テクノロジーの進化がもたらす新しい投資スタイルとして「AI投資」が急速に浸透してきました。

中でも、ロボアドバイザー「FOLIOのROBOPRO(ロボプロ)」は、その先進的なアプローチで多くの投資家の注目を集めています。

しかし、「AI投資」や「ロボアドバイザー」という言葉を耳にするものの、具体的にどのようなものなのか、また、特徴やメリットは何なのか、といった疑問を持つ方も多いでしょう。

人気のロボアドバイザーでは、「ウェルスナビ」「ロボプロ」「テオ」などが知られてますが、その中で私は「ロボプロ」を選択し、3年近く利用してきました。

この記事では、AI投資の基本的な概念から、私が利用してきた中で感じたロボプロの特徴、メリット・デメリット、そして具体的な利用方法から評判まで、詳しく解説します。

投資初心者の方から経験者の方に向け、この記事を通じて「ROBOPRO(ロボプロ)」に関する疑問や不安を解消し、投資判断を下す一助となれば幸いです。

ROBOPRO(ロボプロ)とは?どんなサービス?

ROBOPRO(ロボプロ)は、日本の金融大手、SBIグループ傘下の株式会社FOLIOが提供する、投資のパフォーマンス最大化を目指す全自動の資産運用サービス。

その最大の特徴は、AI技術を駆使して金融市場の動向を予測し、その結果を基に投資配分を最適化すること。

プロのファンドマネージャーが運用する最先端の投資を、AIの活用によって個人が手軽にできるものとして、2020年1月にリリースされた。

ロボプロの具体的な特徴は?

AIを活用した先進的な将来予測

ロボプロは、AI技術を駆使して金市場や経済全体の動きをリアルタイムで分析。

景気の変動や金融市場の変化、リスク要因を予測し、幅広い市場状況に対して柔軟かつ効率的な投資戦略を提供する。

特にAIを活用することで、人間の感情に左右されない精密なリスク管理と市場予測を行うことが可能となる。

AlpacaTech社との先端技術による共同開発

ROBOPROは、AI技術で業界をリードするAlpacaTech社と共同開発された最先端のロボアドバイザーサービス。AIが40以上の先行指標を包括的に解析し、経済の大局的なトレンドから細かな市場の動きまで幅広くカバー。これにより、次なる市場の動向を的確に捉え、効率的な投資ポートフォリオの運用をサポートしている。

柔軟且つ大胆なリバランス戦略で市場変動に対応

ロボプロは、AIの高度な分析結果に基づいて、投資配分を柔軟かつ戦略的にリバランスを行う。

状況に応じて、大胆な調整も行い、ポートフォリオの最適化を図ります。

投資対象には、米国ETFや国際株式を含む幅広いアセットクラスが採用されており、主要ETFには「VTI」(米国株式)や「VEA」(先進国株式)、「VWO」(新興国株式)などが含まれ、分散投資によるリスクヘッジを実現する。

SBIグループの信頼性と安心感

ロボプロはSBIグループ傘下の株式会社FOLIOによって運営されており、SBIグループの強固なセキュリティ基盤と、徹底した資産保護体制により、投資家の資産は安全に管理されている。

投資家の資産は分別管理されており、さらに投資者保護基金にも加入しているため、万が一のリスクにも対応可能な仕組みが整っている。

ROBOPRO(ロボプロ)のメリットは?

ほぼ完全に「放ったらかし」で運用可能

ロボアドバイザー全般に言えるが、メリットとして大きいのは、一度設定すればほぼ放置が可能で、手間なく自動運用できること。

市場の動きを逐一チェックする必要がなく、忙しい日常の中でも資産運用を継続できる。

私もロボプロを利用しているが、基本的に放置状態で運用中。

初心者でも簡単に始められる手軽さ

投資初心者や、日常業務で時間が取れない方にとって、ロボプロは理想的なソリューションと言える。

複雑な投資知識がなくても、初期設定だけで簡単に運用がスタート。

毎月の積立や資産配分の調整といった面倒な作業も全て自動化されており、手間をかけずに投資を進めることが可能。特に、忙しい人にとっては大きなメリットとなる。

AIによる自動リバランスの精度がとても優秀

ロボプロは、AI予測をもとに毎月1回、最適と思われる投資配分に調整する自動リバランスが行われる。

このリバランスは非常に大胆に行われることがあり、市場の変動に応じてポートフォリオがダイナミックに再構築されます。リスクが高いと判断された資産は排除され、パフォーマンスの良い資産を利益確定するなど、感情に左右されない冷静な判断を下すことが可能です。

ロボプロのAI判断は、多くの場合、人間の直感や経験を超える高い精度を持っています。

他のロボアドバイザーとの差別化

ロボプロの自動リバランスは、他のロボアドバイザーサービスと比較しても、その迅速さと精度で一歩リードしている。

特に、市場が大きく動く局面では、ロボプロの迅速かつ正確なリバランスが投資家の資産を守る強力な武器となる。特に、金融市場が不安定な状況下では、他のサービスとの差が顕著に表れることが多く、資産保護の面でも優れた選択肢となる。

ロボプロのデメリットは?

NISAに非対応

多くのロボアドバイザーサービス、例えば「ウェルスナビ」や「松井証券の投信工房」は、NISA(少額投資非課税制度)に対応しており、税制上のメリットを享受できる。

しかし、残念ながら、ROBOPROは現在NISAに対応していないため、NISAを活用して投資したいと考えている人にとっては、この点がデメリットとして挙げられる。

手数料は年率1.1%とやや高め

投資における手数料は、長期的な運用において大きな影響を持ちます。

ROBOPROの手数料は年率1.1%(税込)で、やや高めと言える。

これにはETFの取引コストも含まれている。

運用額が3,000万円を超える部分については、割引手数料として年率0.55%(税込)が適用されるため、大口投資家にとってはメリットもありますが、一般的には少し高めに感じられるかもしれません。

ただし、手数料は別途支払うというより、各投資しているETFからの分配金でほどんどまかなわれているためデメリットと捉えるかどうかは考え方により異なる。

以下は、私のロボプロの取引管理から確認できる、実際の分配金総額と手数料総額の内容。

私の場合のデータではあるが、開始から3年程度で、分配金総額は25,000円程度、手数料総額は22,000円程度となり、分配金で賄われている状態で実質的にな負担は少ないと言える。

ETFの分配金とは?

ETFは、様々な資産を運用することで得られる収益(配当や利子など)を、投資家に分配金として還元します。この分配金は、ETFの運用内容や市場状況によって変動します。

また、分配金の支払い回数もETFによって異なり、四半期ごとや毎月など、さまざまなパターンが存在します。

AIが投資の将来予測するとは具体的にどういうことか?

ロボプロの将来予測の仕組みとしては、AI技術を駆使して、過去の金融データを基に現在の市場状況を分析し、未来の動きを予測することを目的としている。

具体的には、ROBOPROのAIは、過去数十年の景気循環のデータをもとに、現在の金融環境と似ている過去の状況をサンプルとしてピックアップします。

そして、そのサンプルデータに基づき、未来の市場の動きや変動を予測し、最も効果的な資産配分を提案します。

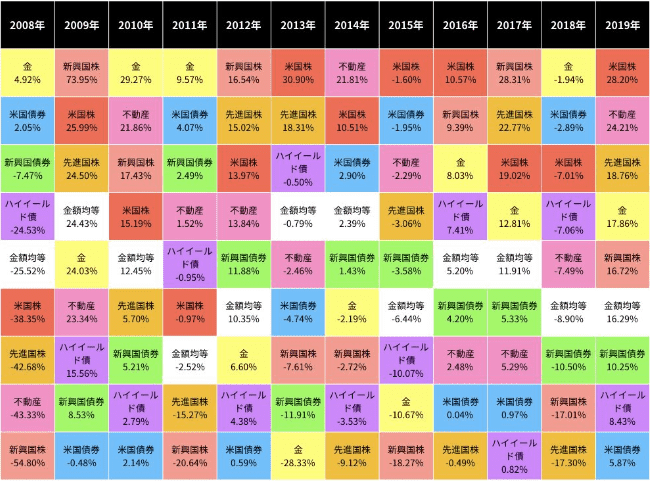

以下の図は、2008年〜2019年までの各年において、パフォーマンスが良かった順に各アセットをマス状に並べたもの。

各アセットの年ごとのパフォーマンスの動き:出典(AIを活用したロボアドバイザー FOLIO ROBO PROで長期投資〜将来の資産を作る〜)

例えば、2008年のリーマンショック後の市場の動きを考えると、金融緩和の影響でゴールドの価格が上昇。

しかし、2013年以降は、景気の回復や低金利の影響で、米国株や不動産の価格が上昇しました。

しかしよく見ると、パフォーマンスの結果は年ごとに大きく異なる様子が伺えます。

これはその年の金融環境や政治環境など固有の状況によりパフォーマンスが大きく変わるということがよくわかります。

ポートフォリオを広く分散した場合、これだけの振れ幅があると、バランスは保たれるものの、結果的にパフォーマンスは中間の平均値に帰するため、大きく利益を伸ばすことが難しいと言えます。

ROBOPROは、このような景気循環などの動きを捉えることで、ある時は攻めの資産配分をダイナミックに行い、またある時は、守りの資産半分を増やして資産防衛するなど、より確実にリターンを最大化することを目指している。

このようなダイナミックな資産配分の変更は、プロのファンドマネージャーでも難しいとされ、また他のロボアドバイザーとも一線を画すポイントと言える。

ロボプロが分析する40以上の先行指標とは?

ロボプロは、投資の先行きを予測するために40以上の指標を参照している。

これは、専門家でさえ常時チェックや把握が難しい数の指標。

この膨大なデータの分析は、まさにAI技術の力を最大限に活用した結果と言える。

具体的にロボプロが参照する主要な指標には、以下のようなもの。

- 株価指数:TOPIX、S&P500

- 債券:米10年債

- 為替の動き

- 商品:原油、金、銅価格

- ハイイールド債:景気後退の先行指標として知られる

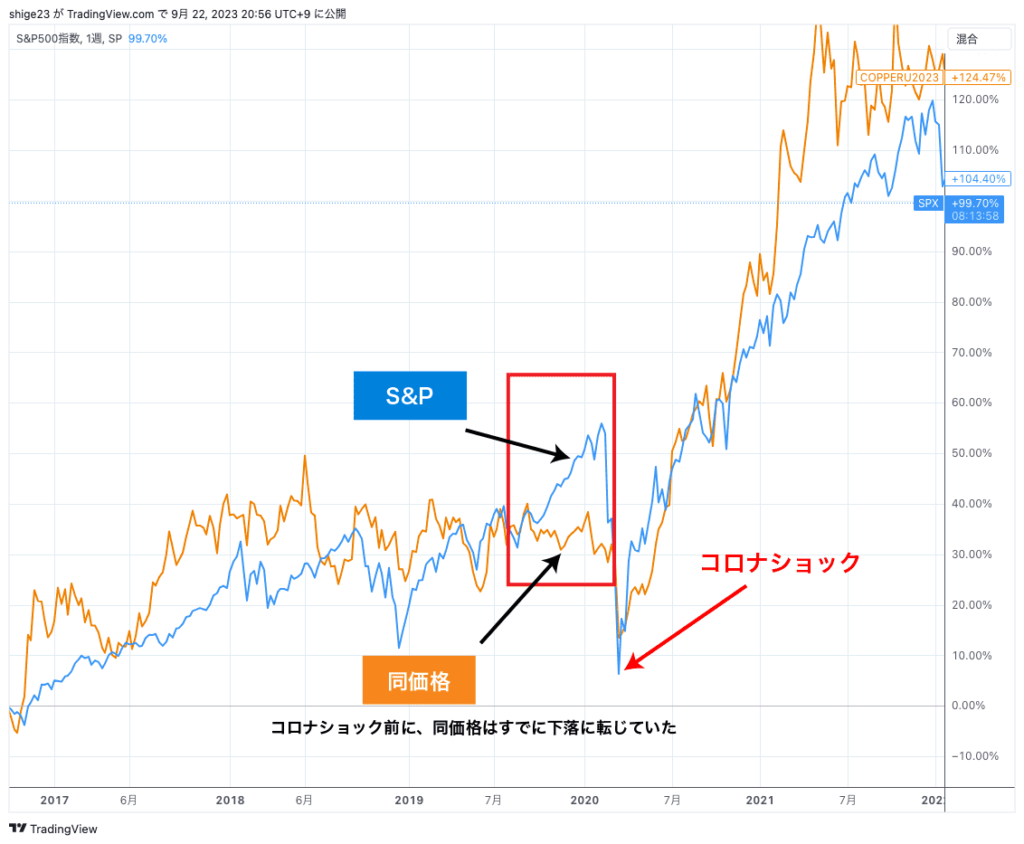

特に注目すべきは、銅の価格動向。

銅は、景気の先行きを示す指標として「Dr.カッパー」とも称され、非常に重要な役割を果たしている。特にロボプロのAI投資ならではの動きとしてわかりやすい事例がある。

2020年2月20日に発生したコロナショック前の銅価格とS&P500の動きを見ると、コロナショックが発生する数ヶ月前から銅価格は下落していました。

この銅価格の動きを捉えたロボプロは、資産配分を守りのポジションにシフト。

そして、銅価格の下げ止まりを早期に察知し、市場全体が不安定な中でも攻めの資産配分に変更。

このような迅速かつ的確な判断は、感情に左右されないAIの強みと言える。

2020年のコロナショック前の銅価格とS&P500の動き

しかし、AIも万能ではない

私の3年間の運用経験から言えることは、AIも完璧ではないという点です。

AIは膨大な過去データを基に予測を行いますが、現在の金融環境や経済状況は、過去のデータだけでは予測できないケースもあります。

特に、予測が難しい政治イベントや予想外の市場変動には対応しきれないことがあります。

例えば、2021年10月の米国大統領選(トランプ氏とバイデン氏の対決)において、ROBOPROはゴールドの比率を50%にまで引き上げ、米国株の割合を大幅に削減しました。

これはリスクを避けるための守りの資産配分でしたが、その期間中、ゴールドのパフォーマンスは低迷し、逆に米国株は上昇。結果的に、期待していたほどの成果は得られませんでした。

このように、AIも完璧ではなく、結果的には状況と異なった判断になるということを理解することが重要です。

ROBOPRO(ロボプロ)はおすすめできるのか?

2020年1月15日に登場したロボプロは、わずか2ヶ月後のコロナショックを経験しました。

公式サイトによれば、2023年7月末時点でのパフォーマンスは約+58%となっています。

この高い数値は、スタート時の特異な状況だったことも要因と思います。

私自身は、2020年10月22日からロボプロを利用し始め、2023年11月の時点でのリターンは+20〜25%となっています。

多くの専門家は、株式投資の年間リターンが8%を達成すれば十分な成功とみなします。

しかし、私のロボプロ投資のリターンは、平均で15%以上、時には25%を超えることもありました。

また、下落局面に非常に強く、私の経験上、大きな損失を経験したり、損益マイナスになったことはありません。

初めは毎月3.5万円の積み立てを行っており、最近は少し減額していますが、積み立てを続けることで、しっかりとした利益を享受しています。

ロボプロがおすすめできるポイントは?

以下は、利回り以外でロボプロがおすすめできるポイントです。

毎月のリバランスチェックで市場予測の参考になる

ロボプロは毎月自動的にリバランスを行います。

このリバランスをチェックすることで、その月の金融市場の動向や先行きについての参考情報を得ることが可能です。

例えば、長期間にわたって米国株式ETF「VTI」に40%近く配分されていた資産が突然ゼロになり、債券の比率が増加する場合、AIが現在のデータや過去の市場動向を踏まえて、先行き不透明な状況を予測していると判断できます。

このような情報は、他の投資ポートフォリオにおける個別銘柄の配分や、コモディティ取引(CFD)の売買で参考にしています。

投資を少なからず実践している方は、一つの市場シグナルとして判断材料になります。

リバランス戦略に学びながら投資の視野を広げる

かなり個人的な感想ですが、専業ではない個人投資家が、立ち回りよく投資の世界で生き残ることは非常に難しいです。

私自身、過去に多くの失敗を経験してきました。

しかし、ロボプロのリバランスフローを客観的に見ていると、先行きの見通しの悪いものは素早く処理して守りに入る、また、先行きの予測が良いものに素早く資産配分を切り替えます。

これは、個人的にすごく参考になります。

特に、個別銘柄を保有していると、利確や損切りのタイミングを見極めることが非常に重要です。

利益を確定した際、その資金を次の成長が期待される銘柄に投資するというリバランスの考え方は、投資パフォーマンスを向上させる上で不可欠な要素です。

ロボプロの戦略を見ながら、私も同様の視点で投資に取り組むようになり、個別銘柄のパフォーマンスが以前よりも大きく改善しました。

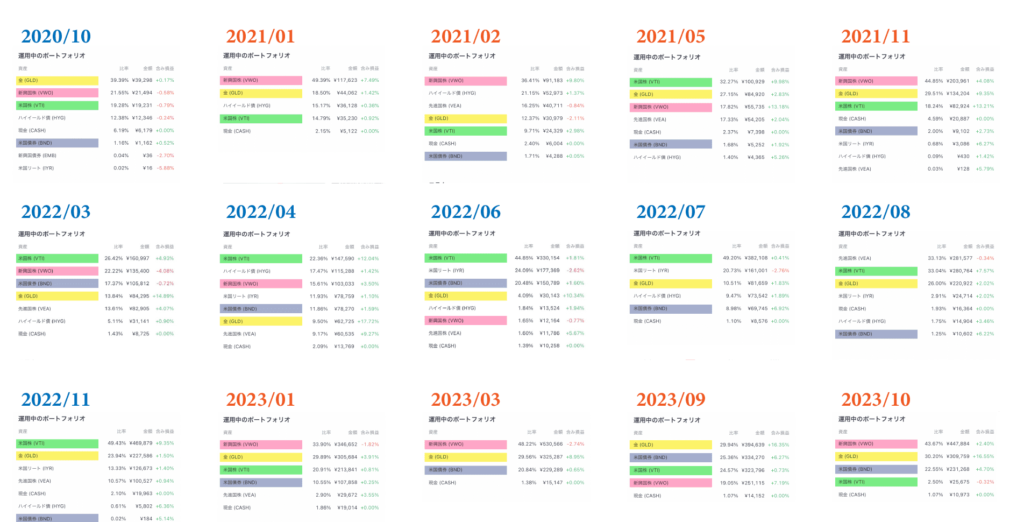

ロボプロのリバランスの詳細な動きは?

ロボプロの投資配分の変化などを、参考に以下掲載します。

ざっくりですが、

- 2021年: 主に新興国株(VWO)や金(GLD)の配分が増加。

- 2022年: 米国株(VTI)や米国リート(IYR)の配分が高まる傾向。

- 2023年: 新興国株(VWO)や金(GLD)の配分は減少し、米国株(VTI)の配分が増加。

ロボプロは毎月リバランスを行います。そのため、月ごとの微細な変化は多いですが、特定のタイミングで大きくドラスティックに投資配分を変更することもあります。

ROBOPRO(ロボプロ)の2020年10月以降のリバランスのサンプル

ROBOPROの評判は?

SNSやオンライン上での評判を調査すると、ROBOPROのパフォーマンスについては、開始時期によって大きく異なり、賛否両論の評判や意見も見られます。

先述した、大統領選のタイミングなどでは、一時的にパフォーマンスが低下する時期が続いており、このような期間に投資を開始したユーザーからは、必ずしも良い評価を受けていないようです。

しかし、ロボアドバイザーを利用する際の基本的な考え方として、短期的な成果を追求するのではなく、長期的な視点での投資を目指すことが重要です。

短期的な利益を求める投資家には、ロボアドバイザーは必ずしも最適ではないかもしれません。

さらに、ROBOPROだけでなく、外国株への投資全般においては、為替の変動が直接的に影響を及ぼします。

例えば、円安の時期に投資を行い、その後円高になった場合、資産の価値が減少する可能性があり、このような為替のリスクを緩和するためにも、定期的な積立投資を行うことがおすすめです。

ROBOPROはどうやって始めたら良い?

それでは初心者の方に向け、ロボプロの始め方を解説します。

初心者がロボプロを始める前の注意点は?

- 最低投資額は10万円から。

- NISAには非対応。

- 利用対象は20歳〜75歳未満。未成年は利用不可。

- FOLIOが提供する「おまかせ投資」と「ロボプロ」の2つのロボアドバイザーから選べますが、同時に両方を利用することはできない。

※すでに「おまかせ投資」を利用中の場合、解約後に「ロボプロ」に切り替える必要があります。

ロボプロの口座開設方法は?

必要なもの: 本人確認書類(運転免許書、マイナンバーカードなど)。

FOLIOのROBOPROの口座開設リンクからアカウント登録を行います

スマホでの口座開設が可能。

個人情報を登録し、本人確認書類をアップロードして申し込みを完了します。

審査が完了したら、取引設定や確定申告の方法を選択します。初心者の方は、「フォリオにまかせる(推奨)」を選択すると良いでしょう。

また、本人確認書類アップロード後の手続きを行うと、登録住所に「ウェルカムレター」が簡易郵便で届きます。レターを開封し、口座開設を完了することもできます。

ロボプロの入金方法は?

入金前の注意点

- 口座開設後、最低10万円以上を入金しても、自動的には投資が開始されません。

- 入金後、購入手続きを行う必要があります。

手数料無料の入金方法

- ロボプロと提携している銀行からの入金は手数料が無料。

- 提携銀行:

- 三菱UFJ銀行

- 三井住友銀行

- みずほ銀行

- 住信SBIネット銀行

- 楽天銀行

- イオン銀行

- PayPay銀行

ROBOPRO(ロボプロ)のリアルタイム入金画面

入金した金額から投資する金額分を購入する

- 入金だけでは投資は開始されません。購入可能金額から、投資したい金額を購入する必要があります。

- ロボプロには、購入せずに放置してしまい、投資が開始されないという問い合わせがあるようです。購入手続きを忘れないよう注意しましょう。

ROBOPRO(ロボプロ)の購入手続き画面

購入・売却のタイミング

- ロボプロでの購入は、夕方6時(18時)までに設定を行うと、当日の深夜、米国市場の取引時間内に購入が完了します。

- 資産の評価額は、翌日の午後13時頃に更新されます。

ロボプロの積立投資とは?

ロボプロでは、一度購入するだけでなく、毎月の積立投資も可能です。

長期的な投資を考えるなら、定期的な積立は非常に有効です。

もちろん、市場の動きを見ながらの購入も可能ですが、ロボアドバイザーの最大の利点は、手間をかけずに投資を続けられることです。

積立の金額は自由に変更でき、一時的に停止することも可能です。ただし、6ヶ月以上積立を停止すると、設定が自動的に解除されるので注意が必要です。

ROBOPRO(ロボプロ)の積立設定

ROBOPROの長期積立特典 抽選プログラム

ロボプロの積立を継続すると、長期積立特典の抽選プログラムに参加できます。

この特典は、積立を継続することで、手数料がキャッシュバックされるチャンスが得られるものです。

- 積立が15回以上続くと、3ヶ月ごとに自動的に抽選が行われます。

- キャッシュバックの割合は、積立の回数に応じて増加します。

- キャッシュバックの上限は10万円です。

ロボプロで売却する際の注意点は?

長期的な資産形成を目指している中、あまり売却することはおすすめしませんが、時折、現金が必要になることも考えられます。

その際、ロボプロの資産を部分的に売却して換金することが可能です。

- 売却は1万円以上、1円単位で行えます。

- 売却指示を出した後、4営業日で受け渡しが完了し、管理画面にも反映されます。

- 売却時の手数料は無料。

注意: 全資産を売却するか、売却後の時価評価額が1万円未満になると、ロボプロのサービスは解約とみなされます。

参考としてウェルスナビのパフォーマンスを紹介

ウェルスナビはロボアドバイザーの中で利用率や知名度が高く、多くのテレビCMでも紹介されています。私のウェルスナビの利用期間は短いですが、比較のための参考データとして以下のパフォーマンスを示します。

ここでは、ウェルスナビについて詳しく解説しませんが、結論としてこちらもおすすめできるロボアドバイザーです。

- 2023年2月から10月の間の平均パフォーマンスは約6〜8%です。

- 一時的に10%を超える時期もありました。

ウェルスナビのパフォーマンスサンプル

まとめ

FOLIOのROBOPRO(ロボプロ)は、近年の投資の中で注目されるロボアドバイザーの一つです。

その魅力は、多様な先行指標を活用しての資産配分や、積立投資の設定、さらにはリアルタイム入金の対応など、多岐にわたります。

特に、長期的な資産形成を目指す投資家にとって、毎月のリバランスや積立投資の設定は大きなメリットとなるでしょう。

しかし、全ての投資にはリスクが伴います。

ロボプロも例外ではありません。

売却時の手数料や、サービスの解約条件など、しっかりと理解しておく必要があります。

また、他のロボアドバイザー、例えばウェルスナビとの比較も参考になるでしょう。

最後に、投資は自己責任です。ロボプロを始める前に、しっかりとサービス内容を理解し、自身の投資目的やリスク許容度に合わせて利用することが大切です。