このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- はじめに

- SMCIは何の会社、どのような事業をしている?

- SMCIの主力製品やサービスは何か?

- 取引市場は?

- SMCIのセクター、業種、属するテーマは?

- SMCIの会社設立と上場したのはいつ?

- 配当は?

- SMCIが属する業界の規模と成長性

- SMCIの競合企業は?

- スーパーマイクロコンピュータ(SMCI)の競合との差別化要素と優位性

- SMCIの今後の展開

- SMCIのAI向けサーバーとその特徴は?

- なぜ、SMCIはAIサーバで圧倒的な成長ができたのか?

- SMCIの業績について

- スーパーマイクロコンピュータ(SMCI)の株価

- SMCIの成長戦略と将来性

- SMCIのサーバー市場のマーケットシェア

- スーパーマイクロコンピュータ(SMCI)の2024年度Q1決算サマリー

- SMCIの2024年度Q2の上方修正に関するリリース内容

- スーパーマイクロコンピューター(SMCI)の2024年度Q2決算サマリー

- スーパーマイクロコンピューター(SMCI)の2024年度Q3決算サマリー

- スーパーマイクロコンピューター(SMCI)の2024年度Q4と通期決算サマリー

- スーパーマイクロコンピュータ(SMCI)の株を買える証券会社は?

- まとめ

はじめに

AI技術、特にChatGPTのような進化したAIの普及に伴い、NVIDIAを筆頭とするAI半導体業界は目覚ましい成長を遂げています。この流れの中で、AIサーバーの需要が急速に高まっており、スーパーマイクロコンピューター(SMCI)が注目を集めています。

2023年4月には100ドル前後だったSMCIの株価は、2024年2月には1000ドルを超え、わずか1年足らずで株価が10倍(テンバガー)になるという驚異的な成長を遂げました。この成長速度はAI関連銘柄の中でも際立っています。

2024年3月には、その成長が認められ、S&P 500の採用銘柄に選ばれました。これは、SMCIの勢いが止まらないことを示しています。

この記事では、投資や財務、決算に詳しくない方々にも分かりやすく、スーパーマイクロコンピューター(SMCI)のビジネスセグメントのパフォーマンス、製品環境、市場全体との関連性について詳しく解説します。

SMCIの事業内容や特徴、そして今後の株価見通しの参考として確認していただけます。

SMCIは何の会社、どのような事業をしている?

- 本社所在地:アメリカ合衆国カリフォルニア州サンノゼ

- 設立年:1993年

- 事業内容:サーバー技術と革新的な高性能・高効率のコンピューティング技術の開発、製造、販売

- 主力製品:サーバーシステム、サーバーボード、ストレージシステム、ネットワークデバイス、デスクトップ/ワークステーション

- 特徴:エンタープライズ、データセンター、クラウドコンピューティング、ハイパフォーマンスコンピューティング(HPC)、ビッグデータ、ストレージ、AIなど、幅広いアプリケーションに対応した製品を提供

- グリーンIT:エネルギー効率の高い製品を提供することで、顧客の電力コストを削減し、環境負荷を低減する取り組みを行っている

- グローバル展開:世界中の多くの国と地域で事業を展開しており、製品は全世界に販売されている

スーパーマイクロコンピューター(SMCI)は、以上のような事業を展開しており、特にサーバー技術と高性能コンピューティング技術の分野で高い評価を得ています。

SMCIの主力製品やサービスは何か?

SMCIの製品とサービスは、企業が自社のビジネスを運営するために必要なIT設備を提供するためのもので、以下の種類に関するサービスを提供している

サーバーシステム

サーバーは、インターネット上で情報を提供するための大型のコンピューターのこと。

SMCIは、一般的なビジネス用途から、大量のデータを処理するための高性能なサーバー、AIやディープラーニングの研究に使われる特殊なサーバーまで、さまざまなニーズに対応したサーバーを提供している。

サーバーボード

サーバーボードは、サーバーの「心臓部」のようなもので、CPUやメモリなどの主要な部品が取り付けられます。

SMCIは、さまざまな種類のサーバーボードを提供しており、顧客は自分のニーズに合わせて選ぶことができる。

ストレージシステム

ストレージシステムは、データを保存するための装置。

SMCIは、大量のデータを高速に保存・取り出すことができる高性能なストレージシステムを提供している。

ネットワークデバイス

ネットワークデバイスは、コンピューター同士をつなげて通信を可能にする装置。SMCIは、高速な通信を可能にするネットワークデバイスを提供している。

デスクトップ/ワークステーション

デスクトップやワークステーションは、一般的なパソコンと同じようなものだが、より高性能で、科学技術計算やグラフィックス作成など、特殊な用途に使われる。

取引市場は?

スーパーマイクロコンピューター(SMCI)の株式は、NASDAQ(ナスダック)で取引されている。

NASDAQは、特にテクノロジー関連の企業が多く上場していることで知られている。

SMCIのセクター、業種、属するテーマは?

スーパーマイクロコンピューター(SMCI)は、以下のセクター、業種、テーマに分類されます。

セクター:テクノロジー

セクターとは、経済活動を大きなカテゴリーに分けたもの。

テクノロジーセクターはコンピューター、ソフトウェア、電子機器、通信機器などを製造または提供する企業を含みます。

業種:コンピューターハードウェア

業種とは、より具体的なビジネスの種類。

コンピューターハードウェア業種は、パソコン、サーバー、ストレージデバイス、ネットワーク機器などの物理的なコンピューター機器を製造する企業を含む。

テーマ:AI(人工知能)、クラウドコンピューティング、ビッグデータ、エネルギー効率

テーマとは、特定のトレンドや技術、産業動向などに関連する企業を集めたカテゴリーのこと。

SMCIは、AIやクラウドコンピューティングといった最先端のテクノロジートレンドに関連する製品を提供。

また、エネルギー効率の高い製品を提供することで、グリーンITやサステナビリティといった環境に配慮したテーマにも関連している。

これらの分類は、投資家がSMCIのビジネスモデルを理解し、同じセクターや業種、テーマの他の企業と比較するための一助となります。

SMCIの会社設立と上場したのはいつ?

スーパーマイクロコンピューター(SMCI)は、1993年にアメリカのサンノゼで設立される。

その後、成長を続け、2007年3月29日にNASDAQ(ナスダック)での初公開(IPO)を行い、公開会社となる。

SMCIは、サーバー、ストレージ、ネットワーキングなどのITインフラ製品を提供し続け、テクノロジー業界でのリーダーシップを維持している。

配当は?

実施せず

SMCIが属する業界の規模と成長性

スーパーマイクロコンピューター(SMCI)が属するデータセンターサーバー市場は、2021年に600億ドル(約6兆円)を超え、2022年から2030年までの期間で年間成長率(CAGR)10%以上の成長が見込まれている。

この成長は、AIや機械学習などの技術がデータセンターサーバーに組み込まれることにより推進されている。

特に、ブレードサーバーのセグメントは、2030年までに約10%の成長が見込まれている。

これは、消費電力の低減と高い処理能力が、データセンターサーバー市場の成長を後押ししている主要な要因。

小規模なデータセンターのサーバー市場は、2022年から2030年までの間に13%の成長が見込まれている。

これは、中小企業がクラウドコンピューティングやAIなどの技術を採用し、データセンター施設全体でサーバーを展開することが増えているため。

さらに、アジア太平洋地域のデータセンターサーバー市場は、デジタル化が進む中で、2030年までに年間成長率15%の成長が見込まれている。

これらの情報から、SMCIが属する業界は大きな規模を持ち、さらに高い成長性を示していることがわかる。

これは、データの需要が増大し、それに伴いデータセンターの需要が増えていることを反映している。

SMCIの競合企業は?

SMCIが活動しているサーバー、ストレージ、ネットワーキングのハードウェア市場では、以下のような企業が競合となります:

- デル・テクノロジーズ(DELL):Dellは、パーソナルコンピューターからエンタープライズ向けのサーバー、ストレージ、ネットワーキング製品まで、幅広いITハードウェアを提供している。

- ヒューレット・パッカード・エンタープライズ (HPE):HPEは、エンタープライズ向けのITインフラストラクチャとソフトウェアを提供しており、サーバーやストレージなどの製品でSMCIと競合している。

- Lenovo:Lenovoもまた、パーソナルコンピューターからエンタープライズ向けのITハードウェアまで、幅広い製品を提供している。

- シスコシステムズ(CSCO):Ciscoは、ネットワーキングハードウェアとソフトウェアを提供しており、特にネットワーキング製品でSMCIと競合している。

これらの企業は、SMCIと同様に、企業やデータセンター向けのITインフラストラクチャを提供しており、顧客のニーズに応じて最適な製品やソリューションを選択することができる。

スーパーマイクロコンピュータ(SMCI)の競合との差別化要素と優位性

SMCIが競合他社と差別化を図るために重視している要素は以下のとおり。

強力なパートナーシップ

スーパーマイクロはエヌビディアやIntel、AMDなどの主要チップメーカーと強力なパートナーシップを築いており、最新のGPUやCPUを迅速に市場に投入することができる。

このパートナーシップにより、AIおよびHPC向けの高性能サーバーを提供している。

カスタマイズ可能なソリューション

スーパーマイクロは、顧客の特定の要件に合わせて製品をカスタマイズする能力を持っている。特に同社の「Server Building Block Solutions」は、顧客の特定のニーズに合わせたカスタマイズが可能。これにより、様々なワークロードやアプリケーションに最適化されたシステムを構築できる。

迅速な納品体制

スーパーマクロのラックスケールソリューションは、迅速な納品が可能であり、特にAIファクトリーの構築において高い評価を得ており、顧客は短期間でシステムを導入し、運用を開始することが可能。

製品の幅広さと深さ

SMCIは、エンタープライズ向けから個人向けまで、幅広いニーズに対応する製品ラインナップを持つ。これにより、顧客は自社の要件に最適な製品を選択することができる。

液冷ソリューション

スーパーマイクロは、最先端の液冷技術を提供しており、これによりデータセンターのエネルギー効率を大幅に向上させることが可能。液冷サーバーは、従来の空冷サーバーに比べて最大40%の電力コストを削減できる。

特に、同社の4U 8-GPU液冷サーバーは、NVIDIA H100/H200 HGX GPUsを搭載し、ペタフロップスのAI計算能力を提供。これにより、非常に高密度なコンピューティング環境を実現し、AIトレーニングやHPCシミュレーションの効率を大幅に向上させられる。

新技術に対応

スーパーマイクロは、Intel Gaudi 3 AIアクセラレータやAMD MI300Xアクセラレータなど、最新の技術をサポートする新しいサーバーを導入しており、顧客は最新の技術を活用した高性能な計算環境を構築できる。

これらの要素は、スーマイクロコンピュータが競争力のあるデータセンターサーバー市場で成功を収めるための重要な要素となっている。

SMCIの今後の展開

SMCIが今後展開する事業内容は、高性能なAIサーバーに必要な半導体企業(AMDやNVIDIA)とのパートナーシップを強化しており、大きな成長要因となる可能性がある。

クラウドゲーミングとビデオホスティング向けの新製品

SMCIは、AMD Ryzen Zen 4 7000シリーズプロセッサを利用した高密度3U 8ノードシステム、MicroCloudを提供開始した。

この新しいマルチノードシステムは、eコマース、ソフトウェア開発、クラウドゲーミング、コンテンツ作成、プライベートサーバーインスタンスなど、スケールでのコスト最適化されたパフォーマンスを提供している。

AMD製品ラインの拡大

SMCIは、クラウドインフラストラクチャ(クラウドサーバーの設備全般)と高性能技術計算に最適化された新しいサーバーとプロセッサを用いて、AMD製品ラインを拡大している。

新しい「Zen 4c」コア最大128コアとAMD 3D V-Cache技術を活用したAMD EPYC 9004シリーズプロセッサシステムのポートフォリオが進化している。

COMPUTEX 2023での新製品とストレージシステムの展示

SMCIは、データセンターからエッジまで、優れたパフォーマンス、柔軟性、エネルギー効率を実現し、迅速なデプロイメントを可能にする新しいサーバーとストレージシステムをCOMPUTEX TAIPEI 2023で展示し、新製品をアピールした。

「Accelerate Everything」戦略の発表

SMCIの創業者でCEOのCharles Liang(チャールズ・リアン)は、クラウド、AI、エッジ、ストレージワークロードを加速する開発、ラックスケール製造への投資、今日のデータセンターの環境影響を減らすための革新を概説するために、エヌビディアのCEOであるJensen Huang(ジェンスン・フアン)と他の業界の著名人と共に、SMCIの「Accelerate Everything」戦略を発表。

これらの展開から、SMCIは新製品の開発、パートナーシップの強化、そして環境に配慮した技術の導入により、業界での競争力を維持し、さらなる成長を目指していることがわかる。

SMCIのAI向けサーバーとその特徴は?

これらのサーバーは、AIトレーニング、ディープラーニング、HPC、ジェネレーティブAI、メタバースを加速することを目指している。

2023年3月24日に、最新のNVIDIA HGX™ H100 8-GPUシステムを含む複数の最新GPUサーバーの出荷を開始。

新しいNVIDIA HGX H100 Delta-Next サーバーは、AIトレーニングアプリケーションにおいて、前世代と比較して、9倍のパフォーマンス向上を期待できる。

また、冷却ファン速度を抑え、ノイズレベルを低減し、消費電力を削減する革新的なエアフロー設計を採用しているため、総所有コスト(TCO)を削減できる。

最新のSupermicro 8U GPU サーバーは、NVIDIA HGX H100 8-GPUを搭載し、AI、ディープラーニング、機械学習、HPCワークロード向けに最適化されている。

また、最速のNVIDIA NVLink® 4.0テクノロジー、NVSwitch™ インターコネクト、NVIDIA Quantum-2 InfiniBandおよびSpectrum®-4イーサネットネットワークを活用した、最速のGPU間通信を実現し、大規模AI処理を可能にする。

スーパーマイクロコンピューター(SMCI)は、AI向けの高性能サーバー提供で最先端サービスを提供し、業界を牽引している。

なぜ、SMCIはAIサーバで圧倒的な成長ができたのか?

スーパーマイクロコンピューター(SMCI)がAIサーバー市場で目覚ましい成長を遂げた理由は、同社の革新的なAI向けインフラストラクチャソリューションと、NVIDIAの最新H100 GPUを含む製品の販売実績にある。

SMCIは、大規模なAIトレーニングからエッジ推論まで、AIの導入を簡素化し、「すぐに使える完全なソリューション」として提供している。

特に、NVIDIAのHGX H100 SXM 8-GPU/4-GPUを活用したシステムは、GPU間の高速通信と大容量データセットの処理能力を最大化し、効率的なAIモデルトレーニングを可能にします。

これらのシステムは、「柔軟にカスタマイズ可能な構造」と「素早く稼働させることができる設計」を特徴とし、企業がAIを活用したビジネスモデルやアプリケーションを効果的に展開できるよう支援している。

一方で、AI半導体市場においてNVIDIAのH100は非常に高い人気を博しており、その需要は供給を上回る状況が続いていた。

しかし、供給が安定し始め、エヌビディアは過去の販売実績に基づいて企業に優先的にH100を供給しています。

SMCIは、前世代のA100 GPUを搭載したサーバーの販売実績を持ち、この実績がH100 GPUの供給に寄与しており、SMCIは多くのH100 GPUを販売し、その結果、売上の増加と株価の成長を実現した。

このように、SMCIのAIサーバー市場での圧倒的な成長は、先進的な製品の提供と、確固たる販売実績による供給の優位性が相まって達成されたものと言える。

SMCIの業績について

スーパー・マイクロ・コンピューター(SMCI)の決算期は、毎年6月30日です。

四半期決算は、Q1:9月、Q2:12月、Q3:3月、Q4:6月となります。

まずは、SMCIの最低限の業績分析を行なうための、以下の4つの指標を確認していきます。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

各データは、Investing.com、TradingViewより参照。

スーパーマイクロコンピュータ(SMCI)の株価

スーパーマイクロコンピュータ(SMCI)の現在株価がわかるリアルタイム株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

SMCIの四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2021:Q4 | 1020 | 1070 | — | |

| 2022:Q1 | 945.15 | 1030 | — | |

| 2022:Q2 | 1150 | 1170 | — | |

| 2022:Q3 | 1230 | 1360 | — | |

| 2022:Q4 | 1560 | 1640 | 53.27% | |

| 2023:Q1 | 1650 | 1850 | 79.61% | |

| 2023:Q2 | 1750 | 1800 | 53.85% | |

| 2023:Q3 | 1390 | 1280 | -5.88% | |

| 2023:Q4 | 1980 | 2180 | 32.93% | |

| 2024:Q1 | 2110 | 2120 | 14.59% | |

| 2024:Q2 | 2970 | 3660 | 103.33% | |

| 2024:Q3 | 3960 | 3850 | 200.78% | |

| 2024:Q4 | 5320 | 5310 | 143.58% | |

| 2025:Q1 | 6340 | 5950 | 180.66% | |

| 2025:Q2 | 5650 | 5680 | 55.19% | |

| 2025:Q3 | — | 5010 | 4600 | 19.48% |

| 2025:Q4 | — | 5980 | 5760 | 8.47% |

| 2026:Q1 | — | 6460 | — | — |

| 2026:Q2 | — | 7610 | — | — |

| 2026:Q3 | — | 8240 | — | — |

| 単位:百万ドル | ||||

SMCIの四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2021:Q4 | 63 | 5.89% | 49.61 | |

| 2022:Q1 | -134.57 | -13.07% | -145.37 | |

| 2022:Q2 | -53.15 | -4.54% | -65.56 | |

| 2022:Q3 | -227.94 | -16.76% | -238.89 | |

| 2022:Q4 | -25.73 | -1.57% | -36.76 | |

| 2023:Q1 | 313.59 | 16.95% | 302.84 | |

| 2023:Q2 | 161.09 | 8.95% | 151.2 | |

| 2023:Q3 | 198.25 | 15.49% | 190.26 | |

| 2023:Q4 | -9.34 | -0.43% | -17.51 | |

| 2024:Q1 | 270.46 | 12.76% | 267.83 | |

| 2024:Q2 | -595.09 | -16.26% | -609.8 | |

| 2024:Q3 | -1520 | -39.48% | -1610 | |

| 2024:Q4 | -641.81 | -12.09% | -655.8 | |

| 2025:Q1 | 408.9 | 6.87% | 364.6 | |

| 2025:Q2 | -239.76 | -4.22% | -267.29 | |

| 2025:Q3 | — | 626.76 | 13.63% | 594.06 |

| 2025:Q4 | — | 863.61 | 18.77% | 840.93 |

| 単位:百万ドル | ||||

SMCIの四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2021:Q4 | 39.08 | 3.65% | |

| 2022:Q1 | 29.13 | 2.83% | |

| 2022:Q2 | 51.05 | 4.36% | |

| 2022:Q3 | 91.78 | 6.75% | |

| 2022:Q4 | 165.21 | 10.07% | |

| 2023:Q1 | 220.12 | 11.90% | |

| 2023:Q2 | 215.18 | 11.95% | |

| 2023:Q3 | 99.08 | 7.74% | |

| 2023:Q4 | 226.75 | 10.40% | |

| 2024:Q1 | 172.51 | 8.14% | |

| 2024:Q2 | 371.46 | 10.15% | |

| 2024:Q3 | 378.31 | 9.83% | |

| 2024:Q4 | 343.4 | 6.47% | |

| 2025:Q1 | 509.2 | 8.56% | |

| 2025:Q2 | 368.62 | 6.49% | |

| 2025:Q3 | — | 146.78 | 3.19% |

| 2025:Q4 | — | 228.39 | 3.97% |

| 単位:百万ドル | |||

SMCIの四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2021:Q4 | 0.08 | 0.08 | 0 | |

| 2022:Q1 | 0.04 | 0.06 | 0.02 | |

| 2022:Q2 | 0.08 | 0.09 | 0.01 | |

| 2022:Q3 | 0.11 | 0.15 | 0.04 | |

| 2022:Q4 | 0.22 | 0.26 | 0.04 | |

| 2023:Q1 | 0.25 | 0.34 | 0.09 | |

| 2023:Q2 | 0.29 | 0.33 | 0.04 | |

| 2023:Q3 | 0.17 | 0.16 | -0.01 | |

| 2023:Q4 | 0.29 | 0.35 | 0.06 | |

| 2024:Q1 | 0.33 | 0.34 | 0.01 | |

| 2024:Q2 | 0.52 | 0.56 | 0.04 | |

| 2024:Q3 | 0.57 | 0.67 | 0.1 | |

| 2024:Q4 | 0.81 | 0.63 | -0.18 | |

| 2025:Q1 | 0.73 | 0.75 | 0.02 | |

| 2025:Q2 | 0.58 | 0.51 | -0.07 | |

| 2025:Q3 | — | 0.41 | 0.31 | -0.1 |

| 2025:Q4 | — | 0.45 | 0.41 | -0.04 |

| 2026:Q1 | — | 0.46 | — | — |

| 2026:Q2 | — | 0.6 | — | — |

| 2026:Q3 | — | 0.66 | — | — |

| 単位:百万ドル | ||||

SMCIの通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 年度(通期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2016年 | — | 2230 | 2220 | — |

| 2017年 | — | 2520 | 2530 | 13.96% |

| 2018年 | — | 3150 | 3310 | 30.83% |

| 2019年 | 3460 | 3460 | 4.53% | |

| 2020年 | 3230 | 3340 | -3.47% | |

| 2021年 | 3510 | 3560 | 6.59% | |

| 2022年 | 5120 | 5200 | 46.07% | |

| 2023年 | 6920 | 7120 | 36.92% | |

| 2024年 | 14940 | 14940 | 109.83% | |

| 2025年 | — | 22250 | 21970 | 47.05% |

| 2026年 | — | 32010 | — | — |

| 2027年 | — | 39920 | — | — |

| 2028年 | — | 50810 | — | — |

| 単位:百万ドル | ||||

SMCIの通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 年度(通期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2016年 | — | 107.99 | 4.86% | 73.88 |

| 2017年 | — | -96.19 | -3.80% | -125.55 |

| 2018年 | — | 83.93 | 2.54% | 59.11 |

| 2019年 | 261.93 | 7.57% | 237.08 | |

| 2020年 | -30.98 | -0.93% | -75.32 | |

| 2021年 | 122.39 | 3.44% | 64.38 | |

| 2022年 | -441.39 | -8.49% | -486.57 | |

| 2023年 | 663.58 | 9.32% | 626.79 | |

| 2024年 | -2490 | -16.67% | -2610 | |

| 2025年 | — | 1660 | 7.56% | 1530 |

| 単位:百万ドル | ||||

SMCIの通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 年度(通期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2016年 | — | 107.49 | 4.84% |

| 2017年 | — | 94.88 | 3.75% |

| 2018年 | — | 94.71 | 2.86% |

| 2019年 | 97.23 | 2.81% | |

| 2020年 | 85.65 | 2.56% | |

| 2021年 | 123.95 | 3.48% | |

| 2022年 | 337.17 | 6.48% | |

| 2023年 | 761.14 | 10.69% | |

| 2024年 | 1210 | 8.10% | |

| 2025年 | — | 1250 | 5.69% |

| 単位:百万ドル | |||

SMCIの通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 年度(通期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2016年 | — | 0.16 | 0.16 | 0 |

| 2017年 | — | 0.16 | 0.16 | 0 |

| 2018年 | — | 0.18 | 0.21 | 0.03 |

| 2019年 | 0.24 | 0.24 | 0 | |

| 2020年 | 0.26 | 0.28 | 0.02 | |

| 2021年 | 0.25 | 0.25 | 0 | |

| 2022年 | 0.52 | 0.56 | 0.04 | |

| 2023年 | 1.12 | 1.18 | 0.06 | |

| 2024年 | 2.38 | 2.21 | -0.17 | |

| 2025年 | — | 2.1 | 2.06 | -0.04 |

| 2026年 | — | 2.54 | — | — |

| 2027年 | — | 3.37 | — | — |

| 2028年 | — | 3.72 | — | — |

| 単位:百万ドル | ||||

SMCIの成長戦略と将来性

以下は、SMCIが競争力を維持し、市場の変化に対応し、成長戦略となる内容として挙げられる。

製品ポートフォリオの拡大

SMCIは、エンタープライズ、クラウド、およびエッジコンピューティング市場向けの製品ラインを拡大している。新しい技術や技術強化を最初に市場に投入することで、顧客に提供する製品の数を増やすことを目指している。

エネルギー効率の改善

製品のエネルギー効率を向上させるために、電力と熱管理機能を強化し、コンポーネント密度を増加させることを目指している。

新市場への進出

同社は、5G、AI、およびエッジコンピューティングといった新たな成長市場への進出を図っている。

顧客基盤の拡大

SMCIは、新規および既存の顧客に対する販売を拡大することにより、顧客基盤を拡大している。これには、Fortune 100企業、大手クラウドサービスプロバイダー、および大手テクノロジー企業が含まれている。

サプライチェーンの最適化

SMCIは、サプライチェーンの効率を向上させるための取り組みを続けている。

これには、コンポーネントの調達、在庫管理、および製品の出荷に関するプロセスの改善が含まれる。

持続可能な製品の開発

SMCIは、エネルギー効率とリサイクル可能性を重視した製品の開発に注力している。これにより、同社は環境に配慮した製品を提供し、持続可能な成長を達成することを目指している。

さらに経営陣は、2023年に景気が軟調に転じた後、2024年は好調になると見ている。

SMCI は NVIDIA のパートナーであり、NVIDIA も AI データセンター ビジネスに強い見通しを示しています。

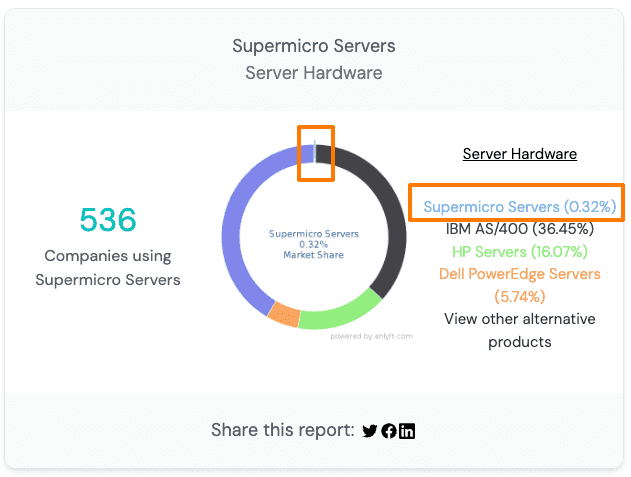

SMCIのサーバー市場のマーケットシェア

SMCIのサーバーマーケットシェアは現時点ではかなり低い。

それゆえシェアの拡大における業績インパクトは大きいと考えられる。

参考:Companies using Supermicro Servers and its marketshare

スーパーマイクロコンピュータ(SMCI)の2024年度Q1決算サマリー

- 売上:$2.12億で、前の四半期の$2.18億と比べると少し減少したが、前年同期の$1.85億と比べると増加。

- 総利益率:16.7%で、前の四半期の17.0%、前年同期の18.8%と比べて減少。

- 純利益:$1.57億で、前の四半期の$1.94億、前年同期の$1.84億と比べて変動している。

- 一株当たり純利益(希薄化後):$2.75で、前の四半期の$3.43、前年同期の$3.35と比べて減少。

- 非GAAPに基づく一株当たり純利益(希薄化後):$3.43で、前の四半期の$3.51、前年同期の$3.42と比べてほぼ変わらず。

- 営業活動によるキャッシュフロー:第1四半期に$2.71億を生み出し、資本支出は$3百万。

- 現金及び現金同等物: 2023年9月30日時点で$5.43億があり、銀行借入金は$1.46億。

会社の見通しと経営陣のコメント

- 2024会計年度第2四半期には、売上が$2.7億から$2.9億を見込んでいる。

- GAAPに基づく一株当たり純利益は$3.75から$4.24、非GAAPに基づく一株当たり純利益は$4.40から$4.88を予想。

- 2024会計年度全体では、売上が$10億から$11億の範囲を維持。

SMCIの2024年度Q2の上方修正に関するリリース内容

SMCIはが 2024 年度第 2 四半期のビジネス最新情報を2024年1月19日に発表。

以前の財務ガイダンスを上回る見込み。

予想される範囲と以前のガイダンス

- 売上高: 36億ドルから36億5000万ドル(以前のガイダンスは27億ドルから29億ドル)

- GAAP基準一株当たり純利益: 4.90ドルから5.05ドル(以前のガイダンスは3.75ドルから4.24ドル)

- 非GAAP基準一株当たり純利益: 5.40ドルから5.55ドル(以前のガイダンスは4.40ドルから4.88ドル)

この発表により株価は大きく上昇を見せている。

スーパーマイクロコンピューター(SMCI)の2024年度Q2決算サマリー

- 売上高:36.6億ドルで、前年同期の18億ドルから大幅に増加、市場予想の34.2億ドルを上回る。

- 調整後EPS (1株当たり利益):5.59ドルで、前年同期の3.26ドルから増加し、市場予想の5.16ドルを上回る。

- 調整後粗利益率:15.5%で、前年同期の18.8%から減少し、市場予想の16.5%を下回る。

今後の見通し

- 次期売上高見通しは 37~41億ドルで、市場予想の30.7億ドルを大きく上回るも見通し。

- 次期調整後EPSは、5.20~6.01ドルで、市場予想の4.65ドルを上回る見通し。

- 今後も既存顧客向けに好調を維持し、新規顧客を拡大し、新製品の強力なパイプラインにより、通期売上高の見通しは、143~147億ドルに上方修正され、市場予想の120.3億ドルを大きく上回る。

ポイント

- AI向けラックスケールの需要が継続し、NVIDIA、Intel、AMD向けの製品が中心。

- 主要コンポーネントの供給力は徐々に改善。

- NVIDIA GH200グレース・ホッパー向けやAMD、Intelの次世代モデル向けの開発を継続し、市場での主導的地位を確保。

- 北米カリフォルニア州サンノゼ、台湾、マレーシアでの工場拡大により、規模のメリットと運用効率が向上。

- スーパーマイクロは、ほぼすべての業界向けにラックスケールを提供し、最も革新的なAIインフラストラクチャを開発、業界をリードしている。

この決算発表により株価は大きく、600ドル近辺までの上昇を見せている。

スーパーマイクロコンピューター(SMCI)の2024年度Q3決算サマリー

- 売上高:第3四半期の売上高は38.5億ドルで、前四半期の36.6億ドルから増加し、前年同期の12.8億ドルと比較して大幅に増加している。

- 粗利益:粗利益率は15.5%で、前四半期の15.4%からわずかに上昇、前年同期の17.6%からは減少している。

- 純利益: 純利益は4.02億ドルで、前四半期の2.96億ドル及び前年同期の8600万ドルから大幅に増加。

- 一株当たり純利益(EPS):希薄化後の一株当たり純利益は6.56ドルで、前四半期の5.10ドル及び前年同期の1.53ドルから増加している。

ビジネスの展望と経営からのコメント

- 第3四半期はAIラックスケールPnPソリューションへの強い需要が見られ、市場リーダーシップを拡大している。

- 2024会計年度の収益見通しを14.3億ドルから14.7億ドルから14.7億ドルから15.1億ドルに引き上げました。

その他の重要な財務情報

- 運用キャッシュフロー:第3四半期の運用活動によるキャッシュフローは15.2億ドルの使用で、キャピタル支出は9300万ドル。

- 現金及び現金同等物:期末の現金及び現金同等物は21.15億ドルで、前年比で大幅に増加している。

非GAAP指標

- 非GAAP一株当たり純利益は6.65ドルで、前四半期の5.59ドル及び前年同期の1.63ドルから増加している。非GAAP指標は、特定の経費を調整したもので、通常のGAAP指標よりも会社の実際の運営状況をより明確に反映することを目的としている。

上記の情報に基づいて、会社の業績が前年度に比べて顕著に改善していることがわかる。

スーパーマイクロコンピューター(SMCI)の2024年度Q4と通期決算サマリー

- 年間売上高: 149億ドルで、前年の71億ドルから110%増加。

- 年間純利益: 12億810万ドルで、前年の6億4000万ドルから大幅に増加。

- 一株当たり利益(EPS):

- GAAP基準で20.09ドル、前年の11.43ドルから増加。

- Non-GAAP基準で22.09ドル、前年の11.81ドルから増加。

第4四半期の詳細

- 売上高: 53億1000万ドルで、前年同期の21億8000万ドルから大幅に増加。

- 純利益: 3億5300万ドル、前年同期の1億9400万ドルから増加。

- 粗利益率: 11.2%、前年同期の17.0%から減少しましたが、これは主に競争激化による影響。

主要事業の進展

- AIインフラの需要増: AI関連インフラの需要が急増し、企業の売上増加の主要な推進力となっている。特に、ラックスケールの液体冷却技術が注目されている。

- データセンターソリューション: 新しいデータセンタービルディングブロックソリューションの導入により、ITインフラ市場での競争力を強化している。

今後の見通し

- 2025年度第1四半期の売上予測: 60億ドルから70億ドル。

- 2025年度通期の売上予測: 260億ドルから300億ドルと、さらに大きな成長を見込んでいる。

経営者のコメント

CEOのチャールズ・リャン氏は、「当社はAI革命の成長を支えるための技術リーダーシップを発揮し、ITインフラ市場で最大の企業になるための基盤を築いている」と述べている。また、マレーシアとシリコンバレーでの拡張投資が、サプライチェーンの強化と規模の経済をもたらすと期待されている。

スーパーマイクロコンピュータ(SMCI)の株を買える証券会社は?

スーパーマイクロコンピュータ(SMCI)の株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| 三菱UFJ eスマート証券(旧社名:auカブコム証券) | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

本記事では、スーパーマイクロコンピューター(SMCI)について詳しく解説しました。

SMCIは、企業向けやデータセンター向けのサーバーやストレージ製品、そしてパソコン用のマザーボードを生産販売しており、その業績は大変好調です。

特に注目すべきは、新型のCPUGPUを搭載したサーバーの販売です。

これが売れると、企業業績は大きく変化する可能性があります。

また、省エネ対応サーバーの推進も業績向上の要因となっています。

さらに、今後のデータセンターの設備投資、特にアメリカ市場が非常に重要になると予想されています。

AMDやNVIDIAの新型のCPUGPUを装着したサーバー製品がどの程度売れるのかが、今後のSMCIの業績に大きな影響を与えるでしょう。

以上から、SMCIは投資家にとって引き続き注目すべき企業であると言えるでしょう。

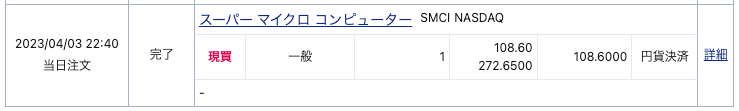

私はSMCIの株を4月頃から購入し始めました。100ドル近辺のタイミングで購入し始めました。

それから買い増しを続けていくうちにアレよアレよと言う間に、300ドルを超えるなど、今までの投資体験では、爆速での上昇を見せてくれました。

2024年3月には1000ドルを突破しています。

利確しながら、下げれば買いを繰り返し、長期的に保有していきたいと考えています。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!