This site is a great place for me (@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- Introduction.

- What is a semiconductor?

- What are the characteristics of the semiconductor sector?

- Why are semiconductors in the spotlight?

- What is the silicon cycle of the semiconductor industry?

- How much growth is there in the semiconductor sector?

- What index tracks stock price trends in the semiconductor industry?

- Comparison of the performance of the SOX Index with the S&P 500 and NASDAQ 100

- What US ETFs can invest in semiconductors?

- Comparative Table of U.S. Semiconductor ETFs

- Semiconductor ETFs for the U.S. that can be invested in the Japanese market

- Semiconductor ETFs for Japan that can be invested in the Japanese market

- Semiconducting mutual funds available in the new NISA (Growth Investment Framework)

- summary

Introduction.

The semiconductor sector has made impressive progress, driving growth in U.S. equities.

There are a wide variety of semiconductors that are indispensable to our daily lives, especially in the field of AI (Artificial Intelligence), where we are seeing rapid development of technologies such as ChatGPT.

The year 2023 is also known as the "first year of AI," and semiconductors supporting AI technology are an essential element of investment strategy.

I myself have actively incorporated AI in my marketing work as part of my job and realized its potential. Therefore, at an early stage,AMDand ... andsuper microcomputerinvestments in the company.

The potential of AI and its growth is just beginning, making it a long-term investment theme.

However, when considering investing in semiconductor stocks, there are many options and it can be difficult to know where to invest.

Such a time,Investing in ETFs and mutual funds that invest in the semiconductor sector as a whole can be an efficient and strategic approach.

In this section, we will share our research on ETFs and mutual funds that can invest in the U.S. and Japanese semiconductor sectors through the new NISA, along with our basic knowledge of semiconductor investment.

What is a semiconductor?

- A semiconductor is a substance or material with properties intermediate between a conductor, which conducts electricity well, and an insulator, which does not conduct electricity.

- Silicon is generally used, and integrated circuits (ICs) using silicon are also called "semiconductors.

- Semiconductors are widely used in electronic devices for computation and information transmission.

- For example, smartphones use many semiconductor devices such as CPUs and memory, and electric vehicles (EVs) require many semiconductors to control motors and batteries.

With the development of self-driving technology and connected cars that are always connected to the Internet, demand for semiconductors for automobiles is also increasing.

The semiconductor market is very large and diverse devices have been developed, but depending on their function and roleThere are five major categories.

What are the five categories of semiconductors?

Semiconductor devices can be divided into five major categories according to their functions and roles.

- Logic:Logic semiconductors are semiconductors that contain logic circuits for data processing and computation. Processors and microcontrollers are included in this category.

- Memory:Memory semiconductors are used to store data temporarily or permanently; they include DRAM (dynamic random access memory) and flash memory.

- CMOS sensor:CMOS sensors are semiconductor devices used as image sensors in cameras. It converts light into electrical signals and produces digital images.

- Power semiconductors:Power semiconductors are devices for handling high voltages and high currents, and are used for power conversion and control. They are used in inverters and power adapters for electric vehicles.

- Analog semiconductors:Analog semiconductors are devices used to process analog signals. They are used to read signals from sensors and process audio signals.

There are many semiconductor brands in these categories, each with different functions and roles.

What are the characteristics of the semiconductor sector?

The semiconductor sector is characterized by the following

Economic Sensitive Sectors:The semiconductor sector isSensitive to economic fluctuations.Demand for semiconductors increases when the economy is strong and decreases when the economy is weak.

Weak Yen Benefit Sector:Japan's semiconductor sector tends to benefit from a weaker yen. This is because many semiconductor companies export their products, and a weaker yen makes them more competitive overseas.

High rate of innovation:The semiconductor industry is characterized by very rapid technological innovation and continuous R&D and investment. This has resulted in new technologies and products being introduced to the market one after another.

Requires large capital investment:The manufacture of semiconductors requires advanced technology and large capital investment. Therefore,Semiconductor companies require large amounts of capital and are susceptible to economic conditions and market fluctuations.

Global supply chain:The semiconductor industry relies on a global supply chain, with companies around the world working together to produce products. Therefore, it is easily affected by international political and economic trends.

These characteristics are points to consider when investing in the semiconductor sector.

Why are semiconductors in the spotlight?

Semiconductors are attracting attention because of their wide range of applications and importance in society.

Semiconductors are used everywhere, in smartphones, computers, automobiles, and even in social infrastructure systems.

Advances in digitization, technology and AI

Semiconductors are essential for the advancement of new technologies such as IoT (Internet of Things), AI (Artificial Intelligence), Big Data, and cloud services.

Especially after 2023,Demand in AI is growing significantly, requiring more advanced semiconductors.

Telework and the proliferation of EC services (e-commerce)

The new coronavirus pandemic has accelerated telework and e-commerce, resulting in increased demand for semiconductors for data centers and telecommunications infrastructure.

Popularization of electric vehicles (EVs)

Electric vehicles are becoming increasingly popular as a response to environmental issues; EVs use more semiconductors than conventional vehicles, with power semiconductors playing a particularly important role.

Deployment of 5G Communications

The deployment of the 5th generation mobile communication system (5G) will enable high-speed, high-capacity data communications, and the communications equipment that supports this will require high-performance semiconductors.

Semiconductor Industry Cycle

The semiconductor industry has its own business cycle, known as the "silicon cycle.Demand for semiconductors increases and decreases periodically due to technological innovation and market demand fluctuations, but over the long term, demand for semiconductors is on a growth trend.

Due to these factors, semiconductors are an indispensable part of modern society, and their importance is expected to continue to grow.

What is the silicon cycle of the semiconductor industry?

The silicon cycle refers to the business cycle specific to the semiconductor industry.

This cycle is,It is formed by the balance between supply and demand for semiconductors, and generally goes through booms and busts in cycles of several years.

Understanding the silicon cycle is important in predicting trends in the semiconductor industry.

Silicon Cycle Phases

Expansion Phase:As the economy grows and demand for electronics increases, demand for semiconductors rises. During this period, semiconductor manufacturers increase production capacity and invest in the development of new technologies.

Excess phase:As production expands in response to increased demand, at some point supply exceeds demand and an excess phase occurs. Prices will fall and inventories will increase.

Adjustment phase:Due to excess inventory and falling prices, semiconductor manufacturers will scale back production. During this period, companies prepare for the next phase of growth by cutting costs and improving efficiency.

Recovery phase:As inventories decline and the market stabilizes, semiconductor prices will begin to recover. As the economy grows, new demand is generated and the market moves back into the expansion phase.

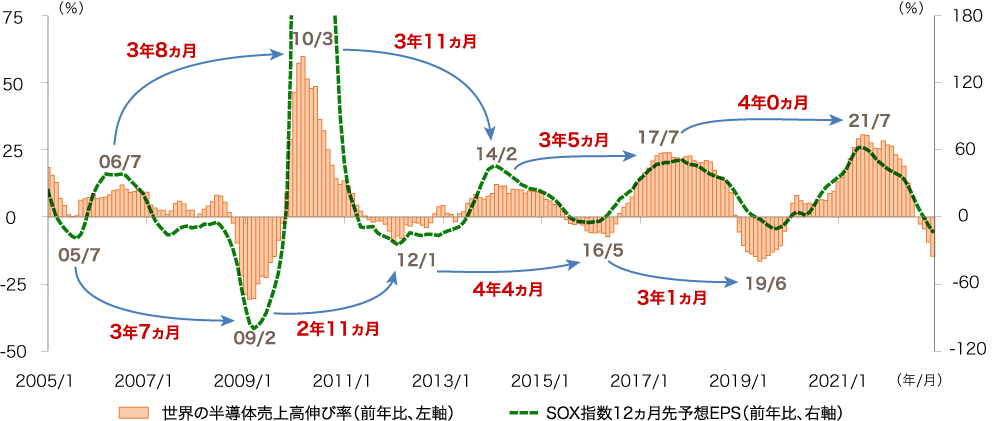

Below is a graph showing the past silicon cycle.

Global Semiconductor Sales Growth and SOX Index 12-Month Ahead EPS Forecast

Source:.Nissay Asset Management

As is clear from this figure, silicon cycles occur in cycles of about 3 to 4 years.

Predictions based on the figure indicate that the peak of the most recent cycle will be around July 2021.

Assuming a cycle duration of about four years, the next cycle's upswing is expected to last until about July 2025, but it is possible that the expected duration may be exceeded.

How much growth is there in the semiconductor sector?

The semiconductor sector has undergone significant changes in recent years.

Although the cycle of increasing and decreasing demand due to the silicon cycle was repeated,The rapid proliferation of AI semiconductors and other products is expected to create sustained demand even as the economy slows.

This shift indicates that the semiconductor sector may break away from its traditional cyclicality and achieve more stable growth.

Semiconductor Sector Growth Outlook

The semiconductor sector is expected to grow revenue by 151 TP3T to 201 TP3T over the next two years, well above the market. This growth will be supported by long-term tailwinds and capacity shortages that will enhance pricing power and dampen economic sensitivity.

Investment Opportunities in the Semiconductor Sector

The semiconductor sector has the overall appeal of high quality, attractive valuations, and strong earnings prospects.

In particular, it is expected to continue to generate consistently strong earnings despite the global economic slowdown, as markets readjust back in line with fundamentals,It is expected to create room for price-to-earnings ratio (PER) increases over the next several years.

Thus, the semiconductor sector is increasingly likely to break out of its past cyclicality and achieve sustainable growth.

What index tracks stock price trends in the semiconductor industry?

Some of the major indices often used to track stock price trends in the semiconductor industry include the following

Philadelphia Semiconductor Index (SOX):Calculated based on stock prices of major semiconductor companies listed on NASDAQThe SOX Index is widely recognized as an important barometer of the semiconductor industry's health and market trends.

NASDAQ OMX PHLX Semiconductor Sector Index (SOX):Another semiconductor index offered by the Philadelphia Stock Exchange, it consists of 30 companies, including semiconductor manufacturers and semiconductor equipment manufacturers.

S&P 500 Semiconductors & Semiconductor Equipment Industry Group Index:Index tracking the performance of semiconductor and semiconductor equipment manufacturers within the S&P 500.

MSCI World Semiconductors and Semiconductor Equipment Index:An index that tracks the stock prices of semiconductor and semiconductor equipment manufacturers worldwide.

Philadelphia Semiconductor Index (SOX) Realtum Chart

A real-time chart of the SOX index, an important indicator for the semiconductor industry, is below.

An analysis of SOX index trends reveals the following trends.

- After the Corona Shock of 2020, demand for electronic devices surged due to the increase in telecommuting and online education. This, coupled with supply chain disruptions, caused production to fail to keep up with demand.

- By the second half of 2022, this special demand had run its course, leading to a prolonged inventory adjustment due to overproduction.

- In 2023, the emergence of ChatGPT and other generative AI led to a surge in demand for semiconductors for AI. In particular,NVIDIAThe supply is not keeping up with the rapid increase in demand, as the two companies have a strong market share in this field.

The demand for semiconductors in various industries is increasing as the advancement of AI technology deeply permeates our work and lives,AIInnovation and development of semiconductor technology is expected to continue with the growth of the

Comparison of the performance of the SOX Index with the S&P 500 and NASDAQ 100

The following graph compares the performance of the SOX index to the S&P 500 and Nasdaq 100 after 2023.

Comparison of the performance of the SOX Index with the S&P 500 and NASDAQ 100

In 2023, big tech companies such as GAFAM experienced remarkable growth, and the NASDAQ index, which includes many technology and semiconductor stocks, grew significantly.

However,The SOX index, which tracks only the semiconductor sector, outperforms the Nasdaq as a whole, indicating that it is driving Nasdaq growth.

What US ETFs can invest in semiconductors?

U.S. ETFs that can invest in the semiconductor sector include the following

- VanEck Semiconductor Stock ETF (SMH):The ETF is designed to invest in the semiconductor industry and is managed by Van Eck.

- Direxion Daily Semiconductor Stocks Bull 3x ETF (SOXL):This ETF pursues the performance of the semiconductor sector with 3x leverage.

- Direxion Daily Semiconductor Stocks Bear 3x ETF (SOXS):An ETF that pursues the opposite direction of the semiconductor sector's performance with 3x leverage.

Van Eck Semiconductor Equity ETF (SMH)

It is linked to the price and yield performance of the MVIS US Listed Semiconductor 25 Index, an index of the 25 largest semiconductor companies listed in the United States.

- Net Assets:15.999 billion dollars

- Setup Date:2011/12/20

- Expense Ratio:0.35% (0.35%)

- Distribution Yield:0.50%

- Management Company:Van Eck

Top 15 Companies in VanEck Semiconductor Equity ETF (SMH)

| ticker | brand name | stock ownership ratio |

|---|---|---|

| NVDA | NVIDIA | 25.74% |

| TSMC | Taiwan Integrated Circuit Mfg. | 9.35% |

| AVGO | broadcom | 5.91% |

| AMD | Advanced Micro Devices | 5.80% |

| ASML | ASML Holding | 5.13% |

| AMAT | Applied Materials, Inc. | 4.63% |

| LRCX | Ram Research | 4.56% |

| QCOM | Qualcomm | 3.99% |

| INTC | Intel (chip manufacturer) | 3.88% |

| ADI | Analog Devices, Inc. | 3.57% |

| TXN | Texas Instruments Inc. | 3.56% |

| KLAC | KLA | 3.52% |

| sulfur oxide (SO, SO2, etc.) | synopsis | 3.43% |

| mu | Micron Technology | 3.27% |

| CDNS | Cadence Design Systems, Inc. | 3.07% |

Direxion Daily Semiconductor Stocks Bull 3x ETF (SOXL)

SOXL is an ETF that tracks the daily performance of the NYSE Semiconductor Index (ICESEMIT) amplified three times.

The ETF invests in major U.S. semiconductor companies and reflects the index's gains when it rises and triples its declines when it falls.

SOXL is a leveraged ETF and is suitable for investors who expect the semiconductor sector to perform better.

Leveraged ETFs are not suitable for long-term investment and are more suited for relatively short-term use. This is because they amplify the daily fluctuations of the underlying index by a fixed multiple, so the compounding effect works over time, making it harder to achieve the targeted multiple performance in a long-term holding.

- Net Assets:8.59 billion dollars

- Setup Date:2010/3/11

- Expense Ratio:0.77%

- Distribution Yield:0.53%

- Management Company:Direxion

SOXL Component Stocks and Ratios

SOXL tracks the NYSE Semiconductor Index (ICESEMIT), and the ICESEMIT index components are as follows

| ticker | Brand name (Japanese) | stock ownership ratio |

|---|---|---|

| AMD | Advanced Micro Devices, Inc. | 8.67% |

| AVGO | broadcom | 8.59% |

| NVDA | NVIDIA | 7.54% |

| INTC | Intel (chip manufacturer) | 6.43% |

| QCOM | Qualcomm | 6.41% |

| NXPI | NXP Semiconductors | 4.01% |

| mu | Micron Technology | 3.99% |

| TXN | Texas Instruments | 3.97% |

| ON | ON Semiconductor | 3.94% |

| LRCX | Lam Research | 3.90% |

Direxion Daily Semiconductor Stocks Bear 3x ETF (SOXS):

SOXS is an ETF that tracks the inverse of the daily performance of the NYSE Semiconductor Index (ICESEMIT), amplified three times.

In other words, the ETF is designed to increase in value when the stock prices of major U.S. semiconductor companies fall and aims to triple its performance when the index falls.

SOXS is a leveraged and inverse ETF, suitable for investors who expect the semiconductor sector to underperform.

As the market falls, the value of SOXS rises becauseSOXL and the exact opposite movement.The first is the "A" in the "A" column.

- Net Assets:$815.71 million

- Setup Date:2010/3/11

- Expense Ratio:0.77%

- Distribution Yield:11.55%

- Management Company:Direxion

Component stocks are the same as SOXL.

Comparative Table of U.S. Semiconductor ETFs

| (data) item | Van Eck Semiconductor Equity ETF (SMH) | Direxion Daily Semiconductor Stocks Bull 3x ETF (SOXL) | Direxion Daily Semiconductor Stocks Bear 3x ETF (SOXS) |

|---|---|---|---|

| Investment Policy | Performance tracking of 25 U.S.-listed semiconductor companies | 3x daily performance tracking of NYSE Semiconductor Index | Daily performance tracking 3x the inverse of the NYSE Semiconductor Index |

| Net assets | 15.999 billion dollars | 8.59 billion dollars | $815.71 million |

| settlement day | 2011/12/20 | 2010/3/11 | 2010/3/11 |

| Expense Ratio | 0.35% (0.35%) | 0.77% (0.77%) | 0.77% (0.77%) |

| Distribution Yield | 0.50 | 0.53% (0.53%) | 11.55% (11.55%) |

| Investment Company | Van Eck | Direxion | Direxion |

SMH is the best option for long-term investment.

On the other hand, in short-term situations where market volatility is high and volatility is high, the strategic use of leveraged ETFs such as SOXL and SOXS can be effective.

Semiconductor ETFs for the U.S. that can be invested in the Japanese market

If you are considering investing in a U.S.-based semiconductor ETF in the Japanese market instead of investing directly in U.S. equities, the following issues are available

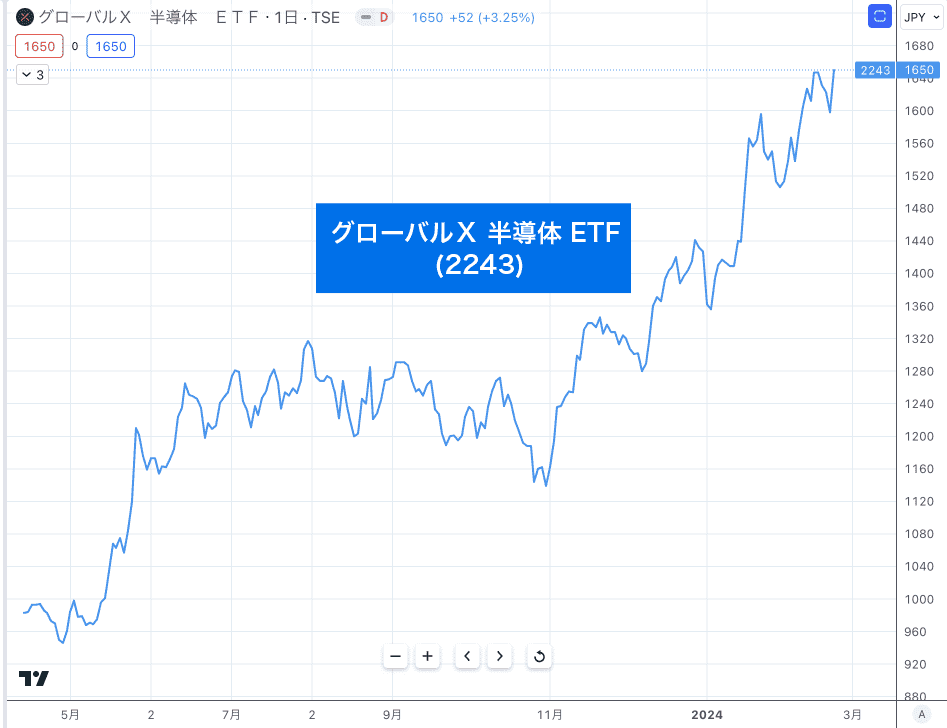

Global X Semiconductor ETF (2243)

An ETF that invests in semiconductor-related companies listed in the U.S. and seeks investment results that track the performance of the Philadelphia Semiconductor Stock Index (SOX Index).

The ETF will invest in a broadly diversified portfolio of stocks of major U.S. semiconductor companies that reflect the growth of the semiconductor industry.

- Net assets10.329 billion yen

- Setup date: March 31, 20122023/4/11

- Expense Ratio0.4125% (0.4125%)

- Component StocksInvests in U.S.-listed semiconductor-related companies included in the SOX Index (Philadelphia Semiconductor Stock Index).

- Investment Management Company Global X

- New NISA support:.Can be invested in the Growth Investment Limit (the Reserve Investment Limit is not available).

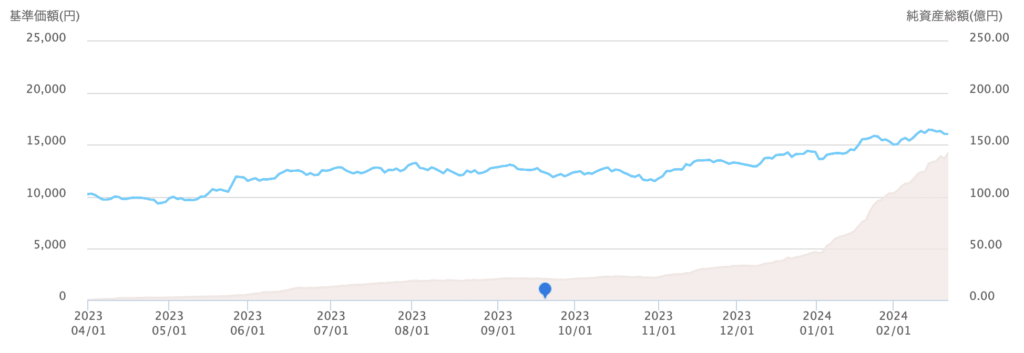

Global X Semiconductor ETF (2243) Stock Chart

The ETF was established in April 2023, so its investment period is short.

Semiconductor ETFs for Japan that can be invested in the Japanese market

Japan's semiconductor industry has strengths in semiconductor production equipment, materials, and testing equipment.

As the semiconductor industry grows, these Japanese companies are also benefiting.

The following semiconductor ETFs listed on the Japanese market are available for the Japanese market.

Global X Semiconductor Related - Japan Equity ETF (2644)

Semiconductor manufacturing and processing, manufacturing equipment and materials.Invest in Japanese companies engaged in semiconductor-related businesses and seek investment results that are linked to the performance of these companies.ETFs.

The ETF aims to capture the growth of Japan's semiconductor industry and invests in a diversified portfolio of stocks of related Japanese companies.

- Net assets61.434 billion yen

- Setup date: March 31, 2012 September 24, 2021

- Expense Ratio0.649% (0.649%)

- Distribution Yield: (%)0.56%

- Component StocksAlthough a specific list of constituent stocks is not provided, the Fund invests in Japanese companies engaged in semiconductor-related businesses.

- Investment Management CompanyGlobal X

- New NISA support:.Can be invested in the Growth Investment Limit (the Reserve Investment Limit is not available).

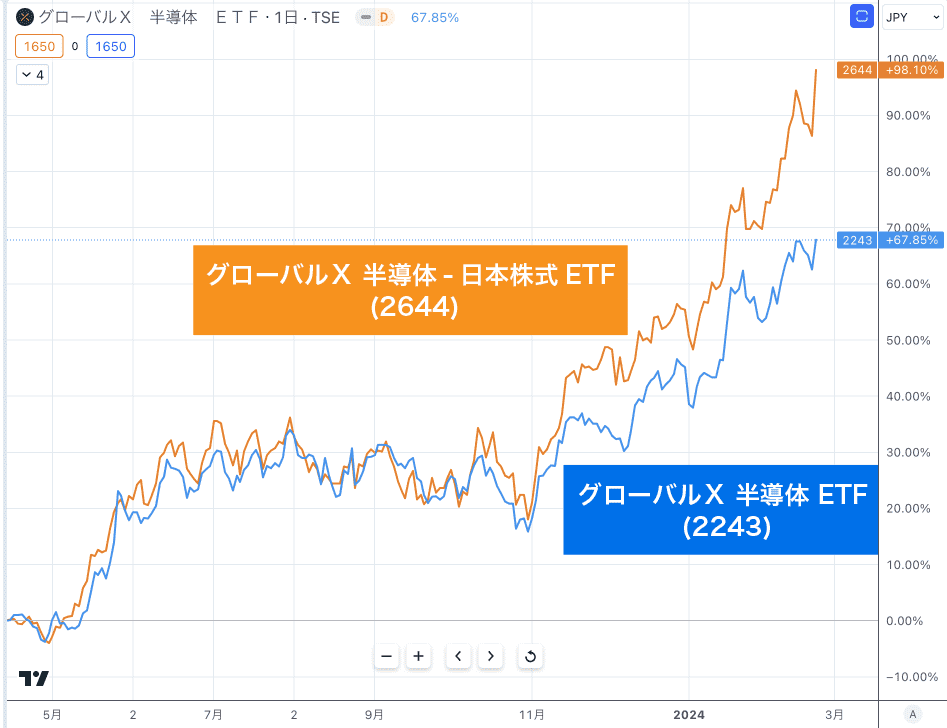

Global X Semiconductor - Japan Equity ETF (2644) vs Global X Semiconductor ETF (2243) Stock Price Comparison Chart

Compare 2644 (Semiconductor Japan Equity ETF) and 2243 (Semiconductor U.S. Equity ETF),2644 (Semiconductor Japan Equity ETF) is outperforming 2243 (Semiconductor U.S. Equity ETF).

This suggests that 2644 invests in Japanese semiconductor-related companies, while 2243 focuses on U.S. semiconductor companies, and thus performs differently depending on market conditions and trends.

Global X Semiconductor ETF Comparison Chart

| (data) item | Global X Semiconductor ETF (2243) | Global X Semiconductor Related - Japan Equity ETF (2644) |

|---|---|---|

| Investment Policy | Investments in U.S.-listed semiconductor-related companies | Investment in Japanese semiconductor-related companies |

| Net assets | 10.329 billion yen | 61.434 billion yen |

| settlement day | 2023/4/11 | 2021/9/24 |

| Expense Ratio | 0.4125% (0.4125%) | 0.649% (0.649%) |

| constituent stocks | Invest in companies included in the SOX index | Invested in Japanese semiconductor-related companies |

Semiconducting mutual funds available in the new NISA (Growth Investment Framework)

Semiconductor-related mutual funds and ETFs available under the new NISA include the following

These can be purchased under the new NISA's "Growth Investment Limit," though,Note that this is not available for the "reserve investment limit.

Nissay SOX Index Index Fund

Through the beneficiary certificates of the Nissay SOX Index Mother Fund, the Fund invests in U.S. stocks, etc. and aims to achieve performance linked to SOX (Philadelphia Semiconductor Stock Index, including dividends, on a yen basis). The Fund does not hedge currency movements and may be affected by currency fluctuations.

- Net Assets:14,205 million yen

- Setup Date:2023/3/31

- Expense Ratio:Trust fee (including tax) 0.1815% per annum

- Distribution Yield:No distribution

Nissay SOX Index Index Fund, Performance Graph

Source:Nissay Asset Management Corporation

Net asset value has increased rapidly since 2024, indicating its popularity.

Nomura Global Sector Investment Series (Global Semiconductor Stock Investment)

We invest in semiconductor-related companies from around the world and determine the stocks in which to invest based on a detailed analysis of the company's technological capabilities, pricing ability, profit structure, and financial condition, as well as the economic conditions of the country or region in which the company operates.

- Net Assets:202,621 million yen

- Setup Date:2009/8/27

- Expense Ratio:Trust fee is 1.65% per annum and 0.3% of trust assets retained

- Distribution Yield:3.36%, with the most recent distribution of 4,350 yen paid on 6/28/2023.

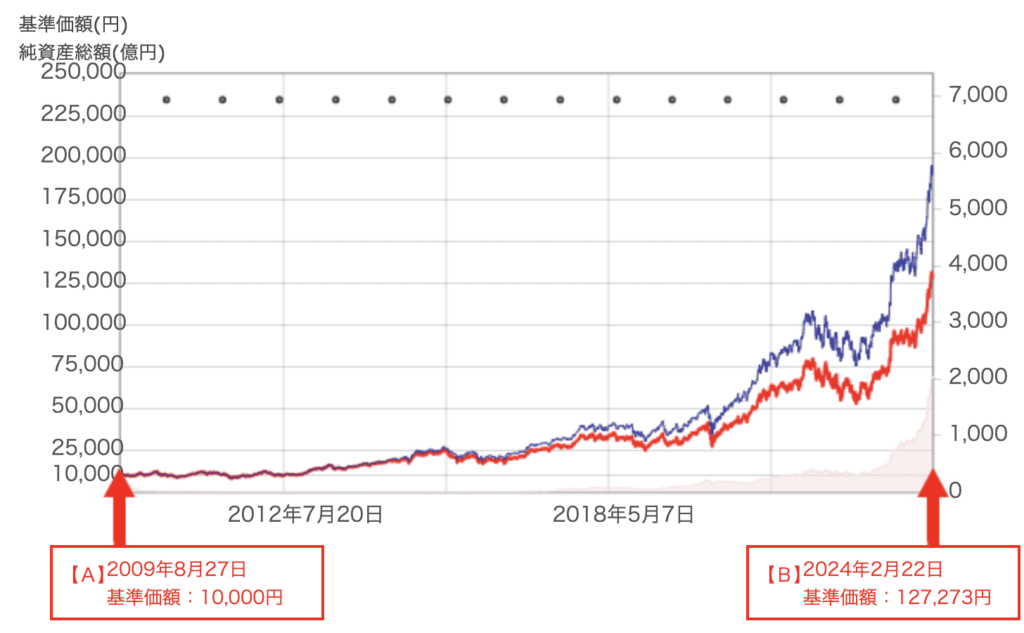

Performance graph of Nomura Global Industry Investment Series (Global Semiconductor Stock Investment)

Source:Nomura Asset Management Co.

Net assets have also increased rapidly here, indicating its popularity.

Comparative chart of semiconductors' mutual funds available under the New NISA (Growth Investment Limit)

| (data) item | Nissay SOX Index Index Fund | Nomura Global Sector Investment Series (Global Semiconductor Stock Investment) |

|---|---|---|

| Investment Policy | Investment in U.S. stocks linked to the SOX index | Investments in semiconductor-related companies around the world |

| Net assets | 14,205 million yen | 202,621 million yen |

| settlement day | 2023/3/31 | 2009/8/27 |

| Expense Ratio | 0.1815% per annum (tax included) | 1.65% per annum (trust fee), 0.3% of trust assets retained |

| Distribution Yield | No distribution | 3.36% (most recent distribution: 4,350 yen on 6/28/2023) |

summary

Investing in the semiconductor sector is an attractive area of growth as technology evolves.

By considering investing in the sector as a whole rather than directly in individual stocks, you can capture the growth potential of this dynamic industry while diversifying your risk.

Here we delve deeper into how to invest in the semiconductor sector as a whole through U.S. ETFs, ETFs that can be traded in the Japanese market, and mutual funds that can be managed under the new NISA (Growth Investment Framework).

The semiconductor industry has a broad industrial structure, with a wide variety of brands ranging from chip design to manufacturing.

Since it is difficult to understand and invest in these stocks individually, investing in the sector as a whole is an efficient and rational approach.

Another option is to invest in NASDAQ, which contains many semiconductor stocks, but ETFs and mutual funds allow for a more specialized focus on the sector.

Since investing in individual stocks is risky in some areas, ETFs and mutual funds can be used to diversify risk and help with strategies to improve performance.

I'm making use of it too! Get the most out of moomoo securities!

I am.moomoo SecuritiesWhat I like most about using the app is that it is easy to use and makes it easy to gather in-depth information, which is important in investing.

Further,Ability to see trends of large and medium investors.and it has been very helpful in considering the future of the stocks.A wealth of news and earnings-related information on each stock, with support for automatic Japanese translationThe company is also happy to provide instant access to information from overseas.

Moomoo Securities also has the lowest U.S. stock trading commissions.

Interested parties can easily register through this banner link!