このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

▼AIが音声変換したポッドキャスト版はこちらからどうぞ。(Spotifyで再生)

- はじめに

- クアンタム・スケープ(QS)とは何の会社、どのような事業をしている?

- 全固体電池とは?リチウムイオン電池と何が違う?

- クアンタム・スケープ(QS)の主力製品は?

- クアンタム・スケープ(QS)のビジネスモデルは?

- クアンタム・スケープが開発する全固体電池の特徴をまとめると?

- 取引市場は?

- クアンタム・スケープ(QS)のセクター、業種、属するテーマは?

- クアンタム・スケープ(QS)の配当について

- クアンタム・スケープ(QS)の競合他社は?

- クアンタム・スケープ(QS)が属する業界の規模と成長性は?

- フォルクスワーゲンとの提携内容と進捗は?

- 技術的課題と開発リスクは?

- パイロットライン・量産体制の見通しは?

- クアンタム・スケープ(QS)の競合との差別化要素と優位性は?

- クアンタム・スケープは再生可能エネルギー分野としても注目されている?

- クアンタム・スケープ(QS)の業績について

- クアンタム・スケープの現在株価

- クアンタム・スケープ(QS)の将来性と今後の株価見通しは?

- クアンタムスケープ(QS)の2025年度Q1決算サマリー

- クアンタクアンタム・スケープ(QS)の株を買える証券会社は?

- まとめ

はじめに

クアンタム・スケープ(QS)は、アメリカを拠点とするバッテリー技術のスタートアップ企業です。

特に次世代のEV(電気自動車)向けの全固体電池技術で世界から注目を集めており、従来のリチウムイオン電池では実現困難とされていた高エネルギー密度、高速充電、長寿命を同時に達成する革新的な技術を開発しています。

この企業が話題となっている背景には、EV市場の急速な成長とともに、現在のバッテリー技術の限界を超えるブレークスルーへの期待があります。クアンタム・スケープが開発する全固体電池は、従来のリチウムイオン電池と比較して約2倍のエネルギー密度を持ち、15分で80%の高速充電が可能であり、さらに50万キロメートル走行後も95%以上の容量を維持するという驚異的な耐久性を実現しています。

さらに注目されているのは、同社がフォルクスワーゲンという自動車業界の巨人と長期的なパートナーシップを築いている点です。VWは2012年から同社への投資を継続し、現在は最大の株主となっており、2024年には商業化に向けた本格的な協業を開始しています。

ここでは、クアンタム・スケープ(QS)の事業内容、革新的な全固体電池技術の詳細、競合との差別化要素、市場における成長性、財務状況、そして将来性までを詳しく解説いたします。

クアンタム・スケープ(QS)とは何の会社、どのような事業をしている?

クアンタム・スケープ(QS)は、電気自動車(EV)向けの全固体リチウムメタル電池技術の開発に特化したアメリカのスタートアップ企業である。

同社は2010年5月14日にスタンフォード大学で設立され、創業者は元スタンフォード大学材料科学・工学科教授のFritz Prinz氏、起業家のJagdeep Singh氏、そして技術者のTim Holme氏である。

「エネルギー貯蔵技術を革新し、持続可能な未来を実現する」という明確なミッションの下、同社は15年以上にわたって次世代バッテリー技術の研究開発に取り組んでいる。

クアンタム・スケープの中核事業は、独自の全固体セラミック分離膜を活用した、アノード(負極)フリー設計の全固体リチウムメタル電池の開発である。

従来のリチウムイオン電池とは根本的に異なる技術アプローチを採用し、高エネルギー密度、高速充電、長寿命、高安全性という4つの要素を同時に実現することを目指している。

同社の技術は主にEV用途に焦点を当てているが、将来的には定置型エネルギー貯蔵システムや民生用電子機器への応用も視野に入れている。

同社は技術ライセンス供与を主軸としたビジネスモデルへの転換を進めており、これまでの自社製造路線から、パートナー企業への技術提供によってより迅速な市場展開を図る戦略である。

主要顧客はフォルクスワーゲン・グループのPowerCoを中心とした大手自動車メーカーであり、2024年7月には年間40GWh(約100万台分のEV相当)の生産ライセンス契約を締結している。

クアンタム・スケープ(QS)の企業情報は以下。

- 会社名:QuantumScape Corporation

- 設立年:2010年5月14日

- 本社所在地:カリフォルニア州 サンノゼ

- 代表者:Dr. Siva Sivaram(CEO兼社長)/Jagdeep Singh(会長)

- 公式サイト:https://www.quantumscape.com

- 主な事業内容:全固体リチウムメタル電池技術の開発・ライセンス供与、EV向け次世代バッテリー技術提供

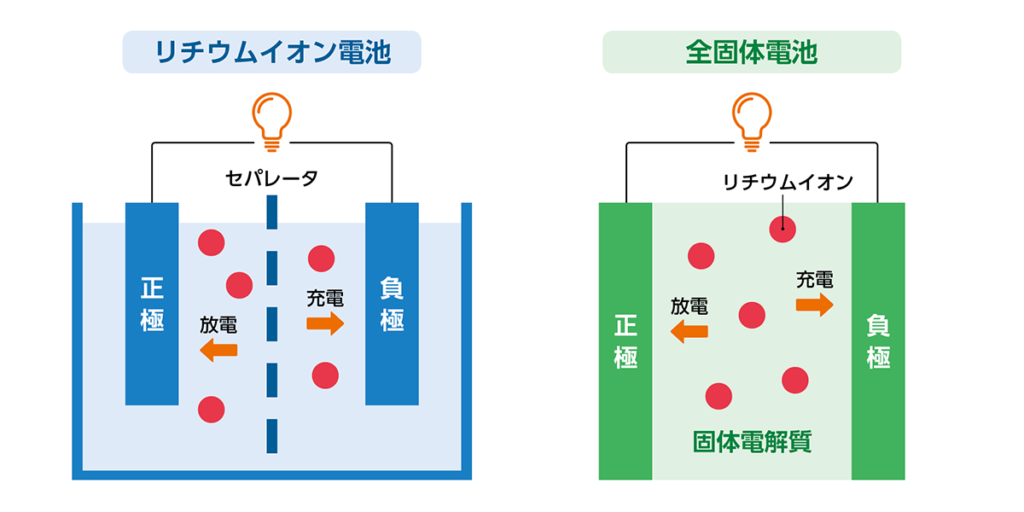

全固体電池とは?リチウムイオン電池と何が違う?

全固体電池とは

全固体電池とは、従来のリチウムイオン電池における液体電解質を固体電解質に置き換えた次世代型の電池技術である。電解質とは、電池内部でイオンを移動させる役割を担う重要な素材であり、この部分を固体にすることで、多くの技術的・安全的なメリットが期待されている。

全固体電池には、以下のような特徴がある:

- 高エネルギー密度(航続距離の延長が可能)

- 発火リスクの大幅な低減(液体電解質のように可燃性でない)

- 高速充電(固体電解質による安定したイオン移動)

- 長寿命化(電解液の劣化がないため)

リチウムイオン電池との主な違い

| 項目 | リチウムイオン電池 | 全固体電池 |

|---|---|---|

| 電解質 | 液体 | 固体 |

| 安全性 | 発火・液漏れのリスクあり | 非可燃で安全性が高い |

| エネルギー密度 | 中程度 | 高い(理論値で2倍近く) |

| 充電速度 | 制限あり | 高速充電が可能 |

| 製造難易度 | 技術確立済み | 高く、現在は研究・試験段階が中心 |

| コスト | 低コスト化が進行 | 高コスト、量産技術はこれから |

全固体電池は、理論的にはリチウムイオン電池の上位互換とされるが、大量生産・長期安定性・コストの壁を乗り越える必要があり、いまだ商業化に至っていないのが実情である。

参考:村田製作所時術記事

クアンタム・スケープ(QS)の主力製品は?

クアンタム・スケープ(QS)の主力製品は以下の通りである。 同社は全固体電池技術において世界最先端の技術を保有し、従来のリチウムイオン電池では不可能とされていた性能特性を実現している。

QSE-5 全固体リチウムメタル電池

次世代EV向け商業製品

QSE-5は、クアンタム・スケープが開発する初の商業化予定製品であり、2024年から本格的な量産準備段階に入っている。

- エネルギー密度:800~1,000 Wh/L(従来品比約40%向上)

- 高速充電:10%から80%まで15分未満で充電完了

- 長寿命:1,000充電サイクル後も95%以上の容量保持

- 動作温度範囲:-30℃から高温まで安定動作

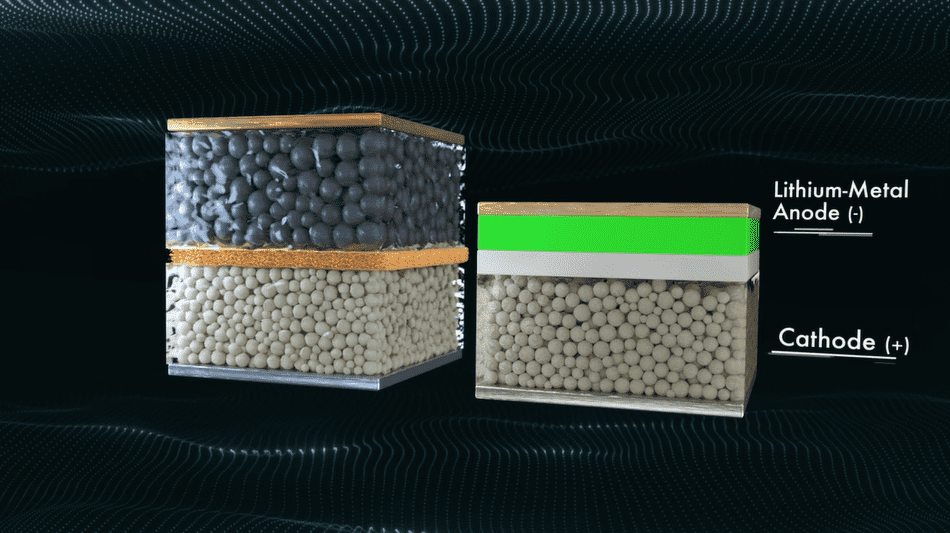

アノードフリー設計による革新

QSE-5の最大の特徴は、業界初のアノード(負極)フリー設計にある。

- 製造時にアノードを持たない構造で材料コストを大幅削減

- 初回充電時にその場でアノードを形成する独自技術

- グラファイト・シリコン材料を完全に排除

- より簡素な製造プロセスにより量産性を向上

独自セラミック分離膜技術

高性能固体電解質

クアンタム・スケープの技術的優位性の中核を成すのが、独自開発のセラミック分離膜である。

- リチウムデンドライト形成を完全に防止

- 高いイオン伝導性により高速充電を実現

- 不燃性・非毒性で安全性を大幅に向上

- -30℃から高温まで安定した性能を発揮

製造プロセスの革新

同社の固体電解質製造技術は、従来の真空蒸着法とは異なる独自のウェットプロセスを採用している。

- 大面積での均質な薄膜形成が可能

- 製造コストの大幅削減を実現

- 量産スケーラビリティに優れた製造手法

- 品質安定性と生産効率の両立

クアンタム・スケープ(QS)のビジネスモデルは?

クアンタム・スケープ(QS)のビジネスモデルは、独自の全固体電池技術のライセンス供与を主軸とし、パートナー企業との長期的な技術協業によって収益を獲得する構造となっている。2024年の戦略転換により、従来の自社製造路線から技術ライセンス中心のモデルへと大きく方向転換している。

技術ライセンス収益

最も重要な収益源として、全固体電池技術のライセンス供与契約がある。

- 主な顧客はフォルクスワーゲンのPowerCoを中心とした大手自動車メーカーと電池メーカー

- 複数年にわたる長期ライセンス契約で安定したロイヤリティ収入を確保

- 前払いロイヤリティと量産開始後の継続的ロイヤリティの組み合わせ

- 2024年7月のPowerCoとの契約では年間40GWh(約100万台分)の生産ライセンスから開始

研究開発・技術コンサルティング収益

技術ライセンスに付随して、専門的な技術支援サービスを提供している。

- 顧客は主に自動車メーカーと電池関連企業

- プロジェクト単位での技術コンサルティング契約

- 技術移管、製造プロセス最適化、品質管理支援などを包括的に提供

- 米国エネルギー省(DOE)などの政府機関からの研究開発受託も含む

プロトタイプ供給収益

商業化前の段階において、限定的なプロトタイプ電池の供給による収益も獲得している。

- 主な顧客は自動車メーカーの研究開発部門

- プロトタイプ単位での販売で、比較的高単価での取引

- Alpha-2プロトタイプなどの技術検証用バッテリーの提供

- 顧客による性能評価と技術検証をサポート

将来の収益多様化戦略

技術ライセンスモデルの成功により、複数の収益源の構築を目指している。

- 異なる用途向けライセンス(EV以外の民生機器、定置型蓄電システム)

- 特許ライセンス収入の拡大

- 製造装置・技術の販売

- 技術人材の派遣・トレーニングサービス

このビジネスモデルにより、巨額の製造設備投資を回避しながら、技術の知的財産価値を最大化し、スケーラブルな成長を実現することを目指している。

クアンタム・スケープが開発する全固体電池の特徴をまとめると?

最大の特徴は「アノードレス構造」である。これは製造時点ではアノード(負極)を持たず、充電時にリチウム金属がセパレータ上に自己形成されるという画期的な方式である。

メリット

- 製造工程の簡素化

- エネルギー密度の大幅な向上(最大で400Wh/kg超のポテンシャル)

- アノード材料のコスト・重量削減

② 独自の固体電解質(セラミックベース)

従来の硫化物系・酸化物系に代わる、QS独自のセラミック材料を用いた固体電解質を採用。これにより、以下の性能が実現されている:

- 室温〜高温まで安定して動作

- 高いイオン伝導率と優れた耐デンドライト性

- サイクル耐久性(1000回以上のフル充放電でも容量保持率 >80%)

③ 高い急速充電性能

クアンタム・スケープの試験データによると、15分以内に80%まで充電可能な性能が示されており、EV市場における“充電の待ち時間”という大きな課題を克服する可能性がある。

④ 多層セルの拡張設計

単層セルから4層→10層→24層と、量産を見据えたスケーラブルな構造拡張を目指している。現在は24層プロトタイプの性能評価段階に入っており、商業化へのマイルストーンを一歩ずつ進めている。

⑤ 高いエネルギー密度

同社のセルは従来のリチウムイオン電池に比べて最大で70%以上高いエネルギー密度を実現可能とされており、EVの航続距離を大幅に引き上げることが期待されている。

⑥ 安全性

全固体電池は、液体電解質を使用するリチウムイオン電池と比較して、短絡や発火のリスクが低い。

クアンタム・スケープの電池は、不燃性で耐熱性の高いセラミックによる固体電解質(セパレーター)を使用することで、これらのリスクをさらに低減している。

- 衝撃や物理的損傷に対しても安全性が高い

- 可燃性の液体電解質を使用しないことで、熱暴走リスクが極めて低い

- 高温環境でも安定して機能しやすい

出典:QuamtumScape

このように、クアンタム・スケープの全固体電池は、「高エネルギー密度 × 高速充電 × 高安全性」を同時に追求している点で、市場における大きな差別化要素を持つ。

取引市場は?

クアンタム・スケープ(QS)は、ニューヨーク証券取引所(NYSE)に上場しており、ティッカーシンボルは「QS」である。

2020年11月にSPAC(特別買収目的会社)のKensington Capital Acquisitionとの合併を通じて上場を果たした。NYSEは世界最大の証券取引所として、革新的な技術を持つ成長企業が多く集まる市場であり、クアンタム・スケープのような次世代技術企業にとって適切な資金調達の場を提供している。

クアンタム・スケープ(QS)のセクター、業種、属するテーマは?

クアンタム・スケープ(QS)は、その事業内容と市場位置づけから、以下のセクター・業種・投資テーマに分類される。

セクター

クアンタム・スケープは、一般消費財(Consumer Cyclical)セクターに属する。自動車産業は消費者の経済状況や景気サイクルに影響を受けやすく、同社の全固体電池技術もEV市場の成長とともに需要が変動する特性を持つため、このセクターに分類されている。

業種

同社は自動車部品(Auto Parts)業界に分類される。クアンタム・スケープの全固体電池は、EVの重要な構成要素であり、自動車メーカーへの技術ライセンス供与や部品供給を行っているため、広義の自動車部品企業として位置づけられている。

属するテーマ

クアンタム・スケープは複数の成長テーマと密接に結びついており、投資対象として高い注目度を誇る。

- 電気自動車(EV)テーマ:EV普及の鍵となる次世代バッテリー技術の開発リーダー

- クリーンエネルギーテーマ:持続可能なエネルギー貯蔵ソリューションの提供

- ESG投資テーマ:環境負荷軽減に貢献する革新的技術の開発

- テクノロジー革新テーマ:材料科学とエネルギー技術の最先端を追求

- グリーンテック投資:脱炭素社会実現に向けた重要な技術インフラ

これらのテーマは相互に関連し合い、同社の技術が持つ社会的価値と投資機会の両面を表している。特に世界各国の脱炭素政策とEV普及促進により、これらのテーマへの投資家の関心は継続的に高まっている。

クアンタム・スケープ(QS)の配当について

クアンタム・スケープ(QS)は現在、配当を実施していない。

同社は創業から15年程度の技術開発型スタートアップ企業であり、現在は全固体電池技術の研究開発と商業化準備に集中している段階である。このため、利益を株主への配当として還元するのではなく、技術開発と事業拡大への再投資を優先している。

技術系スタートアップ企業においては、商業化達成と安定的な収益基盤の確立後に配当政策を検討することが一般的であり、クアンタム・スケープについても2027年以降の商業化成功後に配当実施の可能性が考えられる。

クアンタム・スケープ(QS)の競合他社は?

クアンタム・スケープ(QS)は、全固体電池技術開発において複数の強力な競合企業と激しい競争を繰り広げている。

主要競合企業

トヨタ自動車(日本)

世界最大級の自動車メーカーが推進する全固体電池開発の最有力候補である。

- 2027~2028年の商業化を計画し、業界でも最も早期の実用化を目指す

- パートナーの出光興産と連携し、固体電解質の大量生産技術を確立

- 1,000km超の航続距離と10分未満の急速充電を実現予定

- 独自のフレキシブル固体電解質技術でクラック問題を解決

Solid Power(米国)

フォードとBMWから支援を受ける有力スタートアップで、クアンタム・スケープと最も直接的な競合関係にある。

- シリコンアノードとNMC正極の組み合わせで差別化

- 硫化物系固体電解質を採用し、地球上に豊富な材料を使用

- パックレベルで15~35%のコスト優位性を主張

- 2030年代後半の商業化を目標とする

Samsung SDI(韓国)

韓国の電池製造大手として、独自の全固体電池技術を開発している。

- 2027年に量産開始予定で、競合に先駆けた市場投入を狙う

- スウォン研究開発センターにパイロット生産ラインを建設済み

- 銀カーボン(Ag-C)アノード技術でデンドライト問題を解決

- 800kmの航続距離と1,000回以上の充放電サイクルを実現

ProLogium Technology(台湾)

世界初の全固体電池ギガファクトリーを運営する台湾企業である。

- 2024年から自動車メーカーへの供給開始で先行者優位を確立

- 連続ウェットコーティング技術で製造効率を2.6倍向上

- リチウムセラミック電池技術に特化

- 年間26,000台分の生産能力を2027年までに確立予定

Blue Solutions(フランス)

既に全固体電池の商業生産を行っている唯一の企業として独特な地位を占める。

- EVおよびバス向けポリマー系全固体電池を既に販売中

- ブルターニュ地方に次世代電池工場を2030年稼働予定で建設中

- Foxconnとの提携で二輪車市場への展開も推進

- Gen4技術による次世代固体電池の開発を進行中

アジア地域の競合動向

中国系企業

WeLion(衛藍新能源)とNIOの提携により、2024年後半に577マイル航続距離のES6 SUVを発売予定である。ただし、シリコン黒鉛複合アノードを使用するため、真の全固体電池ではないとの指摘もある。

韓国企業群

LG Energy Solution、SK Innovationなども全固体電池開発に積極的に取り組んでおり、韓国政府の支援を受けて次世代電池技術の確立を目指している。

競合との差別化要素

クアンタム・スケープのアノードフリー設計と独自セラミック分離膜は、競合他社とは根本的に異なるアプローチであり、技術的優位性を保持している重要な要素である。

クアンタム・スケープ(QS)が属する業界の規模と成長性は?

クアンタム・スケープ(QS)が属する全固体電池市場は、次世代エネルギー貯蔵技術として急速な成長が見込まれる新興市場である。

市場規模の現状と予測

2024年の市場規模

全固体電池の世界市場規模は2024年時点で約1.1億ドルと推定されており、まだ商業化初期段階にある。

- アジア太平洋地域が56%の最大シェアを占め、技術開発の中心地となっている

- 北米が次の主要市場として、政府支援と民間投資により急速に拡大中

- ヨーロッパは環境規制を背景とした持続可能な移動手段への需要が牽引

将来成長予測

市場調査各社の予測では、2030~2032年にかけて大幅な市場拡大が見込まれている。

- 2032年までに約7億~14億ドル規模に成長すると予測

- 年平均成長率(CAGR)30~42%という驚異的な成長率

- 2037年には1,220億ドル超の巨大市場に発展する可能性

用途別市場構成

電気自動車(EV)セグメント

全体の63%を占める最大用途として、市場成長の主要推進力となっている。

- 31.49%の最高成長率で拡大予続予測

- 自動車メーカーの航続距離延長と充電時間短縮への需要が牽引

- 2027~2030年の商業化本格開始により急速な普及が期待される

民生用電子機器セグメント

現在は最大シェアを占めるが、EV市場の成長により相対的比重は低下予想。

- スマートフォン、ウェアラブル機器向けの小型高性能電池需要

- 安全性とエネルギー密度の向上により従来電池からの置き換え促進

- アジア太平洋地域での消費者需要が特に旺盛

地域別市場動向

アジア太平洋地域

全市場の43.8%を占める最大地域として、技術開発と量産化をリードしている。

- 日本のトヨタ、韓国のサムスンSDIなどが技術開発を主導

- 中国政府の8.3億ドル投資計画により国家的な技術開発を推進

- 台湾ProLogiumの世界初ギガファクトリーが商業生産を開始

北米地域

34%のシェアを持つ第二の市場として、政府支援と民間投資が活発である。

- バイデン政権のインフレ削減法により税制優遇措置を提供

- QuantumScape、Solid Powerなどの革新的スタートアップが技術開発を牽引

- VW、フォード、BMWなどの自動車大手による巨額投資が継続

投資動向と政府支援

民間投資

2024年だけで数十億ドル規模の投資が全固体電池分野に流入している。

- フォルクスワーゲンのQuantumScapeへの3億ドル投資

- トヨタの2030年までの135億ドル電池技術投資計画

- 中国CATL、BYDなどの大手電池メーカーによる技術開発投資

政府支援策

各国政府が戦略的技術として位置づけ、積極的な支援策を展開している。

- 米国エネルギー省の研究開発受託プログラム

- EU Green Dealの一環としたクリーン技術促進政策

- 日本政府のカーボンニュートラル政策による技術開発支援

この急成長市場において、クアンタム・スケープは技術的優位性と戦略的パートナーシップにより、重要な市場ポジションの確立を目指している。

フォルクスワーゲンとの提携内容と進捗は?

クアンタム・スケープとフォルクスワーゲン・グループの提携は、2012年に開始された12年間にわたる戦略的パートナーシップであり、単なる投資関係を超えた技術開発の長期協業として業界でも類を見ない深い結びつきを築いている。

投資・出資関係

フォルクスワーゲン・グループはクアンタム・スケープの最大株主として、継続的な資金提供を行っている。

2012年の初期投資以降、VWグループは段階的に投資を拡大し、総額数億ドル規模の投資を実行している。特に2020年のSPAC上場時には2億ドルの追加投資を行い、同社の商業化加速を強力にサポートしている。

この投資関係は単なる財務支援ではなく、技術開発ロードマップの共同策定、量産化プロセスの協働設計など、戦略的な意思決定レベルでの深い連携を可能にしている。

PowerCoとのライセンス契約詳細

2024年7月に締結された画期的なライセンス契約は、両社の関係を新たなステージに押し上げた。

VWグループの電池子会社PowerCoは、クアンタム・スケープの全固体電池技術の非排他的製造ライセンスを取得し、年間40GWh(約100万台のEV相当)から開始し、最大80GWhまで拡張可能な生産能力を確保している。

契約条件には前払いロイヤリティと継続ロイヤリティの組み合わせが含まれており、クアンタム・スケープにとって安定した収益基盤を提供している。また、技術移管、製造プロセス最適化、品質管理支援などの包括的技術サポートサービスも含まれている。

技術検証と共同開発の進捗

PowerCoの独立した検証により、技術の実用性が客観的に証明されている。

2024年1月、PowerCoはドイツ・ザルツギッター工場の電池研究所において、クアンタム・スケープのA-sampleプロトタイプの1,000充電サイクル後に95%以上の容量保持率を達成したことを公式発表している。これは業界標準の700サイクル・80%容量保持という要求を大幅に上回る結果である。

2025年第1四半期には、QSE-5サンプル電池の本格出荷が開始されており、PowerCoエンジニアとの共同チームがモジュール・システムレベルでの統合試験を実施している。バッテリー管理システムの設計検証と校正作業も並行して進行中である。

量産化に向けた協業体制

2025年はCobra分離膜プロセスの本格導入年として位置づけられており、PowerCoとの合同エンジニアリングチームが量産設備の自動化レベル向上に取り組んでいる。

PowerCoのフランク・ブローメCEOを含む幹部陣が定期的にクアンタム・スケープのサンノゼ工場を訪問し、工業化プロセスの進捗を直接監督している。この密接な協働により、技術移管から大規模生産まで一貫したサポート体制が構築されている。

2026年のフィールドテスト開始、2027年の商業化実現に向けて、両社のエンジニアリングチームが統合的な開発アプローチを採用している。

技術的課題と開発リスクは?

クアンタム・スケープの全固体電池技術は画期的な性能を実現している一方で、商業化に向けていくつかの重要な技術的課題とリスク要因が存在している。

製造スケーラビリティの課題

最も重要な課題は、研究室レベルの技術を工業規模に拡張することである。

現在の24層セル構造を維持しながら、大面積セラミック分離膜の均質製造を安定して実現することは技術的に極めて困難である。わずかな製造ばらつきが電池性能に大きな影響を与えるため、歩留まり率の向上と品質管理の確立が重要な課題となっている。

特に、アノードフリー設計では初回充電時にリチウムメタルアノードを形成するため、この形成プロセスの制御技術の確立が商業化成功の鍵を握っている。PowerCoとの協業により改善は進んでいるが、ギガワット時規模での安定生産達成には更なる技術革新が必要である。

コスト競争力の実現

全固体電池技術の製造コストを従来のリチウムイオン電池と競争可能なレベルまで削減することは大きな挑戦である。

セラミック分離膜の製造には高温プロセスと精密制御が必要であり、設備投資額と運営コストが従来電池より大幅に高い状況にある。Cobraプロセスにより効率化が図られているものの、2027年の商業化時点で十分なコスト競争力を確保できるかは不透明である。

また、原材料調達においても、高純度セラミック材料の安定供給と価格安定性が課題となっている。村田製作所との提携により改善が期待されるが、グローバル供給網の確立には時間を要する。

技術仕様の最適化

実際のEV使用環境での長期信頼性確保は継続的な技術課題である。

研究室での1,000サイクル試験では優秀な結果を示しているが、実際の車両環境での振動、温度変化、充電パターンの多様性に対する耐久性検証は十分ではない。特に、-30℃での低温特性と高温環境での安全性については、更なる検証データの蓄積が必要である。

さらに、現在の15分急速充電性能を様々な充電インフラと互換性を保ちながら実現することも技術的課題として残っている。

競合技術の急速な進歩

他社の全固体電池技術や次世代リチウムイオン電池の進歩により、クアンタム・スケープの技術優位性が脅かされるリスクがある。

トヨタの2027年商業化計画、Samsung SDIの2027年量産開始予定など、競合他社も積極的な開発を進めており、市場投入時期で先行されるリスクが存在する。また、従来のリチウムイオン電池もエネルギー密度向上と急速充電技術の改善が続いており、全固体電池の絶対的優位性が薄れる可能性もある。

規制・認証への対応

新技術である全固体電池の自動車への搭載には、厳格な安全認証プロセスが必要である。

現在の自動車安全基準は主にリチウムイオン電池を前提としており、全固体電池特有の安全性評価基準の確立が必要となる。各国の規制当局との連携により認証プロセスを進めているが、予期しない規制要求や認証遅延が商業化スケジュールに影響するリスクがある。

パイロットライン・量産体制の見通しは?

クアンタム・スケープの生産体制は、段階的なスケールアップアプローチにより、技術検証から商業生産まで着実に発展している。

現在のサンノゼ工場の生産能力

カリフォルニア州サンノゼのパイロット工場では、2024年末にCobraプロセスが本格稼働を開始し、現在はQSE-5 B1サンプルの高容量生産段階に入っている。

従来のRaptorプロセスと比較して、Cobraは約25倍の熱処理速度向上と大幅な設備フットプリント削減を実現している。現在の生産能力は年間数千セル規模であるが、2025年中に更なる自動化設備の導入により生産量を段階的に拡大する計画である。

PowerCoとの合同エンジニアリングチームにより、設備自動化レベルの向上とQSE-5サンプルの品質向上が継続的に進められている。これらの改善により、2025年後半にはB1サンプルの本格出荷が可能になる見込みである。

ライセンス供与モデルによる量産戦略

クアンタム・スケープは自社での大規模製造工場建設を避け、技術ライセンス供与による量産化を選択している。

この戦略により、巨額の設備投資リスクを回避しながら、複数のパートナー企業を通じたグローバル市場への迅速な展開が可能となる。PowerCoとの契約は年間40GWhから開始し最大80GWhまで拡張可能であり、2027年からの商業生産開始が予定されている。

PowerCoはドイツ、スペイン、カナダに建設中の3つの電池工場において、総生産能力200GWh/年の体制を構築中である。これらの工場では2026年〜2027年の生産開始が予定されており、クアンタム・スケープの技術も段階的に導入される計画である。

技術移管とサプライチェーン構築

製造技術の移管プロセスは既に開始されており、PowerCoのエンジニアチームがサンノゼ工場に常駐し、実際の製造プロセスの習得を進めている。

材料供給体制については、村田製作所との戦略的提携により、セラミック分離膜の大量生産技術の確立を目指している。村田製作所のグローバル製造能力と数十年の先進セラミック製造経験を活用することで、品質安定性と生産スケーラビリティの同時実現を図っている。

その他の重要部材についても、世界各地の設備ベンダー、材料サプライヤー、契約製造業者との技術パートナーネットワークの構築が進められている。

2026年フィールドテストと2027年商業化

2026年のフィールドテスト開始は、クアンタム・スケープにとって重要なマイルストーンである。

フォルクスワーゲンとのローボリューム・ハイビジビリティプロジェクトとして実施される予定であり、実世界での車両実証を通じて技術の実用性を最終確認する段階となる。このプロジェクトは複数フェーズで展開され、2026年のフィールドテストが成功すれば、2027年の本格商業化への道筋が明確になる。

2027年の商業化実現には、製造歩留まり率の更なる向上、コスト削減の達成、品質管理体制の確立が必要である。現在の技術開発ペースと製造改善の進捗を考慮すると、これらの目標達成は十分に現実的と評価されている。

PowerCoとの量産ライセンス契約により、初年度40GWh(約100万台分)の生産能力からスタートし、市場需要に応じて段階的に拡大していく計画である。

クアンタム・スケープ(QS)の競合との差別化要素と優位性は?

クアンタム・スケープ(QS)は、独自のアノードフリー設計技術と戦略的パートナーシップによって、全固体電池市場における圧倒的な技術的優位性を確立している。同社の競争上の強みは、単なる性能向上にとどまらず、他社が容易に模倣できない参入障壁を構築している点にある。

技術的優位性

クアンタム・スケープ最大の差別化要素は、世界初のアノードフリー設計による根本的な技術革新である。

従来の全固体電池は、製造時にグラファイトやシリコンなどの負極材料を必要とするが、同社の技術は初回充電時にその場でリチウムメタルアノードを形成する画期的な手法を採用している。これにより、材料コストを大幅に削減し、同時により高いエネルギー密度を実現している。

この技術は15年以上の研究開発の蓄積によって生み出されたものであり、競合他社が短期間で追随することは極めて困難である。特に、独自のセラミック分離膜技術は、リチウムデンドライト形成を完全に防止する性能を持ち、安全性と耐久性の両面で他社を大きく引き離している。

戦略的提携・パートナーシップ

フォルクスワーゲン・グループとの12年間にわたる戦略的パートナーシップは、他社には容易に構築できない強固な競争優位性を形成している。

VWは単なる投資家ではなく、最大株主として同社の技術開発を深くコミットしており、2024年のPowerCoとの量産ライセンス契約により、年間40GWh(約100万台分)という大規模な事業化が確定している。このような大手自動車メーカーとの密接な協業関係は、技術検証から量産化まで一貫したサポートを提供し、他のスタートアップ企業では実現困難な優位性となっている。

さらに、複数の自動車メーカーとの同時並行的な評価プロセスにより、特定顧客への依存リスクを回避しながら、幅広い市場機会を確保している。

製品・サービスの独自性

同社の全固体電池は、従来のリチウムイオン電池と比較して約40%高いエネルギー密度と15分で80%充電という卓越した性能を実現している。

重要なのは、これらの性能が1,000充電サイクル後も95%以上の容量を維持する長期安定性と組み合わされていることである。この性能水準は、他社の全固体電池技術では同時に達成されておらず、EV用途における実用性の観点で明確な差別化を実現している。

特に、-30℃から高温まで安定動作する広い動作温度範囲は、厳しい環境条件での使用が要求される自動車用途において、競合他社に対する決定的な優位性となっている。

ビジネスモデルの優位性

2024年の技術ライセンス供与モデルへの戦略転換は、従来の製造業型ビジネスモデルとは一線を画する革新的なアプローチである。

このモデルにより、巨額の製造設備投資リスクを回避しながら、スケーラブルな収益構造を構築している。パートナー企業が製造を担当し、同社は技術提供とロイヤリティ収入に集中することで、資本効率性を大幅に向上させている。

さらに、複数年にわたる長期ライセンス契約により、安定した継続収益を確保し、技術開発への継続投資を可能にする良循環を構築している。この戦略により、製造能力の制約を受けることなく、グローバル市場への迅速な展開が可能となっている。

知的財産・特許優位性

200件以上の特許ポートフォリオにより、アノードフリー設計および固体電解質技術の中核部分を包括的に保護している。

これらの特許は、単発的な技術要素ではなく、製造プロセス全体を体系的にカバーしており、競合他社の技術開発において回避困難な参入障壁を形成している。特に、セラミック分離膜の材料組成や製造手法に関する特許は、全固体電池の実用化において必須の技術要素を押さえており、強固な知的財産保護を実現している。

クアンタム・スケープは再生可能エネルギー分野としても注目されている?

クアンタム・スケープは、次世代電池として期待される全固体電池の開発企業としてだけでなく、再生可能エネルギー分野における有力な技術革新企業としても注目されている。

同社は、マイクロソフト創業者ビル・ゲイツ氏が主導するBreakthrough Energy Ventures(BEV)の支援を受けるポートフォリオ企業の一つである。BEVは、脱炭素社会の実現に向けて革新的なエネルギー技術に投資するファンドであり、ゲイツ氏のほか、アマゾン創業者のジェフ・ベゾス氏やソフトバンクの孫正義氏など、世界的な実業家たちが支援メンバーに名を連ねている。

クアンタム・スケープがBEVに選ばれている理由は、同社の電池技術が電気自動車(EV)の普及に不可欠な「高効率・高安全・低炭素」のエネルギー供給を可能にするからである。とりわけ、燃焼エンジンからの脱却を進めるEV産業において、QSの全固体電池は再生可能エネルギーとモビリティの橋渡しを担う中核技術と見なされている。

BEVからの支援は、単なる資金提供にとどまらず、製造スケールアップや人材支援、大手自動車メーカーとの提携推進といった商業化プロセスの加速にも大きく貢献している。つまりクアンタム・スケープは、バッテリー企業であると同時に、再生可能エネルギー革命の担い手としても位置づけられる存在であり、これは他の電池スタートアップとは一線を画す競争優位性の一つといえる。

クアンタム・スケープ(QS)の業績について

クアンタム・スケープの財務年度は12月31日で終了する。

同社は上場企業として、四半期ごとに業績を発表しており、一般的な決算発表スケジュールは以下の通りである

- 第1四半期決算:4月下旬~5月上旬

- 第2四半期決算:7月下旬~8月上旬

- 第3四半期決算:10月下旬~11月上旬

- 第4四半期・通期決算:2月下旬~3月上旬

クアンタム・スケープの現在株価

クアンタム・スケープ(QS)の現在のリアルタイム株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

クアンタム・スケープ(QS)の将来性と今後の株価見通しは?

クアンタム・スケープ(QS)の将来性は、革新的な全固体電池技術の商業化進展と急拡大するEV市場の動向によって大きく左右される。同社の技術的優位性と戦略的パートナーシップは長期的な成長の基盤となる一方で、技術系スタートアップ特有のリスクも内在している。

技術開発・商業化スケジュール

クアンタム・スケープの最大の成長ドライバーは、2025年のB Sampleデリバリーから2027年の商業化開始に至るマイルストーン達成である。

2024年のAlpha-2プロトタイプの顧客出荷開始により、同社は技術検証段階から本格的な商業化準備段階に移行している。VWのPowerCoとの年間40GWh生産ライセンス契約は、技術の実用性が大手自動車メーカーに認められた証拠であり、今後の大規模展開への道筋を示している。

技術ライセンス供与モデルへの転換により、製造設備投資リスクを回避しながら、複数のパートナー企業を通じてグローバル市場への迅速な展開が可能となっている。この戦略により、資本効率性を維持しながら市場シェア拡大を図ることができる。

しかし、全固体電池技術の完全な商業化は依然として技術的課題を伴う。製造スケーラビリティ、コスト競争力、品質安定性の3つの要素を同時に達成することが、長期的成功の鍵となる。

市場環境と競合状況

全固体電池市場は2030年代にかけて年平均成長率30~42%という驚異的な拡大が予測されており、クアンタム・スケープはこの成長市場における先行者優位を確立している。

特に、EV市場の急速な成長と航続距離・充電時間に対する要求の高まりは、同社の技術的優位性を最大限に活用できる市場環境を提供している。政府のEV普及政策と環境規制の強化により、次世代バッテリー技術への需要は中長期的に拡大が確実視される。

一方で、トヨタ、Samsung SDI、Solid Powerなどの競合他社も商業化を加速しており、競争環境は激化している。クアンタム・スケープのアノードフリー設計という独自技術は差別化要因となるが、市場投入時期と性能・コストバランスが競争力を決定づける。

リスク要因

技術系スタートアップとして、クアンタム・スケープは商業化の遅延リスク、技術的課題の発生、競合技術の急速な進歩といった要因に直面している。

特に、量産時の歩留まり率向上、製造コストの削減、品質管理体制の確立は、技術の実用化における重要な課題である。また、パートナー企業との協業関係の維持と拡大も、事業成長の重要な要素となる。

アナリストの平均目標株価$5.19(現在価格から-64.55%)は、これらのリスク要因を反映した慎重な評価を示している。短期的な株価変動リスクは高く、技術進展や商業化スケジュールの遅延に対する市場の反応は厳しいものとなる可能性がある。しかし、技術的ブレークスルーの達成と大手パートナーとの契約拡大が実現すれば、株価は大幅な上昇を見せる可能性も秘めている。全固体電池技術の将来性と市場ポテンシャルを考慮すると、長期投資の観点では注目に値する銘柄である。

クアンタムスケープ(QS)の2025年度Q1決算サマリー

発表日:25/04/24

売上高と収益

- 年間売上高: 該当なし(商業売上はまだ発生せず)

- GAAP純利益: ▲1億1,442.3万ドル(前年同期は▲1億2,064.8万ドル)

- 調整後純利益(Non-GAAP): 非開示

- 調整後EBITDA: ▲6,456万ドル(前年同期は▲7,617.6万ドル)

- その他指標: 総包括損失は▲1億1,475.1万ドル、1株あたり損失は▲0.21ドル

営業費用と利益

- GAAP営業費用: 1億2,357.5万ドル(R&D費用:9,558.9万ドル、一般管理費:2,798.6万ドル)

- Non-GAAP営業費用: 非開示(ただしストックベース報酬4,063.9万ドル含む)

- EBITDA損失(ある場合): 上記参照

- 調整後純損失: 非開示

契約と受注(Bookings)

- 年間受注高: 非開示

- 第1四半期受注: 非開示(ただしPowerCoとの共同開発や村田製作所との提携発表あり)

- 契約顧客数: 非開示

- 大口顧客構成:

- フォルクスワーゲン傘下PowerCoと技術開発

- 村田製作所とセラミックス分野で協業開始

キャッシュと財務状況

- 現金残高(年末): 8億6,030万ドル(現金・現金同等物と短期投資合算)

- 借入・返済などの動き: 株式発行による調達1,007万ドル、ストックオプション行使収入1,118万ドル

- 自由キャッシュフロー(FCF): 非開示(営業CFは▲6,074.9万ドル)

技術・事業ハイライト

- 製品開発や技術的成果:

- QSE-5セルのサンプル出荷開始、2026年に実地テスト予定

- 新型セパレーター「Cobra」プロセスの導入開始(量産性向上が期待される)

- パートナーシップや採用事例:

- PowerCoと共同で量産技術開発を進行中

- 村田製作所とセラミック製造で戦略的提携開始

- 市場でのポジション: 全固体リチウム金属電池分野での技術リーダー、PowerCoによる量産適用計画あり

2025年ガイダンス(または翌期ガイダンス)

- 売上見通し: 商業出荷・売上は未計上の見込み(パイロット段階継続)

- EBITDA見通し: 通期調整後EBITDA損失は2億5,000万~2億8,000万ドルを想定

- その他の注目点:

- 2025年中にCobraプロセスを標準化予定

- QSE-5 B1セルの出荷開始を年内に目指す

- 開発ロードマップとグローバルライセンス展開を含む戦略文書を公表済

クアンタムスケープは商業売上のない状態が続く一方で、量産技術(Cobraプロセス)の前倒し導入と顧客向けサンプル出荷開始により、商用化への確実なステップを踏んでいる。Volkswagen傘下PowerCoとの連携や、村田製作所との提携により、技術的信頼性と製造スケーラビリティの裏付けを獲得。依然として巨額の赤字とキャッシュ消費が続くが、2026年以降の商業化を見据えた転換点に差し掛かっている。

クアンタクアンタム・スケープ(QS)の株を買える証券会社は?

ジョビー・アビエーション(JOBY)の株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| 三菱UFJ eスマート証券 | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

こクアンタム・スケープ(QS)について、その革新的な全固体電池技術から事業戦略、競合状況、将来性まで詳しく見てきました。

同社は、業界初のアノードフリー設計による全固体電池技術で、従来のリチウムイオン電池を大きく上回る性能を実現しており、特にEV向け用途において15分で80%充電、95%以上の容量保持という驚異的な性能を誇ります。フォルクスワーゲンとの12年間にわたる戦略的パートナーシップと技術ライセンス供与モデルにより、リスクを抑制しながらグローバル市場への展開を図っている点も高く評価できます。

全固体電池市場は2030年代にかけて年平均成長率30~42%という急成長が予測されており、EV普及の加速とともに同社の技術的優位性が市場で真価を発揮する可能性が高まっています。

2025年のB Sampleデリバリーから2027年の商業化開始という明確なマイルストーンも、重要な判断材料となるでしょう。

個人的には、次世代エネルギー貯蔵技術のパイオニアとして、クアンタム・スケープの技術革新力と戦略的な事業展開に大きな期待を寄せています。短期的な株価変動リスクはあるものの、全固体電池技術の実用化がもたらすインパクトの大きさを考えると、長期的な視点での成長ポテンシャルは魅力的です。特に、持続可能な社会への転換が加速する中で、同社の技術が果たす役割への注目度は今後ますます高まっていくと考えられます。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!