This site is a great place for me (@mifsee(2) has been working on company and stock analysis while learning privately.

This is only a record of my personal analysis and the contents may contain errors or information that differs from the actual situation. Please understand in advance when viewing this site.

- Introduction.

- First, what is an ETF?

- What is the difference between ETFs and mutual funds?

- What characteristics does VIG have in an ETF?

- VIG's current share price and long-term chart

- Who is Vanguard, the investment management company?

- What is the expense ratio of an ETF? What should I pay attention to?

- What are the advantages of investing in VIG?

- What are the possible disadvantages of investing in VIG?

- What are the constituent stocks of the VIG?

- What is the timing of the replacement of VIG components?

- What is the sector ratio of the VIG?

- What are the conditions for inclusion in the VIG?

- What is VIG's dividend yield?

- Is it true that VIG is strong in falling markets?

- Can VIG expect high dividends in the future?

- I see a lot of articles and searches that say "VIG is not recommended." What are the factors behind this?

- Why are the top 25% high-yielding companies excluded from the VIG component?

- What other ETFs would a novice investor consider comparing to VIG?

- Can VIG be selected as a Nisa target?

- To summarize the characteristics of VIG

- Who is a good candidate for VIG investment?

- Which brokerage firm can I buy VIG shares?

- summary

Introduction.

With the expansion of NISA, interest in U.S. investments is increasing.

However, those who are new to stock investing or inexperienced in U.S. investing may find it difficult to decide which stocks to invest in. I myself have had such an experience.

We especially recommend index investing using ETFs for such investment beginners and those who are looking for a style of investing that gradually accumulates investments over a long period of time.

Here is the output of our in-depth research on VIG, an ETF that is attracting attention as a continuous dividend increase ETF.

First, what is an ETF?

- ETF is an acronym for "Exchange Traded Fund," literally a mutual fund (Fund) traded on an exchange (Exchange).A type of mutual fund listed on a stock exchange.

- ETFs aim to achieve investment results that are linked to the movement of a specific index, such as the Nikkei Stock Average or the Tokyo Stock Exchange Stock Price Index (TOPIX). In other words, since ETFs aim to mimic the movement of that index, for example, for an ETF linked to the Nikkei Stock Average, if the Nikkei Stock Average rises, the price of the ETF will also rise, and conversely, if it falls, the price of the ETF will also fall.

- Because ETFs are traded on stock exchanges just like stocks,You can buy and sell at any time during trading hours.This has the advantage that, unlike regular mutual funds, they can trade according to real-time price fluctuations.

- ETFs,Easily invest in specific markets and sectorsETFs are used by many investors. For example, if you want to invest in the U.S. technology sector, you can easily achieve an investment in that market by purchasing an ETF that is linked to that sector.

Thus, ETFs are used by many investors because of their ease of trading and features that facilitate access to certain markets.

What is the difference between ETFs and mutual funds?

| (data) item | ETF | investment trust |

|---|---|---|

| Listed or not listed | Listed on the stock exchange | Usually not listed on a stock exchange |

| Handling location | Mainly brokerage firms | Securities companies, banks, post offices, etc. |

| Product type | Limited number of products | The number and variety of products are overwhelmingly large. |

| Freedom of Transaction | Real-time transactions are possible | Since the NAV is calculated only once a day, trading at that price |

Understand these differences and choose the one that best suits your investment style and objectives.

What characteristics does VIG have in an ETF?

VIG (Vanguard Dividend Appreciation ETF) has the following characteristics

Invest in companies with consecutive dividend increases

VIG is an ETF that invests in mid- to large-cap stocks with a track record of increasing dividends (and continuing to increase dividends) for more than 10 consecutive years.

High quality of companies

A company is able to increase its dividend because it indicates that the company is performing well and is proactive in returning profits to shareholders,The company has the ability to provide a solid return to shareholders.This means that

Reliable management company

VIG is offered by Vanguard, an American asset management company.

Investment Target

The company's primary investment objective is "large U.S. companies with the potential for consecutive dividend increases."

Low cost to income ratio

VIG's expense ratio is very low at 0.06%.Level.

We will look at this in a little more detail.

VIG's current share price and long-term chart

The 2009 decline was the share price at the time of the Lehman Brothers collapse, about $30.

and thenShare price growth of approximately 5 times or more in 14 yearsIt is showing.

Who is Vanguard, the investment management company?

- Vanguard is a leading asset management firm founded in the United States in 1975 by John Bogle.

- He pioneered the offering of low-cost index funds and revolutionized the industry with his approach.

- With its unique organizational structure, Vanguard operates in the best interest of its investors because they are the real owners.

- It offers funds with very low expense ratios and enjoys a high level of investor confidence.

- Vanguard currently manages assets on a global scale and is one of the top managers of its kind.

What is the expense ratio of an ETF? What should I pay attention to?

The expense ratio of an ETF is the ratio of the expenses required to manage the ETF to the ETF's net asset value.

Specifically, it refers to the fees that are automatically paid to the investment manager while the ETF is held.

This expense ratio is a very important indicator of ETF operating costs.

The following are points to keep in mind when looking at expense ratios

- ETFs with low expense ratios are very advantageous to investors in the long run. The lower the expense ratio, the higher the investment return is likely to be.

- Expense ratios for ETFs are publicly available, so it is important to check them carefully before investing.

- In general, the "expense ratio" of many foreign ETFs tends to be lower than the "trust fee," which is the management cost of a mutual fund. However, there are other expenses to consider as well, such as transaction fees.

The expense ratio directly affects the return on an investment and should be reviewed and understood when considering an investment.

How low is the expense ratio of 0.061 TP3T based on the average ETF expense ratio?

The simple average expense ratio for equity ETFs is 0.49%.

In simple terms, the expense ratio is like a "management fee" for holding an ETF.

this (something or someone close to the speaker (including the speaker), or ideas expressed by the speaker)The lower the expense ratio, the less the investor pays and the higher the return potentialThere is a

For example, an investment of 1 million yen would cost 4,900 yen for an ETF with an expense ratio of 0.49% and 600 yen for a VIG with an expense ratio of 0.06%.

The difference,Significant impact on long-term investmentsThere are times when

Considering the expense ratio for a 10-year investment.

Assuming an investment of 1 million yen, the difference between an expense ratio of 0.49% and 0.06% over 10 years is 43,000 yen.

This is for 1 million, but for 10 million, the difference would be as much as 430,000 yen.

In long-term investments, even a small difference in expense ratios can affect returns as a difference that should not be underestimated.

What are the advantages of investing in VIG?

- VIG invests primarily in U.S. mid- and large-cap stocks that have increased their dividends for more than 10 consecutive years, and thus have stable performance and sound financial conditions,Proactive in returning profits to shareholdersThe first is.

- VIG is able to invest in a large number of companies with continuously increasing dividends in a single issue,Expected diversification of riskCan be done.

- VIG's expense ratio is very low at 0.06%, and for long-term investments, thisLow expense ratio is a major advantage.The following is a list of the most common problems with the "C" in the "C" column.

- VIG not only increased dividends,Stock prices are also expected to rise.Therefore, an increase in total return can be expected.

VIGs are attractive to investors seeking stable returns.

What are the possible disadvantages of investing in VIG?

- VIG's dividend yield is not that high.

- The VIG's selection criteria exclude high-yielding firms in the top 251 TP3T, so they cannot benefit from firms that are temporarily showing high yields.

What are the constituent stocks of the VIG?

VIG consists of 314 stocks. It is possible to diversify investments in a very large number of stocks.

The main components (top 20 stocks) of VIG (Vanguard U.S. Dividend Increasing Equity ETF) are as follows

| ticker | Company Name | stock ownership ratio | |

|---|---|---|---|

| 1 | MSFT | Microsoft | 4.83% |

| 2 | AAPL | apple | 4.66% |

| 3 | UNH | UnitedHealth Group | 3.17% |

| 4 | JPM | JP Morgan Chase & Co. | 3.11% |

| 5 | JNJ | Johnson & Johnson | 2.93% |

| 6 | XOM | ExxonMobil | 2.92% |

| 7 | PG | Procter & Gamble | 2.49% |

| 8 | V | Visa Inc. Class A | 2.48% |

| 9 | AVGO | broadcom | 2.44% |

| 10 | high-definition digital versatile disc (HD DVD, high-definition DVD) | The Home Depot | 2.28% |

| 11 | Ministry of Agriculture, Forestry and Fisheries (formerly Ministry of Economy, Trade and Industry) | MasterCard Class A | 2.23 % |

| 12 | MRK | Merck | 1.82 % |

| 13 | PEP | PepsiCo | 1.74 % |

| 14 | COST | Costco Wholesale | 1.67 % |

| 15 | KO | Coca-Cola | 1.62 % |

| 16 | WMT | Wal-Mart | 1.52 % |

| 17 | MCD | McDonald's (restaurant) | 1.44 % |

| 18 | CSCO | Cisco Systems | 1.43 % |

| 19 | ACN | Accenture plc Class A | 1.35 % |

| 20 | ABT (former Soviet Union intelligency agency) | Abbott. | 1.30 % |

The top 10 stocks account for 311 TP3T of the total.

It includes many well-known and blue-chip companies that everyone knows.

See also:VIG-Vanguard Dividend Appreciation ETF | Vanguard

What is the timing of the replacement of VIG components?

VIG (Vanguard U.S. Increasing Dividend Equity ETF) replaces stocks every March.

The most recent issue replacement was in March 2023.

What is the point of replacing VIG stocks in March 2023?

- The main stocks newly included are as follows

- Apple (AAPL): information technology sector. Percentage of total: 4.24%

- Exxon Mobil (XOM): energy sector. Percentage of total: 3.27%

- Merck & Co (MRK): Healthcare Sector. Percentage of total assets: 1.96%

- Elevance Health (ELV): Healthcare Sector. Percentage of total: 0.80%

- Zoetis (ZTS): Healthcare Sector. Percentage of total: 0.56%

Sector fluctuations are as follows.

- Energy: +3.3% (mainly due to the addition of XOM)

- Finance: +2.1%

- Healthcare: +1.0% (due to the addition of MRK, ELV, ZTS)

- Public interest: +0.2%

- Capital goods: -0.4%

- Material: -0.5%

- Necessities: -0.6%

- Communication: -0.6%

- General consumer goods: -2.0%

- Information Technology: -2.5% (AAPL incorporated, but overall reduced)

The total number of issues increased from "288" to "315".

Among the newly included stocks, Apple, Exxon Mobil, and Merck & Co have particularly high inclusion ratios and are expected to have a significant impact on VIG's future performance. In addition, the energy sector was significantly strengthened by the inclusion of Exxon Mobil.

The health care sector is also strengthened by the inclusion of three new issues.

What is the sector ratio of the VIG?

The top three sectors account for 561 TP3T,Significantly invested in three sectors: information technology, health care, and financeIt can be seen that

| sector | Ratio | |

|---|---|---|

| 1 | Information Technology | 22.50% |

| 2 | Financials | 18.00% |

| 3 | Health Care | 15.40% |

| 4 | Industrials (capital goods) | 13.10% |

| 5 | Consumer Staples | 12.00% |

| 6 | Consumer Discretionary | 7.20% |

| 7 | Materials | 4.50% |

| 8 | Energy | 3.00% |

| 9 | Utilities (Public Utilities) | 3.00% |

| 10 | Communication Services | 1.30% |

What are the conditions for inclusion in the VIG?

- VIG is an ETF linked to the S&P U.S. Dividend Growers Index.

- The index covers companies in the S&P 500 (a stock price index of the 500 largest publicly traded companies in the U.S.) that have increased their dividends for at least 10 consecutive years.

- The index is equally weighted to each stock and aims for stable performance that is not easily affected by the movements of major companies.

VIG is based on this "S&P US Dividend Growers Index" and aims to achieve stable returns by investing in companies that have continuously increased their dividends.

What is VIG's dividend yield?

The dividend yield on VIG (Vanguard U.S. Increasing Dividend Equity ETF) is not very high at this time.

- The average yield over the past 10 years is approximately 1.91 TP3T.

- Current yields are in that average range.

- Yields range from 1.5 to 2.3%.

The dividend yield is the amount of dividends an investor receives from an ETF or stock divided by the price of that ETF or stock.

This number is an indicator of how much an investor can expect to earn from that ETF or stock.

VIG's Distribution Trends

Distributions are profits paid to investors from investment products such as mutual funds, exchange-traded funds (ETFs), and stocks.

VIG's distributions are increasing steadily.

This is due to the fact that many of these companies have high growth potential and stable businesses as they have increased their dividends for 10 consecutive years.

Unit: U.S. dollars

| ex rights day | Distribution amount |

|---|---|

| 2016/9/13 | 0.390 |

| 2016/12/22 | 0.580 |

| 2017/3/29 | 0.420 |

| 2017/6/21 | 0.520 |

| 2017/9/20 | 0.430 |

| 2017/12/21 | 0.550 |

| 2018/3/26 | 0.400 |

| 2018/6/28 | 0.570 |

| 2018/9/26 | 0.500 |

| 2018/12/17 | 0.580 |

| 2019/3/28 | 0.510 |

| 2019/6/17 | 0.470 |

| 2019/9/24 | 0.550 |

| 2019/12/18 | 0.600 |

| 2020/3/26 | 0.470 |

| 2020/6/29 | 0.600 |

| 2020/9/29 | 0.560 |

| 2020/12/21 | 0.660 |

| 2021/3/22 | 0.510 |

| 2021/6/21 | 0.680 |

| 2021/9/20 | 0.700 |

| 2021/12/20 | 0.770 |

| 2022/3/21 | 0.690 |

| 2022/6/21 | 0.690 |

| 2022/9/19 | 0.710 |

| 2022/12/20 | 0.870 |

| 2023/3/24 | 0.750 |

| 2023/6/29 | 0.770 |

| 2023/9/28 | 0.771 |

| 2023/12/21 | 0.916 |

Is it true that VIG is strong in falling markets?

VIG (Vanguard U.S. Increasing Dividend Equity ETF) is considered strong in a declining market for the following reasons.

- The VIG is for companies that have increased their dividends consecutively,Financially sound and have a stable business modelOften.

- The constituents of the VIG includeFewer high PER stocksTherefore, it can maintain stable performance in falling markets compared to other ETFs.

- Because VIG has invested in over 300 companies,Even if a particular company's performance slumps, overall performance is unlikely to be significantly affectedThe following is a list of the most common problems with the "C" in the "C" column.

What was the extent of the decline during the Corona shock?

The difference between the decline in VIG and other ETFs during the Corona shock is described below.

- VIG decline rate: -12.28%

- SPY decline rate: -15.42%

- QQQ decline: -24.11%

QQQ is down twice as much as VIG because it is an ETF for high-tech companies linked to the NASDAQ 100.

From these factors and data,VIG shows relatively strong performance in falling marketsThe following is a list of the most common problems with the "C" in the "C" column.

Can VIG expect high dividends in the future?

- VIG targets companies that have increased their dividends consecutively, thus maintaining stable performance and increasing dividend payments.

- VIG has demonstrated that it has a track record of increasing dividends in the past and has the ability to continue to do so in the future.

From these factors,VIG may continue to pay high dividends in the future.It can be said.

I see a lot of articles and searches that say "VIG is not recommended." What are the factors behind this?

Possible reasons for the large number of articles and search needs for "do not recommend VIG" include

- VIG is suitable for those who believe that continuing to increase dividends is a growth factor for the stock price, and is not recommended for those who do not find this characteristic attractive.

- VIG is an ETF that is suited for long-term investments and is not suitable for those who are considering it for short-term investments.

- VIG is a passively managed ETF (i.e., it tracks a specific index) and may not be suitable for those who want to actively manage their investments.

These factors suggest that VIGs should be selected according to specific investment objectives, time frames, and management styles, and are not generally recommended for all investors.

Why are the top 25% high-yielding companies excluded from the VIG component?

The VIG excludes high-yielding firms in the top 251 TP3T, although it does include firms that have increased their dividends consecutively. The reasons for this are.

- Companies with high dividend yields may have difficulty maintaining those yields. In particular, companies that try to maintain high dividends despite poor performance increase the risk of dividend cuts in the future, and thisExclude high-yielding companies to avoid riskThe company is doing so.

- VIG aims to select companies with high quality and stable performance, because the pursuit of high dividend yields alone risks selecting companies of low quality or companies whose yields are enhanced by temporary fluctuations in performance,To avoid companies that simply have high yields.to such exclusion criteria.

- Because companies with high dividend yields may have less room to reinvest their earnings,Risk of reduced growth potential for the companyThe VIG excludes high-yielding companies because its objective is to select companies with growth potential that can continue to increase their dividends.

For these reasons,By excluding high-yielding companies in the top 251 TP3T, VIG seeks to select companies with high quality, stable performance, and growth potential.

What other ETFs would a novice investor consider comparing to VIG?

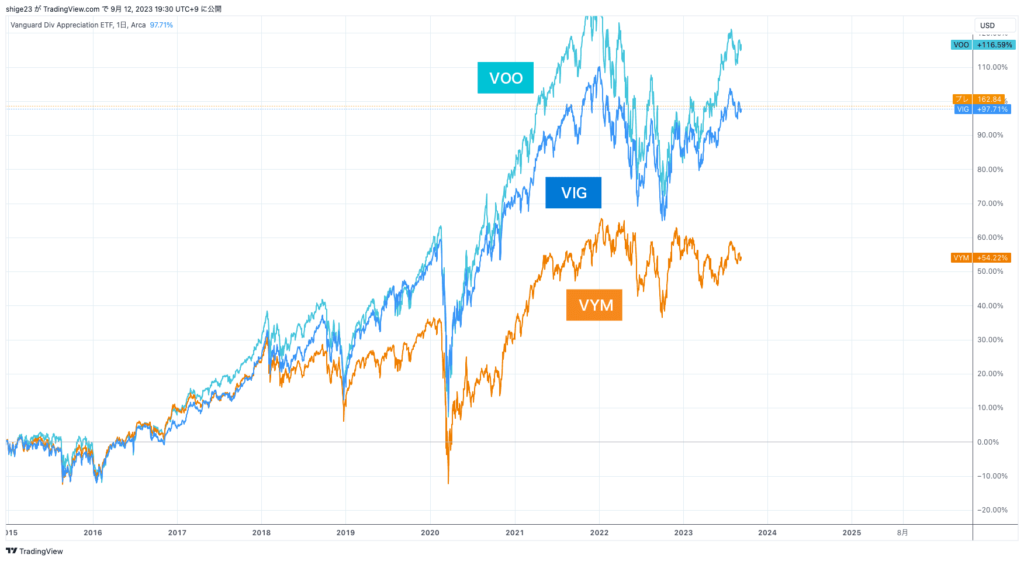

VIG is often compared to VYM and VOO. their characteristics and performance.

- VYM: An ETF that tracks U.S. companies with high dividend yields; the index it tracks is the FTSE High Dividend Yield Index.

- VOO: An ETF for 500 large-cap U.S. stocks; the index it tracks is the S&P 500 Index.

Performance since 2015 is as follows

Performance comparison chart with VIG, VYM, and VOO

The characteristics of each ETF are clearly evident in their performance.

VOO is linked to the S&P 500 and thus includes GAFAM and NVIDIA, which is currently showing high growth rates, and has a higher stock price growth rate than VIG.

VYM tracks high dividend, high dividend yielding companies, so the few tech companies have lower stock price growth.

In addition to stable companies, VIG is a very well-balanced ETF because of its high information technology sector ratio, including Microsoft and Apple.

Based on the characteristics of each, it is important to select appropriate ETFs in line with investment objectives.

Can VIG be selected as a Nisa target?

- Although it is possible to trade within the general NISA framework, it is not possible to invest in VIG using the "Tsumitate NISA (savings NISA)" and thus cannot enjoy the benefits of the savings NISA.

- Only domestic investment trusts (and some domestic ETFs) that meet certain requirements can be invested in the Tatemono NISA, and VIG, an overseas ETF, cannot be invested in the Tatemono NISA.

To summarize the characteristics of VIG

- Companies that have increased dividends for more than 10 consecutive yearsfor the purpose of this project.

- The expense ratio is very low at 0.061 TP3T compared to the ETF average of 0.41 TP3TThe company is suitable for long-term investment.

- Because high dividend yielding companies are risky,Excludes top 251 TP3T high dividend paying companiesThe company is doing so.

- Due to the composition of the company, which is mainly composed of stable companiesStrong in falling marketsThe following is a list of the most common problems with the "C" in the "C" column.

- Apple was added to the component stocks,High expectations of price increases.The "new" is a "new".

- The dividend yield is not high, but dividends are increasing steadily,Expected to be a high dividend ETF in the futureCan be done.

Who is a good candidate for VIG investment?

- VIG has a long-term perspective.Investors seeking stable returnsSuitable for

- VIG excludes companies with dividend yields that are too high,Investors who wish to avoid excessive riskSuitable for

- Because VIG invests in diverse sectors,People who want to invest without sector bias.Suitable for

- VIG's expense ratio is as low as 0.061 TP3T, which keeps costs low even for long-term investments,Investors who value low expense ratiosSuitable for

- VIGs tend to show relatively stable performance in falling markets,Investors seeking ETFs that are resilient to market volatilitySuitable for

Which brokerage firm can I buy VIG shares?

We have listed the major brokerage firms that offer VIG shares. At these brokerages, you can choose to invest as a CFD (Contract for Difference) in addition to direct stock trading as a foreign stock.

I myself mainly use SBI Securities, but some stocks they handle may not be available for purchase. In such cases, I sometimes use CFDs at Saxo Bank Securities or IG Securities.

| Popular Brokerage Firms | stock trading | CFD Trading |

|---|---|---|

| SBI Securities | Fat. | ✕ |

| Matsui Securities Co. | Fat. | ✕ |

| Rakuten Securities, Inc. | Fat. | ✕ |

| Monex, Inc. | Fat. | ✕ |

| au kabu.com Securities | Fat. | ✕ |

| DMM Stock | Fat. | ✕ |

| Saxo Bank Securities | Fat. | Fat. |

| IG Securities | ✕ | Fat. |

| GMO CLICK Securities, Inc. | ✕ | ✕ |

| moomoo Securities | Fat. | ✕ |

summary

The features of the U.S. ETF "VIG" and the advantages and disadvantages of investing in it are explained in detail. Furthermore, through a comparison with other popular ETFs "VOO" and "VYM," the uniqueness and investment suitability of VIG are also discussed.

I myself started buying VIG during the Corona shock.

That was my first U.S. investment and VIG is now the centerpiece of my portfolio.

In particular, the addition of Apple to the constituent stocks makes VIG an even more attractive investment.

However, VIG may not necessarily be the best choice for investors who value high dividends. However, VIG's good price appreciation performance and its resistance to falling markets make it an attractive ETF when it comes to long-term investment with peace of mind.

I'm making use of it too! Get the most out of moomoo securities!

I am.moomoo SecuritiesWhat I like most about using the app is that it is easy to use and makes it easy to gather in-depth information, which is important in investing.

Further,Ability to see trends of large and medium investors.and it has been very helpful in considering the future of the stocks.A wealth of news and earnings-related information on each stock, with support for automatic Japanese translationThe company is also happy to provide instant access to information from overseas.

Moomoo Securities also has the lowest U.S. stock trading commissions.

Interested parties can easily register through this banner link!