This site is a great place for me (@mifsee(2) has been working on company and stock analysis while learning privately.

This is only a record of my personal analysis and the contents may contain errors or information that differs from the actual situation. Please understand in advance when viewing this site.

- Introduction.

- Why is gold in the spotlight?

- What are the basic properties of gold and its value as an asset?

- How much has the gold price grown?

- How does Gold's performance compare to the S&P 500 and Orcan?

- What are the options for investing in gold/gold?

- What factors are expected to contribute to gold's significant growth in the future?

- Rising geopolitical risks

- Inflation fears and declining dollar value

- Large purchases of gold by central banks

- Monetary easing policy in the U.S. (expectation of future interest rate cuts)

- Supply constraints and rising mining costs

- Progress of de-dollarization and growing interest in international currencies

- Physical gold demand in India and other Asian countries

- Recession

- Why are some countries pushing for de-dollarization?

- Related ETFs (U.S. stocks) that can invest in Gold

- Related mining stocks (U.S. stocks) that can invest in Gold

- Related ETFs (Japanese equities) that can invest in Gold

- Related Mining Stocks (Japanese Stocks) that can invest in Gold

- What Japanese services are available to accumulate pure gold?

- Should I invest in gold denominated in yen or dollar?

- summary

Introduction.

In 2024, the price of gold is growing by more than 301 TP3T, a much higher rate than the S&P 500, and gold's potential is being reevaluated.

Gold is generally considered to be a safe asset, with approximately 10% of a portfolio held in gold, but it is now attracting attention not only as a safe asset but also as a promising investment with the potential for capital gains from rising prices.

This section delves into the key points to keep in mind when investing in gold and your investment options.

Why is gold in the spotlight?

Gold is attracting attention because of multiple factors, including

Geopolitical risks and economic uncertainty

Gold is becoming increasingly important as a "safe asset" in the face of international political and economic instability. Especially with continuing geopolitical tensions such as the conflict between the U.S. and China and the conflict between Russia and Ukraine,Demand for gold as a risk-averse asset is increasing.

Investors tend to increase their gold holdings to stabilize their portfolios in uncertain times.

U.S. monetary policy and expectations of lower interest rates

The Federal Reserve is considering future interest rate cuts in order to maintain economic growth while controlling inflation.

In a low interest rate environment, the "opportunity cost" of gold, an asset that does not generate interest, decreases, making gold investments more attractive.

As interest rates fall, the dollar tends to weaken, increasing the likelihood that the value of gold, which trades in dollars, will rise.

Central bank gold holdings increase

The amount of gold held by the world's central banks will continue to increase in 2024.

In particular, China, India, and Turkey are aggressively buying gold, boosting gold demand.

According to the World Gold Council, gold is seen as a long-term preserver of value, especially as part of a movement to reduce dependence on the dollar (de-dollarization).

Supply constraints and increased mining costs

On the gold supply side, rising mining costs have contributed to higher prices.

With increasing labor and energy costs and increasing dependence on hard-to-mine areas, the cost of gold production is on the rise and supply is limited.

These supply-side constraints are supporting the gold price.

Role as a countermeasure against inflation

Gold's role as a hedge against inflation (a value preservation measure) is emphasized.

Gold is increasingly in demand as a means of asset preservation, especially when the economy is inflationary, as it is seen as a means of preserving purchasing power.

These factors combine to support the value of gold in 2024.

For investors, holding gold is attracting attention because it provides a hedge against risk and asset stability in times of economic and market instability.

What are the basic properties of gold and its value as an asset?

The basic characteristics of gold and its value as an asset include the following elements

Rarity and Immutability

Gold has limited reserves on earth and is extremely rare as a natural resource.

Actual,The total amount of gold mined so far is estimated to be equivalent to one Olympic swimming pool, and this limited amount is considered a symbol of scarcity.

Gold is also resistant to oxidation and corrosion, a characteristic that allows it to retain its value over long periods of time without tarnishing.

This constancy adds to its attractiveness as an asset value, especially as gold is more likely to retain its value over time while paper money and other assets are subject to inflation and value fluctuations.

Role as a means of preserving value

Historically, gold has been seen as an important hedge against risk in times of economic instability and inflation.

Gold serves as a "safe asset" in times of market instability or when other assets are at risk of rapidly losing value.

Particularly,In times of financial crisis, recession, or heightened geopolitical risk, funds are more likely to flow into gold.

This value preservation function is the reason why many investors and central banks hold gold.

Role as an International Currency

Gold also functions as an alternative to money and has the property of being an "international currency" that can replace currencies such as the dollar and the euro.

Particularly,When the value of the dollar wavers, gold is looked to as the "standard of value" and serves as part of the asset value.In addition, central banks in many countries hold gold and use it as an asset to support economic stability and the value of their currencies.

Function as an inflation hedge

Gold is resistant to inflation because it maintains its value relative toGold is more likely to retain its real purchasing power when other assets lose value during price increases.

This is supported by the historical trend that gold prices often rise during periods of high inflation.

Versatility and fluidity

Gold is not just an investment asset, as it is also used for decorative and industrial purposes (especially in the electronics and medical fields), and thus has a physical demand.

Further,Because the gold market is traded worldwide, it is highly liquid and easily converted into cash, another factor that increases its value as an asset.

Thus, gold is attracting attention as an asset that can maintain high asset value over the long term due to its scarcity, immutability, and characteristics as a means of economic stability.

How much has the gold price grown?

Gold prices are showing remarkable growth going into 2024.

Gold price chart for 2024

The gold price rose about 38% and continues to reach record highs, exceeding $2,700 per troy ounce.

It had fallen to around $1630 in November 2022 when the Fed raised interest rates rapidly due to inflation, but has since grown over $1,000 in less than two years.

Gold price chart from November 2022

This rapid rise since 2024 has been influenced by multiple factors, including geopolitical tensions, fluctuations in U.S. monetary policy, and large purchases of gold by central banks in emerging markets.

Even more noteworthy are the expectations of the U.S. Federal Reserve to cut interest rates.

The market is predicting that the Fed will cut interest rates starting in September 2024, which could push the gold price to a new nominal high.

Central bank purchases of gold have also contributed to the price increase.

Emerging economies, especially China, Russia, and India, are increasing their gold holdings to reduce their dependence on the U.S. dollar, and this is affecting the supply-demand balance in the market. All of these factors combine to produce strong growth in gold prices in 2024.

How does Gold's performance compare to the S&P 500 and Orcan?

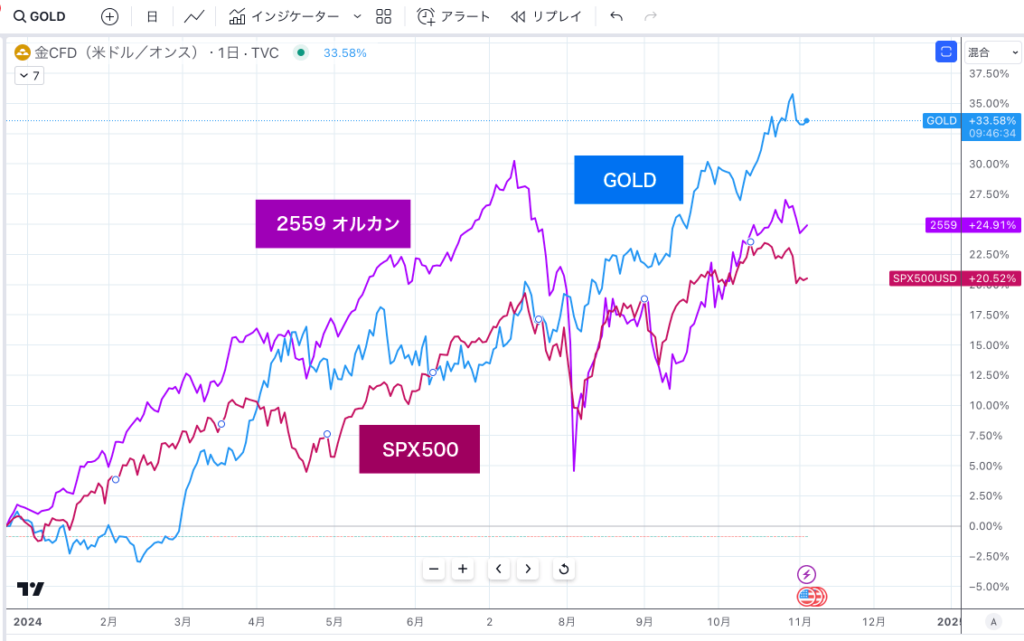

The performance of Gold in 2024 compared to Orcan (eMAXIS Slim All Country All World Equity) and the S&P 500 is shown below.

- Gold+33.58%

- Orcan (2559)+24.91%

- S&P500 (SPX500USD)+20.52%

Gold is the best performing of the three assets, and its growth stands out.

Comparison chart between Gold, Orcan and S&P 500

What are the options for investing in gold/gold?

Purchase of physical gold (bullion and coins)

- summaryGold Bullion Market: A method of purchasing real assets such as gold bullion or gold coins and storing them at home or in a dedicated vault. This method is popular as a means of preserving the value of assets over the long term, as it allows you to hold gold directly in physical form.

- Advantages:

- Can be physically held as a real asset and easily retain value over a long period of time.

- Resistant to inflation and currency instability, effective as a "safe asset" in times of economic turmoil.

- The peace of mind of being able to manage your own money without the influence of the gold price or currency.

- demerit:

- The risk of theft or damage increases the need for storage and insurance.

- Often charge a commission on sale, and are illiquid.

- Costly to purchase and hold, not suitable for immediate cash conversion.

Gold ETF (Exchange Traded Fund)

- summaryHow to Buy: Buy ETFs that are linked to the price of gold. Instead of holding actual gold, you invest in securitized gold and can trade in real time.

- Advantages:

- Can be purchased in small amounts and can be easily invested without the hassle of storage and management.

- High liquidity and immediate trading on exchanges, making it easy to cash in.

- Many stocks have low trust fees and are suitable for long-term holding.

- demerit:

- Lacks the security of physical holdings, since the actual product is not held directly.

- Involves the risk of currency fluctuation (especially in the case of foreign ETFs).

- Not suitable for short-term income since there are no distributions.

gold mining stocks

- summaryGold mining and refining: A method of investing in the shares of companies that mine and refine gold, and thereby indirectly benefit from an increase in the price of gold. Tends to be linked to the price of gold, but also has company-specific risks.

- Advantages:

- As the price of gold rises, mining companies' revenues are likely to increase, creating a leverage effect.

- In some cases, dividends may be paid, providing additional income in addition to the fluctuations in the price of gold.

- It also enjoys the growth of the mining industry and related industries, which has a diversification effect.

- demerit:

- Research is necessary, as it is affected not only by the gold price, but also by the business risk of the company and the industry as a whole.

- It is also susceptible to the overall stock market and may move in price differently than the gold price.

- It also entails region- and company-specific risks, making it a higher risk for a stable asset.

pure gold reserve

- summaryA savings method in which gold is purchased in small increments for a fixed monthly amount. The objective is to increase assets from small amounts over the long term.

- Advantages:

- The timing of purchases can be diversified, reducing the risk of fluctuations in the gold price.

- It is suitable for starting with small amounts and accumulating assets over time and over the long term.

- Some plans allow physical exchange if a certain reserve amount is secured, giving the advantage of actual ownership.

- demerit:

- Management fees and trading commissions may apply and are not suitable for short-term profits.

- There may be restrictions on the timing of sale, making it difficult to buy and sell freely.

- Dependent on fluctuations in the price of gold, yields may be lower than other assets.

gold futures trading

- summaryFutures: A method of trading in the futures market in which a fixed price is traded based on a forecast of the future price of gold. By utilizing leverage, large amounts of money can be traded with small amounts of money.

- Advantages:

- The leverage effect allows for large positions with small amounts of money, making it easy to target short-term profits.

- Suitable for day trading and short-term investment, as it allows aggressive trading with price fluctuations.

- It can also be used as a hedging instrument against market fluctuations, which is useful for risk management.

- demerit:

- Due to the high leverage trading, there is a risk of significant losses if the gold price moves in the opposite direction.

- Futures trading requires a high level of market knowledge and is challenging for beginners.

- There is a risk of unexpected loss due to fixed deadlines.

CFD Trading

- summary: A method of investing in the rise or fall of the gold price using CFDs (Contracts for Difference). The investor does not actually hold the gold, but settles for the difference in response to fluctuations in the gold price.

- Advantages:

- Leverage allows for investment in the rise and fall of the gold price with a small amount of money.

- Trading commissions are low, making it suitable for short-term trading and day trading.

- Since you can also take sell positions, you can aim for profits even when the gold price is falling.

- demerit:

- Risks due to leverage are high and losses can be significant.

- It is not suitable for long-term holdings and lacks security because it does not hold physical gold.

- Dependence on the services of financial institutions and brokerage firms makes trading conditions and commissions variable.

While there are many trading methods available, I personally utilize individual gold mining stocks, related ETFs, and CFD trading, which allows me to take advantage of daily price movements. I also have a domestic pure gold reserve and have a gold portfolio in both dollar and yen denominations.

What factors are expected to contribute to gold's significant growth in the future?

Below are some of the factors that will continue to drive gold growth in the future.

Rising geopolitical risks

Geopolitical tensions around the world,Investors tend to increase their holdings of gold, a "safe asset," as a countermeasure against uncertainty, especially amid the ongoing U.S.-China conflict, Russia-Ukraine problems, and Middle East issues.

Historically, increased political and economic unrest tends to increase demand for gold and drive up its price.

Unlike other assets, gold retains its value independent of any currency and is used as a means of preserving the value of assets while minimizing the impact of geopolitical risk.

Inflation fears and declining dollar value

As inflation rises, the purchasing power of paper money declines, but gold is noted as an inflation hedge because of its ability to maintain its value.

In particular, as the value of the U.S. dollar declines, the relative value of gold, which is traded in dollars, increases.

Because gold tends to retain its relative value during times of inflation, demand for gold as a means of value preservation increases during times of heightened inflationary concerns.

A decrease in the value of the dollar will also increase demand for gold from abroad, which will support prices.

Large purchases of gold by central banks

Central banks around the world, especially emerging economies such as China, Russia, and India, are increasing the amount of gold they hold as part of their foreign exchange reserves. This is intended to reduce their dependence on the dollar and stabilize their assets.

According to data from the World Gold Council, central bank gold holdings have increased significantly in recent years, and this demand supports the gold price.

The increasing number of countries seeking to increase their holdings of non-dollar assets has also contributed to the increase in gold demand.

Monetary easing policy in the U.S. (expectation of future interest rate cuts)

If U.S. monetary policy is accommodative, interest rates are expected to decline, which will lower the "opportunity cost" of gold, an asset that does not generate interest rates, making gold more attractive.

Particularly,If the Federal Reserve (Fed) hints at a future interest rate cut, investors will be more inclined to increase their gold holdings from a risk diversification perspective.

In addition, as interest rates fall, the dollar weakens, leading to an increase in the price of gold, which is traded in dollars.

Supply constraints and rising mining costs

Gold mining costs have increased over the years as labor costs and energy prices have risen.

In addition, supply is constrained by a decrease in easily accessible mines and an increase in mining in areas that are difficult to access.

When gold demand is maintained or increases in the face of limited supply, gold prices tend to be pushed higher.

In addition, supply shortages and rising mining costs are expected to result in a shortage of new supply, which is expected to support prices.

Progress of de-dollarization and growing interest in international currencies

More and more countries are seeing gold as an alternative asset to the U.S. dollar, and there is a trend toward de-dollarization, especially in emerging economies.

Gold's nature as an "international currency" with a global standard of value makes it an attractive asset for countries seeking to diversify their foreign exchange reserves.

Gold is increasingly being added to asset portfolios to avoid the risk of dollar dependence, and this demand is supporting growth in the gold market.

RELATED:BRICS Pay: The New International Payment System Explained

Physical gold demand in India and other Asian countries

There is a strong culture in the Asian region, especially in India, of purchasing gold during the wedding season and religious events.

In China and other Asian countries, gold is also valued as a symbol of wealth and a means of asset protection, and demand for gold is growing along with economic growth.

Physical gold demand in Asian countries is an important factor supporting a firm gold price. In addition, economic growth and rising living standards are expected to lead to more individual purchases of gold, further increasing physical demand.

Recession

In times of recession, demand for both gold and bonds as safe assets tends to increase.

Risky assets such as stocks and real estate are sold, and investors seek to ensure asset stability by purchasing safe assets such as gold and government bonds to avoid risk.

Gold, in particular, is less dependent on the financial system and is more likely to be trusted as a means of asset preservation in situations of economic uncertainty. Bonds also tend to rise in price during recessions, which increases demand alongside gold.

Why are some countries pushing for de-dollarization?

Factors such as economic and geopolitical risk aversion and the strengthening of sovereignty are behind the de-dollarization of some countries. The reasons are explained in more detail below.

Avoiding the risk of economic sanctions

When the U.S. imposes strong economic sanctions, it often takes advantage of the fact that dollars are used for international payments and restricts the circulation of dollars to sanctioned countries.

To avoid such sanctions risks, countries such as Russia and Iran are "de-dollarizing," reducing their dependence on the dollar and relying on their own currencies and other reserve assets (such as the euro, yuan, and gold).

Currency Stability and Strengthening Sovereignty

U.S. monetary policy (especially interest rate hikes and cuts) directly affects the economies of countries that use the dollar as their reserve currency.

For example, when the U.S. raises interest rates, the dollar strengthens and countries with dollar-denominated debt face an increased repayment burden. To avoid these effects and strengthen their own financial sovereignty, an increasing number of countries are seeking to de-dollarize.

Diversification of foreign currency reserves

Central banks in various countries are diversifying their foreign exchange reserves to avoid excessive dependence on the dollar and to mitigate risk.By increasing its holdings of euros, yuan, and gold as part of its efforts to de-dollarize, the country seeks to reduce the influence of the dollar in the international economy and maintain stability.

Multipolarity of the global monetary order

In recent years, the global economy has shifted from a unipolar U.S. economy to a multipolar one.

While China is promoting the internationalization of the renminbi through its "One Belt, One Road" initiative and other measures, Russia is encouraging the use of the ruble, and the global currency system is diversifying.

With this background,Currencies other than the dollar are becoming more influential, especially emerging and resource-rich countries, which are pushing for de-dollarization.

These factors have led to a shift away from the dollar, which in turn has led to large gold holdings.

Related ETFs (U.S. stocks) that can invest in Gold

Only the first one has a real-time chart, but since it is linked to the gold price, the price movement is basically the same.

SPDR Gold Shares (GLD)

- summaryGold ETF: One of the world's largest gold ETFs that is linked to the price of gold, with physical gold as the underlying asset and linked to the market price of gold.

- AdvantagesHighly liquid and can be invested from small amounts. Widely used as a safe asset.

- trust fee0.40%

iShares Gold Trust (IAU)

- summaryGold ETF: A gold ETF managed by BlackRock that is linked to changes in the price of gold and, like GLD, is backed by physical gold.

- Advantages: Lower trust fees than GLD, making it suitable for long-term holdings. It also has high liquidity.

- trust fee0.25%

SPDR Gold Mini-Shares Trust (GLDM)

- summaryGLD: A low-cost version of GLD, also linked to the gold price. Because it holds physical gold, its value fluctuates in accordance with the gold market.

- AdvantagesThe trust fee is very low, making it suitable for beginners because it is easy to invest in small amounts.

- trust fee0.10%

Aberdeen Standard Physical Gold Shares ETF (SGOL)

- summary: A gold ETF managed by Aberdeen Standard and backed by gold held in Swiss vaults.

- AdvantagesThe trust is kept in Switzerland and is favored by investors who want to minimize geopolitical risk. Trust fees are also low.

- trust fee0.17%

GraniteShares Gold Trust (BAR)

- summary: A gold ETF managed by GraniteShares and linked to physical gold. Emphasizes low-cost management.

- Advantages: Low trust fees make it suitable for long-term holdings.

- trust fee0.17%

Each of these ETFs has different trust fees and liquidity, allowing investors to choose according to their needs. You can choose according to short- or long-term holdings.

Related mining stocks (U.S. stocks) that can invest in Gold

Newmont Corporation (Newmont Corporation, NEM)

- summaryThe world's largest gold mining company, headquartered in the United States. It operates gold mining operations in many countries and produces silver and copper in addition to gold.

- AdvantagesThe company has a stable financial base and pays dividends, making it suitable for long-term holdings. Sensitive to fluctuations in the gold price; profits tend to rise when the gold price rises.

- risk: May be affected by regional regulations and environmental risks.

Barrick Gold Corporation, GOLD

- summary: A major gold mining company headquartered in Canada, with mining sites around the world, including South America and Africa. In addition to gold, the company also mines copper.

- AdvantagesThe company has a large number of gold mines and has the potential to generate significant revenues during periods of rising gold prices. Diversified risk due to diverse geographic expansion.

- risk: Some mining is done in areas where political instability persists, which may expose the company to geopolitical risk.

Kinross Gold Corporation, KGC

- summary: A medium-sized gold mining company headquartered in Canada with mines in North America, South America, and Africa. Production is particularly high in the United States and Russia.

- AdvantagesThe company is a medium-sized company with a high potential for share price appreciation if its performance improves. Medium-sized company with high potential for share price appreciation if performance improves.

- risk: The company operates relatively small-scale mines, which means that there is significant risk due to price fluctuations and declining production.

Agnico Eagle Mines Limited (Agnico Eagle Mines Limited, AEM)

- summaryA major gold mining company headquartered in Canada with a concentration of mines in North America. The company focuses on the mining business and has solid operations.

- Advantages: Attractive mine development with low geographic risk, specializing in North America. It pays dividends and is a popular and stable investment.

- riskThe company lacks geographic diversity, as it does not own any mines outside of North America.

Alamos Gold Inc. (AGI)

- summary: A medium-sized gold mining company headquartered in Canada, with mines primarily in North America (Canada and Mexico). The company operates with a focus on sustainability.

- Advantages: Relatively low geographic risk and supportive of sustainable mining activities. High potential as a growth company with room for production expansion.

- riskThe company is a medium-sized company, which means that its financial strength is inferior to that of large companies and its limited production scale may be a risk factor for stock price volatility.

Franco-Nevada Corporation, FNV

- summary: A Canadian gold royalty company that does not directly mine, but invests in the revenues derived from gold mines. Also holds royalties on minerals other than gold.

- Advantages: Characterized by a stable profit structure that is resistant to fluctuations in the gold price. Royalty model allows the company to enjoy profits based on the gold price while avoiding the risk of operating a gold mine.

- riskThe risk of direct mining is low, but the business model is dependent on the gold price, so profits are likely to decline when the gold price falls.

Related ETFs (Japanese equities) that can invest in Gold

Related ETFs that can invest in gold with Japanese stocks include the following

Pure Gold Listed Trust [1540].

- summaryGold ETF: A Japanese gold ETF listed on the Tokyo Stock Exchange that is linked to the price of gold. It holds physical gold as the underlying asset and earns returns based on price movements of the gold price.

- AdvantagesGold can be traded in Japanese yen, eliminating the need for storage and management. Since physical gold can also be held, there is a sense of security as a real asset.

- trust fee0.44%

- Stock Price (1540) Chart (Yahoo! JAPAN Finance)

NEXT FUNDS NOMURA ETN Gold Futures Linked [2037

- summaryETN: An ETN (Exchange Traded Note) linked to the price of gold futures, and thus linked to the price trend of gold. Because it is based on futures, it has different risk characteristics from physical gold.

- Advantages: A product that can be invested in small amounts and is sensitive to short-term price fluctuations. Easy to earn returns when the price of gold rises.

- demerit:Based on futures prices, so less secure as a physical asset. Trust fees are also slightly higher than those of ETFs.

- trust fee0.80%

- Stock Price (2037) Chart (Yahoo! JAPAN Finance)

MAXIS Precious Metals [1541].

- summaryETF: An ETF offered by Mitsubishi UFJ International Asset Management, which is linked to the price of precious metals. In addition to gold, it has the feature of being linked to precious metals in general.

- AdvantagesDiversification effect as an investment not only in gold but also in precious metals in general. Suitable for long-term asset protection.

- demeritThe price of gold is not fully linked to the price of other precious metals, and is also affected by the price fluctuations of other precious metals.

- trust fee0.44%

- Stock Price (1541) Chart (Yahoo! JAPAN Finance)

These ETFs can be traded on Japanese stock exchanges, making them an easy way for domestic investors to invest in gold.

Related Mining Stocks (Japanese Stocks) that can invest in Gold

Gold-related mining stocks in Japanese equities include the following companies

Sumitomo Metal Mining Co.

- summaryJapan's largest nonferrous metals company, mining and refining a variety of metal resources including gold. It has mining resources in Japan and abroad, and is also involved in the production of copper and nickel in addition to gold.

- AdvantagesThe company has high gold refining capacity and a stable supply system. The company handles not only gold but also a variety of other metal resources, allowing it to diversify the risk of gold price fluctuations to some extent.

- riskIn addition to the price of gold, it is also affected by fluctuations in other metal markets, such as copper and nickel, making it unsuitable for investments that depend solely on a specific gold price.

- Stock Price (5713) Chart (Yahoo! JAPAN Finance)

Dowa Holdings Corporation [5714].

- summary: The company is engaged in the business of refining precious metals, including gold, and supplying gold as a material for electronic components. The company also operates a reclamation business, which is unique in that it actively recycles gold.

- Advantages: The company will recycle gold, which will expand profit-earning opportunities when resource prices soar. In addition, a stable supply of gold is expected to increase as demand for electronic components increases.

- risk: There is a risk of increased costs due to recycling costs and environmental regulations as well as the price of gold.

- Stock Price (5714) Chart (Yahoo! JAPAN Finance)

Mitsui Kinzoku Mining Co.

- summaryA major non-ferrous metals company involved in the refining and sale of gold as well as copper and lead. With mining and refining bases mainly in the Asian region, the company is able to respond to a wide range of metal resources.

- Advantages: Handling diverse metal resources and diversifying risks. In addition to gold refining, stable demand is expected due to its many industrial applications.

- riskThe company is dependent on multiple metal resources, so fluctuations in the price of certain resources will affect its earnings.

- Stock Price (5706) Chart (Yahoo! JAPAN Finance)

Although these Japanese companies do not have direct gold mining operations on a large scale, they play an important role in the refining and supply of gold. If you want to make gold-related investments in Japan, you can indirectly benefit from the growth of the gold market through these companies

What Japanese services are available to accumulate pure gold?

Mitsubishi Materials "MJC (My Gold Plan)

- summaryGold savings service provided by Mitsubishi Materials, with monthly savings starting at 1,000 yen. Purchased gold is stored by Mitsubishi Materials.

- featureThe amount of gold can be accumulated in small amounts, and the accumulated gold can be withdrawn as bullion. The transaction fee is 2.5% of the reserve amount.

- Mitsubishi Materials "MJC (My Gold Plan)

Tanaka Kikinzoku "Pure Gold Reserve

- summaryTanaka Kikinzoku offers a service in which you can accumulate gold from as little as 3,000 yen per month. Purchased gold is managed by Tanaka Kikinzoku.

- featureGold can be withdrawn as bullion or coins, and other metals (platinum and silver) can also be accumulated. Fees range from 1.51 TP3T to 2.51 TP3T, depending on the amount of reserve.

- Tanaka Kikinzoku "Pure Gold Reserve

SBI Securities "Gold and Platinum Accumulation

- summarySBI Securities: A service that allows customers to accumulate funds from 100 yen per month using their securities accounts at SBI Securities. This service is provided in partnership with Tanaka Kikinzoku Co.

- featureSuitable for beginners as they can start with as little as ¥100. Portfolio management is possible with other assets since it is managed in a securities account. Commission fee is 1.651 TP3T of the amount saved.

- SBI Securities "Gold and Platinum Accumulation

Rakuten Securities "Pure Gold Reserve

- summaryRakuten Securities, Inc. and Tanaka Kikinzoku Kikinzoku offer a pure gold accumulation service that allows investors to accumulate gold from as little as 100 yen.

- featureThe company is popular among those who want to make the most of their points, as they can use Rakuten points to accumulate funds. Commission fee is 1.651 TP3T.

- Rakuten Securities "Pure Gold Reserve

Monex, Inc. "Pure Gold Reserve

- summaryMonex, Inc.: You can accumulate funds in your Monex, Inc. securities account, starting at 1,000 yen per month. Alliance with Tanaka Kikinzoku Co.

- feature: Gold savings can be made in a brokerage account, making it easy to manage with other investments. Commission fee is 1.651 TP3T.

- Monex, Inc. "Pure Gold Reserve

These services can be started with small amounts, and the accumulated gold can be withdrawn as bullion or coins. Each service has different features, such as fees and available points, so it is important to choose the service that best suits your objectives and investment amount.

Should I invest in gold denominated in yen or dollar?

Yen-denominated gold investment

Advantages

- Stability with minimal currency risk

Being denominated in Japanese yen, the investment is less susceptible to exchange rate fluctuations, allowing for a stable investment in line with the economic conditions in Japan. - Increase in assessed value when the yen depreciates

When the yen depreciates, even if the dollar-denominated gold price remains unchanged, the value of gold appreciated in yen will rise, allowing investors to enjoy foreign exchange gains. It also provides a hedging effect against a decline in the value of the Japanese yen. - counter-inflation measures

Even if the yen's depreciation becomes an inflationary factor, the price of gold will rise and retain its asset value, thus complementing the decline in purchasing power. - Easy to manage and cash

Can be managed and purchased in yen through securities companies and pure gold reserve services in Japan, with fewer complications in terms of fund transfers and taxation. Easy to cash in yen, convenient for daily financial planning.

demerit

- Possibility of limited returns

Even if the gold price increases in dollar terms, a stronger yen may reduce the return in yen. - No foreign exchange gains

While it is easy to benefit from dollar-denominated gold when the yen is weak, the benefits of the exchange rate cannot be maximized because the benefits cannot be enjoyed directly in yen terms.

Gold Investment in Dollars

Advantages

- Reap the benefits of foreign exchange

As the yen depreciates, the value in yen terms increases even if the gold price does not change, providing an additional return due to the exchange rate. - Offsetting effect of dollar depreciation

As the dollar weakens, the price of gold rises relative to the dollar, so that even if the dollar declines in value, the value of gold rises and the value of the asset is easily preserved. - Effect of Currency Diversification

Holding gold as part of dollar-denominated assets provides a hedge against the risk of yen depreciation and Japanese yen inflation. In addition, the U.S. market is rich in options such as gold ETFs and gold mining stocks, making it easy to diversify one's portfolio. - Maintain real purchasing power

Gold prices are also likely to rise when the dollar is inflated or declining in value, which has the effect of compensating for the declining purchasing power of dollar-denominated assets.

demerit

- exchange risk

If the yen appreciates, returns in yen terms may decrease even if the gold price rises. - Exchange fees are incurred.

Since trading in dollars incurs foreign exchange commissions and frequent transactions increase costs, long-term holdings are the norm.

The advantages and disadvantages of each can be summarized as follows

Yen-denominated gold investmentis suitable for those who want to minimize foreign exchange risks and focus on inflation countermeasures and daily fund management during yen depreciation. It is easy to manage domestically and to obtain a certain level of return when the yen weakens.

Gold Investment in Dollarsis effective when the yen is expected to weaken or when aiming to profit from price increases during a period of dollar depreciation while diversifying currencies. is also useful as an inflation hedge, as it provides long-term portfolio diversification benefits.

Depending on your risk tolerance, asset allocation, and long-term strategy, you may want to successfully combine yen-denominated and dollar-denominated gold investments.

summary

I personally like investing in commodities, including gold, and I invest in a variety of stocks. Of these, gold occupies a central position and a very large percentage of my portfolio.

I started investing in gold when I was relatively young. At that time, based on vague information that "inflation will rise in the future," I believed in the simple equation that gold is strong during the inflationary phase and continued to steadily accumulate pure gold in Japan for several thousand to ten thousand yen every month.

When I checked the gold price after forgetting about it for a while, I found that the price had risen more than expected and the unrealized profit had grown significantly.

At the time, I was also investing in Japanese stocks, but things did not go well there, as I kept losing money. Gold, however, held its value consistently and never lost money.

Then came the Corona shock, and there were times when the price of gold dropped significantly, but we made a series of spot purchases at that time, and that choice has served us well today.

Ironically, gold investments that started out with no profit motive have performed best.

We feel that gold is best invested in a long-term, steady accumulation.

We intend to continue to invest in gold with this stance.

I'm making use of it too! Get the most out of moomoo securities!

I am.moomoo SecuritiesWhat I like most about using the app is that it is easy to use and makes it easy to gather in-depth information, which is important in investing.

Further,Ability to see trends of large and medium investors.and it has been very helpful in considering the future of the stocks.A wealth of news and earnings-related information on each stock, with support for automatic Japanese translationThe company is also happy to provide instant access to information from overseas.

Moomoo Securities also has the lowest U.S. stock trading commissions.

Interested parties can easily register through this banner link!