):

ARMは、モバイルデバイス向けに広く用いられるCPUコアの設計を行っている。

AMDは、ARMの技術を利用した製品も提供している一方で、ARMの技術を基にした他の半導体企業とも競争している。 - クアルコム(QCOM):

クアルコムは、モバイルデバイス向けのCPUと無線通信チップの開発と製造で知られている。AMDとクアルコムは、特にモバイルデバイスと無線通信技術の市場で競争している。

AMDの競合は幅広く、製品、市場により異なる。

AMDの競合との差別化要素と優位性は?

- 高性能CPUとGPU:

AMDは、高性能のCPU(RyzenとEPYCシリーズ)とGPU(Radeonシリーズ)を提供しており、幅広い分野で高く評価されており、パフォーマンス、エネルギー効率、価格などの面で競争力がある。 - 技術革新:

AMDは、7nmおよび5nmの製造プロセスを採用するなど、技術革新に力を入れており、高いパフォーマンスと効率を提供している。 - GPUが統合されたAPU:

AMDは、CPUとGPUを統合したAPU(Accelerated Processing Unit)を開発している。

パソコン、ゲーム機、大規模システムの分野で非常に高い競争力を持っている。 - 価格競争力:

AMDは、同等の性能を提供する競合製品に比べて、より手頃な価格で製品を提供している。 - パートナーシップと協力関係:

AMDは、Microsoft、Sony、Samsungなどの大手企業とのパートナーシップと協力関係を通じて、新製品の開発と販売を強化している。

AMDは競争が激しい市場で活動しているが、インテルはGPUを生産しておらず、エヌビディアはCPUを生産していないため、AMDはGPU、CPUどちらも統合されたチップ(APU)の提供でさらなる競合優位性につながると見られている。

AMDの今後の展開は?

- AMDは、2022年の後半に、データセンターのサーバー向けに非常に性能の高いCPUを発売。

- エヌビディアの高性能GPU「H100(最新型データセンター用)」に匹敵する「AMD Instinct Platform」のリリースをアナウンス。

- ChatGPTをはじめとするGenerativeAIのニーズが高まり、AIサーバー向けとして、「MI300」に関心が寄せられている。

- データセンター向けのAI GPU市場で、エヌビディアが独壇場でシェアをとっているAIスーパーコンピュータのシェアを、AMDが奪いにいく可能性。

- 人工知能(AI)研究開発のため、アイルランドに最大1億3500万ドル(約190億円)の投資を発表。データセンターや6G(第6世代移動通信)の開発を進める。

通常ディープラーニングではデータトレーニングするには、GPUが効率的に動くが、推論などにはCPUを使う方が効率的である。

エヌビディアの「H100」はGPUのみであり、AMDの「MI300」は、APU(GPUとCPU)を搭載しているため効率化と価格的にもエヌビディアより安いため、競争力が高く、エヌビディアが独占しているデータセンター向けのAI GPU市場でAMDがAIスーパーコンピュータのシェアを部分的に奪っていくかどうか注目されている。

Instinct MI300とは?

出典:AMD Instinct™ MI300 Series Accelerators

- Instinct MI300はCPUとGPUとHBM3を1つ搭載。

- CPUダイとGPUダイ、さらにHBM3メモリーまでを1つのパッケージに収めたAPUの構造。

- 性能が従来の8倍向上し、データセンター向けに第4四半期に投入予定と発表。(2023年12月予定通りリリース)

- ラインナップは、GPU単体の「Instinct MI300A」、CPU+GPUの構成となる「Instinct MI300X」、Instinct MI300Xを8基まとめて搭載した「Instinct MI300X Platform」の3種類。

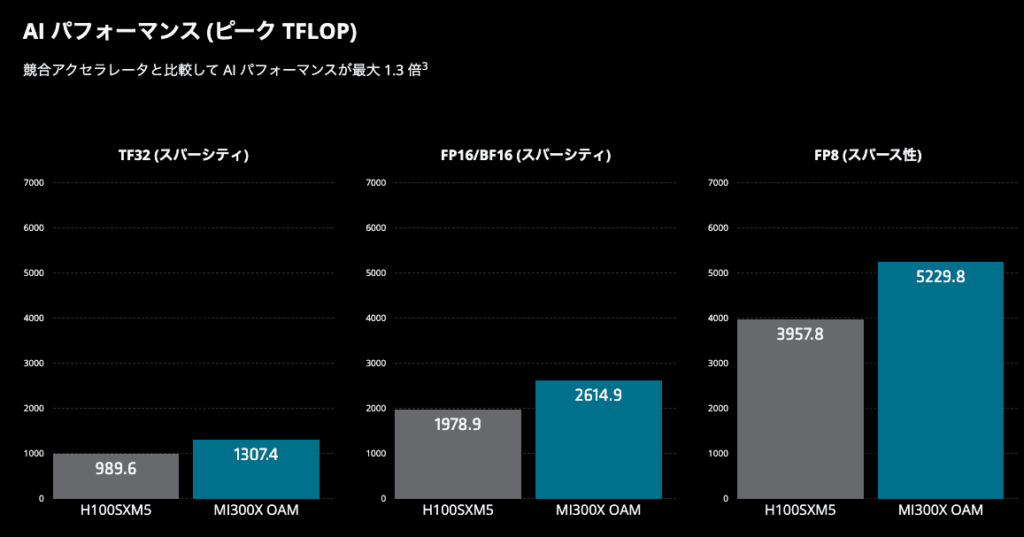

「Instinct MI300シリーズ」は「NVIDIA H100」を超えるパフォーマンス

出典:AMD Instinct™ MI300 Series Accelerators

- エヌビディアのGPU「H100」を上回るスペックを持つとされ、AIパフォーマンスでは、最大1.3倍、HPCパフォーマンスでは、最大 2.4 倍と発表。

APUとは?メリットは?

- APU(Accelerated Processing Unit)とは、1つ以上のCPUと、GPU(グラフィックスアクセラレータ)が組み合わさったAMD社のプロセッサ。

- CPUとGPUが組み合わさっていることによる低コスト化を実現。

- CPUとGPUが組み合わさっていることでデータ回路が減少し、消費電力の低減が可能。

- CPUとGPUが離れている場合よりもデータのアクセスが効率的に行え、処理スピードの高速化が可能。

- 高精度なグラフィックス処理性能ではビデオカードが必要となるが、一般的なパソコン用途やゲーム用途であれば、ビデオカードが不要となるため、物理的な省スペース化が実現。

- APUのデメリットとしては、APUに統合されたGPUのパフォーマンスは独立したGPUカードに比べて一般的に低くなる。高度なグラフィックスや計算処理を必要とするアプリケーションには、独立したGPUカードがより適している場合がある。

ここからは、AMDの業績について見ていきます。

AMDの業績について

まずは、AMDの最低限の業績分析を行なうための、以下の4つの指標を確認していきます。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

各データは、Investing.com、TradingViewより参照。

AMDの株価、現在価格

AMDの株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

AMDの四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2021:Q1 | 3180 | 3440 | — | |

| 2021:Q2 | 3620 | 3850 | — | |

| 2021:Q3 | 4110 | 4310 | — | |

| 2021:Q4 | 4520 | 4830 | — | |

| 2022:Q1 | 5010 | 5890 | 71.22% | |

| 2022:Q2 | 6530 | 6550 | 70.13% | |

| 2022:Q3 | 5650 | 5570 | 29.23% | |

| 2022:Q4 | 5510 | 5600 | 15.94% | |

| 2023:Q1 | 5300 | 5350 | -9.17% | |

| 2023:Q2 | 5320 | 5360 | -18.17% | |

| 2023:Q3 | 5690 | 5800 | 4.13% | |

| 2023:Q4 | 6130 | 6170 | 10.18% | |

| 2024:Q1 | 5480 | 5470 | 2.24% | |

| 2024:Q2 | 5730 | 5830 | 8.77% | |

| 2024:Q3 | 6710 | 6820 | 17.59% | |

| 2024:Q4 | 7530 | 7660 | 24.15% | |

| 2025:Q1 | 7120 | 7440 | 36.01% | |

| 2025:Q2 | 7410 | 7680 | 31.73% | |

| 2025:Q3 | 8760 | 9250 | 35.63% | |

| 2025:Q4 | — | 9620 | — | — |

| 単位:百万ドル | ||||

AMDの四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2021:Q1 | 898 | 26.10% | 832 | |

| 2021:Q2 | 952 | 24.73% | 888 | |

| 2021:Q3 | 849 | 19.70% | 764 | |

| 2021:Q4 | 822 | 17.02% | 736 | |

| 2022:Q1 | 995 | 16.89% | 924 | |

| 2022:Q2 | 1040 | 15.88% | 906 | |

| 2022:Q3 | 965 | 17.32% | 842 | |

| 2022:Q4 | 567 | 10.13% | 443 | |

| 2023:Q1 | 486 | 9.08% | 328 | |

| 2023:Q2 | 379 | 7.07% | 254 | |

| 2023:Q3 | 421 | 7.26% | 297 | |

| 2023:Q4 | 381 | 6.18% | 242 | |

| 2024:Q1 | 521 | 9.52% | 379 | |

| 2024:Q2 | 593 | 10.17% | 439 | |

| 2024:Q3 | 628 | 9.21% | 496 | |

| 2024:Q4 | 1300 | 16.97% | 1090 | |

| 2025:Q1 | 939 | 12.62% | 727 | |

| 2025:Q2 | 2010 | 26.17% | 1730 | |

| 2025:Q3 | 2160 | 23.35% | 1900 | |

| 単位:百万ドル | ||||

AMDの四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2021:Q1 | 673 | 19.56% | |

| 2021:Q2 | 840 | 21.82% | |

| 2021:Q3 | 953 | 22.11% | |

| 2021:Q4 | 1210 | 25.05% | |

| 2022:Q1 | 868 | 14.74% | |

| 2022:Q2 | 661 | 10.09% | |

| 2022:Q3 | -21 | -0.38% | |

| 2022:Q4 | -102 | -1.82% | |

| 2023:Q1 | -44 | -0.82% | |

| 2023:Q2 | 6 | 0.11% | |

| 2023:Q3 | 253 | 4.36% | |

| 2023:Q4 | 397 | 6.43% | |

| 2024:Q1 | 62 | 1.13% | |

| 2024:Q2 | 259 | 4.44% | |

| 2024:Q3 | 765 | 11.22% | |

| 2024:Q4 | 1090 | 14.23% | |

| 2025:Q1 | 806 | 10.83% | |

| 2025:Q2 | -134 | -1.74% | |

| 2025:Q3 | 1270 | 13.73% | |

| 単位:百万ドル | |||

AMDの四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2021:Q1 | 0.44 | 0.52 | 0.08 | |

| 2021:Q2 | 0.54 | 0.63 | 0.09 | |

| 2021:Q3 | 0.66 | 0.73 | 0.07 | |

| 2021:Q4 | 0.76 | 0.92 | 0.16 | |

| 2022:Q1 | 0.91 | 1.13 | 0.22 | |

| 2022:Q2 | 1.03 | 1.05 | 0.02 | |

| 2022:Q3 | 0.69 | 0.67 | -0.02 | |

| 2022:Q4 | 0.67 | 0.69 | 0.02 | |

| 2023:Q1 | 0.56 | 0.6 | 0.04 | |

| 2023:Q2 | 0.57 | 0.58 | 0.01 | |

| 2023:Q3 | 0.68 | 0.7 | 0.02 | |

| 2023:Q4 | 0.77 | 0.77 | 0 | |

| 2024:Q1 | 0.62 | 0.62 | 0 | |

| 2024:Q2 | 0.68 | 0.69 | 0.01 | |

| 2024:Q3 | 0.92 | 0.92 | 0 | |

| 2024:Q4 | 1.08 | 1.09 | 0.01 | |

| 2025:Q1 | 0.94 | 0.96 | 0.02 | |

| 2025:Q2 | 0.48 | 0.48 | 0 | |

| 2025:Q3 | 1.17 | 1.2 | 0.03 | |

| 2025:Q4 | — | 1.31 | — | — |

| 単位:百万ドル | ||||

AMDの通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 年度(通期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2016年 | — | 4240 | 4270 | — |

| 2017年 | 5260 | 5330 | 24.82% | |

| 2018年 | 6500 | 6470 | 21.39% | |

| 2019年 | 6710 | 6730 | 4.02% | |

| 2020年 | 9530 | 9760 | 45.02% | |

| 2021年 | 16130 | 16430 | 68.34% | |

| 2022年 | 23520 | 23600 | 43.64% | |

| 2023年 | 22670 | 22680 | -3.90% | |

| 2024年 | 25670 | 25790 | 13.71% | |

| 2025年 | — | 33100 | — | — |

| 2026年 | — | 40240 | — | — |

| 2027年 | — | 47400 | — | — |

| 2028年 | — | 62260 | — | — |

| 単位:百万ドル | ||||

AMDの通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 年度(通期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2016年 | — | 90.00 | 2.11% | 13 |

| 2017年 | 12 | 0.23% | -101 | |

| 2018年 | 34 | 0.53% | -129 | |

| 2019年 | 493 | 7.33% | 276 | |

| 2020年 | 1070 | 10.96% | 777 | |

| 2021年 | 3520 | 21.42% | 3220 | |

| 2022年 | 3560 | 15.08% | 3120 | |

| 2023年 | 1670 | 7.36% | 1120 | |

| 2024年 | 3040 | 11.79% | 2400 | |

| 単位:百万ドル | ||||

AMDの通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 年度(通期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2016年 | — | -469 | -10.98% |

| 2017年 | 67 | 1.26% | |

| 2018年 | 456 | 7.05% | |

| 2019年 | 589 | 8.75% | |

| 2020年 | 1,380 | 14.14% | |

| 2021年 | 3,680 | 22.40% | |

| 2022年 | 1,610 | 6.82% | |

| 2023年 | 625 | 2.76% | |

| 2024年 | 2220 | 8.61% | |

| 単位:百万ドル | |||

AMDの通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 年度(通期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2016年 | — | -0.15 | -0.14 | 0.01 |

| 2017年 | 0.14 | 0.17 | 0.03 | |

| 2018年 | 0.45 | 0.46 | 0.01 | |

| 2019年 | 0.62 | 0.64 | 0.02 | |

| 2020年 | 1.24 | 1.29 | 0.05 | |

| 2021年 | 2.65 | 2.79 | 0.14 | |

| 2022年 | 3.5 | 3.5 | 0 | |

| 2023年 | 2.65 | 2.65 | 0 | |

| 2024年 | 3.31 | 3.31 | 0 | |

| 2025年 | — | 3.91 | — | — |

| 2026年 | — | 6.03 | — | — |

| 2027年 | — | 7.66 | — | — |

| 単位:百万ドル | ||||

AMDの成長戦略は?

AMDの2023年第1四半期の決算報告から見られる、成長への戦略的焦点をまとめると、

- データセンターと組み込みシステム:

これらのセグメントは、第1四半期の収益の50%以上を占めている。引き続きこれらのセグメントでの成長を期待している。 - AIと機械学習:

AIのニーズに応える新しいツールとフレームワークを提供。 - クラウドコンピューティング:

データセンター向けの領域でのパフォーマンスとエネルギー効率を向上させるプロセッサを提供。 - モバイルプロセッサー:

新しいモバイルプロセッサを発表し、これらのプロセッサを使用した新しい商用、消費者、ゲーム体験を強化。 - パートナーシップ:

AMDはSamsungとの長期間の合意を更新。 - グラフィックスとゲーム:

新しいプロフェッショナルグラフィックスカードを発表。

AMDは業界のトレンドに対応し、新製品とテクノロジーのラインナップの拡大を目指している。

AMDのCPU市場のマーケットシェアは?

市場調査企業のMercury ResearchによるAMDのCPUマーケットシェアの推移。

- 2022年第2四半期からの、DesctopCPUとMobillityCPUの在庫調整による下落はあるものの、全体としてシェアを堅調に伸ばしている。

- ServerCPUにおいても、2022年から急速にシェア拡大している。

AMDがザイリンクスを買収したことで得られるメリット・デメリットは?

ザイリンクスとは、FPGA(フィールドプログラマブルゲートアレイ)を中心としたプログラマブルロジックデバイスを開発する半導体製造企業。

ザイリンクス買収の目的とメリット

- 買収した主な目的は、AMDの製品ポートフォリオの拡大、特にデータセンター市場での競争力を強化すること。

- FPGAは、機械学習、通信インフラストラクチャ、クラウドコンピューティングなどの高成長市場で幅広く使われており、ザイリンクスのFPGA技術を取り入れることで、AMDは更なる競争力を強化するねらい。

デメリット

- かなり高額な買収案件のためのれん代の償却費が嵩むと想定され、財務的リスクが増える。

半導体セクター全体の動きは?

半導体セクターにおける主要な企業は、AMD、NVIDIA、Intel、TSMC。

企業ごとの主要なポイントは以下。

- Intel(インテル):

2023年1月に開発名「Sapphire Rapids」(サファイアラピス)という新型のサーバー用CPUを発売。Intelはサーバー用CPU市場で約80%のシェアを持っていますが、ここ数年、新製品の投入が遅れている。

しかし、この新型CPUのリリースにより、Intelのサーバー向けやデータセンター向けの売上が回復する可能性がある。 - AMD(アドバンスト・マイクロ・デバイセズ):

AMDはIntelのシェアを削って成長してきた企業である。

新しいIntelの製品が市場に出ることで、新たな成長の機会が出てくる可能性があります。 - NVIDIA(エヌビディア):

NVIDIAはデータセンター向けに強いGPUを提供しており、その市場が拡大すると、NVIDIAも更にGPUを出荷できる可能性がある。 - TSMC(Taiwan Semiconductor Manufacturing Company):

TSMCもAMDやNVIDIAと同様に売上は横ばいあるいは若干増加の傾向。

半導体企業の動向は特にIntelの新型CPUの売上動向や、その影響による市場全体の動きが注目されています。

また、DRAM(Dynamic Random Access Memory)において、IntelとAMDの新型CPUは、より高速で高性能なDDR5というDRAMの規格を採用している。

これにより、DRAMメーカーの平均単価が上がり、採算改善に寄与する可能性がある。

AMDの今後の展開と将来性は?

AMの今後の展開と将来性については、以下のポイントが注目される。

- 半導体市場の成長:半導体業界は引き続き成長しており、AMDはこの市場で重要な役割を果たしている。クラウドコンピューティング、データセンター、AI、ゲーミングなどの分野での需要増加が、AMDの成長を後押しする。

- 製品ラインの拡大:AMDは、高性能なCPUとGPUの開発に注力している。特に、RyzenシリーズのCPUとRadeonシリーズのGPUは市場で高い評価を受けており、これらの製品ラインの拡充が期待されている。

- データセンターとクラウド市場:AMDは、データセンター向けのEPYCプロセッサによって市場シェアを拡大している。クラウドプロバイダーや大企業からの需要が増加しており、これが収益の大きな源泉となっている。

- AIの進展:AMDはパートナーと共にAIの未来を推進している。 AMDは、高性能なCPUとGPUの開発に注力しており、新しいAMD Instinct™ MI300シリーズやAMD Ryzen™プロセッサーなどが注目されている。

- 競争環境:IntelやNVIDIAといった競合他社との競争は激しく、これらの企業も継続的に革新的な製品を市場に投入している。AMDは、技術革新とコスト競争力を維持することが重要。

- 技術革新:AMDは、製造プロセスの改善や新しいアーキテクチャの開発に注力している。特に、5nmプロセス技術の採用や、次世代のアーキテクチャへの移行は、性能向上と効率性の向上に寄与する。

総じて、AMDは技術革新と市場の動向に敏感に対応することで、今後も半導体業界で重要なプレイヤーとしての地位を維持し、成長を続ける可能性が高いと考えられる。

ただし、市場の変動や競争環境の変化には注意が必要。

AMDの2023年度Q3決算サマリー

売上高と収益

- 売上高: 68億ドルで前年同期比18%増。データセンター部門とクライアント部門の売上増が牽引。

- GAAPベースの純利益: 7億7,100万ドル、1株当たり利益は0.47ドルで前年同期比大幅増加。

- Non-GAAPベースの純利益: 15億4,000万ドル、1株当たり利益は0.92ドルと前年同期比31%増。

部門別の成長

- データセンター部門: 売上35億ドルで前年同期比122%増。特にInstinct GPUおよびEPYC CPUの販売が好調。

- クライアント部門: 売上18億8,100万ドルで前年同期比29%増。Ryzenシリーズの高い需要が寄与。

- ゲーム部門: 売上は4億6,200万ドルで前年同期比69%減。セミカスタム製品の需要低下が影響。

- 組み込み部門: 売上は9億2,700万ドルで前年同期比25%減少。顧客の在庫調整が影響するも、需要は回復傾向。

キャッシュフローと株主還元

- 営業キャッシュフロー: 6億2,800万ドル。

- フリーキャッシュフロー: 4億9,600万ドル。

将来ガイダンス

- 第4四半期の売上予測: 売上は約75億ドルと予測。データセンターとAI分野の需要拡大が期待される。

- Non-GAAP粗利益率: 54%を見込む。

AMDは、データセンターおよびAI市場でのシェア拡大を目指し、今後も成長を続ける方針を発表。

AMDの2023年度Q2決算サマリー

売上高と収益

- 売上高: 58億3,500万ドルで、前年同期比9%増。主にデータセンターおよびクライアント部門の成長が寄与。

- GAAPベースの純利益: 2億6,500万ドルで、前年同期から大幅増加。1株当たりの利益は0.16ドル。

- Non-GAAPベースの純利益: 11億2,600万ドル、1株当たり0.69ドルと前年同期比で増加。

部門別の成長

- データセンター: 売上は28億3,400万ドルで、前年同期比115%増加。特にAMD Instinct GPUおよび4世代目EPYC CPUの需要が成長を牽引。

- クライアント部門: 売上は14億9,200万ドルで前年同期比49%増。AMD Ryzenプロセッサの売上増が要因。

- ゲーム: 収益は前年同期比59%減少。セミカスタム製品の売上が低迷。

- 組み込み部門: 売上は8億6,100万ドルで、前年同期比41%減少。顧客の在庫調整が影響。

キャッシュフローと株主還元

- 営業キャッシュフロー: 5億9,300万ドルで前年同期より改善。

- フリーキャッシュフロー: 4億3,900万ドル。主に営業活動からのキャッシュフロー増加によるもの。

将来ガイダンス

- 第3四半期の売上予測: 67億ドルを予測し、前年同期比で16%増加を見込む。

- Non-GAAPベースの予測: 売上の中間値に基づく粗利益率は53.5%の見込み。

AMDは今後もAIとデータセンター分野での需要増加を見込んでおり、特に次世代プロセッサやGPUの投入を通じて市場での競争力を強化する方針。

AMDの2023年度Q1決算サマリー

売上高と収益

- 売上高: 55億ドルで前年同期比2%増加。データセンターおよびクライアント部門の成長が、ゲームおよび組み込み部門の減収を一部相殺。

- GAAPベースの純利益: 1億2,300万ドル、1株当たり利益は0.07ドル。

- Non-GAAPベースの純利益: 10億1,300万ドル、1株当たり利益は0.62ドル。いずれも前年同期比で増加。

部門別の成長

- データセンター部門: 売上は23億ドルで前年同期比80%増。特にAMD Instinct GPUおよび第4世代EPYC CPUの需要が大幅に増加。

- クライアント部門: 売上は13億7,000万ドルで前年同期比85%増。主にAMD Ryzenシリーズの販売が寄与。

- ゲーム部門: 売上は9億2,200万ドルで前年同期比48%減少。Radeon GPUおよびセミカスタム製品の需要低下が影響。

- 組み込み部門: 売上は8億4,600万ドルで前年同期比46%減少。顧客の在庫調整が影響。

キャッシュフローと株主還元

- 営業キャッシュフロー: 5億2,100万ドル。

- フリーキャッシュフロー: 3億7,900万ドル。

将来ガイダンス

- 第2四半期の売上予測: 売上は約57億ドルと予測。AI関連の需要増加が期待される。

- Non-GAAP粗利益率: 53%を見込む。

AMDは、AI技術およびデータセンター分野における成長を見込み、今後も次世代プロセッサやGPUを通じて競争力を強化し、さらなる売上と利益成長を目指す方針。

AMDの株を買える証券会社は?

AMDの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| 三菱UFJ eスマート証券(旧社名:auカブコム証券) | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ◯ |

| moomoo証券 | ◯ | ✕ |

まとめ

- AMDは、PC、ゲーム、データセンター、組み込みシステムといった多様な市場で、高性能な半導体製品を提供し、影響力は増大の一途を辿っている。

- ザイリンクスの買収は、その一環として、AMDが新たな市場での競争力を拡大しようとしている明確な動き。

- しかし、近期の決算報告では、クライアント部門が苦戦しているが、データセンターや組み込み部門では、堅調な成長を見せている。AMDの多角化戦略が功を奏しており成長に期待ができる。

- 一方で、研究開発費は増加傾向にあり、新技術の開発と市場での競争力を維持するための投資である。AMDが投資対象として魅力的である理由を示している。

以上から、AMDは投資家にとって引き続き注目すべき企業であると言える。