AI investing" is rapidly gaining popularity as a new investment style brought about by the evolution of technology.

Among other things, the robo-advisor "ROBOPRO in FOLIO(ROBOPRO)" has attracted the attention of many investors with its advanced approach.

However, many people hear the terms "AI investment" and "robo-advisor," but have questions about what exactly they are, and what their features and benefits are.

Popular robo-advisors are known as "Wealth Navi," "ROBOPRO," and "Theo," among others, of which I chose ROBOPRO and have used it for almost three years.

In this article, I will explain in detail the basic concepts of AI investing, the features, advantages and disadvantages of ROBOPRO as I have used them, and the specifics of their use, as well as their reputation.

We hope that this article will help beginners and experienced investors alike to resolve any questions or concerns they may have about ROBOPRO and help them make an investment decision.

- What is ROBOPRO? What kind of service?

- What are the specific features of ROBOPRO?

- What are the advantages of ROBOPRO?

- What are the disadvantages of ROBOPRO?

- What exactly does AI mean by predicting the future of an investment?

- What are the more than 40 leading indicators analyzed by ROBOPRO

- But AI is no panacea either.

- Can I recommend ROBOPRO?

- What can ROBOPRO recommend?

- What is the detailed movement of the ROBOPRO rebalancing?

- What is ROBOPRO's reputation?

- How do I get started with ROBOPRO?

- What should a beginner be aware of before starting a roboproject?

- How do I open a ROBOPRO account?

- How do I deposit money into ROBOPRO?

- Purchase the amount of money you want to invest from the amount you have deposited.

- What is ROBOPROs Accumulated Investment?

- ROBOPRO's Long-Term Savings Rewards Lottery Program

- What should I be aware of when selling with ROBOPRO?

- Wealth Navi performance as a reference.

- summary

What is ROBOPRO? What kind of service?

ROBOPRO is a major Japanese financial services company,A fully-automated asset management service offered by FOLIO Corporation, a member of the SBI Group, that aims to maximize investment performance.

Its most important features are,Predicts financial market trends using AI technology and optimizes investment allocations based on the resultsThe following is a list of the items that are to be

It was released in January 2020 as a way for individuals to easily make cutting-edge investments managed by professional fund managers through the use of AI.

What are the specific features of ROBOPRO?

Advanced AI-based future forecasting

ROBOPRO uses AI technology to analyze the gold market and the economy as a whole in real time.

Provide flexible and efficient investment strategies for a wide range of market conditions by anticipating economic fluctuations, changes in financial markets, and risk factors.

In particular, the use of AI will enable precise risk management and market forecasting unaffected by human emotions.

Joint development with AlpacaTech on advanced technology

ROBOPRO is a cutting-edge robo-advisor service developed in collaboration with AlpacaTech, an industry leader in AI technology, whose AI comprehensively analyzes over 40 leading indicators, covering a wide range of topics from broad economic trends to detailed market movements. This enables the service to accurately identify upcoming market trends and support efficient management of investment portfolios.

Flexible and bold rebalancing strategy to respond to market fluctuations

ROBOPRO flexibly and strategically rebalances investment allocations based on advanced AI analysis.

Bold adjustments will be made to optimize the portfolio as circumstances warrant.

A wide range of asset classes, including U.S. ETFs and international equities, are employed as investment targets. Major ETFs include "VTI" (U.S. equities), "VEA" (developed country equities), and "VWO" (emerging country equities) to hedge risk through diversification.

Reliability and security of the SBI Group

ROBOPRO is operated by FOLIO Corporation, a subsidiary of the SBI Group, and investors' assets are safely managed by the SBI Group's strong security infrastructure and thorough asset protection system.

Investors' assets are segregated and are also covered by an investor protection fund, so there is a system in place to handle any risk that may arise.

What are the advantages of ROBOPRO?

Almost completely "leave it alone" operation possible

The big advantage of robo-advisors in general is,Once set up, the system can be almost completely left alone and can be operated automatically without hassle.Things to do.

There is no need to check market movements every step of the way, and asset management can be continued even in the midst of a busy daily routine.

I am also using ROBOPRO, but am basically operating in a neglected state.

Easy to start, even for beginners

ROBOPRO is an ideal solution for investment novices and those who are unable to find time for their daily tasks.

Operations can be easily started without complicated investment knowledge, just by setting up the initial setup.

All the tedious tasks such as monthly savings and asset allocation adjustments are also automated, making it possible to proceed with investments without much hassle. This is especially a great advantage for busy people.

Very good accuracy of automatic rebalancing by AI

ROBOPRO is,Automatic rebalancing is performed once a month based on AI forecasts to adjust the investment allocation to what is considered optimal.

This rebalancing can be very bold, dynamically restructuring the portfolio in response to market fluctuations.Assets deemed risky are eliminated, and calm, unemotional decisions can be made, such as taking profits on assets that are performing well.It is.

In many cases, ROBOPRO's AI decisions are highly accurate, exceeding human intuition and experience.

Differentiation from other robo-advisors

ROBOPRO's automatic rebalancing is,Compared to other robo-advisor services, it is a step ahead in terms of its speed and accuracy.

Especially during periods of significant market volatility, ROBOPROs rapid and accurate rebalancing is a powerful weapon in protecting investors' assets. In particular, under conditions of financial market instability, the difference between ROBOPRO and other services is often more pronounced, making it an excellent choice in terms of asset protection.

What are the disadvantages of ROBOPRO?

Not compatible with NISA

Many robo-advisor services, such as Wealth Navi and Matsui Securities' Investment Trust Studio, are compatible with the NISA (small amount investment tax exemption) system, which offers tax benefits.

Unfortunately, however, ROBOPRO does not currently support NISA, and this is a disadvantage for those who wish to invest using NISA.

The fee is a little high at 1.1% per annum.

Fees in investments have a significant impact on long-term management.

ROBOPRO's fee is 1.1% per year (tax included), which can be considered a little high.It can be said.

This includes the transaction costs of ETFs.

For the portion of the investment amount exceeding 30 million yen, a discount fee of 0.55% per annum (tax included) will be applied, which is advantageous for large investors, but generally it may seem a little high. .

However, whether this is considered a disadvantage or not depends on one's perspective, since the fees are largely covered by the distributions from each ETF rather than being paid separately.

Below is a description of the actual total distributions and total fees, as can be seen from my robo-pro transaction management.

Although the data is for my case, after about 3 years since the start of the program, the total distribution amount is about 25,000 yen and the total commission amount is about 22,000 yen,The burden is low in real terms, as it is covered by distributions.

What are ETF distributions?

ETFs return the income (dividends, interest, etc.) earned from the management of various assets to investors as distributions. These distributions fluctuate depending on the ETF's operations and market conditions.

The frequency of distribution payments also varies from ETF to ETF, and there are various patterns, such as quarterly or monthly.

What exactly does AI mean by predicting the future of an investment?

ROBOPRO's future forecasting mechanism uses AI technology to analyze current market conditions based on past financial data in order to predict future trends.

Specifically, ROBOPRO's AI is,Pick a sample of past situations similar to the current financial environment based on business cycle data over the past several decadesI will do so.

Then, based on that sample data, we predict future market movements and fluctuations and propose the most effective asset allocation.

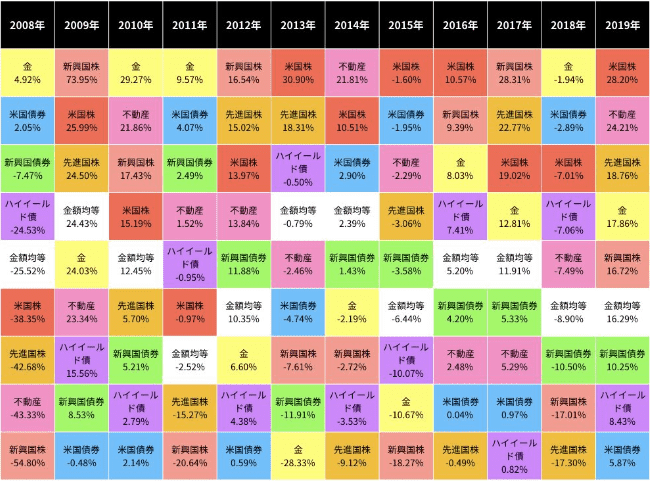

The following chart shows each asset in massed order of performance for each year from 2008 to 2019.

Year-to-year performance movement for each asset: Source (AI-based robo-advisor FOLIO ROBO PRO for long-term investment - building future assets.)

For example, considering the market movements after the Lehman Brothers collapse in 2008, the price of gold rose due to monetary easing.

However, since 2013, the economic recovery and low interest rates have led to an increase in the prices of U.S. stocks and real estate.

However, a closer look reveals that performance results vary widely from year to year.

This isIt is easy to see that performance varies greatly depending on the unique circumstances of the financial and political environment of the year.

When the portfolio is widely diversified, such a wide swing makes it difficult to grow profits significantly because, although balanced, the resulting performance is attributed to the mean in the middle.

ROBOPRO captures such movements in the economic cycle and dynamically allocates assets offensively at times, and defends assets by increasing the defensive half of assets at other times,The goal is to maximize returns more reliably.

Such dynamic asset allocation changes are considered difficult even for professional fund managers, and it is also a point that sets them apart from other robo-advisors.

What are the more than 40 leading indicators analyzed by ROBOPRO

ROBOPRO is,More than 40 indicators are referenced to predict the future of an investmentThe company is doing so.

This is a number of indicators that even experts have difficulty checking or understanding at all times.

The analysis of this vast amount of data is truly the result of taking full advantage of the power of AI technology.

Specifically, the key indicators to which ROBOPRO refers include the following

- Stock price indices: TOPIX, S&P500

- Bonds: 10-year U.S. Treasury note

- Exchange rate movement

- Commodities: crude oil, gold, copper prices

- High-yield bonds: known as a leading indicator of recession

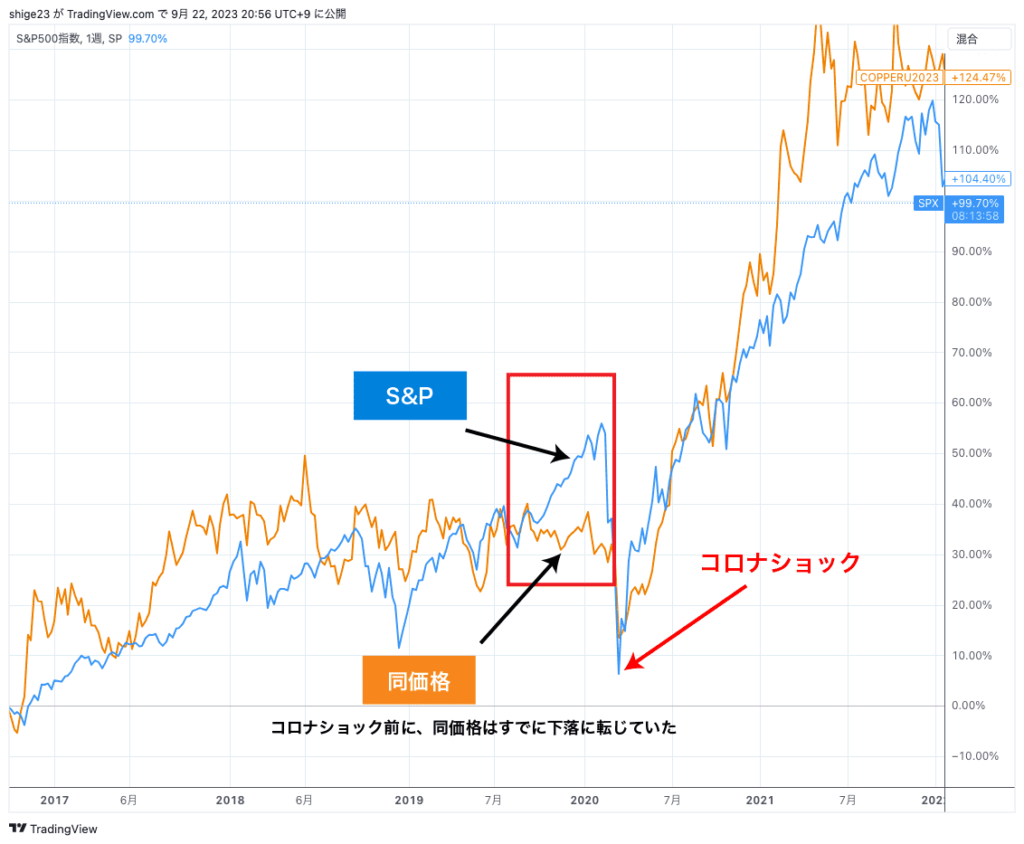

Particularly noteworthy are copper price trends.

Copper is also known as "Dr. Copper" as an indicator of the economic outlook and plays a very important role. There is one particularly clear example of a move that is unique to robo-professional AI investing.

The movement of copper prices and the S&P 500 prior to the February 20, 2020 Corona shock shows that copper prices had been declining for several months before the Corona shock occurred.

ROBOPRO caught this copper price move and shifted its asset allocation to a defensive position.

Then, the company quickly detected that the copper price had bottomed out and changed to an aggressive asset allocation, even though the overall market was unstable.

Such quick and accurate decisions are the strength of AI, which is not influenced by emotion.

Copper prices and S&P 500 movement before the 2020 Corona Shock

But AI is no panacea either.

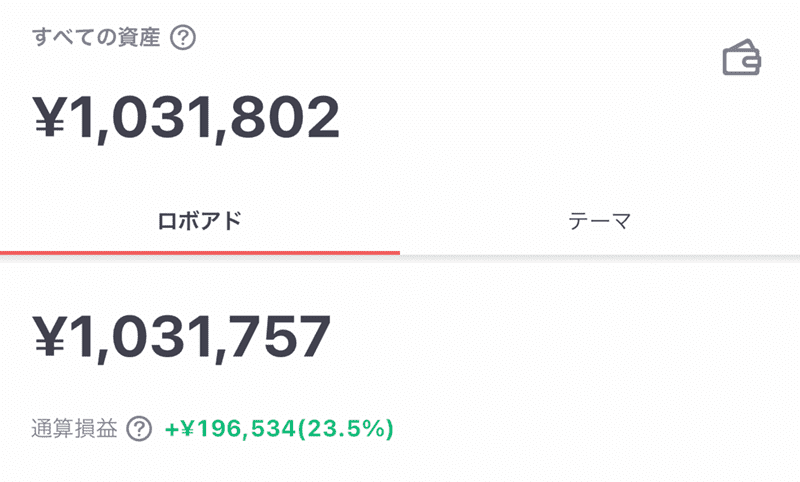

MyAfter three years of operation, I can say that AI is not perfect either.This is the point.

AI makes forecasts based on vast amounts of historical data, but there are cases where the current financial environment and economic conditions cannot be predicted based on historical data alone.

In particular, it may not be able to respond to difficult-to-predict political events or unexpected market fluctuations.

For example, during the October 2021 U.S. presidential election (Trump vs. Biden), ROBOPRO raised its gold ratio to 501 TP3T and significantly reduced its proportion of U.S. equities.

This was a defensive asset allocation to avoid risk, but during that period, gold's performance was sluggish and, conversely, U.S. equities rose. As a result, the results were not as good as expected.

Thus, it is important to understand that AI is not perfect and will result in decisions that differ from the situation.

Can I recommend ROBOPRO?

ROBOPRO appeared on January 15, 2020, and experienced a coronal shock just two months later.

According to the official website, performance as of the end of July 2023 was approximately +581 TP3T.

I think this high number was due in part to the unique situation at the start of the project.

I myself started using ROBOPRO on October 22, 2020 and as of November 2023 my returns are +20-251 TP3T.

Many experts consider an annual return of 81 TP3T on an equity investment to be sufficient success.

However, my robo investment returns averaged over 151 TP3T and sometimes over 251 TP3T.

Also,It is very strong in declining phases and in my experience has never experienced significant losses or negative profit/loss.

In the beginning, we accumulated 35,000 yen per month, and although we have recently reduced the amount slightly, we continue to enjoy a solid profit by continuing to accumulate.

What can ROBOPRO recommend?

Below are some points, other than yield, where ROBOPRO can be recommended.

Monthly rebalance checks to help forecast the market

ROBOPRO automatically rebalances monthly.

By checking this rebalancing, it is possible to obtain reference information on the trends and outlook of the financial markets during the month.

For example, if assets that have been allocated nearly 401 TP3T to the VTI U.S. equity ETF for a long period of time suddenly drop to zero and the percentage of bonds increases, we can conclude that the AI is predicting an uncertain future based on current data and historical market trends.

Such information is used as a reference in the allocation of individual stocks in other investment portfolios and in the trading of commodities (CFDs).

For those who practice a small amount of investment, it is one market signal that can be used to make a decision.

Expand your investment horizons while learning from rebalancing strategies

It is quite personal, but it is very difficult for an individual investor who is not a full-time professional to survive in the investment world in a well-run business.

I myself have experienced many failures in the past.

However, an objective look at the rebalancing flow of robo-profits shows that they quickly process those with poor prospects and go on the defensive, and they also quickly switch asset allocations to those with good prospects.

This is very helpful to me personally.

Particularly,When holding individual stocks, it is very important to know when to take profits and lossesIt is.

The idea of rebalancing is that when you lock in a profit, you invest that money in stocks that are expected to grow next,It is an essential element in improving investment performance.

I began to approach my investments from a similar perspective, looking at ROBOPRO's strategy, and the performance of individual stocks has improved significantly from what it was before.

What is the detailed movement of the ROBOPRO rebalancing?

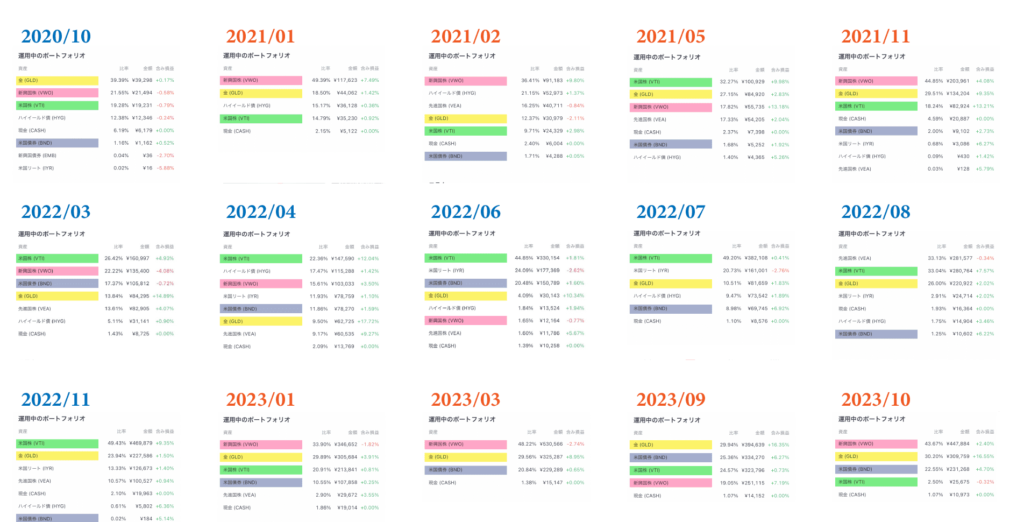

Changes in the investment allocation of ROBOPRO and other information is included below for reference.

Roughly,

- 2021: Increased allocation mainly to emerging market equities (VWO) and gold (GLD).

- 2022: Allocations to U.S. equities (VTI) and U.S. REITs (IYR) tend to increase.

- 2023: Allocations to emerging market equities (VWO) and gold (GLD) decrease, while allocations to U.S. equities (VTI) increase.

ROBOPRO rebalances monthly. As a result, there are many minute changes from month to month, but there are also large, drastic changes in investment allocation at specific times.

Sample of ROBOPRO's rebalancing after October 2020

What is ROBOPRO's reputation?

A survey of social networking sites and online reputations shows that the performance of ROBOPRO varies widely from start to finish, with mixed reviews and opinions.

The aforementioned periods of temporary underperformance, such as the timing of the presidential election, have not always been well received by users who started investing during these periods.

However,The basic approach when using a robo-advisor is to aim for long-term investment rather than pursuing short-term resultsIt is.

For investors seeking short-term gains, robo-advisors may not necessarily be the best choice.

Furthermore, not only ROBOPRO, but investments in foreign stocks in general are directly affected by exchange rate fluctuations.

For example, if an investment is made during a period of yen depreciation and the yen subsequently appreciates, the value of the asset may decrease. To mitigate such currency risk, it is recommended that regular savings investments be made.

How do I get started with ROBOPRO?

Now, for beginners, we will explain how to get started with ROBOPRO.

What should a beginner be aware of before starting a roboproject?

- The minimum investment is 100,000 yen.

- NISA is not supported.

- Eligible users are between the ages of 20 and 75. Minors are not allowed.

- You can choose between two robo-advisors offered by FOLIO, "Omakase Investment" and "ROBOPRO," but you cannot use both at the same time.

*If you are already using "Omakase Investment", you will need to switch to "ROBOPRO" after cancelling your account.

How do I open a ROBOPRO account?

Required: Identification documents (driver's license, my number card, etc.).

ROBOPRO in FOLIORegister an account through the account opening link at

Accounts can be opened with a smartphone.

Register your personal information and upload your identification documents to complete the application.

Once the review is complete, choose how you would like to set up your transactions and file your tax returns. Beginners should select "Leave it to Folio (recommended)".

After uploading your identification documents, you will also receive a "Welcome Letter" by simple mail to your registered address. You may also open the letter and complete the account opening process.

How do I deposit money into ROBOPRO?

Precautions before making a deposit

- After opening an account, even if you deposit at least 100,000 yen, the investment will not start automatically.

- After payment is received, the purchase must be completed.

Fee-Free Deposit Methods

- Deposits from banks affiliated with ROBOPRO are free of charge.

- Partner Banks

- Mitsubishi UFJ Bank

- Sumitomo Mitsui Banking Corporation

- Mizuho Bank

- SBI Sumishin Net Bank

- Rakuten Bank, Ltd.

- AEON Bank

- PayPay Bank

ROBOPRO real-time deposit screen

Purchase the amount of money you want to invest from the amount you have deposited.

- Deposit alone does not initiate the investment. You must purchase the amount you wish to invest from the available amount.

- ROBOPRO has received some inquiries about investments not being initiated because they were left without purchase. Be careful not to forget to complete the purchase procedure.

ROBOPRO purchase procedure screen

Timing of purchase and sale

- Purchases in ROBOPRO can be completed at midnight on the same day, during U.S. market trading hours, if set up by 6:00 p.m. (6:00 p.m.).

- Asset valuations will be updated at approximately 1:00 p.m. the following day.

What is ROBOPROs Accumulated Investment?

ROBOPRO allows you to purchase once and also invest in monthly savings.

If you are considering a long-term investment, regular savings can be very effective.

Of course, you can also buy while watching market movements, but the greatest advantage of a robo-advisor is that it allows you to continue investing without hassle.

The amount of the reserve can be changed freely and can be temporarily suspended. Please note, however, that if you stop saving for more than 6 months, your settings will be automatically cancelled.

ROBOPRO savings settings

ROBOPRO's Long-Term Savings Rewards Lottery Program

If you continue to accumulate ROBOPRO funds, you can participate in the Long-Term Savings Reward Drawing Program.

This benefit gives you the opportunity to earn cash back on your commissions by continuing to accumulate funds.

- If the accumulation continues more than 15 times, the lottery is automatically drawn every three months.

- The percentage of cash back increases with the number of times you accumulate funds.

- The maximum cash refund is 100,000 yen.

What should I be aware of when selling with ROBOPRO?

While we do not recommend that you sell too much in your quest to build long-term assets, it is possible that you may need cash from time to time.

At that time, the assets of the ROBOPRO can be partially sold and redeemed for cash.

- Sales can be made in increments of 1 yen, with a minimum amount of 10,000 yen.

- After the sale order is submitted, delivery is completed in four business days and is reflected on the management screen.

- There is no commission on the sale.

Note: If all assets are sold or the market value after the sale is less than 10,000yen, the robo-pro service is considered terminated.

Wealth Navi performance as a reference.

Wealth Navi has a high usage rate and name recognition among robo-advisors and is featured in many TV commercials. Although my period of Wealth Navi usage is short, the following performance is shown as reference data for comparison.

We will not explain Wealth Navi in detail here, but in conclusion, we can recommend this robo-advisor as well.

- Average performance between February and October 2023 is about 6-81 TP3T.

- There was a period of time when it temporarily exceeded 101 TP3T.

Wealth Navi Performance Samples

summary

ROBOPRO in FOLIO(ROBOPRO) is one of the most notable robo-advisors in recent years.

Its attractions include asset allocation using a variety of leading indicators, setting up reserve investments, and even supporting real-time deposits.

Investors seeking to build long-term assets will especially benefit from monthly rebalancing and setting up a savings account.

However, all investments involve risk.

ROBOPRO is no exception.

You should have a clear understanding of the fees involved in the sale and the cancellation terms of the service.

Comparisons with other robo-advisors, such as Wealth Navi, would also be helpful.

Finally, investing is a personal responsibility. Before starting ROBOPRO, it is important to thoroughly understand the services offered and to use them in accordance with your own investment objectives and risk tolerance.