このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

▼AIが音声変換したポッドキャスト版はこちらからどうぞ。(Spotifyで再生)

- はじめに

- JEPQとはどのような特徴を持つETF?

- JEPQの運用の仕組みは?

- JEPQの経費率は?

- JEPQの配当利回りは?

- JEPQはなぜこれだけの利回りを出せるのか?

- JEPQの分配金(配当)の支払い時期は?

- JEPQの分配金(配当)の推移は?

- JEPQの現在株価と長期チャート

- JEPQの構成銘柄は?

- JEPIのセクター比率は?

- JEPIとJEPQの違いは?

- JEPIとJEPQどちらに投資すべき?

- JEPQに投資するメリットは?

- JEPQの投資で考えられるデメリットは?

- 「JEPQはおすすめしない」という記事、検索も多くみられがその要因は?

- JEPQはニーサの対象として選べるのか?

- JEPQの特徴をまとめると

- JEPQ投資の分配金再投資戦略のヒント

- JEPQの株を買える証券会社は?

- まとめ

はじめに

以前、高配当ETF「JEPI」について詳細に調査しましたが、ナスダック100のハイテク銘柄に焦点を当て、さらに高い配当利回りを求める投資戦略を考える際、JEPIと同様の仕組みを採用するJEPQも注目する価値があります。

そこで、JEPQについても深く掘り下げてみたいと思います。

長期投資において、配当の重要性は非常に高いです。

ハイテク銘柄と高配当を求めるなら、JEPQは押さえておきたいETFです。

この記事では、JEPQの特徴やメリット・デメリットを分かりやすく解説し、JEPQがあなたの投資スタイルに合っているかどうかを確認してみてください。

関連記事:高配当ETF「JEPI」とは?長期投資におすすめの理由と魅力

JEPQとはどのような特徴を持つETF?

JEPQ(JPMorgan Nasdaq Equity Premium Income ETF)は、以下のような特徴を持つETF。

- JEPQは、J.P. Morganが提供するアクティブ運用のETF。

- 正式名称は、JPMorgan Nasdaq Equity Premium Income ETF(JPモルガン・ナスダック米国株式・プレミアム・インカムETF)

- JEPQは、月次の分配可能な収入とナスダック100への露出を目指しており、低いボラティリティを維持しながら一貫したプレミアム収入を求めることを目的としている。

- JEPQの株式ポートフォリオは、基本的な研究とポートフォリオ構築にデータサイエンスのアプローチを適用している。

また、ナスダック100インデックスのアウト・オブ・ザ・マネー・コールオプションを書くことにより、毎月の分配可能な収入を生成するための規律あるオプションオーバーレイ戦略を実施している。 - JEPQは、2022年5月3日に設立され、NASDAQで取引されている。

ETFについてはこちらで詳しく解説。

JEPQの運用の仕組みは?

JEPQの運用の仕組みはJEPIと基本的に同じ。

アクティブ運用

JEPQはアクティブに運用されるファンドで、ナスダック100に上場している企業に投資している。

カバードコール戦略

JEPQは、ナスダック100指数に対してカバードコール(保有株に対するコールオプションの売却)を間接的に実施している。これは、エクイティリンクノート(ELN)を通じて行われている。

主要な保有銘柄

JEPQの主要な保有銘柄には、Apple(AAPL)、Microsoft(MSFT)などの大手テクノロジー株が含まれている。

また、ナスダック100指数への投資とカバードコールの経済的特性を組み合わせたELNにも投資している。

収益と利回り

JEPQは、ELNへの投資により収益と利回りを大幅に増加させている。

この運用の仕組みにより、JEPQはナスダック100の企業に投資しつつ、カバードコール戦略を用いて高い収益と利回りを目指している。

カバード・コール戦略については以下を参照。

高配当ETF「JEPI」とは? – カバード・コール戦略とは?

JEPQの経費率は?

JEPQの経費率 (Net Expense Ratio): 0.35%

この経費率は、ETFの運用に関連する費用を示しており、年間の運用資産額に対するパーセンテージとして表示される。

具体的には、JEPQを保有する投資家は、運用資産額の0.35%を年間の経費として支払うことになる。

この経費率は、アクティブ運用のETFとしては比較的低い部類に入る。

JEPQの配当利回りは?

JEPQは、12ヶ月のローリング配当利回りが12.51%、30日間のSEC利回りが11.68%という魅力的な利回りを提供している。

これは、デリバティブ収入カテゴリーで上位デシルの利回りとなる。

つまり、投資ファンドにおける「デリバティブ収入カテゴリー」と呼ばれるグループの中で、上位10%に位置しており、特に高い収益を生み出している。

※ローリング配当利回りとは、特定の期間(通常は過去12ヶ月)にわたって計算された、投資ファンドや株式の平均配当利回りのこと。

この利回りは、過去1年間に支払われた配当を、その期間の平均株価やファンドの純資産価値(NAV)に対して割ったもので、簡単に言えば、ローリング配当利回りは過去1年間の平均的な配当収益率を示しており、投資家がその期間に受け取った配当の割合を反映している。

※30日SEC利回り(30-Day SEC Yield)とは、アメリカ証券取引委員会(SEC)によって定義された、投資ファンドが過去30日間に得た収益を基に計算した年間の利回り。

簡単に言えば、30日SEC利回りはファンドが最近30日間でどれくらいの収益を生み出したかを年率で示したもの。

JEPQはなぜこれだけの利回りを出せるのか?

JEPQは、その高い利回りを以下の戦略によって実現している。

- JEPQは、米国の大型成長株に対するオプションを売却する戦略を中心に収入を生成している。この戦略により、ナスダック100インデックスと同等のリターンを目指しつつ、より低いボラティリティを実現している。

- ファンドは、リスク調整後の期待リターンを最大化するために、独自のデータ駆動型戦略を採用している。

- JEPQの最大の保有銘柄には、GAFAMやマグニフィセント・セブンと呼ばれる、Apple(AAPL)、Microsoft(MSFT)、Alphabet(GOOG)、Amazon(AMZN)、NVIDIA(NVDA)などが大手テック銘柄が含まれている。また、ナスダック100への露出は、エクイティリンクノートを通じて得られている。

- JEPQは、ナスダック100と高い相関性を維持しつつ、複数のタイムフレームで安定したパフォーマンスを示している。

これらの戦略と特徴により、JEPQは高い利回りを提供しつつ、リスクを管理し、ナスダック100インデックスとの相関性を維持している。

JEPQの分配金(配当)の支払い時期は?

JEPQは、インカム(株式の配当金とオプションプレミアム)を原資として毎月分配を目指している。

ただし、必ずしも毎月分配が行われるわけではなく、分配の有無や額は変動する可能性がある。

JEPQの分配金(配当)の推移は?

JEPQ 分配金は、変動はあるが、0.35〜0.45ドルあたり。

JEPIと金額的に大きく変わらないと言える。

| 権利落ち日 | 分配金 |

|---|---|

| 2022/6/1 | 0.376 |

| 2022/7/1 | 0.34 |

| 2022/8/1 | 0.407 |

| 2022/9/1 | 0.546 |

| 2022/10/3 | 0.38 |

| 2022/11/1 | 0.681 |

| 2022/12/1 | 0.546 |

| 2022/12/29 | 0.576 |

| 2023/2/1 | 0.441 |

| 2023/3/1 | 0.433 |

| 2023/4/3 | 0.454 |

| 2023/5/1 | 0.484 |

| 2023/6/1 | 0.363 |

| 2023/7/3 | 0.367 |

| 2023/8/1 | 0.366 |

| 2023/9/1 | 0.451 |

| 2023/10/2 | 0.417 |

| 2023/11/1 | 0.418 |

| 2023/12/1 | 0.422 |

| 2023/12/28 | 0.392 |

JEPQの現在株価と長期チャート

2022年5月に運用を開始した新しいETFであるJEPQは、運用期間がまだ短い。

このETFはボラティリティを抑えた運用を目指していますが、対象となるナスダック100のハイテク銘柄が多いため、JEPIと比較すると変動の幅はやや大きくなっている。

JEPQの構成銘柄は?

JEPIの構成銘柄数は、91銘柄。※リンク債(Equity Linked Notes)を含む。

ナスダック100を中心とした多くの銘柄に分散投資することが可能。

JEPQの主な構成銘柄(上位20銘柄)は以下の通り。

上位20銘柄でウェイトは約63%程度。

| ティッカー | 企業名 | 組入比率 | |

|---|---|---|---|

| 1 | MSFT | マイクロソフト | 7.63% |

| 2 | AAPL | アップル | 6.83% |

| 3 | AMZN | アマゾン・ドット・コム | 4.35% |

| 4 | GOOG | アルファベット | 4.33% |

| 5 | META | メタ・プラットフォームズ | 3.62% |

| 6 | NVDA | エヌビディア | 3.60% |

| 7 | AVGO | ブロードコム | 3.44% |

| 8 | TSLA | テスラ | 3.38% |

| 9 | AMD | アドバンスト・マイクロ・デバイセズ | 3.38% |

| 10 | ADBE | アドビ | 3.30% |

| 11 | NFLX | ネットフリックス | 3.23% |

| 12 | COST | コストコ・ホールセール | 2.82% |

| 13 | INTU | インテュイット | 2.53% |

| 14 | CSCO | シスコ・システムズ | 1.96% |

| 15 | CMCSA | コムキャスト | 1.92% |

| 16 | BKNG | ブッキング・ホールディングス | 1.62% |

| 17 | QCOM | クアルコム | 1.52% |

| 18 | ISRG | インテュイティブ・サージカル | 1.51% |

| 19 | ADI | アナログ・デバイセズ | 1.34% |

| 20 | REGN | レジェネロン・ファーマシューティカルズ | 1.32% |

参照:JPMorgan Nasdaq Equity Premium Income ETF

JEPIのセクター比率は?

セクター比率はITや通信などのハイテク銘柄で半数を占めており、比較的偏ったバランスとなっている。

| セクター | 比率 | |

|---|---|---|

| 1 | Information Technology(情報技術) | 40.20% |

| 2 | Other(その他) | 16.60% |

| 3 | Communication Services(通信サービス) | 12.60% |

| 4 | Consumer Discretionary(一般消費財) | 11.80% |

| 5 | Health Care(ヘルスケア) | 6.10% |

| 6 | Consumer Staples(生活必需品) | 5.60% |

| 7 | Industrials(インダストリアル) | 3.70% |

| 8 | Financials(金融) | 1.20% |

| 9 | Utilities(公益事業) | 1.10% |

| 10 | Energy(エネルギー) | 0.30% |

| 11 | Real Estate(不動産) | 0.30% |

JEPIとJEPQの違いは?

JEPI(JPMorgan Equity Premium Income ETF)とJEPQ(JPMorgan Nasdaq Equity Premium Income ETF)の主な違いは以下の通り。

| 特徴 | JEPI | JEPQ |

|---|---|---|

| 焦点 | 低ボラティリティの大型米国株 | 成長性とテクノロジー株、ナスダック100指数 |

| ボラティリティ | 1.46% | 2.37% |

| インデックス | S&P 500指数 | NASDAQ 100指数 |

| 戦略 | カバードコール戦略(保有株に対するコールオプションの売却) | 同様のカバードコール戦略を採用 |

JEPIとJEPQどちらに投資すべき?

どちらに投資するかを選択する際は、それぞれのETFの特性を理解し、慎重に検討することが重要。

JEPIとJEPQはどちらも配当利回りのパフォーマンスに優れています。

JEPIは安定性の高い企業に投資しているため、ボラティリティが低く、安定感がある一方、JEPQはハイテク企業に投資しているため、ボラティリティが高め。

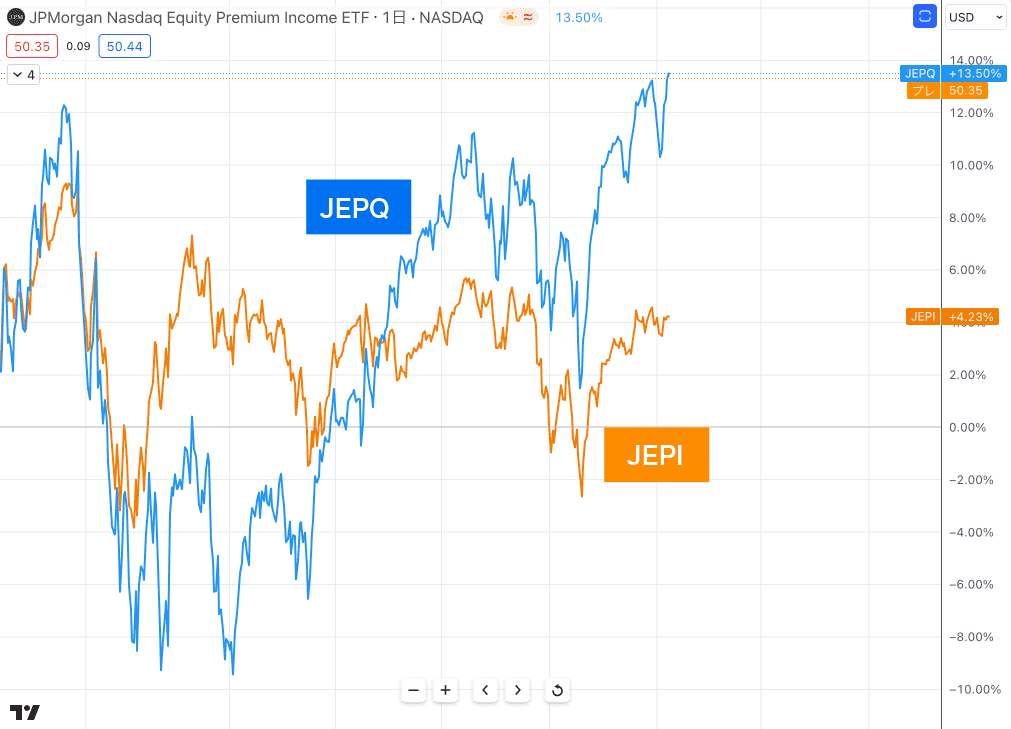

パフォーマンスを比較すると、JEPQは株価成長の面で優れていると言えます。2022年後半の下落相場ではJEPQは大きく下落しましたが、2023年には好調なパフォーマンスを発揮し、JEPIを大きく上回っています。

JEPQとJEPIの株価パフォーマンス比較

JEPQに投資するメリットは?

JEPQへの投資には以下のようなメリットがある。

- JEPQもJEPIと同様にカバードコール戦略を採用しており、この戦略によってインカム収益を上乗せすることが可能。これにより、株価上昇に一定程度追随しつつ、高いインカムゲインを得ることができる。

- JEPQはナスダック100に上場しているハイテク銘柄に焦点を当てており、成長性の高いセクターへの投資が可能。キャピタルゲイン(株価の上昇)の機会が増えます。

- JEPQは毎月の分配を目指しており、投資家は定期的なキャッシュフローを得ることができる。これは、特にインカムを重視する投資戦略において大きなメリットとなる。

- カバードコール戦略とハイテク銘柄への投資の組み合わせにより、JEPQは成長性とインカムゲインのバランスを提供。投資家は市場の変動に対して柔軟な対応が可能となる。

これらのメリットは、JEPQが成長性の高いハイテクセクターへの露出とカバードコール戦略を組み合わせることで、投資家にとって魅力的な選択肢となっている。

JEPQの投資で考えられるデメリットは?

JEPQへの投資における考えられるデメリットは以下の通り。

- JEPQは、主にテクノロジー株に投資しており、これらの株式は市場平均よりもボラティリティが高い傾向があるため、ファンドの価値が市場の変動により大きく影響を受ける可能性がある。

- JEPQはカバードコール戦略を採用しており、市場が急上昇する場合、ファンドは市場のパフォーマンスに追いつくのが難しい可能性がある。また、オプション戦略は複雑であり、特定の市場環境では効果が低下する可能性がある。

これらのデメリットは、JEPQへの投資が特定のリスクを伴うことを示しており、自身の投資目的やリスク許容度に合わせて慎重に検討する必要がある。

「JEPQはおすすめしない」という記事、検索も多くみられがその要因は?

「JEPQはおすすめしない」という記事が多い理由は、以下の要因が考えられる。

- JEPQはカバードコール戦略を用いており、市場が下落する場合、オプションはある程度の保護を提供するが、大きな下落から完全に守ることはできない。

- 利子率がピークに達したとの見方が広がり、リスク資産への投資が再び増加する可能性がある。このような市場環境では、JEPQは市場平均を下回るパフォーマンスを示す可能性がある。

- 現在、オプションのボラティリティが歴史的に低い水準にあり、これはオプションを売る戦略にとっては不利な状況と言える。

これらの要因により、一部の投資家やアナリストはJEPQをおすすめしないという立場を取っている可能性がある。

JEPQはニーサの対象として選べるのか?

- 一般的なNISAの枠内での取引は可能だが、つみたてNISA(積立NISA)を使ってJEPIに投資することはできないため、つみたてNISAの特典を享受することはでない。

- つみたてNISAで投資できるのは、一定の要件を満たした国内投資信託(及び一部の国内ETF)に限られるため、海外ETFであるVIGには投資できない。

JEPQの特徴をまとめると

- JEPQはナスダック100指数に上場している企業に投資し、この指数の成長性とテクノロジー株に焦点を当てている。

- ファンドはカバードコール戦略を採用しており、ナスダック100指数のアウト・オブ・ザ・マネー・コールオプションを書くことにより、毎月の分配可能な収入を生成している。

- JEPQは魅力的な利回りを提供しており、毎月配当を実施している。

- リードポートフォリオマネージャーは株式および株式デリバティブの投資に30年以上の経験を持っている。

これらの特徴は、JEPQがナスダック100の企業に投資しつつ、カバードコール戦略を用いて高い収益と利回りを目指していることを示している。

JEPQ投資の分配金再投資戦略のヒント

この内容は以前JEPIの記事で紹介したものですが、JEPQに適用した場合の例として記載。

毎月の分配金で1株購入するには?

JEPQの分配金を利用して毎月1株を購入するためには、JEPQの株価と分配金の額を考慮する必要があります。

例えば、JEPQの株価が平均45〜50ドルで推移している場合、毎月の分配金が50ドル以上であれば、その分配金を再投資して1株を購入することが理論上可能。

ただし、実際の分配金の額は市場の状況やETFのパフォーマンスによって変動するため、毎月1株を購入できるとは限りません。

分配金での株数増加の可能性

あなたが保有しているJEPQの資産が6000ドルで、年間利回りが10%だとすると、年間で600ドルの収入が見込めます。これを単純に12ヶ月で割ると、毎月約50ドルの分配金が得られる計算になる。

JEPQの株価が50ドル近辺で安定していれば、理論上は毎月の分配金で1株を購入することが可能。

ただし、実際の分配金の額や株価は変動するため、毎月株数が増えるとは限りません。

複利の恩恵について

6000ドルを1ドル150円で計算すると、約90万円になります。

つまり、約90〜100万円程度のJEPQ資産を築くことで、分配金を再投資することによる複利の効果を享受しやすくなります。

ただし、複利効果を最大限に活用するためには、分配金の再投資が継続的に行われ、かつ投資対象のパフォーマンスが安定している必要。

為替の影響を考慮する場合、配当金はドルで支払われます。

そのため、ドルで投資を行うことで、為替変動によるリスクを抑えることが可能です。現在円安が進んでいる状況では、円で外国株を購入すると、為替変動の影響をより受けやすくなります。したがって、投資を検討する際には、為替リスクを重要な考慮事項として扱うべきです。

JEPQの株を買える証券会社は?

JEPQの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| auカブコム証券 | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

この記事では、高配当かつハイテク銘柄に投資できるETF「JEPQ」の特徴、投資のメリット・デメリットについて詳しく解説しました。

一般的にハイテク銘柄は配当利回りが高くないことが多いですが、JEPQは株価成長を目指すナスダックへの投資とインカム志向を兼ね備えた投資家にとって魅力的な選択肢となります。

また、毎月の分配金により、投資家は安定したキャッシュフローを得ることができます

JEPIと同様に、JEPQも長期投資における複利効果を期待できるため、長期的な投資戦略を考えている方にとっては有力な選択肢の一つです。