This article was written by me (@mifsee(2) has been analyzing companies while studying them personally, and this is the output of those analyses.

This is only for personal analysis records. The contents may contain some errors or factual inaccuracies. Please be aware of this beforehand when viewing.

It is not intended to provide investment advice or encourage the purchase of stocks.

- Introduction.

- What is Advanced Micro Devices (AMD)?

- What are AMD's typical products?

- What is AMD's sales ratio by segment?

- Who is AMD's customer base?

- What is the trading market for AMD?

- What are AMD's sectors, industries, and themes to which it belongs?

- When was AMD founded and listed on the stock exchange?

- Dividends?

- What is the size and growth potential of the industry to which AMD belongs?

- Who are AMD's competitors?

- What are AMD's differentiating factors and advantages over the competition?

- What is the future of AMD?

- What is Instinct MI300?

- What is APU? What are the advantages?

- AMD's Financial Results

- AMD stock price, current price

- What is AMD's growth strategy?

- What is AMD's market share of the CPU market?

- What are the advantages and disadvantages of AMD's acquisition of Xilinx?

- How is the semiconductor sector as a whole doing?

- What are the future developments and prospects for AMD?

- AMD's Q3 FY2023 Financial Results Summary

- AMD's Q2 FY2023 Financial Results Summary

- AMD's Q1 FY2023 Financial Results Summary

- What brokerage firms can I buy AMD stock from?

- summary

Introduction.

It is easy to understand for those without a basic knowledge of investments, finance, or financial results, and provides an in-depth look at the performance of each of Advanced Micro Devices' (AMD) business segments, new product releases, and AMD's future prospects with the overall market situation.

The AI market has taken off with the release of ChatGPT, and the semiconductor sector is at the center of it.

As a fundamental technology that underpins the operation of AI, this sector is hotly pursued both inside and outside the industry.

In particular, we will focus on Advanced Micro Devices (AMD), a key player in the semiconductor industry, and delve into the details of the company, from its corporate analysis to its performance and future growth prospects.

In an easy-to-understand manner for readers without investment or financial expertise, we will look at AMD's performance in each of its business segments, its latest product releases, and its future outlook and prospects.

What is Advanced Micro Devices (AMD)?

- Advanced Micro Devices (AMD)Ha,An American multinational company that designs and manufactures semiconductors.

- AMD offers products such as microprocessors (especially for PCs and servers), graphics, and embedded processors.

- Its products are used in a wide range of fields, including gaming, data centers, automotive, aeronautics, and defense.

- AMD is Intel in the microprocessor market and in the graphics processor market.NVIDIAare the main competitors.

- AMD introduced the world's first 8-core desktop processor based on the x86 architecture,The company has developed the Radeon series of high-performance graphics cards and is increasing its market share.

- These technologies are used in a wide range of digital devices and infrastructures, including personal computers, game consoles, data centers, and supercomputers.

- AMD's products are,It has become an essential component element for applications such as high-performance computing, 3D graphics, virtual reality, and artificial intelligence.

AMD's company profile is below

- Company Name: P.O. Box Advanced Micro Devices, Inc.

- Year of establishment: April 1, 19491969.

- Headquarter Location: Tokyo, JapanSanta Clara, California

- establishment (of a business, etc.)Person:.Jerry Sanders and other co-founders

- CEO: Mr. T. H. HuangLisa Su

Dr. Lisa Su has served as AMD's CEO since October 2014, and under her leadership AMD has experienced remarkable growth and innovation in the semiconductor industry.

What are AMD's typical products?

CPU (Central Processing Unit)

AMD manufactures CPUs for high-performance desktops, notebooks, and servers.

- RyzenThe leading product in the desktop and notebook market. Suitable for gaming, creative work and general productivity tasks.

- ThreadripperAMD's high-performance desktop CPUs, suitable for advanced, creative work and data analysis.

- EPYCDesigned for servers and data centers: advanced security features and industry-leading multi-core performance.

GPU (Graphics Processing Unit)

AMD manufactures high-performance graphics cards under the Radeon brand.

These cards are used for advanced graphics such as gaming, video editing, and 3D rendering. AMD also offers a professional GPU called Radeon Pro.

APU (Accelerated Processing Unit)

An APU integrates the CPU and GPU into a single chip.

Sold under the Ryzen and Athlon brand names. Particularly popular with mobile devices and budget-conscious consumers.

What is AMD's sales ratio by segment?

According to AMD's Q1 2023 revenue report, AMD's total revenue was $5.4 billion.

Revenues and percentages for the major product segments are as follows

- Data Center Segment: $1.295 billion in revenue; 24%

- Client segment: $739M in revenue; 14%

- Gaming segment: revenues $1.757 billion; 331 TP3T

- Embedded segment: revenues $1.562 billion; 29%

Who is AMD's customer base?

- End User:

AMD's products are widely used by individual users who specialize in gaming and creative activities.

These users are using AMD's Ryzen CPUs and Radeon GPUs for performance-demanding tasks such as gaming, video editing, and 3D rendering. - Computer manufacturer:

PC manufacturers use a large number of AMD CPUs and GPUs to manufacture their products.

Major PC manufacturers such as Dell, HP, and Lenovo offer PCs with AMD products. - Servers and data centers:

AMD's EPYC server CPUs are widely used in data centers and cloud services such as Amazon Web Services (AWS) and Microsoft Azure.

These companies use AMD's products because they require high performance and efficient data processing. - Game software manufacturer:

Sony's PlayStation and Microsoft's Xbox provide custom CPUs and GPUs. - Embedded systems manufacturer:

Processors for embedded systems are used in specialized areas such as networking equipment, digital signage, and medical devices. - Educational and research institutions:

Universities and research institutions use AMD's high-performance CPUs and GPUs for high-performance computing (HPC) and AI research.

What is the trading market for AMD?

AMD is traded on the NASDAQ market.

What are AMD's sectors, industries, and themes to which it belongs?

The sector is classified as "Technology" and belongs to the "Semiconductors" industry sector.

The main equity themes belong to

- Semiconductor related

- Related to ChatGPT

- Metaverse Related

- Blockchain-related

When was AMD founded and listed on the stock exchange?

- AMD (Advanced Micro Devices) was founded in 1969 in Sunnyvale, California.

- The founders were Jerry Sanders and his seven colleagues, all of whom came from Fairchild Semiconductor.

- AMD was listed on NASDAQ in 1972.

- The company continued to grow and in the 2000s became one of the market leaders in high-performance microprocessors for personal computers.

Dividends?

Not implemented

What is the size and growth potential of the industry to which AMD belongs?

AMD is part of the semiconductor industry, with a particular focus on the processor (CPU) and graphics processor (GPU) markets.

Semiconductor products include personal computers, smartphones, servers, networking equipment, consumer electronics, and industrial equipment, and are expected to grow due to a number of factors, including technology advances, accelerating digitization, the expansion of data centers, increasing demand for AI and machine learning, and the proliferation of 5G and IoT.

Who are AMD's competitors?

- Intel (Intel):

Intel is the leader in the microprocessor (CPU) market and has long been competing with AMD. - NVIDIA (NVDA):

NVIDIAis focused on the development and manufacture of graphics processor units (GPUs).

NVIDIA's GPUs are used in a wide range of applications, including gaming, professional visualization such as BI tools, and data centers; AMD and NVIDIA compete in the GPU market, especially for gaming and AI applications. - ARM Holdings (ARM):

ARMdesigns CPU cores that are widely used for mobile devices.

While AMD also offers products based on ARM technology, it also competes with other semiconductor companies based on ARM technology. - Qualcomm (QCOM):

Qualcommis known for developing and manufacturing CPUs and wireless communication chips for mobile devices; AMD and Qualcomm compete in the mobile device and wireless communication technology markets in particular.

AMD's competition is broad and varies by product and market.

What are AMD's differentiating factors and advantages over the competition?

- High performance CPU and GPU:

AMD offers high-performance CPUs (Ryzen and EPYC series) and GPUs (Radeon series) that are highly regarded in a wide range of sectors and are competitive in terms of performance, energy efficiency, and price. - Innovation:

AMD's focus on innovation, including the use of 7nm and 5nm manufacturing processes, provides high performance and efficiency. - APU with integrated GPU:

AMD is developing an APU (Accelerated Processing Unit) that integrates the CPU and GPU.

The company is very competitive in the areas of personal computers, game consoles, and large-scale systems. - Price competitiveness:

AMD offers products that are more affordable than competing products offering comparable performance. - Partnerships and Collaborations:

AMD is enhancing the development and marketing of new products through partnerships and collaborations with leading companies such as Microsoft, Sony, and Samsung.

AMD is active in a highly competitive market, but since Intel does not produce GPUs and NVIDIA does not produce CPUs, AMD is expected to gain an additional competitive advantage by offering chips that integrate both GPUs and CPUs (APUs).

What is the future of AMD?

- AMD will launch very high performance CPUs for data center servers in the second half of 2022.

- Announced the release of the AMD Instinct Platform, which is comparable to NVIDIA's high-performance H100 GPU (for modern data centers).

- The growing need for GeneticAI, including ChatGPT, has generated interest in the MI300 for AI servers.

- The possibility of AMD taking over the AI supercomputer share of the AI GPU market for data centers, where NVIDIA is taking the lion's share of the market.

- Announced an investment of up to $135 million (about 19 billion yen) in Ireland for artificial intelligence (AI) research and development. The company will promote the development of data centers and 6G (6th generation mobile communications).

In deep learning, GPUs are usually efficient for training data, but CPUs are more efficient for inference and other tasks.

NVIDIA's H100 has only a GPU, while AMD's MI300 has an APU (GPU and CPU), which improves efficiency and is cheaper than NVIDIA's in terms of price, making it highly competitive. In the AI GPU market for data centers, which NVIDIA dominates, AMD's AI It remains to be seen whether AMD will take a partial share of the supercomputer market.

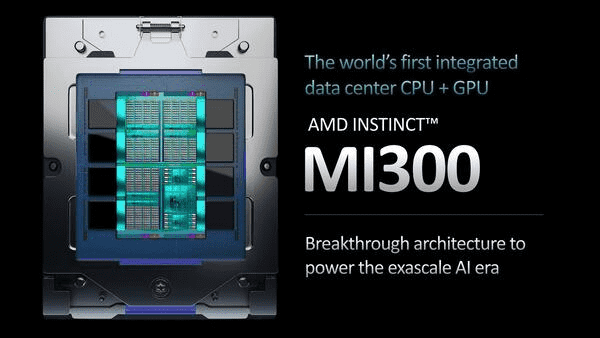

What is Instinct MI300?

Source:AMD Instinct™ MI300 Series Accelerators

- Instinct MI300 has one CPU, one GPU and one HBM3.

- The structure of the APU, which includes the CPU die, GPU die, and even HBM3 memory in a single package.

- Announced an 8x performance improvement over previous models and plans to launch in Q4 for data centers. (Release on schedule for December 2023)

- The lineup consists of three types: the Instinct MI300A with a single GPU, the Instinct MI300X with a CPU + GPU configuration, and the Instinct MI300X Platform with eight Instinct MI300X units installed together.

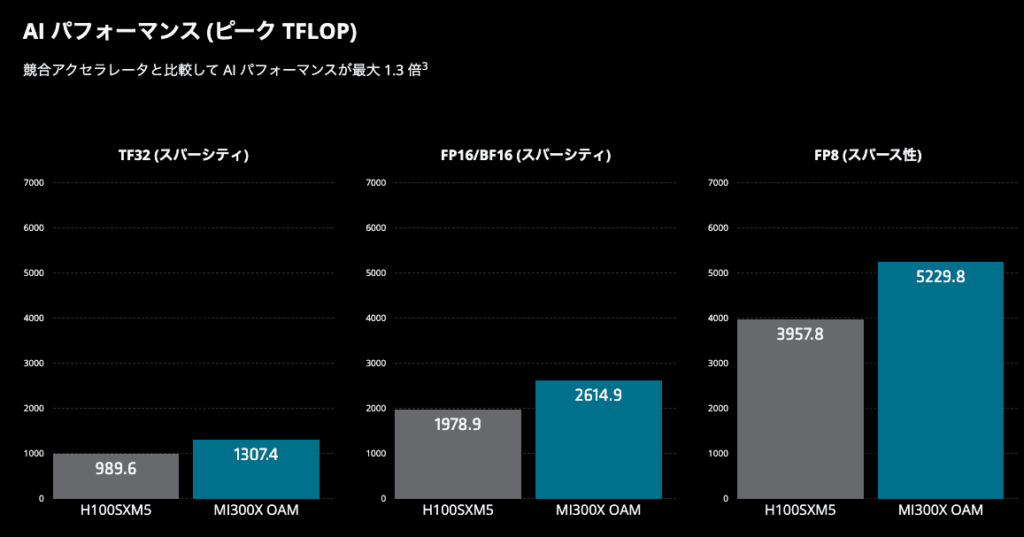

The Instinct MI300 Series exceeds the performance of the NVIDIA H100.

Source:AMD Instinct™ MI300 Series Accelerators

- NVIDIAThe GPU is said to have specifications that exceed those of the H100 GPU in the HPC market, with up to 1.3x AI performance and up to 2.4x HPC performance, according to the announcement.

What is APU? What are the advantages?

- An APU (Accelerated Processing Unit) is AMD's processor that combines one or more CPUs and a GPU (graphics accelerator).

- Low cost due to the combination of CPU and GPU.

- The combination of CPU and GPU reduces data circuits, which in turn reduces power consumption.

- Data can be accessed more efficiently than when the CPU and GPU are separated from each other, resulting in faster processing speeds.

- High-precision graphics processing performance requires a video card, but for general PC and gaming applications, a video card is not necessary, resulting in physical space savings.

- One disadvantage of APUs is that the performance of a GPU integrated into an APU is generally lower than that of an independent GPU card. For applications that require advanced graphics or computational processing, an independent GPU card may be more suitable.

We will now look at AMD's performance.

AMD's Financial Results

First, we will review the following four indicators to analyze AMD's minimum performance.

- Sales: An indicator of a company's performance and growth.

- Operating Cash Flow and Operating Cash Flow Margin: Indicators that look at how much cash a company generates from its services. The margin is considered excellent when the ratio is 15%.

- Operating Profit: Profit earned by a company from its core business. An indicator to evaluate a company's performance.

- EPS: An indicator that looks at a company's earning power "profitability" and "growth potential" in terms of net income per share. The higher the number, the higher the earning power.

Each data is,Investing.com, ,TradingViewSee from

AMD stock price, current price

AMD stock chart (TradingView).

The chart shows the Relative Strength Index (RSI). Reference as an indicator of market overheating.

*An overbought indicator when the RSI exceeds 70% to 80%, and conversely, an oversold indicator when the RSI falls below 20% to 30%.

AMD Quarterly: Sales Trends

Quarterly sales forecasts and actual sales and year-on-year changes.

| Fiscal year (Quarter) | date of publication | Sales Forecast | Sales results | relative change from last year |

|---|---|---|---|---|

| 2021:Q2 | 3620 | 3850 | - | |

| 2021:Q3 | 4110 | 4310 | - | |

| 2021:Q4 | 4520 | 4830 | - | |

| 2022:Q1 | 5010 | 5890 | - | |

| 2022:Q2 | 6530 | 6550 | 70.13% | |

| 2022:Q3 | 5650 | 5570 | 29.23% | |

| 2022:Q4 | 5510 | 5600 | 15.94% | |

| 2023:Q1 | 5300 | 5350 | -9.17% | |

| 2023:Q2 | 5320 | 5360 | -18.17% | |

| 2023:Q3 | 5690 | 5800 | 4.13% | |

| 2023:Q4 | 6130 | 6170 | 10.18% | |

| 2024:Q1 | 5480 | 5470 | 2.24% | |

| 2024:Q2 | 5730 | 5830 | 8.77% | |

| 2024:Q3 | 6710 | 6820 | 17.59% | |

| 2024:Q4 | 7530 | 7660 | 24.15% | |

| 2025:Q1 | 7120 | 7440 | 36.01% | |

| 2025:Q2 | 7410 | 7680 | 31.73% | |

| 2025:Q3 | - | 8730 | - | - |

| 2025:Q4 | - | 9170 | - | - |

| 2026:Q1 | - | 8830 | - | - |

| Millions of U.S. dollars | ||||

AMD Quarterly: Cash Flow Trends

Quarterly operating CF, operating CF margin, and free CF.

- Operating CF: The total amount of cash earned from the main business.

- free CF: Money at the disposal of companies. The real earning power of companies.

- Operating CF Margin:An indicator of earning efficiency. How many % of sales remain as cash. (151 TP3T or more is excellent)

| Fiscal year (Quarter) | date of publication | Operating CF | Operating CF Margin | free CF |

|---|---|---|---|---|

| 2021:Q2 | 952 | 24.73% | 888 | |

| 2021:Q3 | 849 | 19.70% | 764 | |

| 2021:Q4 | 822 | 17.02% | 736 | |

| 2022:Q1 | 995 | 16.89% | 924 | |

| 2022:Q2 | 1040 | 15.88% | 906 | |

| 2022:Q3 | 965 | 17.32% | 842 | |

| 2022:Q4 | 567 | 10.13% | 443 | |

| 2023:Q1 | 486 | 9.08% | 328 | |

| 2023:Q2 | 379 | 7.07% | 254 | |

| 2023:Q3 | 421 | 7.26% | 297 | |

| 2023:Q4 | 381 | 6.18% | 242 | |

| 2024:Q1 | 521 | 9.52% | 379 | |

| 2024:Q2 | 593 | 10.17% | 439 | |

| 2024:Q3 | 628 | 9.21% | 496 | |

| 2024:Q4 | 1300 | 16.97% | 1090 | |

| 2025:Q1 | 939 | 12.62% | 727 | |

| 2025:Q2 | 2010 | 26.17% | 1730 | |

| Millions of U.S. dollars | ||||

AMD Quarterly: Operating Income Trends

Quarterly operating income and operating margin.

- Operating income: The most important profit that shows the power of earning in the core business.

| Fiscal year (Quarter) | date of publication | Operating income | Operating profit ratio |

|---|---|---|---|

| 2021:Q2 | 840 | 21.82% | |

| 2021:Q3 | 953 | 22.11% | |

| 2021:Q4 | 1210 | 25.05% | |

| 2022:Q1 | 868 | 14.74% | |

| 2022:Q2 | 661 | 10.09% | |

| 2022:Q3 | -21 | -0.38% | |

| 2022:Q4 | -102 | -1.82% | |

| 2023:Q1 | -44 | -0.82% | |

| 2023:Q2 | 6 | 0.11% | |

| 2023:Q3 | 253 | 4.36% | |

| 2023:Q4 | 397 | 6.43% | |

| 2024:Q1 | 62 | 1.13% | |

| 2024:Q2 | 259 | 4.44% | |

| 2024:Q3 | 710 | 10.41% | |

| 2024:Q4 | 1090 | 14.23% | |

| 2025:Q1 | 806 | 10.83% | |

| 2025:Q2 | -134 | -1.74% | |

| Millions of U.S. dollars | |||

AMD Quarterly: EPS Trends

Quarterly EPS forecast and actual EPS.

| Fiscal year (Quarter) | date of publication | EPS Forecast | EPS Results | between (e.g. two people) |

|---|---|---|---|---|

| 2021:Q2 | 0.54 | 0.63 | 0.09 | |

| 2021:Q3 | 0.66 | 0.73 | 0.07 | |

| 2021:Q4 | 0.76 | 0.92 | 0.16 | |

| 2022:Q1 | 0.91 | 1.13 | 0.22 | |

| 2022:Q2 | 1.03 | 1.05 | 0.02 | |

| 2022:Q3 | 0.69 | 0.67 | -0.02 | |

| 2022:Q4 | 0.67 | 0.69 | 0.02 | |

| 2023:Q1 | 0.56 | 0.6 | 0.04 | |

| 2023:Q2 | 0.57 | 0.58 | 0.01 | |

| 2023:Q3 | 0.68 | 0.7 | 0.02 | |

| 2023:Q4 | 0.77 | 0.77 | 0 | |

| 2024:Q1 | 0.62 | 0.62 | 0 | |

| 2024:Q2 | 0.68 | 0.69 | 0.01 | |

| 2024:Q3 | 0.92 | 0.92 | 0 | |

| 2024:Q4 | 1.08 | 1.09 | 0.01 | |

| 2025:Q1 | 0.94 | 0.96 | 0.02 | |

| 2025:Q2 | 0.48 | 0.48 | 0 | |

| 2025:Q3 | - | 1.17 | - | - |

| 2025:Q4 | - | 1.31 | - | - |

| 2026:Q1 | - | 1.2 | - | - |

| Millions of U.S. dollars | ||||

AMD Full Year: Sales Trends

This is the sales forecast for the full year and actual sales and year-on-year changes.

| Fiscal year (full year) | date of publication | Sales Forecast | Sales results | relative change from last year |

|---|---|---|---|---|

| 2016 | - | 4240 | 4270 | - |

| 2017 | 5260 | 5330 | 24.82% | |

| 2018 | 6500 | 6470 | 21.39% | |

| 2019 | 6710 | 6730 | 4.02% | |

| Year 2020 | 9530 | 9760 | 45.02% | |

| Year 2021 | 16130 | 16430 | 68.34% | |

| Year 2022 | 23520 | 23600 | 43.64% | |

| Year 2023 | 22670 | 22680 | -3.90% | |

| Year 2024 | 25670 | 25790 | 13.71% | |

| Year 2025 | - | 33100 | - | - |

| Year 2026 | - | 40240 | - | - |

| Year 2027 | - | 47400 | - | - |

| Year 2028 | - | 62260 | - | - |

| Millions of U.S. dollars | ||||

AMD Full Year: Cash Flow Trends

Quarterly operating CF, operating CF margin, and free CF.

| Fiscal year (full year) | date of publication | Operating CF | Operating CF Margin | free CF |

|---|---|---|---|---|

| 2016 | - | 90.00 | 2.11% | 13 |

| 2017 | 12 | 0.23% | -101 | |

| 2018 | 34 | 0.53% | -129 | |

| 2019 | 493 | 7.33% | 276 | |

| Year 2020 | 1070 | 10.96% | 777 | |

| Year 2021 | 3520 | 21.42% | 3220 | |

| Year 2022 | 3560 | 15.08% | 3120 | |

| Year 2023 | 1670 | 7.36% | 1120 | |

| Year 2024 | 3040 | 11.79% | 2400 | |

| Millions of U.S. dollars | ||||

AMD Full Year: Operating Income Trends

Operating income and operating margin for the full year.

| Fiscal year (full year) | date of publication | Operating income | Operating profit ratio |

|---|---|---|---|

| 2016 | - | -469 | -10.98% |

| 2017 | 67 | 1.26% | |

| 2018 | 456 | 7.05% | |

| 2019 | 589 | 8.75% | |

| Year 2020 | 1,380 | 14.14% | |

| Year 2021 | 3,680 | 22.40% | |

| Year 2022 | 1,610 | 6.82% | |

| Year 2023 | 625 | 2.76% | |

| Year 2024 | 2220 | 8.61% | |

| Millions of U.S. dollars | |||

AMD Full Year: EPS Trends

This is the EPS forecast and actual EPS for the full year.

| Fiscal year (full year) | date of publication | EPS Forecast | EPS Results | between (e.g. two people) |

|---|---|---|---|---|

| 2016 | - | -0.15 | -0.14 | 0.01 |

| 2017 | 0.14 | 0.17 | 0.03 | |

| 2018 | 0.45 | 0.46 | 0.01 | |

| 2019 | 0.62 | 0.64 | 0.02 | |

| Year 2020 | 1.24 | 1.29 | 0.05 | |

| Year 2021 | 2.65 | 2.79 | 0.14 | |

| Year 2022 | 3.5 | 3.5 | 0 | |

| Year 2023 | 2.65 | 2.65 | 0 | |

| Year 2024 | 3.31 | 3.31 | 0 | |

| Year 2025 | - | 3.91 | - | - |

| Year 2026 | - | 6.03 | - | - |

| Year 2027 | - | 7.66 | - | - |

| Millions of U.S. dollars | ||||

What is AMD's growth strategy?

To summarize AMD's strategic focus on growth as seen in its Q1 2023 earnings report,

- Data Centers and Embedded Systems:.

These segments accounted for more than 501 TP3T of Q1 revenue. We expect continued growth in these segments. - AI and Machine Learning:.

Provides new tools and frameworks to meet the needs of AI. - Cloud Computing:.

Provides processors that improve performance and energy efficiency in areas for data centers. - Mobile Processors

New mobile processors are introduced and new commercial, consumer, and gaming experiences enhanced using these processors. - Partnerships:

AMD renews its long-term agreement with Samsung. - Graphics and Games

New professional graphics cards are announced.

AMD is responding to industry trends and looking to expand its portfolio of new products and technologies.

What is AMD's market share of the CPU market?

AMD's CPU market share according to Mercury Research, a market research firm.

- Despite the decline in DesctopCPU and MobillityCPU from Q2 2022 due to inventory adjustments, overall market share is increasing steadily.

- In ServerCPU, the market share is also expanding rapidly from 2022.

What are the advantages and disadvantages of AMD's acquisition of Xilinx?

Xilinx is a semiconductor manufacturing company that develops programmable logic devices, primarily FPGAs (field programmable gate arrays).

Purpose and Benefits of the Xilinx Acquisition

- The main purpose of the acquisition is to expand AMD's product portfolio, especially to strengthen its competitiveness in the data center market.

- FPGAs are widely used in high-growth markets such as machine learning, communications infrastructure, and cloud computing, and by incorporating Xilinx FPGA technology, AMD aims to further strengthen its competitive edge.

demerit

- Financial risk is expected to increase due to the amortization of goodwill, as this is a fairly expensive acquisition deal.

How is the semiconductor sector as a whole doing?

Leading companies in the semiconductor sector are AMD, NVIDIA, Intel, and TSMC.

The main points for each company are as follows

- Intel:.

In January 2023, the company will launch a new server CPU with the development name "Sapphire Rapids" (Sapphire Rapids).Intel has a market share of about 80% in the server CPU market, but has been slow to introduce new products in the past few years.

However, the release of this new CPU may help Intel's sales for servers and data centers to recover. - AMD (Advanced Micro Devices):.

AMD is a company that has grown by cutting into Intel's market share.

As new Intel products come to market, new growth opportunities may emerge. - NVIDIA (NVIDIA):

NVIDIA offers strong GPUs for data centers, and as that market grows, NVIDIA may be able to ship even more GPUs. - TSMC (Taiwan Semiconductor Manufacturing Company):.

TSMC, like AMD and NVIDIA, is also trending flat or slightly increasing sales.

Semiconductor companies are particularly interested in the sales trends of Intel's new CPUs and their impact on the overall market.

In DRAM (Dynamic Random Access Memory), new CPUs from Intel and AMD use the faster and more powerful DDR5 DRAM standard.

This could increase the average unit price for DRAM manufacturers and contribute to improved profitability.

What are the future developments and prospects for AMD?

The following points are noteworthy regarding the future development and potential of AM.

- Semiconductor market growthThe semiconductor industry continues to grow and AMD is playing an important role in this market. Increasing demand in areas such as cloud computing, data centers, AI, and gaming will drive AMD's growth.

- Product Line Expansion:.AMD is focusing on the development of high-performance CPUs and GPUs. In particular, Ryzen series CPUs and Radeon series GPUs are highly regarded in the market, and the company is expected to expand these product lines.

- Data Center and Cloud Markets:.AMD is gaining market share with its EPYC processors for data centers. Increasing demand from cloud providers and large enterprises has been a major source of revenue.

- Advances in AI:.AMD is working with partners to drive the future of AI. AMD is focusing on the development of high-performance CPUs and GPUs, including the new AMD Instinct™ MI300 series and AMD Ryzen™ processors.

- Competitive Environment:.Competition from competitors such as Intel and NVIDIA is intense, and these companies are also continuously introducing innovative products to the market; it is important for AMD to maintain its technological innovation and cost competitiveness.

- InnovationAMD is focusing on improving its manufacturing processes and developing new architectures. In particular, the adoption of 5nm process technology and the transition to next-generation architectures will contribute to improved performance and efficiency.

In general, AMD is likely to maintain its position as an important player in the semiconductor industry and continue to grow in the future by being responsive to technological innovation and market trends.

However, attention should be paid to market fluctuations and changes in the competitive environment.

AMD's Q3 FY2023 Financial Results Summary

Sales and Revenues

- Net sales: $6.8 billion, up 181 TP3T YoY. Driven by sales growth in the Data Center and Client divisions.

- Net Income under GAAP: $771 million, with earnings per share of $0.47, a significant increase over the same period last year.

- Non-GAAP Net Income: $1.54 billion, earnings per share of $0.92, up 31% from the same period last year.

Sectoral Growth

- Data Center Division: Sales of $3.5 billion, up 1221 TP3T YoY. Sales of Instinct GPUs and EPYC CPUs were particularly strong.

- Client Department: Sales of $1,881M, up 29% YoY, driven by high demand for the Ryzen series.

- Game Division: Sales were $462M, down 69% YoY. Affected by lower demand for semi-custom products.

- Embedded Division: Sales were $927M, down 25% YoY. Demand is on a recovery trend despite the impact of inventory adjustments by customers.

Cash Flow and Shareholder Returns

- Operating Cash Flow: $628 million.

- free cash flow: $496 million.

Future Guidance

- Q4 Sales Forecast: Sales are projected to be approximately $7.5 billion. Demand is expected to grow in the data center and AI fields.

- Non-GAAP Gross Margin: 54% is expected.

AMD announced plans to continue to grow and expand its share of the data center and AI markets.

AMD's Q2 FY2023 Financial Results Summary

Sales and Revenues

- Net sales: $5.835 billion, up 9% from the same period last year. Growth was mainly driven by the data center and client segments.

- Net Income under GAAPEarnings per share was $0.16.

- Non-GAAP Net Income: $1.126 billion, or $0.69 per share, up from the same period last year.

Sectoral Growth

- data center: Sales were $2.834 billion, up 115% YoY. Growth was driven by demand for AMD Instinct GPUs and 4th generation EPYC CPUs in particular.

- Client Department: Sales were $1.492 billion, up 49% YoY, driven by increased sales of AMD Ryzen processors.

- game: Revenues declined 59% YoY. Sales of semi-custom products were sluggish.

- Embedded Division: Sales were $861 million, down 41% from the same period last year. Affected by inventory adjustments by customers.

Cash Flow and Shareholder Returns

- Operating Cash Flow: $593 million, an improvement from the same period last year.

- free cash flow: $439 million. Mainly due to increased cash flow from operating activities.

Future Guidance

- Third Quarter Sales Forecast: $6.7 billion projected, a 16% increase over the same period last year.

- Non-GAAP projections: Gross profit margin based on the median sales is expected to be 53.5%.

AMD expects demand to continue to increase in the AI and data center areas, and intends to strengthen its competitiveness in the market, especially through the introduction of next-generation processors and GPUs.

AMD's Q1 FY2023 Financial Results Summary

Sales and Revenues

- Net sales: $5.5 billion, up 21 TP3T YoY. Growth in the Data Center and Client segments partially offset declines in the Gaming and Embedded segments.

- Net Income under GAAP: $123 million, earnings per share $0.07.

- Non-GAAP Net Income: $1,013 million and earnings per share of $0.62. Both increased from the same period last year.

Sectoral Growth

- Data Center Division: Sales were $2.3 billion, up $80% YoY. Demand for AMD Instinct GPUs and 4th generation EPYC CPUs in particular increased significantly.

- Client Department: Sales were $1.37 billion, up 85% YoY. Mainly contributed by sales of AMD Ryzen series.

- Game Division: Sales were $922M, down $48% YoY, due to lower demand for Radeon GPUs and semi-custom products.

- Embedded Division: Sales were $846M, down $46% from the same period last year. Affected by inventory adjustment by customers.

Cash Flow and Shareholder Returns

- Operating Cash Flow: $521 million.

- free cash flow: $379 million.

Future Guidance

- Second Quarter Sales Forecast: Sales are projected to be approximately $5.7 billion, with AI-related demand expected to increase.

- Non-GAAP Gross Margin: 53% is expected.

AMD expects growth in the AI technology and data center areas and intends to continue to strengthen its competitiveness through next-generation processors and GPUs to achieve further sales and profit growth.

What brokerage firms can I buy AMD stock from?

We have listed the major brokerage firms that offer AMD shares. At these brokerages, you can choose to invest as a CFD (Contract for Difference) in addition to direct stock trading as a foreign stock.

I myself mainly use SBI Securities, but some stocks they handle may not be available for purchase. In such cases, I sometimes use CFDs at Saxo Bank Securities or IG Securities.

| Popular Brokerage Firms | stock trading | CFD Trading |

|---|---|---|

| SBI Securities | Fat. | ✕ |

| Matsui Securities Co. | Fat. | ✕ |

| Rakuten Securities, Inc. | Fat. | ✕ |

| Monex, Inc. | Fat. | ✕ |

| Mitsubishi UFJ e-Smart Securities (formerly au kabu.com Securities) | Fat. | ✕ |

| DMM Stock | Fat. | ✕ |

| Saxo Bank Securities | Fat. | Fat. |

| IG Securities | ✕ | Fat. |

| GMO CLICK Securities, Inc. | ✕ | Fat. |

| moomoo Securities | Fat. | ✕ |

summary

- AMD's influence continues to grow as it offers high-performance semiconductor products in markets as diverse as PCs, gaming, data centers, and embedded systems.

- The acquisition of Xilinx, for its part, is a clear move by AMD to expand its competitiveness in new markets.

- However, recent financial reports show that while the client segment is struggling, the data center and embedded segments are showing solid growth AMD's diversification strategy is paying off and growth is expected.

- On the other hand, R&D spending is on the rise, an investment to develop new technologies and remain competitive in the market, showing why AMD is an attractive investment target.

Based on the above, AMD continues to be a company that investors should keep an eye on.