This site is a great place for me (@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- Introduction.

- What is All Country (Orcan)?

- Why is Orcan so popular?

- What are Orcan's investment objectives?

- What is the summary of eMAXIS Slim All World Equity (All Country)?

- What are the fees and costs for Orcan (All Country)?

- How do trust fees affect long-term investment performance?

- Who is suited to invest in Orcan (All Country)?

- How did Orcan (All Country) perform?

- What is the variance ratio for Orcan?

- What are the disadvantages and risks of Orcan investment?

- What happens to Orcan performance when the exchange rate appreciates against the yen?

- What are the characteristics and differences between the Orcan, S&P 500, and NASDAQ 100 respectively?

- Which would you choose, "Orcan" or "S&P500"?

- I see a lot of articles and searches that say "Orcan is not recommended." What are the factors behind this?

- What is the future and outlook for Orcan?

- summary

Introduction.

With the NISA program undergoing a major renewal as the "New NISA," interest in equity investments, especially in U.S. stocks and overseas markets, has been growing rapidly.

I have been receiving more and more questions from friends and acquaintances asking me, "What should I choose for my savings NISA?" I have been receiving more and more questions from friends and acquaintances, and I myself have been considering ways to make savings investments more effective.

In this article, we will focus on a mutual fund that has received particular attention, Orcan (All Country), and take a closer look at its advantages and disadvantages.

We also delved into what criteria and objectives these stocks should be selected for, comparing them to the "S&P 500," a leading U.S. index, and the "NASDAQ 100," which is dominated by high-tech stocks.

I am managing Nisa through SBI Securities, but I believe that Rakuten Securities and other securities companies offer generally similar mechanisms for the information discussed in this article.

What is All Country (Orcan)?

The name "Orcan" is an abbreviation of this "all-country" term.

The fund is characterized by its ability to invest not only in developed countries such as the U.S. and Japan, but also in emerging markets in a diversified manner.

In other words, it provides investment opportunities in the entire global stock market without depending on any particular country or region.

Therefore,Unlike funds that invest only in stocks of the U.S. and other developed countries or funds that focus exclusively on the U.S., these funds are used as an investment approach to diversify risk while enjoying global growth.

The ability to invest in a broad range of major equity markets throughout the world means that risk is not concentrated in any particular country or region. This is,It is attracting attention as a means of balancing risk management and growth expectations for investors seeking to build assets over the long term.The following is a summary of the results of the survey.

Why is Orcan so popular?

The popularity of the Orcan "eMAXIS Slim All-Country All-World Equity (All Country)" is due to its broad diversification, low cost, and suitability for long-term asset building.

Below are the main reasons why Orcan is particularly popular.

Diversified investment in stocks worldwide

Orcan invests in a diversified portfolio of equities from 23 developed countries and 24 emerging markets to mitigate certain geographic risks.

By investing broadly in global economic growth, the portfolio is less susceptible to fluctuations in regional economies.

Low operating costs

The main feature of the "eMAXIS Slim" series is its low investment cost,Orcan's trust fee (investment management fee) is very low at approximately 0.0571 TP3T.

This low cost is especially important for long-term investments and is a major advantage for investors.

Adoption of passive management

Orcan employs passive management, aiming to achieve returns that are linked to a specific market index. Since it can efficiently benefit from the average growth of the market, its management costs are lower than those of active funds. In addition, stable management in line with overall market trends can be expected.

Suitable for long-term investment

The broad investment in global equities allows the fund to capture the long-term rise in stock prices that accompanies economic growth, and to aim for steady growth in assets while minimizing risk.

It is an ideal option, especially for investors seeking to build long-term assets.

Friendly to investment beginners

Because Orcan provides exposure to all global equity markets in a single product,No complex investment decisions are required.

It is a simple investment product that is easy to handle even for investment beginners.

High inflows into the fund

At the start of the new Nisa in 2024,Orcan's total net asset value has reached approximately 2.4 trillion yen, ranking it second in terms of inflows.

This large inflow of funds demonstrates investor confidence and is a factor that confirms its popularity.

Because of these factors, ORKAN continues to be an attractive option for investors seeking to build long-term assets. In particular, its stable management and low cost are highly valued when investing through a system such as the "Mashitate NISA" (a Japanese traditional savings and installment savings plan).

What are Orcan's investment objectives?

Orcan's investment objectives are,It aims to achieve performance in line with the MSCI All Country World Index (ACWI).

This index is,It covers all global equity markets (about 50+ countries), including developed and emerging markets, and is comprised of thousands of stocks.

It is unique in that it offers a wide range of investment opportunities in a diverse economic environment.

What is the summary of eMAXIS Slim All World Equity (All Country)?

- Management Company:Mitsubishi UFJ Asset Management Co.

- Category:International Equity/Global (including Japan)

- Index tracking target:MSCI All Country World Index

- Date of fund establishment:October 31, 2018

- Distributions:nashi (Pyrus pyrifolia, esp. var. culta)

Although the fund was established relatively recently in 2018 and has not been in operation for a long period of time, it has attracted the support of many investors because of its broad investment in the global stock market.

What are the fees and costs for Orcan (All Country)?

- Purchase commission (tax included)nashi (Pyrus pyrifolia, esp. var. culta)

- Trust fees (incl. tax)/year: (%)Within 0.05775%

- Amount retained in trust assetsnashi (Pyrus pyrifolia, esp. var. culta)

This data is for SBI Securities, which has very low trust fees.

Investors can diversify into the global stock market at a relatively low cost.

The trust fee is a cost that directly affects the fund's operations, and its low cost is favorable for long-term investment performance.

How do trust fees affect long-term investment performance?

Trust fees are a very important factor in long-term investments, and their impact cannot be ignored.

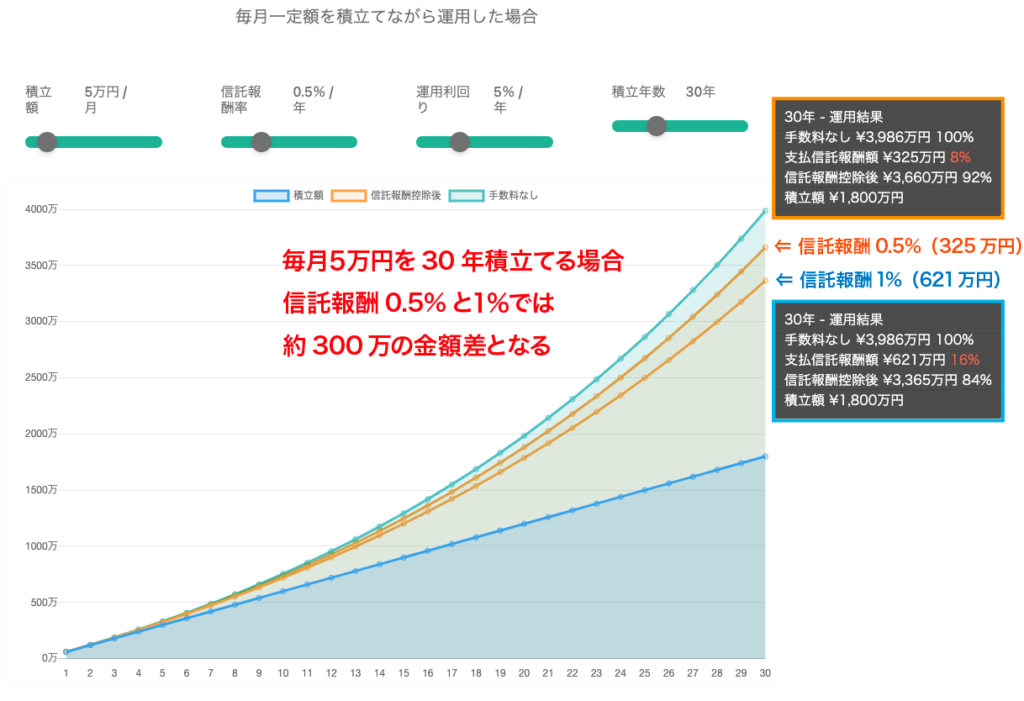

For example,If 50,000 yen is accumulated monthly for 30 years, even a difference of 0.51 TP3T and 11 TP3T in trust fees will result in a difference of approximately 3 million yen in final investment results.

This is because small differences in trust fees have a large impact through the compounding effect.

Therefore, while the rate of trust fees may seem like a small number, it is essential to carefully review and understand its impact, as it can make a significant difference in investment returns over the long term.

Simulation results of the difference in trust fees when 50,000 yen is accumulated monthly for 30 years

Reference:Trust Fee Simulation

Who is suited to invest in Orcan (All Country)?

People who are particularly suited to invest in Orcan are those with the following characteristics and objectives

- People seeking long-term asset building:Diversified investment in stocks from all over the world, allowing investors to capture the long-term rise in stock prices due to economic growth. It is suitable for those who want to steadily increase their assets over time.

- People who value diversification:It is best suited for those who wish to avoid specific market risks and invest with a global perspective, as it diversifies its investments across various regions and industries, including emerging markets as well as developed countries.

- novice investor:Orcan offers a simple investment strategy that provides access to all global stock markets with a single product, making it easy for even novice investors to get involved.

It is especially suited for those who want to invest in savings without hassle. - People who want to use the Accumulation NISA:It is also ideal for those who wish to make tax-free long-term investments by taking advantage of tax benefit programs such as the Accumulation NISA. It is a great advantage for those who wish to diversify their investments globally while taking advantage of tax benefits.

People who fit these criteria are well worth considering investing in Orcan. People who fit these characteristics and objectives are well worth considering investing in Orcan.

How did Orcan (All Country) perform?

An analysis based on TradingView's chart shows stable growth of approximately 801 TP3T from a base year of 2020 through February 2024.

Comparisons with other popular mutual fund issues are discussed below.

*Graph of Orcan prices from a base year of 2020 to February 2024.

What is the variance ratio for Orcan?

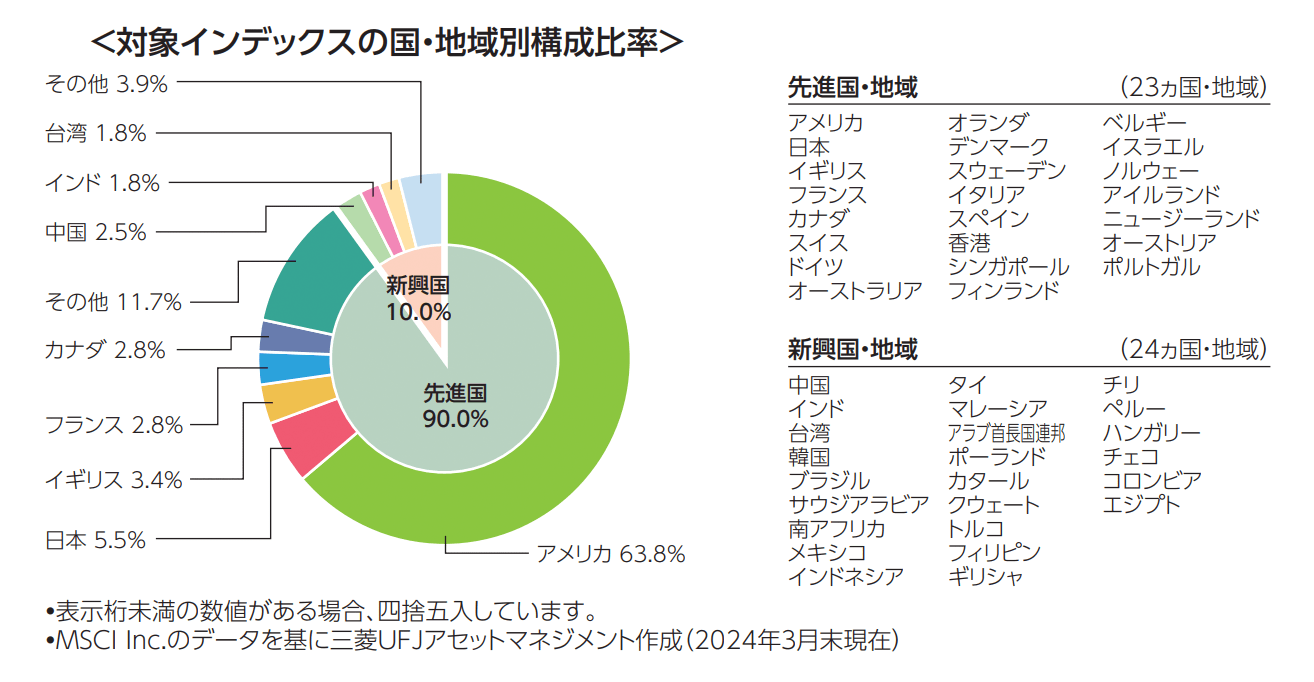

ORKAN (All Country) invests in equities and other assets in 23 developed countries, including Japan, and 24 emerging countries that are included in the underlying index.

Source:Investment trust explanatory document (prospectus)

Orcan Composition by Region

| Local Category | Country/Region | Ratio |

|---|---|---|

| Developed countries/regions | America | 63.80% |

| Japan | 5.50% | |

| United Kingdom | 3.40% | |

| France | 2.80% | |

| Canada | 2.80% | |

| Other | 11.70% | |

| total amount | 90.00% | |

| Emerging Countries and Regions | China | 2.50% |

| India | 1.80% | |

| Taiwan | 1.80% | |

| Other | 3.90% | |

| total amount | 10.00% |

- Although Orcan's investment portfolio is diversified throughout the world, it is in fact heavily dependent on developed countries, especially the U.S. market. The percentage of investments in the U.S. exceeds 601 TP3T, and in this regard, the view exists that the effectiveness of diversification is limited.

- Even though the fund invests worldwide, it is strongly influenced by the U.S. market, so there is a risk that the benefits of global diversification may be somewhat skewed. In particular, there is concern that the performance of the U.S. economy will be heavily influenced by the performance of the U.S. economy.

Orcan's Top Included Currencies

Since the U.S. accounts for a high percentage of the portfolio by region, the U.S. dollar also makes up a large portion of the portfolio's currency.

| included currency | Ratio |

|---|---|

| US dollar | 64% |

| Euro- | 8% |

| suffix for names of swords, armour, musical instruments, etc. | 5.50% |

| British pound | 3.50% |

| Hong Kong dollar | 2.50% |

| Canadian dollar | 2.80% |

| Swiss franc | 2.10% |

| Australian dollar | 1.70% |

| Indian rupee | 1.90% |

| New Taiwan Dollar | 1.80% |

Orcan's top-rated stocks

U.S. stocks are almost the top share of the portfolio.

| description | type of industry | Country/Region | Ratio |

|---|---|---|---|

| apple | Technology Hardware and Equipment | America | 4.5% |

| Microsoft | Software Services | America | 4.0% |

| Amazon.com. | General Consumer Goods & Services Distribution & Retail | America | 2.1% |

| NVIDIA | Semiconductor and semiconductor manufacturing equipment | America | 1.7% |

| Alphabet A Class | Media & Entertainment | America | 1.5% |

| Meta Platforms Class A | Media & Entertainment | America | 1.1% |

| tesla | Automobiles and automotive parts | America | 0.9% |

| UnitedHealth Group | Healthcare Equipment and Services | America | 0.8% |

| Alphabet C Class | Media & Entertainment | America | 0.8% |

| Eli Lilly and Company | Pharmaceuticals, Biotechnology & Life Sciences | America | 0.8% |

What are the disadvantages and risks of Orcan investment?

Disadvantages and risks to consider when investing in Orcan are as follows

market risk

Because the fund invests in the global stock market, trends in the global economy and political and economic instability in certain countries and regions have a direct impact on the fund's NAV.

It is inevitable that Orcan's performance will also be affected when the overall market declines.

exchange risk

Because Orcan also invests in assets traded in currencies other than the Japanese yen,Fluctuations in exchange rates may affect investment results.

As the yen appreciates, the yen-equivalent value of assets denominated in foreign currencies decreases; as the yen depreciates, the value increases. The impact of such foreign exchange risk on the fund's returns cannot be ignored.

concentration risk

Although the investment is diversified,In fact, the fund is heavily dependent on developed countries, especially the U.S. market, so there is a risk that a decline in a particular market could have a significant impact on the fund as a whole.

The portfolio is highly influenced by the U.S. market and is therefore susceptible to fluctuations in the U.S. economy.

Emerging Market Risks

While emerging markets offer the potential for high returns, they are riskier than developed markets due to factors such as political instability, economic volatility, and lack of market transparency. Therefore, instability in emerging markets may have a negative impact on the fund.

Risks with Accumulated Nisa

Even when assuming a long-term investment such as savings Nisa, it is important to understand the risk factors mentioned above. In particular, sufficient understanding of and response to foreign exchange and emerging market risks are required.

In light of these risks, when considering an investment in Orcan, one should make a careful decision in light of one's own risk tolerance and investment objectives.

What happens to Orcan performance when the exchange rate appreciates against the yen?

Because Orcan invests in a wide range of stocks traded in currencies other than the Japanese yen,Fluctuations in exchange rates have a direct impact on investment results.

Especially since about 601 TP3T of Orcan is invested in U.S. stocks,As the yen appreciates, the yen equivalent value of assets denominated in foreign currencies will likely decrease, resulting in a decline in the fund's NAV.

For example, when a U.S. dollar-denominated stock is converted to yen, a stronger yen results in a lower valuation in yen even though the valuation in dollars is the same. This exchange rate effect would reduce Orcan's return when the yen appreciates, even if the stock price in the U.S. market is rising.

Specific examples of performance due to exchange rate (yen appreciation/weakness)

Even if Orcan were to generate a return of 51 TP3T in the U.S. market, the final return in yen terms could be negative if the yen appreciates and the exchange rate changes 101 TP3T during the same period.

Conversely, if the U.S. dollar strengthens and the yen depreciates, the yen equivalent value of foreign currency denominated assets will increase and performance can be expected to improve.

Orcan has no currency hedges.

Since ORKAN does not hedge currency risk, currency risk is directly reflected in the fund's NAV. Therefore, investors who wish to avoid currency risk should exercise caution, but conversely may benefit from a weakening of the yen.

Thus, as the yen appreciates, the yen equivalent value of Orcan's foreign currency denominated assets tends to decrease and performance declines.

However, since it is difficult to predict market trends in foreign exchange, long-term investment decisions must be made based on risk tolerance, including foreign exchange risk.

What are the characteristics and differences between the Orcan, S&P 500, and NASDAQ 100 respectively?

Popular issues in the savings NISA include mutual funds that track the Orcan, S&P 500, and NASDAQ 100, each of which has its own features and benefits. Below is a summary of each fund and its differences.

Orcan (eMAXIS Slim All World Equity)

- Investment Scope: Stocks of all countries (23 developed countries + 24 emerging countries)

- feature: Investing in the growth of the entire world. Diversified investments, with a focus on the U.S., but also including Japan and emerging countries.

- trust fee: within 0.05775% (very low cost)

- Investment Policy: Linked to the MSCI All Country World Index (ACWI)

- Investment Target: Diversified investments in a wide range of markets and no dependence on specific regions, making it easy to diversify risk. However, the high dependence on the U.S. market is a challenge.

- Suitable investors: People who want to bet on the growth of the world as a whole, and who are looking for low-cost, long-term asset-building.

S&P 500 (eMAXIS Slim U.S. Equity)

- Investment Scope: 500 leading U.S. companies

- feature: Investments in large companies that reflect the overall U.S. economy and spread across a variety of industries. A strategy of investing directly in the growth of the U.S. economy.

- trust fee: within 0.09372%

- Investment Policy: Linked to the S&P 500 Index

- Investment Target: A portfolio that covers all major industry sectors and focuses on large U.S. companies. Long-term stability, but dependent on the U.S. economy.

- Suitable investors: People who want to bet on American growth and invest in a stable group of companies.

NASDAQ 100 (iFreeNEXT NASDAQ100 Index)

- Investment Scope: 100 leading non-financial companies in the Nasdaq market

- feature: Especially technology and innovation related companies are included in this category, which offers high returns. However, volatility is high and risks are high.

- trust fee: 0.495% (relatively high)

- Investment Policy: Linked to NASDAQ100 index

- Investment Target: High growth potential due to high concentration of technology-related stocks. High risk due to concentration in certain sectors, but high returns can be expected.

- Suitable investors: People who want to bet on the technology sector and innovation, and who are looking for short-term growth.

Below is a comparison chart to help you understand the differences between each mutual fund.

Comparison Summary

| indicator | olcan | S&P 500 | NASDAQ100 |

|---|---|---|---|

| investment trust | eMAXIS Slim All World Equity | eMAXIS Slim U.S. Equity | iFreeNEXT NASDAQ100 |

| net assets | Approx. 2,430 billion yen | Approx. 3.6 trillion yen | Approx. 96.3 billion yen |

| trust fee | Within 0.05775% | Within 0.09372% | 0.495% |

| Investment Policy | Global Stocks | U.S. equities (linked to S&P 500 index) | U.S. equities (linked to NASDAQ100 index) |

| risk | Diversification across the globe reduces risk. | dependence on the American economy | Concentration risk in the technology sector |

| Return expectations | Moderate (depends on overall global economy) | High (U.S. growth) | Very high (growth in technology stocks) |

Points of comparison

- olcan: Suitable for those who want to diversify their investments across the globe and who want to reduce costs while emphasizing risk diversification.

- S&P 500: Suitable for those who want to invest in the U.S. economy and expect long-term returns while spreading risk among large, stable companies.

- NASDAQ100: Suitable for those who want to bet strongly on technology and high-growth companies, and for those who seek high risk/high return.

The decision on which fund to choose should be based on your investment objectives, risk tolerance, and outlook for the U.S. market and technology sector.

Which would you choose, "Orcan" or "S&P500"?

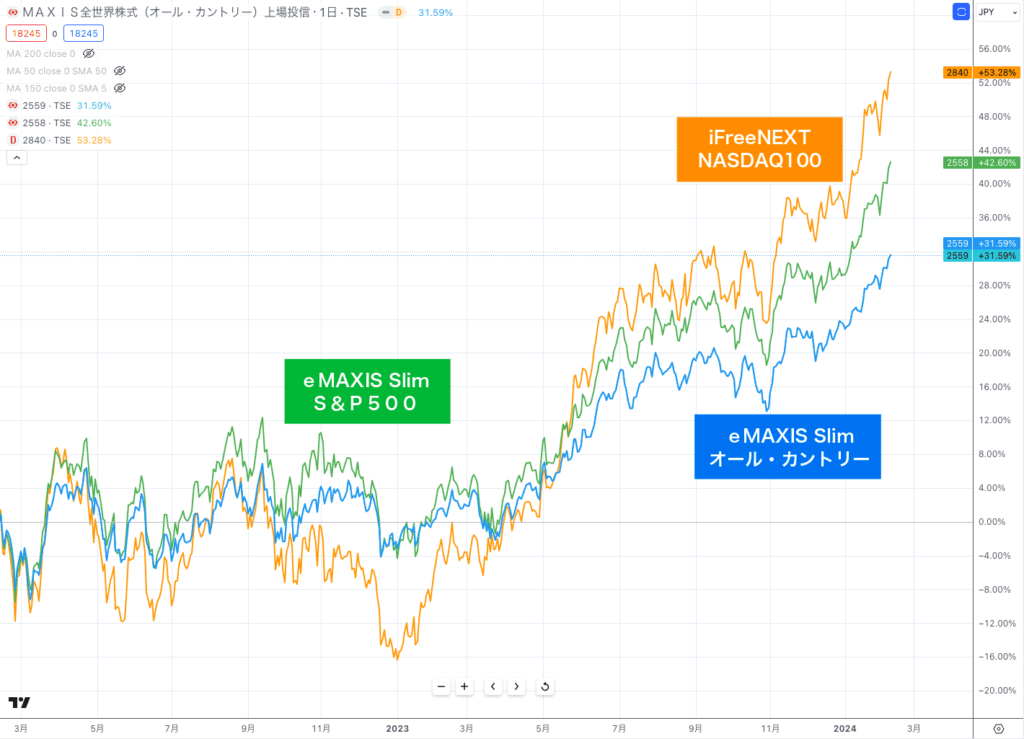

Comparing the performance of each of the Orcan, S&P 500, and Nasdaq 100 eligible stocks

Below is a graph comparing the performance of each mutual fund from about 2022.

- Blue: BlueMitsubishi UFJ-eMAXIS Slim All World Equity (All Country)

- Green: (green)Mitsubishi UFJ-eMAXIS Slim U.S. Equity (S&P 500)

- Orange: (orange)Daiwa-iFreeNEXT NASDAQ100 Index

- NASDAQ100(Orange) is the best performing, reflecting the strong performance of technology companies in particular.

- S&P 500(green) maintains the second best performance after the NASDAQ 100, reflecting the stable growth of large U.S. companies.

- olcan(blue) has a slightly more modest performance than the other two, but its worldwide diversification means that it is not biased toward any particular market risk and can be expected to grow steadily.

In 2023, the NASDAQ 100 has performed strongly, led especially by the U.S. technology sector.

However, since approximately 601 TP3T of Orcan is also invested in U.S. stocks, it is expected that there will not be a significant difference in the long run.

These differences can help investors make choices based on their objectives and risk tolerance. The NASDAQ 100 is appropriate if you want to focus on the technology sector, the S&P 500 if you want to bet on the overall U.S. economy, and Orcan if you want risk diversification.

I see a lot of articles and searches that say "Orcan is not recommended." What are the factors behind this?

Some critical opinions about Orcan can be attributed primarily to the following points.

Questions about the effectiveness of diversification

It has been pointed out that although Orcan aims to reduce risk by diversifying its investments worldwide, in practice its effectiveness is limited.

Particularly,S&P 500compared to the Orcan, the Orcan includes emerging market and small- and mid-cap stocks, which may have increased risk as a result.

For example, during the Corona Shock of 2020, critics argue that the diversification effect was not fully realized because there was no significant difference in price movements between the Global Equity Fund and the S&P 500 Fund.

Inferiority of Returns

The perceived inferior returns of the Orcan compared to the S&P 500 is another reason for the critical opinion; the S&P 500 is focused on large U.S. companies and is highly liquid, attracting attention from investors around the world.

Therefore, some believe that investing in the S&P 500 provides some global investment opportunities. Historical data shows that the S&P 500 often offers higher returns than the Orcan, resulting in the opinion that "you can't beat the S&P 500 by investing globally."

Concerns about counterproductive effects of dispersion

Orcan's broad geographic and market diversification makes it attractive to investors who expect stability. However, in recent years, when the U.S. market has shown particularly strong growth, some believe that concentrating investments in the U.S. will provide higher returns, and it has been pointed out that excessive diversification may instead suppress returns.

Dominance of the U.S. market

U.S. stocks in the S&P 500 include many large companies with global influence and brand power, and their performance has been very consistent. Some investors believe that concentrating on the U.S. market will provide sufficient returns rather than diversifying across the entire world. This is the reason behind the opinion that Orcan is not recommended.

Consistency with investment strategy

Critical opinions about Orcan depend largely on the strategy and risk tolerance of individual investors. In particular, investors who prefer technology stocks or concentrated investments in certain countries may believe that the S&P 500 or NASDAQ 100 offer a better balance of risk and return.

On the other hand, for investors seeking risk diversification and stable long-term growth, Orcan remains a viable option.

Thus, the opinion that "we do not recommend Orcan" is based primarily on its limited diversification benefits and its poor past performance relative to the S&P 500.

However, for investors seeking diversification with a global perspective, Orcan remains an attractive option, and it is important to select the best fund for one's investment goals and risk tolerance.

What is the future and outlook for Orcan?

Possible points about the future of Orcan (eMAXIS Slim All World Equity (All Country)) and its prospects are as follows.

Linked to global economic growth

Because Orcan invests in a wide range of stock markets throughout the world,The growth of the global economy has a direct impact on the fund's performance.

Since it invests not only in developed countries but also in emerging markets, it is able to provide a comprehensive view of economic development and market trends around the world.

Risk mitigation through diversification

Because it invests in a diversified portfolio of equities from more than 50 countries around the world, it is less susceptible to the economic conditions of specific countries or regions. This is expected to protect the portfolio from geopolitical risks and region-specific economic fluctuations.

U.S. Market Influence

U.S. stocks account for approximately 601 TP3T of Orcan's investments,Trends in the U.S. market have a significant impact on fund performanceDoing so. If the U.S. economy remains strong, returns on Orcan can be expected. On the other hand, it should be noted that Orcan is susceptible to a correction phase in the U.S. market.

Currency Risk and the Impact of a Strong Yen

Orcan does not hedge foreign exchange rates, so exchange rate fluctuations will affect investment results.

If the yen appreciates, the yen equivalent value of foreign currency denominated assets will decrease, which may lower the fund's valuation.

The exchange rate between the Japanese yen and the U.S. dollar is particularly important, and investment decisions must take into account currency risk.

Utilization under the new NISA system

Starting in 2024.New NISA Systemwill increase the annual tax-exempt investment limit. By taking advantage of this program to invest in Orcan, it will be possible to efficiently build long-term assets. Orcan, with its ability to diversify investments worldwide, continues to be a strong investment option for the new NISA.

Future Outlook

- Global Economic Recovery and Growth: As recovery from the Corona disaster continues, the global economy is gradually getting back on track for growth. Emerging economies are also expected to develop, and these may contribute to Orcan's improved performance.

- Developments in the Technology Sector: Technology companies continue to grow, especially in the U.S., and are expected to contribute to returns in the U.S. market, which is Orcan's primary investment destination.

- geopolitical riskOn the other hand, geopolitical tensions and trade friction could bring instability to the market, and caution is advised.

Orcan is a fund that allows investors to enjoy the economic growth of all countries while reducing risk through diversification. It can be a promising option for investors seeking to build long-term assets while taking into account the influence of the U.S. market and currency risk.

We will continue to focus on Orcan's performance, keeping in mind trends in the global economy and the new NISA system.

summary

This article examined the characteristics and differences between Orcan (All Country), which invests in the entire world, and mutual funds that focus on U.S. stocks, such as the S&P 500 and NASDAQ 100.

My personal view is that there is no significant difference between any of the stocks, and since the return on each is highly dependent on economic conditions, I feel it is important to make a choice based on the investor's goals and risk tolerance.

However, if you are a novice investor seeking to build long-term assets by managing risk and investing in a holistic manner, ORKAN is one of the best options for you. By diversifying their investments worldwide, investors can expect stable returns without depending on any particular market.

I myself am looking for higher performance while maximizing the benefits of the tax system when utilizing NISA.

We have a performance-oriented investment strategy, especially since our age makes it difficult to make long-term investments of 20 to 30 years.

However, for investors in their 20s and 30s or those using a junior NISA, Orcan's low cost and stable growth prospects make it a logical choice for long-term asset building.