This site is a great place for me (@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- Introduction.

- What kind of company is Spok Holdings (SPOK)?

- What are the main business activities of Spok Holdings (SPOK)?

- What makes Spock Holdings stand out from the crowd of investors?

- What are the sectors, industries, and themes to which Spock Holdings belongs?

- What is Spok Holdings (SPOK)'s dividend?

- Who are Spock Holdings' competitors?

- What are Spock Holdings' differentiators and advantages over its competitors?

- What are the future prospects and trends in the healthcare communication solutions market?

- What is the future of the digital health market?

- Current share price of Spok Holdings (SPOK)

- Spock Holdings Financial Results

- Spok Holdings (SPOK) Quarterly: Sales Trends

- Spok Holdings (SPOK) Quarterly: Cash Flow Trends

- Spok Holdings (SPOK) Quarterly: Operating Income Trends

- Spok Holdings (SPOK) Quarterly: EPS Change

- Spok Holdings (SPOK) Full Year: Sales Trends

- Spok Holdings (SPOK) Full Year: Cash Flow Trends

- Spok Holdings (SPOK) Full Year: Operating Income Trends

- Spok Holdings (SPOK) Full Year: EPS Change

- What are the future developments and prospects for Spock Holdings?

- Spock Holdings Q4 2023 and Annual Report Financial Summary

- Which brokerage firms can I buy shares of Spok Holdings (SPOK)?

- summary

Introduction.

Turning to the stock chart of Spock Holdings (SPOK), we can see a seemingly modest but steady uptrend.

Attracted by this gradual but intermittent growth, we decided to investigate further.

Spock Holdings, while not yet well known, may be a hidden growth stock given its high dividend payout and potential in the market.

We will watch with anticipation to see how this issue develops in the future.

What kind of company is Spok Holdings (SPOK)?

Spok Holdings (SPOK) is,A provider of critical communication solutions, especially in the medical field.

About Us

- Year of establishment: April 1, 1949January 1986

- Headquarter Location: Tokyo, JapanAlexandria, Virginia

- CEO: Vincent D. Kelly

- Listed on NASDAQ SPOK

What are the main business activities of Spok Holdings (SPOK)?

Spok Holdings (SPOK)'s main business is the provision of communication solutions in the healthcare sector. Below are the details

Promoting cooperation among medical teams

Spock Holdings is developing products to facilitate collaboration among healthcare teams and improve patient care.

For this,Tools for streamlining communication and rapid information sharing among healthcare professionalsare included.

Spok Care Connect® Platform

The company's flagship product, theSpok Care Connect® is a platform that enables rapid collaboration among medical team members.

Through this platform, healthcare professionals can quickly access the people and information they need.

Used in more than 2,200 hospitals

Spock Holdings' solution is,It is used in more than 2,200 hospitals, including the U.S. News & World Report's Best of the Best.

Customers send more than 100 million messages through the Spok® solution each month.

Commitment to Innovation

Spock Holdings is focused on innovation to shape the future of medical communication, aiming to improve and streamline communication in the healthcare industry.

From these businesses,Spock Holdings specializes in improving communication and efficiency in the healthcare industryIt can be seen that the

Its products and services are intended to help healthcare professionals work together more effectively and improve the quality of patient care.

What makes Spock Holdings stand out from the crowd of investors?

The main factors that make Spok Holdings (SPOK) highly valued by investors are as follows

High institutional ownership

Spock Holdings shares are,45% are held by institutional investors.This indicates that the company's stock price is sensitive to the trading behavior of institutional investors.

Because institutional investors have significant resources and liquidity, their investment decisions have important implications, especially for individual investors.

Presence of major shareholders

50% of the company's stock is held by 16 investors, including hedge funds. It is,It means that a particular shareholder may have a significant influence on the company.

Shareholder alignment with management

The management of Spock Holdings owns shares in the company. This indicates an alignment of interests between management and shareholders and is generally considered a positive factor.

Percent owned by the general public

Shareholdings in 33% by the general public, especially retail investors, have a non-negligible influence on the company's operations.

Ownership by public companies

The ownership of 4.81 TP3T shares by other public companies suggests a strategic interest, which is also worth noting.

These factors show why Spock Holdings is an attractive investment for investors.

In particular, the high involvement of institutional investors,It shows that Spock Holdings has gained a certain amount of trust from professional investors.

What are the sectors, industries, and themes to which Spock Holdings belongs?

sector

- Spock Holdings is part of the Communications Services sector, particularly in the area of healthcare communications.

type of industry

- Wireless Telecommunications:.Spock Holdings' primary industry is health information services in wireless telecommunications.

Themes belonging to

- Medical Communication Solutions:.Exchange of knowledge and information related to the medical and healthcare fields among healthcare professionals, between healthcare professionals and patients, and among patients, etc.

What is Spok Holdings (SPOK)'s dividend?

- Dividend Yield in 2023:.8.51%

- Dividend payout ratio (latest 12 months): (%) 68.68%

- Frequency of dividend payments:. quarterly

- Dividend payment monthMarch, June, September, December (specific dates may vary)

Spock Holdings has a dividend yield of over 81 TP3T, making it a very attractive high dividend paying stock.

How long has Spock Holdings been paying dividends?

According to the dividend payment history of Spok Holdings (SPOK), the company has been paying dividends since at least 2010 and regularly since then.

Below is historical data on quarterly dividend amounts and yields.

*Data areInvesting.comsee

Who are Spock Holdings' competitors?

Major competitors of Spok Holdings (SPOK) include.

- Voalte, Inc [privately held]:.An American healthcare technology company that provides communication and collaboration solutions for healthcare organizations.

- Vocera Communications (Vocera) [VCRA]:.Provides communication technologies and solutions for the healthcare industry.

- PerfectServe, Inc. [Private Company]:.Healthcare technology company. Providing solutions to improve communication and patient care between healthcare professionals and patients.

It can be said that there are not many direct competitors in Spock Holdings' business.

This makes it easier for the company to develop advantageous business operations in terms of market dominance, brand recognition, and expansion of its customer base.

What are Spock Holdings' differentiators and advantages over its competitors?

Spok Holdings' (SPOK) differentiators and advantages over its competitors are as follows

- Spock Holdings' solutions are used in more than 2,200 hospitals, and thisThe company's extensive installation record demonstrates its reliability and track record.

- The Spok Care Connect® platform enables rapid collaboration among healthcare team members to improve the quality of patient care. The platform is designed to provide healthcare professionals with quick access to the people and information they need.

- The company focuses on innovation in medical communication,The company's commitment to providing new solutions and future growth has given it a competitive edge.

- A corporate culture that puts the customer first encourages the development of products and services that address customer needs, resulting in increased customer satisfaction and the building of long-term customer relationships.

These factors demonstrate why Spock Holdings differentiates itself from and has an edge over its competitors in the healthcare communication solutions market.

What are the future prospects and trends in the healthcare communication solutions market?

For more information on the future and trends in the healthcare communication solutions market, see below.

- Communication in the medical field is being transformed by evolving technologies such as virtual reality, wearable devices, and smartwatches. These technologies improve communication between healthcare professionals and patients, enabling more efficient diagnosis and treatment.

- The COVID-19 pandemic has increased the demand for remote medicine (telemedicine). Telemedicine using smartphones and tablets contributes to improved access to healthcare.

- AI technology is helping to improve the accuracy of patient health monitoring and diagnosis; AI data analysis is helping to suggest the best treatment for individual patients and to predict their health status.

- Patient privacy protection and data security are key issues in medical communications, and HIPAA-compliant electronic health record (EHR) and electronic medical record (EMR) systems are being implemented.

- New communication tools such as voice recognition software and chat boxes are being introduced in the medical field to streamline communication between healthcare professionals and patients.

These trends indicate that the healthcare communication solutions market will continue to grow, with technological advancements being an important factor in improving the quality of communication in the healthcare sector.

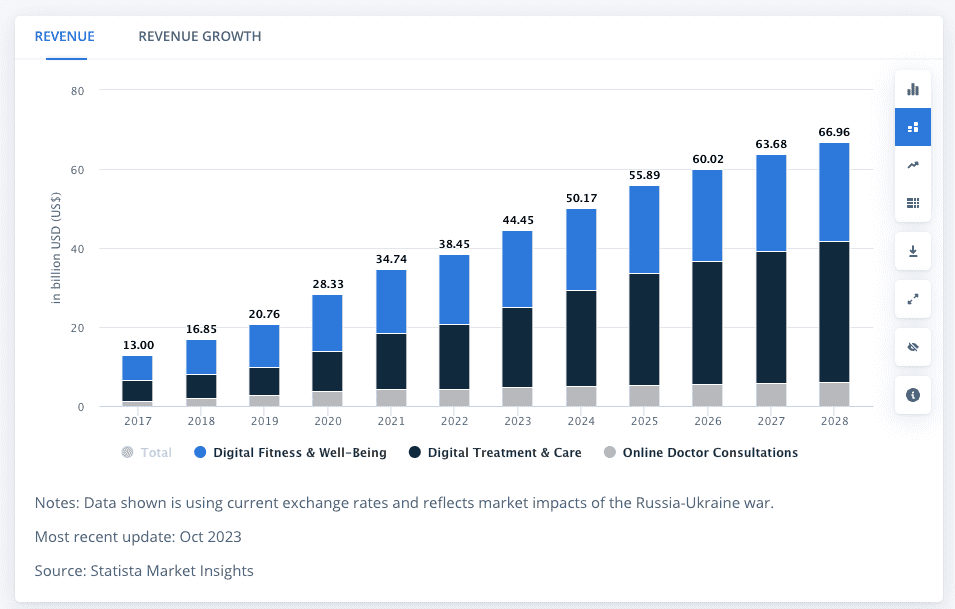

What is the future of the digital health market?

Information on growth data and future prospects for the digital health market is provided below.

- in the United States of AmericaDigital health market revenue is projected to reach approximately US$4.445 billion in 2023The company has been

- This market,Growing at a compound annual growth rate (CAGR) of 8.541 TP3T between 2023 and 2028The company expects that the market will grow,Market size will reach approximately US$6.696 billion by 2028It is predicted that

- The average revenue per user (ARPU) in 2023 is projected to be approximately US$137,700.00.

- The largest segment of the digital health market is "digital treatment and care," which is projected to generate revenues of approximately US$2.041 billion in 2023.

These data are,The digital health market is poised for significant growth in the coming years.

In particular, increased demand for digital solutions such as telemedicine and remote patient monitoring will be a major driver of this growth.

The growing importance of remote healthcare services due to the COVID-19 pandemic is also contributing to market growth.

Source:Digital Health - United States

Current share price of Spok Holdings (SPOK)

Spock Holdings stock chart (TradingView).

The chart shows the Relative Strength Index (RSI). Reference as an indicator of market overheating.

*An overbought indicator when the RSI exceeds 70% to 80%, and conversely, an oversold indicator when the RSI falls below 20% to 30%.

Spock Holdings Financial Results

First, we will review the following four indicators to perform a minimum performance analysis of Spok Holdings (SPOK).

- Sales: An indicator of a company's performance and growth.

- Operating Cash Flow and Operating Cash Flow Margin: Indicators that look at how much cash a company generates from its services. The margin is considered excellent when the ratio is 15%.

- Operating Profit: Profit earned by a company from its core business. An indicator to evaluate a company's performance.

- EPS: An indicator that looks at a company's earning power "profitability" and "growth potential" in terms of net income per share. The higher the number, the higher the earning power.

Each data is,Investing.com, ,TradingViewSee from

Spok Holdings (SPOK) Quarterly: Sales Trends

Quarterly sales forecasts and actual sales and year-on-year changes.

| Fiscal year (Quarter) | date of publication | Sales Forecast | Sales results | relative change from last year |

|---|---|---|---|---|

| 2022:Q2 | - | 33.7 | - | |

| 2022:Q3 | 32.8 | 33.74 | - | |

| 2022:Q4 | 32.48 | 33.26 | - | |

| 2023:Q1 | 32.26 | 33.18 | - | |

| 2023:Q2 | 33.6 | 36.46 | 8.19% | |

| 2023:Q3 | 33.7 | 35.43 | 5.01% | |

| 2023:Q4 | 32.65 | 33.95 | 2.07% | |

| 2024:Q1 | 34.84 | 34.91 | 5.21% | |

| 2024:Q2 | 34.31 | 33.98 | -6.80% | |

| 2024:Q3 | 34.3 | 34.87 | -1.58% | |

| 2024:Q4 | 35.5 | 33.89 | -0.18% | |

| 2025:Q1 | 34 | 36.29 | 3.95% | |

| 2025:Q2 | 35 | 35.69 | 5.03% | |

| 2025:Q3 | - | 35.9 | - | - |

| 2025:Q4 | - | 34.4 | - | - |

| Millions of U.S. dollars | ||||

Spok Holdings (SPOK) Quarterly: Cash Flow Trends

Quarterly operating CF, operating CF margin, and free CF.

- Operating CF: The total amount of cash earned from the main business.

- free CF: Money at the disposal of companies. The real earning power of companies.

- Operating CF Margin:An indicator of earning efficiency. How many % of sales remain as cash. (151 TP3T or more is excellent)

| Fiscal year (Quarter) | date of publication | Operating CF | Operating CF Margin | free CF |

|---|---|---|---|---|

| 2022:Q2 | -1.02 | -3.03% | -1.53 | |

| 2022:Q3 | 5.75 | 17.04% | 5.17 | |

| 2022:Q4 | 6.6 | 19.84% | 4.6 | |

| 2023:Q1 | 2.61 | 7.87% | 1.96 | |

| 2023:Q2 | 8.59 | 23.56% | 7.42 | |

| 2023:Q3 | 3.2 | 9.03% | 2.59 | |

| 2023:Q4 | 11.79 | 34.73% | 10.79 | |

| 2024:Q1 | 2 | 5.73% | 1.12 | |

| 2024:Q2 | 7.42 | 21.84% | 6.78 | |

| 2024:Q3 | 11.1 | 31.83% | 10.26 | |

| 2024:Q4 | 8.41 | 24.82% | 7.55 | |

| 2025:Q1 | 2.25 | 6.20% | 1.51 | |

| 2025:Q2 | 7.04 | 19.73% | 5.99 | |

| Millions of U.S. dollars | ||||

Spok Holdings (SPOK) Quarterly: Operating Income Trends

Quarterly operating income and operating margin.

- Operating income: The most important profit that shows the power of earning in the core business.

| Fiscal year (Quarter) | date of publication | Operating income | Operating profit ratio |

|---|---|---|---|

| 2022:Q2 | 2.86 | 8.49% | |

| 2022:Q3 | 5.04 | 14.94% | |

| 2022:Q4 | 3.84 | 11.55% | |

| 2023:Q1 | 4.73 | 14.26% | |

| 2023:Q2 | 6.32 | 17.33% | |

| 2023:Q3 | 6.29 | 17.75% | |

| 2023:Q4 | 4.46 | 13.14% | |

| 2024:Q1 | 5.32 | 15.24% | |

| 2024:Q2 | 4.82 | 14.18% | |

| 2024:Q3 | 5.29 | 15.17% | |

| 2024:Q4 | 4.64 | 13.69% | |

| 2025:Q1 | 6.08 | 16.75% | |

| 2025:Q2 | 5.41 | 15.16% | |

| Millions of U.S. dollars | |||

Spok Holdings (SPOK) Quarterly: EPS Change

Quarterly EPS forecast and actual EPS.

| Fiscal year (Quarter) | date of publication | EPS Forecast | EPS Results | between (e.g. two people) |

|---|---|---|---|---|

| 2022:Q2 | - | 0.1 | - | |

| 2022:Q3 | 0.11 | 0.15 | 0.04 | |

| 2022:Q4 | 0.18 | 1.21 | 1.03 | |

| 2023:Q1 | 0.19 | 0.15 | -0.04 | |

| 2023:Q2 | 0.23 | 0.23 | 0 | |

| 2023:Q3 | 0.18 | 0.22 | 0.04 | |

| 2023:Q4 | 0.13 | 0.17 | 0.04 | |

| 2024:Q1 | 0.26 | 0.21 | -0.05 | |

| 2024:Q2 | 0.24 | 0.17 | -0.07 | |

| 2024:Q3 | 0.16 | 0.18 | 0.02 | |

| 2024:Q4 | 0.2 | 0.18 | -0.02 | |

| 2025:Q1 | 0.18 | 0.25 | 0.07 | |

| 2025:Q2 | 0.18 | 0.22 | 0.04 | |

| 2025:Q3 | - | 0.19 | - | - |

| 2025:Q4 | - | 0.2 | - | - |

| Millions of U.S. dollars | ||||

Spok Holdings (SPOK) Full Year: Sales Trends

This is the sales forecast for the full year and actual sales and year-on-year changes.

| date of publication | Sales Forecast | Sales results | relative change from last year |

|---|---|---|---|

| - | 33.7 | - | |

| 32.8 | 33.74 | - | |

| 32.48 | 33.26 | - | |

| 32.26 | 33.18 | - | |

| 33.6 | 36.46 | 8.19% | |

| 33.7 | 35.43 | 5.01% | |

| 32.65 | 33.95 | 2.07% | |

| 34.84 | 34.91 | 5.21% | |

| 34.31 | 33.98 | -6.80% | |

| 34.3 | 34.87 | -1.58% | |

| 35.5 | 33.89 | -0.18% | |

| 34 | 36.29 | 3.95% | |

| 35 | 35.69 | 5.03% | |

| - | 35.9 | - | - |

| - | 34.4 | - | - |

| Millions of U.S. dollars | |||

Spok Holdings (SPOK) Full Year: Cash Flow Trends

Quarterly operating CF, operating CF margin, and free CF.

| date of publication | Operating CF | Operating CF Margin | free CF |

|---|---|---|---|

| -1.02 | -3.03% | -1.53 | |

| 5.75 | 17.04% | 5.17 | |

| 6.6 | 19.84% | 4.6 | |

| 2.61 | 7.87% | 1.96 | |

| 8.59 | 23.56% | 7.42 | |

| 3.2 | 9.03% | 2.59 | |

| 11.79 | 34.73% | 10.79 | |

| 2 | 5.73% | 1.12 | |

| 7.42 | 21.84% | 6.78 | |

| 11.1 | 31.83% | 10.26 | |

| 8.41 | 24.82% | 7.55 | |

| 2.25 | 6.20% | 1.51 | |

| 7.04 | 19.73% | 5.99 | |

| Millions of U.S. dollars | |||

Spok Holdings (SPOK) Full Year: Operating Income Trends

Operating income and operating margin for the full year.

| date of publication | Operating income | Operating profit ratio |

|---|---|---|

| 2.86 | 8.49% | |

| 5.04 | 14.94% | |

| 3.84 | 11.55% | |

| 4.73 | 14.26% | |

| 6.32 | 17.33% | |

| 6.29 | 17.75% | |

| 4.46 | 13.14% | |

| 5.32 | 15.24% | |

| 4.82 | 14.18% | |

| 5.29 | 15.17% | |

| 4.64 | 13.69% | |

| 6.08 | 16.75% | |

| 5.41 | 15.16% | |

| Millions of U.S. dollars | ||

Spok Holdings (SPOK) Full Year: EPS Change

This is the EPS forecast and actual EPS for the full year.

| date of publication | EPS Forecast | EPS Results | between (e.g. two people) |

|---|---|---|---|

| - | 0.1 | - | |

| 0.11 | 0.15 | 0.04 | |

| 0.18 | 1.21 | 1.03 | |

| 0.19 | 0.15 | -0.04 | |

| 0.23 | 0.23 | 0 | |

| 0.18 | 0.22 | 0.04 | |

| 0.13 | 0.17 | 0.04 | |

| 0.26 | 0.21 | -0.05 | |

| 0.24 | 0.17 | -0.07 | |

| 0.16 | 0.18 | 0.02 | |

| 0.2 | 0.18 | -0.02 | |

| 0.18 | 0.25 | 0.07 | |

| 0.18 | 0.22 | 0.04 | |

| - | 0.19 | - | - |

| - | 0.2 | - | - |

| Millions of U.S. dollars | |||

What are the future developments and prospects for Spock Holdings?

The following factors are important when considering the future development and potential of Spok Holdings (SPOK)

Market Trends and Industry Growth

- Spock Holdings is active in the healthcare communication solutions market, which is expected to grow due to advances in technology, the proliferation of remote medicine, and the use of artificial intelligence.

- Differentiation from competitors, market positioning, and the development of new products and services will impact future market share and growth.

Financial Condition and Profitability

- Historical performance trends and future earnings projections indicate the health of the company and its growth potential. Sales stability and profitability are especially important.

Innovation and Product Development

- Innovation in the adoption of new technologies and product development is key to securing competitive advantage.

- Developing products and services that meet the needs of the healthcare industry is essential for sustainable growth.

Spock Holdings' future depends largely on its market growth potential, financial condition, technological innovation, strategic partnerships, and management's strategy.

As the healthcare communications market grows, how companies address these elements will be key to their success.

Spock Holdings Q4 2023 and Annual Report Financial Summary

A summary of Spock Holdings' fourth-quarter and full-year financial reports follows.

Highlights for Q4 2023

- Net incomeThe company recorded net income of $3.4 million in the fourth quarter. This compares to $24.2 million in the same period last year ($2.3 million excluding a non-cash tax deduction related gain of $219,000), which represents an increase in real earnings.

- Adjusted EBITDAAdjusted EBITDA for the fourth quarter was $6.5 million, up from $5.6 million in the same period of 2022.

- Software Department Reservations:.Software operational bookings for Q4 totaled $4.1M, up 22% from the previous year. This includes 14 six-figure customer contracts.

- Software RevenueSoftware revenue was $14.9M in the fourth quarter, up 4% from the same period last year.

- Wireless RevenuesWireless revenues were $19.1M, nearly on par with $19M for the same period in 2022. However, units in service are down 2.51 TP3T quarter-over-quarter and down 6.41 TP3T over the past 12 months.

Full Year Results

- Revenue Growth2023 marked the first annual revenue growth in the company's history, with annual growth recorded in both the software and wireless divisions.

Summary of Financial Results

- Spock Holdings has maintained a stable performance, with solid growth in the software and wireless sectors.

- The increase in bookings and revenue growth in the software segment indicates that the company's products are gaining good market acceptance.

- The wireless segment has stable revenues, but the decline in units in service is an area that will need to be monitored in the future.

Which brokerage firms can I buy shares of Spok Holdings (SPOK)?

We have listed the major brokerage firms that offer shares in Spock Holdings. At these brokerages, you can choose to invest as a CFD (Contract for Difference) as well as directly as a foreign stock.

I myself mainly use SBI Securities, but some stocks they handle may not be available for purchase. In such cases, I sometimes use CFDs at Saxo Bank Securities or IG Securities.

| Popular Brokerage Firms | stock trading | CFD Trading |

|---|---|---|

| SBI Securities | Fat. | ✕ |

| Matsui Securities Co. | Fat. | ✕ |

| Rakuten Securities, Inc. | Fat. | ✕ |

| Monex, Inc. | Fat. | ✕ |

| Mitsubishi UFJ e-Smart Securities (formerly au kabu.com Securities) | Fat. | ✕ |

| DMM Stock | ✕ | ✕ |

| Saxo Bank Securities | Fat. | Fat. |

| IG Securities | ✕ | Fat. |

| GMO CLICK Securities, Inc. | ✕ | ✕ |

| moomoo Securities | Fat. | ✕ |

summary

Spock Holdings has established a dominant position in the healthcare communications market with limited competition.

This market is expected to grow as technology advances and remote medicine becomes more prevalent, raising expectations for the stability and growth potential of Spock Holdings' performance.

Although not well known, the stock's price has shown a mild growth trend, and its high dividend characteristics make it a good long-term investment strategy.

By keeping a close eye on market trends and steadily increasing the number of shares, the company can aim for both future earnings growth and stable dividend income.

Personally, I am interested in the future of Spock Holdings.

I'm making use of it too! Get the most out of moomoo securities!

I am.moomoo SecuritiesWhat I like most about using the app is that it is easy to use and makes it easy to gather in-depth information, which is important in investing.

Further,Ability to see trends of large and medium investors.and it has been very helpful in considering the future of the stocks.A wealth of news and earnings-related information on each stock, with support for automatic Japanese translationThe company is also happy to provide instant access to information from overseas.

Moomoo Securities also has the lowest U.S. stock trading commissions.

Interested parties can easily register through this banner link!