このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- はじめに

- エヌビディア(NVIDIA)とはどんな会社?

- GPUとは何ですか?CPUとの違いは?

- AI(人口知能)の挙動とGPUの関係は?

- エヌビディアは何がすごい?

- エヌビディアの主な事業内容は?

- エヌビディアの製品で注目されている「H100」とは?

- エヌビディアの製品で注目されている「Blackwell」とは?

- エヌビディアの配当は?

- エヌビディアのセクター、業種、属するテーマは?

- エヌビディアの競合企業は?

- エヌビディアの競合との差別化要素と優位性は?

- エヌビディアと競合半導体メーカーとの業績比較

- エヌビディアの現在株価

- エヌビディアの業績について

- エヌビディアの今後の株価はどのように推移すると想定される?

- エヌビディアの今後の展開と将来性は?

- エヌビディアの2023年第3四半期の決算サマリー

- エヌビディアの2023年第4四半期と年次報告決算サマリー

- エヌビディアの2024年第1四半期の決算サマリー

- エヌビディアの2024年第2四半期の決算サマリー

- エヌビディアの2024年第3四半期の決算サマリー

- エヌビディア(NVDA)の株を買える証券会社は?

- まとめ

はじめに

AI技術の進化、特にChatGPTのような高度なシステムの進展により、その基盤となる技術の重要性が一層高まっています。

この背景には、超高性能な半導体の必要性があり、その分野でエヌビディアは特に注目を集めています。

エヌビディアの業績は驚異的な成長を遂げており、2023年に時価総額1兆ドルを突破した後、わずか1年で3兆ドルを超え、時価総額で世界トップに躍り出ました。

エヌビディアは、GAFAM(Google、Apple、Facebook、Amazon、Microsoft)と並び、「マグニフィセント・セブン」の一角としてその存在感を示しています。特に、AIやデータセンター、自動運転技術など多岐にわたる分野での技術革新が評価されています。

この記事では、エヌビディアの企業概要、技術的な側面、財務状況、市場でのポジション、そして将来性について詳しく掘り下げます。

エヌビディアの技術革新の背後にある要因、市場での競争力、そして財務的な健全性を多角的な視点から分析します。

エヌビディア(NVIDIA)とはどんな会社?

エヌビディア(NVIDIA Corporation)は、主にグラフィックスプロセッサユニット(GPU)の設計および製造で知られるアメリカの多国籍テクノロジー企業。

会社概要

- 設立年: 1993年

- 創業者: ジェンスン・フアン、クリス・マラコフスキー、カーティス・プリーム

- 本社所在地: カリフォルニア州サンタクララ

市場での位置づけ

エヌビディアは、GPU市場において先駆者であり、リーダーとしての地位を確立している。

特に、ゲーム、プロフェッショナルグラフィックス、データセンター、AI、自動運転車の分野での技術革新において、業界をリードしている。

技術革新と影響

エヌビディアの技術は、コンピュータグラフィックスの進化に大きな影響を与え、AIやディープラーニングの分野での研究と実用化を加速させている。

また、自動運転車の開発においても、その技術は重要な役割を果たしている。

GPUとは何ですか?CPUとの違いは?

AI(人工知能)におけるGPU(グラフィックス処理ユニット)の役割と、それがCPU(中央処理ユニット)とどう異なるかをわかりやすくまとめると、

GPUの役割

GPUはもともとビデオゲームの高度なグラフィックス処理のために開発されたが、AI分野では大量のデータを同時に並列処理する能力が重宝されている。

AIでは、特にディープラーニングと呼ばれる学習プロセスで、大量のデータを高速に処理し、パターンを学習する必要がある。GPUはこの大量のデータを同時に処理することが得意で、AIの学習時間を大幅に短縮する。

CPUとの違い

CPUはコンピュータの「脳」として、さまざまな種類のタスクを一つずつ、または少数を並行して処理するのに適している。これに対し、GPUは単純な計算を非常に多く、同時に行うのに特化している。

表にまとめると、

| 特徴 | GPU | CPU |

|---|---|---|

| 主な用途 | 高度なグラフィックス処理、大量データの並列処理 | 汎用的な計算、複雑なタスクの逐次処理 |

| AIにおける役割 | ディープラーニングなどのデータ集約型タスクでの高速並列処理 | システム全体の調整、複雑な計算 |

| 処理方式 | 大量の単純な計算を同時に実行(並列処理) | 複数の異なるタスクを一つずつまたは少数を並行して処理(逐次処理) |

| 適しているタスク | 画像処理、データ分析など同じ種類の計算を大量に行うタスク | 複雑な計算やシステム全体の調整など多様なタスク |

つまり、AIにおけるGPUの役割は、大量のデータを高速で並列処理し、AIの学習プロセスを効率化すること。これはCPUの一つずつ処理するアプローチとは異なり、AIのようなデータ集約型のタスクに特に有効となる。

AI(人口知能)の挙動とGPUの関係は?

人工知能(AI)の動作は大きく「学習」と「推論」の二つのフェーズに分けて考えられる。

学習(Training):学習フェーズでは、AIモデルは大量のデータを用いて特定のタスクを実行する方法を学ぶ。このプロセスは通常、GPUのような高速な計算リソースを必要とし、ディープラーニングのような複雑なアルゴリズムが用いられることが多い。

推論(Inference):学習済みのAIモデルが新しいデータに対して予測や判断を行う。推論は、学習よりも計算リソースを少なく済ませることができ、リアルタイムでの応答が求められるアプリケーションにおいて重要。このフェーズでは、CPUや特化したAI推論チップが使用されることもある。

エヌビディアのGPUは、推論プロセスにおいても高い効率性を発揮しており、リアルタイムの応答が求められるAIの挙動やタスクにおいて特に有効である。

エヌビディアは何がすごい?

エヌビディア(NVIDIA)が注目される理由は、その革新的な技術と市場での影響力にある。

コンピュータグラフィックスの進化を牽引し、GPU技術の革新者として広く認識されているエヌビディアは、高解像度とリアルタイムのゲームプレイで業界内で高い評価を受けている。

さらに、AIとディープラーニングの分野では、データ処理能力と学習効率の向上に大きく貢献し、AI市場でほぼ独占的で支配的な地位を築いている。

最新情報によれば、エヌビディアはAIチップ市場におけるリーダーとしての地位を一層強化し、その最新のBlackwellアーキテクチャは生成AIや大規模言語モデル(LLM)の処理において、前世代のを大幅に上回る性能を実現している。

エヌビディアのデータセンター向けビジネスは前年比で顕著な成長を遂げており、これは、AIおよびハイパフォーマンス・コンピューティング(HPC)分野における同社の技術がさらに重要性を増していることを示唆している。

エヌビディアのGPUは加速コンピューティングの核として機能し、AI分野だけでなく、自動運転を含む将来の技術革新の中核となる多岐にわたる分野に影響を及ぼしています。

CEOのジェンセン・ファンは、加速コンピューティング、生成AI、ロボティクスなどの分野での最新のブレークスルーを発表し続けており、これがエヌビディアの将来の成長に大きな期待をもたらしている。

これらの進展は、エヌビディアが単なるハードウェアメーカーを超え、技術革新の最前線で業界をリードし続けていることを示している。

エヌビディアの主な事業内容は?

エヌビディア(NVIDIA)の主な事業内容は以下の通り。

グラフィックスプロセッサユニット(GPU)の開発と販売

- ゲーミング市場向けの「GeForce」シリーズGPU。

- プロフェッショナルグラフィックス市場向けの「RTX Aシリーズ」GPU(以前の「Quadro」シリーズ)。

- 高性能コンピューティング(HPC)市場向けの「A100」や「H100」、および最新の「Blackwell」シリーズGPU。

データセンターとクラウドコンピューティング

- AI、ディープラーニング、ビッグデータ分析用の高性能コンピューティングプラットフォーム。

- クラウドサービスプロバイダー向けのGPUと関連ソリューション。

自動運転車とAI技術

- 自動運転車の開発に必要なAIプラットフォームとソフトウェア。

- 車載コンピュータシステム「NVIDIA DRIVE」。

AIとディープラーニングの研究開発

- AIアルゴリズムとモデルの開発。

- ディープラーニングトレーニングと推論のためのプラットフォーム。

その他の分野への技術応用

- ヘルスケア、製造業、金融業など、多様な産業でのAIとGPU技術の応用。

エヌビディアは、これらの事業を通じて、グラフィックス処理、AI、データセンター、自動運転技術などの分野で大きな影響を与えている。

エヌビディアの製品で注目されている「H100」とは?

エヌビディアの「NVIDIA H100 Tensor Core GPU」とは、高性能コンピューティング(HPC)と人工知能(AI)アプリケーション向けに設計された最先端のGPU。

この製品は、エヌビディアのデータセンター向けGPU製品ラインの一部であり、特にディープラーニング、機械学習、大規模なデータ処理において高い性能を発揮する。

「H100」の主な特徴と利点

- 「H100」は、エヌビディアの最新のGPUアーキテクチャである「Hopper」を採用。このアーキテクチャは、以前の「Ampere」よりも大幅に性能が向上している。

- 「H100」は、AIトレーニングと推論のための高度な機能を備えており、特にディープラーニングのモデルトレーニングにおいて、以前のモデルよりも高速な処理能力を提供する。

- ビッグデータ分析や科学計算など、大量のデータを扱うアプリケーションに最適化されており、複雑な計算を高速に処理できる。

- より高い計算性能を保ちながら、エネルギー効率も向上、データセンターの運用コストを削減し、環境に優しい運用が可能になる。

- 「H100」は、ヘルスケア、金融、自動運転車、気候変動研究など、多様な分野での応用が期待されている。

エヌビディアの「H100」は、データセンターとAIアプリケーションの未来を形作る重要な製品であり、その高性能と革新的な機能により、多くの業界での技術進化を加速させることが期待されている。

「H100」の値段はどれくらい?

「NVIDIA H100 Tensor Core GPU」の価格は非常に高額である。

CNBC によると、eBayでの「H100」の価格は $39,995 から $46,000 の範囲で販売されている。

1ドル140円で計算すると、560万〜645万程度となる。

AI企業では「H100」をどれくらい使っている?

- テスラ:10,000個のNVIDIA H100 GPUを使用するコンピュートクラスターに投資している。

- OpenAI:最新のGPT-5などのAIモデルをトレーニングするために、最大50,000個のNVIDIA H100アクセラレーターが必要としている。

- Voltage Park:このスタートアップ企業は、24,000個のNVIDIA H100 GPUを受け取っており、これらは複数のデータセンターに分散されている。

- Google:Google Cloudは、次世代のA3 GPUスーパーコンピューターにNVIDIA H100 GPUを採用している。機械学習モデルのトレーニングと推論に特化している。

AIを積極的に活用している企業は、NVIDIAのH100 GPUを大量に使用していることがわかる。

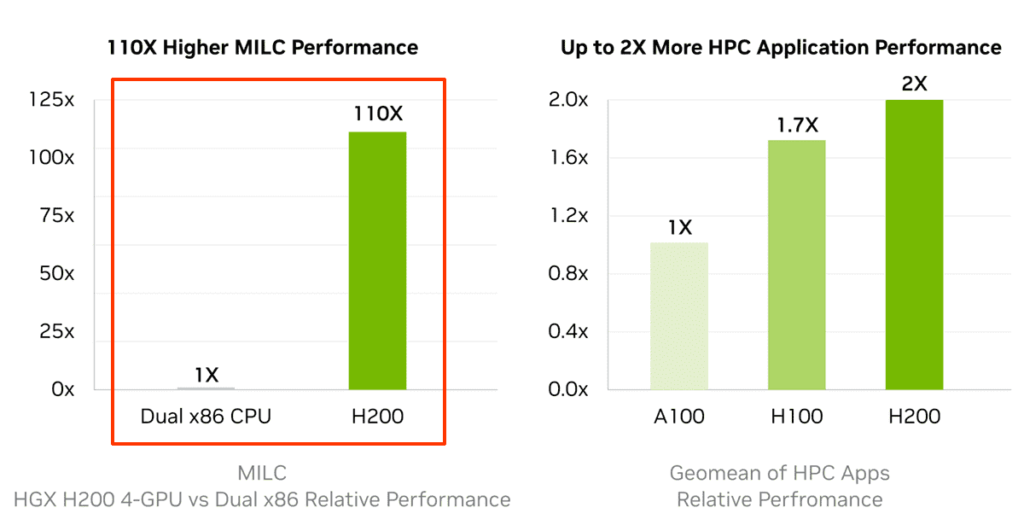

「NVIDIA HGX H200」はどれくらいすごい?

2023年11月13日に、エヌビディア(NVIDIA)は最新のサーバー向けGPU「NVIDIA HGX H200」を発表した。

「H200」は、AIとハイパフォーマンス・コンピューティング(HPC)の分野における最先端のニーズに応えるために設計され、前世代の「H100」と比較して、推論速度が2倍に向上している。

また、HPC性能においては従来のx86 CPUの110倍という驚異的な性能を発揮する。

「H200」は特にAIモデルのトレーニングやデプロイメントに適しており、大規模なデータセンターや研究施設での使用が想定され、高度なメモリ管理とGPU間の高速通信をサポートすることで、複雑なAI計算やデータ処理タスクに対応できる。

エヌビディアの製品で注目されている「Blackwell」とは?

2024年3月18日にエヌビディア(NVIDIA)は最新のサーバー向けGPUを発表しました。Blackwell(ブラックウェル)は、前世代のHopperアーキテクチャを大幅に進化させ、特に大規模な言語モデル(LLM)の訓練や推論を効率的に行うための機能を強化しています。

Blackwellの主な特徴と技術は以下。

- トランスフォーマーエンジン:第二世代のトランスフォーマーエンジンを搭載し、特に4ビット浮動小数点のAI推論機能をサポート。これにより、AIモデルの計算速度と効率が大幅に向上している。

- 高性能チップ:Blackwell GPUは2080億個のトランジスタを持ち、TSMCの4NPプロセスで製造される。これは、前世代と比べて25倍のコスト効率とエネルギー効率を実現している。

- NVLink 5:新しいNVLink 5は、双方向で1.8TB/sのスループットを提供し、最大72個のGPUを単一のGPUとして連携させることができる。これにより、大規模なAIモデルの通信効率が向上する。

- RASエンジン:信頼性、可用性、保守性を向上させるための専用エンジンを搭載し、大規模なAIデプロイメントの稼働時間を最大化する。

- ディープラーニングの効率化:新しいFP4およびFP6の数値フォーマットをサポートし、AI推論の効率をさらに高める。

- 生成的AIスーパーコンピュータ:NVIDIA DGX SuperPODは、Blackwellアーキテクチャを利用して、トリリオンパラメータ規模の生成的AIモデルを効率的に処理できるように設計されている。

Blackwellは、特にAIや高性能計算(HPC)向けに設計されており、その強力な計算能力と効率的なエネルギー使用は、様々な産業での利用が期待されている。

Blackwell、H200、H100の比較表はこちら。

| 特徴/モデル | NVIDIA HGX H200 | NVIDIA HGX H100 | Blackwell B200 |

|---|---|---|---|

| アーキテクチャ | Hopper | Hopper | Blackwell |

| 推論速度 | H100の2倍 | 前世代と比較して30倍 | H100の約4倍 |

| HPC性能 | x86 CPUの110倍 | – | H100の2倍 |

| GPUメモリ | 141GB | 80GB | 192GB |

| GPUメモリ帯域幅 | 4.8TB/s | 2TB/s | 16TB/s ( |

| 最大熱設計電力 (TDP) | 最大700W | 最大400W | 最大1200W |

| HBMメモリタイプ | HBM3e | HBM2e | HBM3e |

この比較から、Blackwellは、H200、H100に比べて大幅な性能向上を達成していることがわかる。

補足説明

- アーキテクチャ: H200とH100はどちらもHopperアーキテクチャに基づいているが、Blackwell B200は次世代のBlackwellアーキテクチャを採用。

- 推論速度:Blackwell B200はH100の約4倍の推論速度を持ち、特にAIおよび生成的AIに特化している。

- HPC性能:H200はx86 CPUの110倍の性能を持つが、Blackwell B200はH100の2倍のHPC性能を提供。

- GPUメモリ:Blackwell B200は192GBのメモリを搭載し、これはH200やH100を上回る。

- GPUメモリ帯域幅:Blackwell B200のメモリ帯域幅は16TB/sで、H200やH100を大幅に上回る。

- 最大熱設計電力 (TDP):Blackwell B200は最大1200WのTDPで、H200やH100よりも高い消費電力が必要だが、それに見合った高い性能を提供。

- HBMメモリタイプ:Blackwell B200とH200はどちらも最新のHBM3eメモリを使用しているが、H100はHBM2eメモリを使用。

エヌビディアの配当は?

- 2024年の配当利回りは、0.02%

- 配当性向(直近12ヶ月) 1.34%

※同社の利益の1.34%が配当として株主に支払われていることを示す - 配当支払いは四半期ごと(3月・6月・9月・12月)

- 2024年Q1決算で増配を発表:0.04ドルから0.10ドルに150%増額

エヌビディアのセクター、業種、属するテーマは?

セクター

- エヌビディアはテクノロジーセクターに分類される。

業種

- エヌビディアは半導体業界に属しており、主にグラフィックスプロセッシングユニット(GPU)の設計と製造に注力している。

属するテーマ

- 人工知能(AI)

- ゲーミング

- データセンター

- 自動運転車

- 仮想現実(VR)/拡張現実(AR)

エヌビディアの競合企業は?

- AMD (Advanced Micro Devices)【AMD】

- グラフィックスプロセッサユニット(GPU)と中央処理ユニット(CPU)の分野でエヌビディアと競合している。

- 特にゲーミングとデータセンター向けのGPU市場での競争が激しい。

- インテル (Intel Corporation)【INTC】

- 主にCPU市場で競合しているが、GPU市場にも進出してきている。

- エヌビディアとは、データセンターとAIコンピューティング市場で競合関係にあります。

- クアルコム (Qualcomm)【QCOM】

- モバイルデバイス向けのGPUとプロセッサーで競合。

- 特にスマートフォンやタブレット市場での競争がある。

- アップル (Apple Inc.)【AAPL】

- 自社開発のMシリーズチップ(M1, M2など)で、パーソナルコンピューター市場において競合。

- GPU性能においてもエヌビディアと競合する場面が増えている。

- アームホールディングス【ARM】

- ARMベースのプロセッサー技術で、特にモバイルデバイスや組み込みシステム市場で競合。

- エヌビディアはARMの買収を試みたが、規制上の問題で断念。

エヌビディアの競合との差別化要素と優位性は?

エヌビディア(NVIDIA)は、競合他社と比較していくつかの重要な差別化要素と優位性を持っている。

GPU技術のリーダーシップ

エヌビディアはGPU市場における技術的リーダーであり、高性能なグラフィックス処理技術を提供している。これはゲーミング、プロフェッショナルグラフィックス、およびデータセンター市場において競合他社との明確な差別化要素となる。

AIとディープラーニングへの強いフォーカス

エヌビディアはAIとディープラーニングの分野で先駆け的な役割を果たしており、これらの分野で使用されるGPUの開発において競合他社よりも遥かにリードしている。特に、データセンターとクラウドコンピューティングにおけるAIアプリケーションでの使用がほぼ独占市場となっている。

CUDAプラットフォーム

CUDA(Compute Unified Device Architecture)は、エヌビディアが開発したプログラミングモデルであり、GPUを利用した並列コンピューティングを可能にする。このプラットフォームは、開発者がエヌビディアのGPUを最大限に活用できるように設計されており、競合他社にはない独自の強みとなる。

幅広い製品ラインナップ

エヌビディアは、個人用ゲーミングGPUからプロフェッショナルグレードのデータセンター向けGPUまで、幅広い製品ラインナップを持っており、多様な市場ニーズに対応できる柔軟性がある。

エコシステムとパートナーシップ

エヌビディアは、ソフトウェア開発者、ハードウェアメーカー、研究機関などとの強固なパートナーシップを築いており、エヌビディアの技術が広く採用され、エコシステム全体の成長を促進している。

これらの要素は、エヌビディアが競合他社と比較して強みとなり、優位に立つ理由の一部である。

特に、AIとディープラーニングの分野での強みは、今後の技術進化において重要な役割を果たすと考えられる。

エヌビディアと競合半導体メーカーとの業績比較

エヌビディアの2023年Q2の四半期決算と、その同時期タイミングの競合メーカーとの比較。

| 比較項目 | エヌビディア (NVIDIA) (2023年Q2) | インテル (Intel) (2023年Q3) | AMD (2023年Q3) |

|---|---|---|---|

| 売上高 | 13,507百万ドル | 14,158百万ドル | 5,800百万ドル |

| 営業利益 | 6,800百万ドル | -8百万ドル | 224百万ドル |

| 当期純利益 | 6,1880百万ドル | 310百万ドル | 299百万ドル |

| 売上高営業利益率(営業利益 /売上高) | 50.34% | -0.06% | 3.86% |

| EPS (1株当たり利益) | 2.7ドル | 0.41ドル | 0.7ドル |

売上高の高さ

エヌビディアの売上高は13,507百万ドルで、AMDの5,800百万ドルと比較して約2.3倍、インテルの14,158百万ドルと比較してもほぼ同等。

これは、エヌビディアが高い市場シェアを持ち、競合他社と同等またはそれ以上の市場影響力を持っていることを示す。

営業利益の大きさ

エヌビディアの営業利益は6,800百万ドルで、これはインテルの-8百万ドル(損失)やAMDの224百万ドルと比較して非常に高い。

これはエヌビディアの事業が非常に収益性が高いことを示し、効率的な経営と高いマージンを持っていることを意味する。

売上高営業利益率の高さ

エヌビディアの売上高営業利益率は50.34%で、これはインテルの-0.06%やAMDの3.86%と比較して非常に高い。

これはエヌビディアが売上に対して高い利益を生み出していることを示し、財務的に非常に健全であることを意味する。

EPS(1株当たり利益)の高さ

エヌビディアのEPSは2.7ドルで、これはインテルの0.41ドルやAMDの0.7ドルと比較して高い。これは株主にとって魅力的であり、エヌビディアの株式が投資家にとって価値があることを示している。

これらのデータから、エヌビディアは財務的に非常に強固な位置にあり、競合他社と比較しても高い収益性と効率性を持っていることがわかる。

特に、高い営業利益と売上高営業利益率は、エヌビディアが市場での強い競争力を持ち、今後も成長を続ける可能性が高いことを示唆する。

エヌビディアの現在株価

エヌビディアの株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

エヌビディアの業績について

まずは、エヌビディア(NVDA)の最低限の業績分析を行なうための、以下の4つの指標を確認していきます。

各データは、Investing.com、TradingViewより参照。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

エヌビディア(NVDA)の四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2021:Q3 | 6820 | 7100 | — | |

| 2021:Q4 | 7420 | 7640 | — | |

| 2022:Q1 | 8120 | 8290 | — | |

| 2022:Q2 | 6700 | 6700 | — | |

| 2022:Q3 | 5780 | 5930 | -16.48% | |

| 2022:Q4 | 6020 | 6050 | -20.81% | |

| 2023:Q1 | 6530 | 7190 | -13.27% | |

| 2023:Q2 | 11190 | 13510 | 101.64% | |

| 2023:Q3 | 16290 | 18120 | 205.56% | |

| 2023:Q4 | 20400 | 22100 | 265.29% | |

| 2024:Q1 | 24620 | 26040 | 262.17% | |

| 2024:Q2 | 28780 | 30040 | 122.35% | |

| 2024:Q3 | 33170 | 35080 | 93.60% | |

| 2024:Q4 | 38100 | 39330 | 77.96% | |

| 2025:Q1 | 43330 | 44060 | 69.20% | |

| 2025:Q2 | — | 45940 | — | — |

| 2025:Q3 | — | 53120 | — | — |

| 2025:Q4 | — | 59440 | — | — |

| 2026:Q1 | — | 61730 | — | — |

| 単位:百万ドル | ||||

エヌビディア(NVDA)の四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2021:Q3 | 1520 | 21.41% | 1300 | |

| 2021:Q4 | 3030 | 39.66% | 2760 | |

| 2022:Q1 | 1730 | 20.87% | 1370 | |

| 2022:Q2 | 1270 | 18.96% | 837 | |

| 2022:Q3 | 392 | 6.61% | -138 | |

| 2022:Q4 | 2250 | 37.19% | 1740 | |

| 2023:Q1 | 2910 | 40.47% | 2660 | |

| 2023:Q2 | 6350 | 47.00% | 6060 | |

| 2023:Q3 | 7330 | 40.45% | 7050 | |

| 2023:Q4 | 11500 | 52.04% | 11240 | |

| 2024:Q1 | 15350 | 58.95% | 14980 | |

| 2024:Q2 | 14490 | 48.24% | 13510 | |

| 2024:Q3 | 17630 | 50.26% | 16810 | |

| 2024:Q4 | 16630 | 42.28% | 15550 | |

| 2025:Q1 | 27410 | 62.21% | 26190 | |

| 単位:百万ドル | ||||

エヌビディア(NVDA)の四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2021:Q3 | 2670 | 37.61% | |

| 2021:Q4 | 2970 | 38.87% | |

| 2022:Q1 | 3220 | 38.84% | |

| 2022:Q2 | 499 | 7.45% | |

| 2022:Q3 | 601 | 10.13% | |

| 2022:Q4 | 1260 | 20.83% | |

| 2023:Q1 | 2140 | 29.76% | |

| 2023:Q2 | 6800 | 50.33% | |

| 2023:Q3 | 10420 | 57.51% | |

| 2023:Q4 | 13610 | 61.58% | |

| 2024:Q1 | 16910 | 64.94% | |

| 2024:Q2 | 18640 | 62.05% | |

| 2024:Q3 | 21870 | 62.34% | |

| 2024:Q4 | 24030 | 61.10% | |

| 2025:Q1 | 21640 | 49.11% | |

| 単位:百万ドル | |||

エヌビディア(NVDA)の四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2021:Q3 | 0.11 | 0.12 | 0.01 | |

| 2021:Q4 | 0.12 | 0.13 | 0.01 | |

| 2022:Q1 | 0.13 | 0.14 | 0.01 | |

| 2022:Q2 | 0.05 | 0.05 | 0.00 | |

| 2022:Q3 | 0.07 | 0.06 | -0.01 | |

| 2022:Q4 | 0.08 | 0.09 | 0.01 | |

| 2023:Q1 | 0.09 | 0.11 | 0.02 | |

| 2023:Q2 | 0.21 | 0.27 | 0.06 | |

| 2023:Q3 | 0.34 | 0.40 | 0.06 | |

| 2023:Q4 | 0.46 | 0.52 | 0.06 | |

| 2024:Q1 | 0.56 | 0.61 | 0.05 | |

| 2024:Q2 | 0.65 | 0.68 | 0.03 | |

| 2024:Q3 | 0.75 | 0.81 | 0.06 | |

| 2024:Q4 | 0.85 | 0.89 | 0.04 | |

| 2025:Q1 | 0.74 | 0.81 | 0.07 | |

| 2025:Q2 | — | 1.01 | — | — |

| 2025:Q3 | — | 1.2 | — | — |

| 2025:Q4 | — | 1.37 | — | — |

| 2026:Q1 | — | 1.43 | — | — |

| 単位:百万ドル | ||||

エヌビディア(NVDA)の通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|

| 6820 | 7100 | — | |

| 7420 | 7640 | — | |

| 8120 | 8290 | — | |

| 6700 | 6700 | — | |

| 5780 | 5930 | -16.48% | |

| 6020 | 6050 | -20.81% | |

| 6530 | 7190 | -13.27% | |

| 11190 | 13510 | 101.64% | |

| 16290 | 18120 | 205.56% | |

| 20400 | 22100 | 265.29% | |

| 24620 | 26040 | 262.17% | |

| 28780 | 30040 | 122.35% | |

| 33170 | 35080 | 93.60% | |

| 38100 | 39330 | 77.96% | |

| 43330 | 44060 | 69.20% | |

| — | 45940 | — | — |

| — | 53120 | — | — |

| — | 59440 | — | — |

| — | 61730 | — | — |

| 単位:百万ドル | |||

エヌビディア(NVDA)の通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|

| 1520 | 21.41% | 1300 | |

| 3030 | 39.66% | 2760 | |

| 1730 | 20.87% | 1370 | |

| 1270 | 18.96% | 837 | |

| 392 | 6.61% | -138 | |

| 2250 | 37.19% | 1740 | |

| 2910 | 40.47% | 2660 | |

| 6350 | 47.00% | 6060 | |

| 7330 | 40.45% | 7050 | |

| 11500 | 52.04% | 11240 | |

| 15350 | 58.95% | 14980 | |

| 14490 | 48.24% | 13510 | |

| 17630 | 50.26% | 16810 | |

| 16630 | 42.28% | 15550 | |

| 27410 | 62.21% | 26190 | |

| 単位:百万ドル | |||

エヌビディア(NVDA)の通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 発表日 | 営業利益 | 営業利益率 |

|---|---|---|

| 2670 | 37.61% | |

| 2970 | 38.87% | |

| 3220 | 38.84% | |

| 499 | 7.45% | |

| 601 | 10.13% | |

| 1260 | 20.83% | |

| 2140 | 29.76% | |

| 6800 | 50.33% | |

| 10420 | 57.51% | |

| 13610 | 61.58% | |

| 16910 | 64.94% | |

| 18640 | 62.05% | |

| 21870 | 62.34% | |

| 24030 | 61.10% | |

| 21640 | 49.11% | |

| 単位:百万ドル | ||

エヌビディア(NVDA)の通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|

| 0.11 | 0.12 | 0.01 | |

| 0.12 | 0.13 | 0.01 | |

| 0.13 | 0.14 | 0.01 | |

| 0.05 | 0.05 | 0.00 | |

| 0.07 | 0.06 | -0.01 | |

| 0.08 | 0.09 | 0.01 | |

| 0.09 | 0.11 | 0.02 | |

| 0.21 | 0.27 | 0.06 | |

| 0.34 | 0.40 | 0.06 | |

| 0.46 | 0.52 | 0.06 | |

| 0.56 | 0.61 | 0.05 | |

| 0.65 | 0.68 | 0.03 | |

| 0.75 | 0.81 | 0.06 | |

| 0.85 | 0.89 | 0.04 | |

| 0.74 | 0.81 | 0.07 | |

| — | 1.01 | — | — |

| — | 1.2 | — | — |

| — | 1.37 | — | — |

| — | 1.43 | — | — |

| 単位:百万ドル | |||

エヌビディアの今後の株価はどのように推移すると想定される?

エヌビディア(NVIDIA)の株価の将来的な推移について予測する際には、いくつかの重要な要因やリスクを考慮する必要がある。

以下はエヌビディアの株価推移に影響を与える可能性のある要因をまとめたもの。

- エヌビディアはGPU技術の分野でのリーダーであり、AIとディープラーニングの急速な進展により、技術革新の継続が、株価の成長に寄与する可能性が高い。

- エヌビディアの財務状況は非常に強固であり、高い収益性と成長性を示しており、この傾向が続く場合、株価はポジティブな影響を受ける可能性がある。

- 自動運転車、データセンター、クラウドコンピューティング、ヘルスケアなど、新しい市場への進出はエヌビディアに新たな成長機会を提供し、これらの成功は、株価にプラスの影響を与える可能性がある

- エヌビディアの競争環境、特にAMDやインテルなどの競合他社の動向も、株価に影響を与える重要な要因。競争が激化すると、株価には圧力がかかる可能性がある。

- 全体的な経済状況や株式市場のセンチメントも、株価に大きな影響を与えるため、経済の減速や市場の不安定性は、株価にネガティブな影響を与える可能性がある。

- 政府の規制や政策の変更、特に貿易政策やテクノロジー関連の規制は、エヌビディアのビジネスに影響を与え、間接的に株価に影響を及ぼす可能性がある。

これらの要因を考慮すると、エヌビディアの株価は、同社の持続的な技術革新、強固な財務状況、および新しい市場でのビジネスチャンスによって、ポジティブな方向に推移する可能性があると言える。

しかし、市場の不確実性や競争の激化などのリスク要因も考慮する必要があることを忘れてはならない。

エヌビディアの今後の展開と将来性は?

エヌビディア(NVIDIA)の今後の展開と将来性については、多角的に見ていく必要がある。

現時点では、以下のような要素が考えられる。

AIとディープラーニングの進化

AIとディープラーニングは今後も急速に進化し続ける分野であり、エヌビディアのGPUはこれらの技術の進展に不可欠となる。

特に、AIモデルのトレーニングと推論において、エヌビディアの製品は重要な役割を果たすと考えられる。

データセンターとクラウドコンピューティングの成長

データセンターとクラウドコンピューティング市場の拡大は、エヌビディアにとって大きな成長機会となる。GPUは、これらの分野でのデータ処理と計算処理の効率化に貢献していくと考えられる。

自動運転車の技術開発

自動運転技術の進展に伴い、エヌビディアのGPUとAIプラットフォームは、自動運転車の開発においてますます重要になると考えられる。エヌビディアは、自動運転車のためのAIアルゴリズムとデータ処理技術の開発に注力している。

ゲーミング市場の拡大

ゲーミング市場の成長は、エヌビディアにとって引き続き重要な収益源となる。高性能ゲーミングGPUの需要は、特にeスポーツの人気の高まりとともに増加している。

新しい市場への進出

エヌビディアは、ヘルスケア、製造、建設など、新しい市場への進出を模索している。これらの分野では、AIとデータ分析の応用が拡大しており、エヌビディアの技術が重要な役割を果たす可能性がある。

研究開発への投資

エヌビディアは研究開発に積極的に投資しており、これにより新しい技術革新が期待される。特に、エネルギー効率の高いGPUの開発や、より高度なAIアルゴリズムの研究が進んでいる。

これらの要素を考慮すると、エヌビディアは今後も技術革新の先頭に立ち、多様な市場での成長機会を追求することが予想できる。

特に、AIとデータ処理技術の進展が、エヌビディアの将来性を大きく左右することになると考えられる。

エヌビディアの2023年第3四半期の決算サマリー

エヌビディアの第3四半期決算報告書のサマリーは以下の通り。

決算のハイライト

- 総収入:第3四半期の総収入は$18.12億で、前年同期比206%増、前四半期比34%増。前年同期比で大幅な増収増益を達成。特にデータセンター向けの製品群における強い需要による結果。

- データセンター収入:データセンターからの収入は記録的な$14.51億で、前四半期比41%増、前年同期比279%増。

- 利益:GAAP(一般に公正妥当と認められた会計原則)に基づく1株当たり利益は$3.71で、前年同期比12倍以上、前四半期比50%増。非GAAPに基づく1株当たり利益は$4.02で、前年同期比約6倍、前四半期比49%増。

- 将来の見通し:第4四半期の収入は$20.00億と予想、GAAPおよび非GAAPの粗利益率はそれぞれ74.5%と75.5%を見込んでいる。

製品と市場の動向

- データセンター向けGPUの成長:H100の需要が大きく伸びており、これが収益の大きな部分を占めている。H100の供給量も増加、今後の売上増加が期待される。

- 新製品の投入:NVIDIA HGX™ H200と新しいNVIDIA H200 Tensor Core GPUの発表。2024年には、H100の拡張版と次世代のB100が市場に投入予定。これらの新製品は、データセンター市場でのNVIDIAの地位をさらに強化につながると見られる。

- 地域別の成長:アメリカ市場の成長が顕著だが、中国、台湾を含め、その他の地域でも売上が伸びている。

エヌビディアの2023年第4四半期と年次報告決算サマリー

2024年2月21日発表のエヌビディアの第4四半期および通期の決算報告のサマリーは以下の通り。

- 第4四半期の収益:$22.1億で、前四半期から22%増加し、前年同期からは265%の増加を記録。

- データセンターからの収益:第4四半期のデータセンター収益は$18.4億で、前四半期から27%増、前年同期からは409%増加。

- 通期の収益: $60.9億で、前年から126%増加。

- 第4四半期のGAAPベースの1株当たり利益:$4.93で、前四半期から33%増、前年同期から765%増加。

- 通期のGAAPベースの1株当たり利益:$11.93で、前年から586%増加。

- 将来の見通し:第1四半期の収益は$24.0億と予想されている。

決算ハイライト

- データセンター:第4四半期のデータセンター収益は記録的な$18.4億で、Googleとの共同作業でNVIDIAのデータセンターとPC AIプラットフォーム全体での最適化を発表した。

- ゲーミング:第4四半期のゲーミング収益は$2.9億で、前四半期からは変わらず、前年同期から56%増加。

エヌビディアがデータセンターとゲーミングの両セグメントで強力な成長を遂げていることを示している。特にデータセンター収益の大幅な増加は、AIとハイパフォーマンス・コンピューティング市場でのエヌビディアの強力な地位を反映している。

エヌビディアの2024年第1四半期の決算サマリー

- 売上高: 2億6044万ドルで、前年同期の7192万ドルから262%増加。

- 純利益:1億4881万ドルで、前年同期の2043万ドルから628%増加。

- 一株当たりの純利益 (EPS):

- GAAP基準で5.98ドル

- 非GAAP基準で6.12ドル

セグメント別業績

- データセンター:

- 売上は2億2563万ドルで、前年同期比427%増加。

- NVIDIA Hopper GPUプラットフォームの需要が高まり、大規模言語モデルやAIアプリケーションのトレーニングと推論に使用されてる。

- ゲーミング:

- 売上は2億6470万ドルで、前年同期比18%増加。

- ただし、前四半期比では8%減少。

- プロフェッショナルビジュアライゼーション:

- 売上は4270万ドルで、前年同期比45%増加。

- 前四半期比では8%減少。

- 自動車:

- 売上は3290万ドルで、前年同期比11%増加。

- 前四半期比では17%増加。

その他のハイライト

- 株式分割: 2024年6月7日に10対1の株式分割を実施予定。これにより、既存の株主は1株あたり9株の追加株式を受け取る。

- 配当:四半期配当を0.04ドルから0.10ドルに150%増額。分割後の1株あたり0.01ドルに相当。

- キャッシュフロー:

- 営業活動によるキャッシュフローは15.3億ドルで、前年同期の2.9億ドルから大幅に増加。

- 主要な現金使用は株式の買い戻し(7.7億ドル)と配当支払い(9800万ドル)。

将来の見通し

- 第2四半期の売上予測:280億ドル(±2%)。

- 粗利益率:GAAP基準で74.8%、非GAAP基準で75.5%。

- 営業費用:GAAP基準で39.5億ドル、非GAAP基準で28億ドル。

- 税率:GAAP基準および非GAAP基準で17%(±1%)。

このサマリーから、エヌビディアが2025年度第1四半期において非常に強力な成績を収め、特にデータセンター部門での成長が著しいことが分かる。また、株式分割と配当の増額により、投資家に対する利回りが向上している。

エヌビディアの2024年第2四半期の決算サマリー

- 売上高: 300億ドルで、前年同期比122%増加、前四半期比15%増加。

- GAAP純利益: 165億9,900万ドル、前年同期比168%増加。

- GAAP一株当たり利益(EPS): 0.67ドル、前年同期の0.25ドルから大幅に増加。

- Non-GAAP純利益: 169億5,200万ドルで、前年同期比152%増加。

- Non-GAAP一株当たり利益: 0.68ドル、前年同期の0.27ドルから増加。

部門別売上

- データセンター: 売上は263億ドルで、前年同期比154%増加し、全体の売上を牽引している。特にHopper GPUコンピューティングプラットフォームの需要が高く、企業やクラウドサービスプロバイダーからの需要が増加した。

- ゲーミング: 売上は29億ドルで、前年同期比16%増加。新しいGeForce RTX 40シリーズGPUの売上が好調。

- プロフェッショナルビジュアライゼーション: 売上は4億5,400万ドルで、前年同期比20%増加。RTX GPUワークステーションの需要が増加。

- 自動車: 売上は3億4,600万ドルで、前年同期比37%増加。AIコックピットソリューションと自動運転プラットフォームの需要が成長を牽引した。

事業の進展

- AIと次世代GPU: 新しいBlackwellアーキテクチャのサンプル出荷を開始し、今後の生産拡大を予定している。Hopperの需要も引き続き強く、今後の出荷増加が期待されている。

- 株主還元: 2025年度上半期で株主への還元額は154億ドルに達し、株式買戻しと現金配当を実施。さらに、追加の株式買戻し枠500億ドルが承認された。

将来の見通し

- 第3四半期の売上予測: 約325億ドルを見込んでおり、引き続きデータセンター部門の成長が期待されている。

- 粗利益率の見通し: GAAP基準で74.4%、Non-GAAP基準で75.0%を予想している。

エヌビディアは、AIとデータセンターの需要拡大により強力な成長を遂げており、今後も次世代GPUとAI関連の技術革新が業績を支えると期待されている。

エヌビディアの2024年第3四半期の決算サマリー

発表日:24/11/21

売上高と収益

- 総売上高:351億ドル。前年同期比94%増、前四半期比17%増。

- データセンター売上:307億ドル。前年同期比112%増、前四半期比17%増。

- 主力であるHopperアーキテクチャに対する需要が成長を牽引。

- ゲーム部門売上:33億ドル。前年同期比15%増、前四半期比14%増。

- 自動車部門売上:4億4900万ドル。前年同期比72%増、前四半期比30%増。

利益

- GAAPベース純利益:193億ドル。前年同期比109%増、前四半期比16%増。

- 1株当たり利益(GAAP):0.78ドル。前年同期比111%増、前四半期比16%増。

- Non-GAAPベース純利益:200億ドル。前年同期比100%増、前四半期比18%増。

注目ポイント

- データセンター事業:

- AIとクラウド需要が急増。大規模言語モデルや生成AIの普及に対応。

- Blackwellアーキテクチャの生産準備が進行中。2025年度第4四半期から出荷開始予定。

- ゲーム部門:

- GeForce RTX 40シリーズが引き続き好調。

- 自動車部門:

- 自動運転技術を中心に売上が成長。

将来ガイダンス

- 2025年度第4四半期予測:

- 売上高:375億ドル(±2%)。

- GAAP営業費用:48億ドル。

- 税率:16.5%(±1%)。

エヌビディアは、AI市場の成長を背景にデータセンター事業を大幅に拡大し、収益の飛躍的な伸びを実現した。今後もBlackwellアーキテクチャの出荷とAI需要の増加が、さらなる成長を牽引すると期待される。

エヌビディア(NVDA)の株を買える証券会社は?

エヌビディアの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| 三菱UFJ eスマート証券(旧社名:auカブコム証券) | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ◯ |

| moomoo証券 | ◯ | ✕ |

まとめ

エヌビディア(NVIDIA)の企業概要、技術革新、財務状況、市場での地位、そして将来性について見てきました。

エヌビディアは、GPU技術のパイオニアとして、AI、ディープラーニング、自動運転車、データセンターなどの分野で重要な役割を果たしています。その技術革新と市場でのリーダーシップは、同社の株価に大きな影響を与えています。

財務的には、エヌビディアは高い収益性と成長性を示しており、その営業率は競合他社と比較しても業績を維持しています。

売上高、営業利益、EPS(1株当たり利益)などの指標は、同社の財務的な強さを示しており、営業利益率は、2023年Q2から50%を超える数値を叩き出し、さらにQ4では60%を超えるなど、驚異的な収益率を見せています。

また、新しい市場への進出と技術の応用範囲の拡大は、今後の成長機会をさらに広げています。

エヌビディアは技術革新の先駆者として、今後も多くの成長機会を持っていると考えられ、長期的な視点で見た場合、エヌビディアの株式は魅力的な投資対象であると言えるでしょう。

私自身は、エヌビディアの株よりもAMDの株式配分を多く持っていますが、人工知能や自動運転がこれから当たり前の世の中になっていく過程で、半導体という「つるはしとシャベル」の役割を果たす企業への投資は、一つの戦略として考えています。

またエヌビディアは、多くの関連企業により支えられ、ともに成長しています。それらエヌビディアに関連する銘柄(米国株・日本株・仮想通貨)に焦点を当て紹介しています。

さらに、エヌビディアの成長を享受しながら、分散投資できるETFと、投資信託の銘柄もまとめています!エヌビディアの組入れ比率の高い米国のETFと、投資信託の銘柄は以下をご覧ください!

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!