このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その成果をまとめたものです。

あくまで私の個人的な分析記録であり、内容には誤りや実際と異なる情報が含まれているかもしれません。ご覧になる場合は予めご了承ください。

はじめに

エヌビディアをはじめとするAI半導体の急成長を目の当たりにして、「半導体に早く投資しておけばよかった」と考える方も多いでしょう。

しかし、半導体業界は非常に細分化されており、多くの企業が存在し、投資する銘柄においても選択肢が非常に多いです。

特に、エヌビディアの株価も800ドル台に達しており、市場へのタイミングを見計らうのが難しい状況です。

そのため、個々の半導体銘柄ではなく、米国の半導体セクター全体に投資するETF「SMH」の選択肢について深く掘り下げてみることにします。

このETFは、米国主要半導体25銘柄に分散投資するもので、エヌビディアを含むAI半導体の主要銘柄が含まれています。

このパッケージの魅力とメリット、デメリットを解説し、ハイテク銘柄を集めたナスダック100やレバレッジETFのSOXLとの比較を通じて、それらのパフォーマンスを分析します。

SMHとはどのような特徴を持つETF?

SMH(ヴァンエック半導体ETF)は、半導体産業に特化したETFで、主にアメリカの半導体企業に投資している。

このETFは、「MVID 米国上場半導体25インデックス」にできるだけ密接に追従することを目指しており、この指数は、半導体製造および装備に関与する企業のパフォーマンスを追跡している。

SMHの主な特徴は以下の通り。

- 運用会社:VanEck(ヴァンエック)

- 運用資産総額:約79.8億ドルに達する。

- 経費率:0.35%となっており、特化型のETFとしては一般的な水準。

VanEck(ヴァンエック)とは?

- VanEckは、アメリカに拠点を置くグローバルな投資管理会社。

- 1955年にジョン・C・ヴァンエックによって設立され、特に新興市場や特殊資産クラスに注力している。

- VanEckは、ETF(上場投資信託)の提供においても特に知られており、金、自然資源、不動産などの特定セクターやテーマに焦点を当てた商品を数多く扱っている。

- デジタル資産や持続可能な投資など、革新的な投資ソリューションを提供していることでも評価されている。

ETFについてはこちらで詳しく解説。

SMHの運用の仕組みは?

SMHの運用構造の主要な特徴は以下。

現物拠出型ETF

SMHは「現物拠出型ETF」と呼ばれる種類の投資商品。

具体的には市場で株式を購入し、その株式の「バスケット」(つまり一揃いの株式群)を運用会社に提供する仕組み。

その代わりに、投資家はETFの受益証券を受け取ることにより、SMHは「MVIS米国上場半導体25インデックス」という特定の株価指数の動きにできるだけ密接に追従することを目指す。

つまり、このETFは指数の成績を模倣するように設計されており、その指数に含まれる銘柄の価格変動を反映する。

これによって、投資家は個々の銘柄を直接選ばずとも、半導体セクター全体の動きに投資することが可能になる。

流通市場と発行市場

ETFには流通市場と発行市場の二つの市場が存在する。

流通市場では、一般の投資家が証券取引所でETFを売買し、一方、発行市場では、運用会社と指定参加者(通常は大手金融機関)間でETFの受益権が設定または解約され、これによりETFの発行済み受益権口数が増減する。

このような運用構造により、SMHは株価指数に連動したパフォーマンスを提供しつつ、投資家には株式のような取引の自由度と透明性を提供している。

また、ETFはその構造上、分散投資やリアルタイムでの取引が可能であり、投資戦略に柔軟性を持たせることができる。

SMHの経費率は?

- SMH(ヴァンエック半導体ETF)の経費率は0.35%

この経費率は、ETFの運用に伴う費用をカバーし、指数の追跡精度を維持するために用いられる。コストとしては比較的標準的。

SMHの配当利回りは?

- SMH(ヴァンエック半導体ETF)の配当利回りは現在0.46%

年間で1株あたり約1.0427ドルの配当が支払われる。

半導体は成長産業であるため、配当利回りは低い傾向にある。

SMHの分配金(配当)の支払い時期は?

- SMH(ヴァンエック半導体ETF)は年に一度配当(分配金)を支払う。

通常、米国の株式やETFでは四半期ごと(年4回)に分配金が支払われることが多いが、SMHは年1回の支払いとなっている。

SMHの現在株価と長期チャート

2000年5月から開始されており、運用期間は長い。2023年以降、特に高い成長を示している。

SMHの構成銘柄は?

ヴァンエック・半導体株ETF (SMH)の組入銘柄の構成銘柄と組入比率は以下の通り。

| ティッカー | 企業名(日本語) | 組入比率 |

|---|---|---|

| NVDA | エヌビディア(NVIDIA Corporation) | 19.57% |

| TSM | 台湾積体電路製造(Taiwan Semiconductor Manufacturing Co., Ltd.) | 12.57% |

| AVGO | ブロードコム(Broadcom Inc.) | 7.89% |

| ASML | ASML ホールディング | 4.88% |

| QCOM | クアルコム(QUALCOMM Incorporated) | 4.81% |

| TXN | テキサス・インスツルメンツ(Texas Instruments Incorporated) | 4.76% |

| AMAT | アプライド・マテリアルズ(Applied Materials, Inc.) | 4.58% |

| LRCX | ラムリサーチ(Lam Research Corporation) | 4.54% |

| MU | マイクロン・テクノロジー(Micron Technology, Inc.) | 4.51% |

| AMD | アドバンスト・マイクロ・デバイセズ(Advanced Micro Devices, Inc.) | 3.97% |

| INTC | インテル(Intel Corporation) | 3.94% |

| ADI | アナログ・デバイセズ(Analog Devices, Inc.) | 3.75% |

| KLAC | KLA コーポレーション | 3.51% |

| SNPS | シノプシス(Synopsys, Inc.) | 3.25% |

| CDNS | ケイデンス・デザイン・システムズ(Cadence Design Systems, Inc.) | 3.04% |

| NXPI | NXP セミコンダクターズ(NXP Semiconductors N.V.) | 1.98% |

| MRVL | マーベル・テクノロジー(Marvell Technology, Inc.) | 1.74% |

| MCHP | マイクロチップ・テクノロジー(Microchip Technology Incorporated) | 1.73% |

| STM | STマイクロエレクトロニクス(STMicroelectronics) | 1.26% |

| MPWR | モノリシック・パワー・システムズ(Monolithic Power Systems, Inc.) | 1.00% |

| ON | ON セミコンダクター(ON Semiconductor Corporation) | 0.85% |

| SWKS | スカイワークス・ソリューションズ(Skyworks Solutions, Inc.) | 0.61% |

| TER | テラダイン(Teradyne, Inc.) | 0.52% |

| QRVO | クォーヴォ(Qorvo, Inc.) | 0.40% |

| OLED | ユニバーサル・ディスプレイ(Universal Display Corporation) | 0.29% |

| n/a | 米ドル(US Dollar) | 0.04% |

SMHの主要な構成銘柄には、エヌビディアが約20%を占め、次いでTSMCが12%の割合で含まれている。

これらのAI半導体関連銘柄だけで、全体の30%以上を占めている。

その他にも、エヌビディア関連の半導体銘柄が多く含まれており、これらはETFの優れたパフォーマンスに寄与している。

参照:SMH – VanEck Semiconductor ETF | Holdings & Performance | VanEck

これらの情報は、SMHが半導体産業の主要企業に焦点を当てていることを示しており、技術進化や市場の需要の変動がETFのパフォーマンスに影響を与えることが期待される。

ナスダック100とSMHの違いは?

ナスダック100とSMH(ヴァンエック・半導体株ETF)は、対象とする市場セグメントと構成銘柄において主要な違いがある。

ナスダック100(NASDAQ100)

ナスダック100は、米国のNASDAQ株式市場に上場している非金融セクターの大手企業100社から成る株価指数。

この指数はテクノロジー企業が多くを占めているが、消費財、ヘルスケア、産業など多岐にわたるセクターの企業も含まれている。代表的な構成銘柄にはアップル、アマゾン、グーグル(アルファベット)、フェイスブック(META社)などがある。

SMH(ヴァンエック・半導体株ETF)

一方、SMHは半導体セクターに特化しており、主に半導体製造や関連機器の企業に投資する。SMHは、ナスダック100よりもはるかに専門的なフォーカスを持っており、NVIDIA、台湾積体電路製造(TSMC)、インテルなどの半導体企業が主な構成銘柄。

投資戦略としては、ナスダック100は広範なテクノロジーと非金融セクターに分散投資したい場合に適しており、半導体業界の成長が見込まれる場合、または業界特有の動向に敏感なポートフォリオを組みたい場合はSMHが適している。

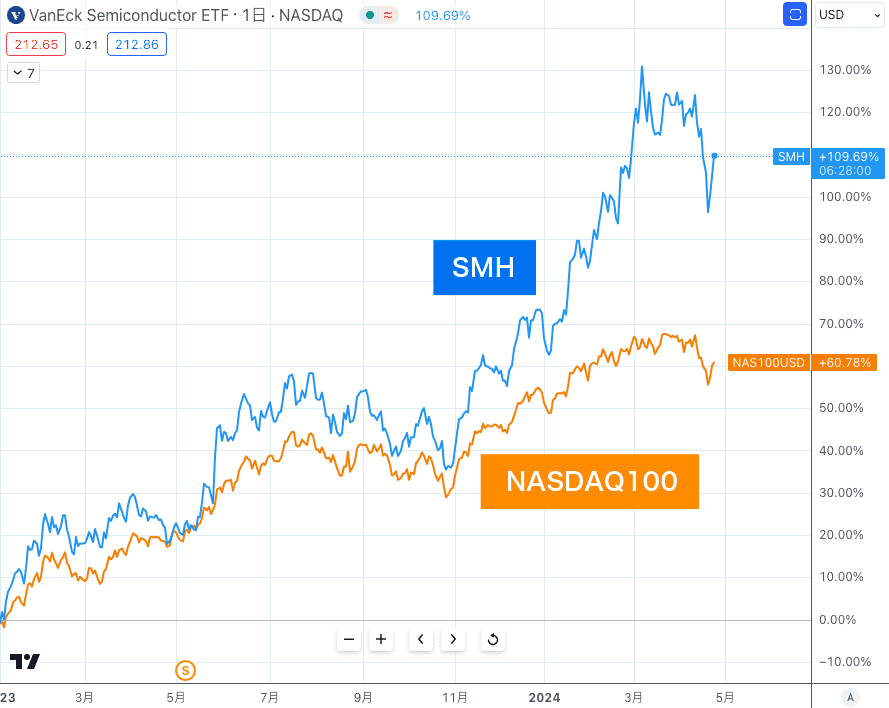

SMHとナスダック100のパフォーマンス比較

2023年から見ると、SMHは約110%のリターンを達成し、ナスダック100は60%の成長を見せている。

この期間、ハイテク銘柄は全体として非常に大きな成長を遂げたが、特にSMHはナスダック100を上回るパフォーマンスを示している。

これは、SMHが特に成長を牽引している重要なハイテク銘柄を多く含んでいるため、SMHは非常に高いパフォーマンスを記録している。

SMHとナスダック100のパフォーマンス比較グラフ

レバレッジETFのSOXLとSMHはどう違う?

SMH(ヴァンエック・半導体株ETF)とSOXL(Direxion デイリー 半導体株ブル3倍 ETF )は、共に半導体業界に関連するETFだが、その性質とリスクプロファイルに大きな違いがある。

SOXL (Direxion デイリー 半導体株ブル3倍 ETF )

SOXLは、Pホルツマン・セミコンダクター指数のパフォーマンスの3倍を目指すレバレッジETF。

つまり、指数が1%上昇するとSOXLの価値は約3%上昇し、逆に1%下落すると3%の価値が下落する。

これは、日々の市場の動きに対して非常に敏感であり、短期的なトレーディングに適している一方で、長期保有にはリスクが高いとされている。

レバレッジETFは、構造上、時間の経過とともに価値が減少する可能性がある(いわゆる「レバレッジ効果の減衰」)。

SOXLのリスクとリターンはSMHよりも大きく、市場の小さな動きに対して大きな影響を受けやすい。

そのため、SMHは長期的な投資に適しており、SOXLは短期的な市場の動きを利用したアクティブなトレーディングに適している。

SMHとSOXLとナスダック100どれに投資すべき?

ETFを選択する際には、投資目標、リスク許容度、投資期間などの個人的な要因を考慮することが重要。

SMH、SOXL、ナスダック100はそれぞれ異なる特性を持っているため、これらの要因に基づいて適切な選択を行う必要がある。

以下はSMH、SOXL、ナスダック100、それぞれのETFの特性を理解するための比較表。

| 特性 | SMH(ヴァンエック・半導体株ETF) | SOXL(Direxion デイリー 半導体株ブル3倍 ETF )) | ナスダック100 |

|---|---|---|---|

| セクターの特化 | 半導体業界専門 | 半導体業界専門 | 広範なテクノロジー及び非金融セクター |

| レバレッジ | なし | 3倍レバレッジ | なし |

| 投資スタイル | 中長期投資向け | 短期トレーディング向け | 長期投資向け |

| リスクレベル | 中 | 高 | 中 |

| 主な投資対象企業 | NVIDIA, TSMC, Intel 等 | NVIDIA, TSMC, Intel 等 | Apple, Amazon, Google 等 |

- SMH:半導体業界に特化し、長期的な成長を目指す投資に適している。業界特有のリスクがあるがが、非レバレッジなので比較的リスクは低い。

- SOXL:同じく半導体業界に特化しているが、日々の市場の動きを3倍に増幅するため、非常にリスクが高くなる。短期的な利益を狙うアクティブトレーダー向けと言える。

- ナスダック100:広範な業種の大手企業に投資し、テクノロジー企業が主体ですが、消費財やヘルスケアなど多様なセクターをカバーしてる。長期的な安定した成長を期待できる投資選択。

SMHに投資するメリットは?

投資する際にSMH(ヴァンエック・半導体株ETF)を選択する主なメリットは以下の通り。

半導体業界への集中投資

SMHは半導体業界に特化しているため、業界の成長が期待される主要企業に投資できる。このため、半導体市場の成長に直接的に関連するリターンを期待することができる。

分散投資によるリスク管理

SMHは米国の主要半導体25企業に投資することで、個々の企業に関連するリスクを分散できる。これにより、単一の企業の不振が全体のパフォーマンスに与える影響を軽減できる。

成長産業へのエクスポージャー

半導体はテクノロジー進化の核心に位置し、スマートフォンからデータセンター、自動運転車に至るまで、幅広く応用されている。SMHへの投資は、このような成長産業へのエクスポージャーを提供できる。

手軽さと流動性

ETFのため、株式と同様に購入・売却が可能。これにより、投資家は容易にポジションを調整することができる。

コスト効率:

SMHは比較的低い経費率を提供しており、投資リターンを食い潰すことなく、効率的な投資が可能。

SMHは技術セクターの発展に焦点を当てつつ、投資家が市場の不確実性を管理しやすい。

SMHの投資で考えられるデメリットは?

SMHへの投資にはいくつかのデメリットもあり、考えられる主なものは以下。

- 業界特有のリスク:SMHは半導体業界に特化しているため、業界特有のリスクに大きく影響されます。技術の進化、製品のサイクル、供給網の問題、政治的なリスクなど、業界固有の変動がETFのパフォーマンスに直接的に影響を与える可能性があります。

- 市場変動性:半導体産業は高い市場変動性を持っているため、技術の急速な進展や経済状況の変化が市場価格に大きな影響を与えることがある。これにより、投資価値が短期間に大きく変動する可能性がある。

- 経済サイクルへの敏感さ:半導体は経済サイクルに敏感な業界です。景気の波によっては、需給が減少し、それが直接的に業界のパフォーマンスに影響を及ぼすことがある。

- 競争の激化:半導体市場は非常に競争が激しく、常に新しい技術や製品が市場に導入されている。競争に遅れをとる企業は迅速に市場シェアを失う可能性があり、これがETFの成績に影響を与えることがある。

これらのデメリットを理解し、自身のリスク許容度と投資目標に合わせて慎重に投資を行うことが重要。

SMHはニーサの対象として選べるのか?

- 一般的なNISAの枠内での取引は可能だが、つみたてNISA(積立NISA)を使ってSMHに投資することはできないため、つみたてNISAの特典を享受することはでない。

- つみたてNISAで投資できるのは、一定の要件を満たした国内投資信託(及び一部の国内ETF)に限られるため、海外ETFであるSMHには投資できない。

つみたて投資枠ではなく、成長投資枠として選択できる投資信託銘柄は以下の2つ

関連記事:新NISA(成長投資枠)で利用できる半導体の投資信託

SMHの株を買える証券会社は?

SMHの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| auカブコム証券 | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

この記事では、主要な米国半導体銘柄に集中投資するETF「SMH」に焦点を当て、その特徴や投資のメリット・デメリットについて詳しく解説しました。

半導体業界は景気の波に敏感であり、約4年ごとに訪れる「シリコンサイクル」と呼ばれる景気循環の影響を受けます。

しかし、AI技術を核とする現在の成長は一時的なものではなく、将来的な発展も大いに期待される分野です。

半導体は日常生活に欠かせない製品に広く使用されており、自動運転のような今後の技術進化においても中核的な役割を果たします。

多くの投資選択肢がありますが、「SMH」はその持続的な成長潜在力を背景に、長期投資に魅力的なETFと言えるでしょう。