このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- はじめに

- まず、ETFとは何ですか?

- ETFと投資信託の違いは?

- VIGはどのような特徴を持つETF?

- VIGの現在株価と長期チャート

- 運用会社のバンガード社とは?

- ETFの経費率とは?何に注意すればよい?

- VIGに投資するメリットは?

- VIGの投資で考えられるデメリットは?

- VIGの構成銘柄は?

- VIGの構成銘柄の入れ替えタイミングは?

- VIGのセクター比率は?

- VIGへの組入条件は?

- VIGの配当利回りは?

- VIGは下落相場に強いのは本当か?

- VIGは今後高配当が期待できるのか?

- 「VIGはおすすめしない」という記事、検索も多くみられがその要因は?

- VIGの構成銘柄では上位25%の高利回り企業は除外されている理由は?

- 投資初心者がVIGと比較検討する他のETFは?

- VIGはニーサの対象として選べるのか?

- VIGの特徴をまとめると

- VIG投資に向いている人は?

- VIGの株を買える証券会社は?

- まとめ

はじめに

NISAの拡大に伴い、米国投資への関心が増しています。

しかし、株式投資が初めての方や米国投資未経験者は、どの銘柄に投資すべきかの判断が難しいことでしょう。私自身もそのような経験があります。

そんな投資初心者や、長期間にわたって少しずつ投資を積み重ねるスタイルをお考えの方に、ETFを活用したインデックス投資を特におすすめします。

ここでは、連続増配ETFとして注目されているVIGについて、深く調査した内容をアウトプットします。

まず、ETFとは何ですか?

- ETFは「Exchange Traded Fund」の頭文字を取ったもので、文字通り取引所(Exchange)で取引される(Traded)投資信託(Fund)のこと。証券取引所に上場している投資信託の一種。

- ETFは、特定の指数、例えば日経平均株価や東証株価指数(TOPIX)などの動きに連動する運用成果を目指すもの。つまり、ETFはその指数の動きを模倣することを目的としているため、例えば日経平均株価に連動するETFは、日経平均株価が上昇すればETFの価格も上昇し、逆に下落すればETFの価格も下落する。

- ETFは株式と同様に証券取引所で取引されるため、取引時間中ならばいつでも売買が可能。これは、通常の投資信託とは異なり、リアルタイムでの価格変動に応じて取引ができるというメリットがある。

- ETFは、特定の市場やセクターへの投資を簡単に行うことができ、多くの投資家に利用されている。例えば、米国のテクノロジーセクターに投資したい場合、そのセクターに連動するETFを購入することで、簡単にその市場への投資を実現することができる。

このように、ETFはその取引のしやすさや、特定の市場へのアクセスを容易にする特徴から、多くの投資家に利用されている。

ETFと投資信託の違いは?

| 項目 | ETF | 投資信託 |

|---|---|---|

| 上場の有無 | 証券取引所に上場 | 通常、証券取引所には上場していない |

| 取扱い場所 | 主に証券会社 | 証券会社、銀行、郵便局など |

| 商品の種類 | 商品数は限られている | 商品数や種類が圧倒的に多い |

| 取引の自由度 | リアルタイムでの取引が可能 | 基準価額が1日1回しか算出されないため、その価格での取引 |

これらの違いを理解し、自分の投資スタイルや目的に合わせて選択しましょう。

VIGはどのような特徴を持つETF?

VIG(Vanguard Dividend Appreciation ETF)は、以下のような特徴を持つ。

連続増配の企業に投資

VIGは10年以上連続で増配(配当を増やし続けている)実績がある、中・大型株に投資するETF。

企業の質が高い

増配できる企業ということは、その企業の業績が良く、株主還元に積極的であることを示しているため、企業がしっかりと株主に還元できる能力を持っていることを意味する。

安心できる運用会社

VIGはアメリカの資産運用会社・バンガード社が提供しています。

投資対象

「米国の連続増配性のある大型企業」を主な投資対象としている。

低い経費率

VIGの経費率は0.06%と非常に低い水準。

もう少し詳しく見ていきます。

VIGの現在株価と長期チャート

2009年の下落がリーマン・ショック時の株価、約30ドル程度。

それから14年経過で、およそ5倍以上の株価成長を見せている。

運用会社のバンガード社とは?

- バンガード社は、1975年にジョン・ボーグルによってアメリカで設立された大手資産運用会社。

- 低コストのインデックスファンドの提供を先駆けとして行い、そのアプローチで業界に革命をもたらした。

- 独特の組織構造を持つバンガードは、投資家が実質的な所有者であるため、投資家の利益を最優先に活動している。

- 非常に低い経費率のファンドを提供し、投資家からの高い信頼を得ている。

- 現在、バンガードは世界的な規模で資産を運用しており、その運用額はトップクラス。

ETFの経費率とは?何に注意すればよい?

ETFの経費率とは、ETFを運用するために必要な費用が、ETFの純資産総額に対してどのぐらいの割合かを表したもの。

具体的には、ETFを保有している間に運用会社に自動的に支払われる費用のことを指す。

この経費率は、ETFの運用コストを示す指標として非常に重要。

経費率を見るときの注意点は以下のとおり。

- 経費率が低いETFは、長期的に見て投資家にとってとても有利。経費率が低ければその分、投資リターンが高くなる可能性がある。

- ETFの経費率は公開されているため、投資前にしっかりと確認することが重要。

- 一般的に、投資信託の運用コストである「信託報酬」と比べ、多くの海外ETFの「経費率」は低い傾向にある。しかし、それだけでなく、取引手数料などの他の費用も考慮する必要がある。

経費率は、投資のリターンに直接影響するため、投資を検討する際には必ず確認し、理解しておくことが必要。

経費率0.06%は平均的なETFの経費率からみてどれくらい低い?

株式ETFの単純平均経費率は0.49%。

わかりやすく説明すると、経費率はETFを保有する際にかかる「運用料」のようなもの。

この経費率が低ければ低いほど、投資家が支払う費用が少なくなり、リターンが高くなる可能性がある。

例えば、100万円を投資した場合、経費率0.49%のETFでは4,900円、経費率0.06%のVIGでは600円の運用料がかかることになる。

この差は、長期間の投資において大きな影響を及ぼすことがあります。

10年投資した場合の経費率を考えると

投資額を100万円と仮定した場合、10年間での経費率0.49%と0.06%の差は、43,000円となる。

これは100万の場合だが、1000万だと43万円もの差となる。

長期投資においては、少しの経費率の違いも侮れないリターンの差として影響する。

VIGに投資するメリットは?

- VIGは、10年以上連続で増配を行っている米国の中・大型株を主な投資対象としているため、安定した業績と健全な財務状況を持ち、株主還元に積極的である。

- VIGは1銘柄で多数の連続増配企業に投資することができるため、リスクの分散が期待できる。

- VIGの経費率は0.06%と非常に低く、長期間の投資においてはこの経費率の低さが大きなメリット。

- VIGは増配だけでなく、株価の上昇も期待できるため、トータルリターンの向上が期待できる。

VIGは安定したリターンを求める投資家にとって魅力的であると言える。

VIGの投資で考えられるデメリットは?

- VIGの配当利回りはそれほど高くない。

- VIGの選定基準により、上位25%の高利回り企業が除外されているため、一時的に高い利回りを示している企業の利益を享受できない。

VIGの構成銘柄は?

VIGの構成銘柄数は、314銘柄。非常に多くの銘柄に分散投資することが可能。

VIG(バンガード・米国増配株式ETF)の主な構成銘柄(上位20銘柄)は以下の通り。

| ティッカー | 企業名 | 組入比率 | |

|---|---|---|---|

| 1 | MSFT | マイクロソフト | 4.83% |

| 2 | AAPL | アップル | 4.66% |

| 3 | UNH | ユナイテッドヘルスグループ | 3.17% |

| 4 | JPM | JPモルガン・チェース・アンド・カンパニー | 3.11% |

| 5 | JNJ | ジョンソン・エンド・ジョンソン | 2.93% |

| 6 | XOM | エクソンモービル | 2.92% |

| 7 | PG | プロクター・アンド・ギャンブル | 2.49% |

| 8 | V | Visa Inc. クラスA | 2.48% |

| 9 | AVGO | ブロードコム | 2.44% |

| 10 | HD | ホームデポ | 2.28% |

| 11 | MA | マスターカード クラスA | 2.23 % |

| 12 | MRK | メルク | 1.82 % |

| 13 | PEP | ペプシコ | 1.74 % |

| 14 | COST | コストコホールセール | 1.67 % |

| 15 | KO | コカ・コーラ | 1.62 % |

| 16 | WMT | ウォルマート | 1.52 % |

| 17 | MCD | マクドナルド | 1.44 % |

| 18 | CSCO | シスコシステムズ | 1.43 % |

| 19 | ACN | アクセンチュア plc クラス A | 1.35 % |

| 20 | ABT | アボット | 1.30 % |

上位10銘柄で全体の31%を占めている。

誰もが知る有名企業や優良企業が多く含まれている。

参照:VIG-Vanguard Dividend Appreciation ETF | Vanguard

VIGの構成銘柄の入れ替えタイミングは?

VIG(バンガード米国増配株式ETF)は毎年3月に銘柄入れ替えを行っている。

直近の銘柄入れ替えは、2023年3月。

2023年3月のVIG銘柄入れ替えのポイントは?

- 新たに組み入れられた主な銘柄は以下。

- Apple(AAPL): 情報技術セクター。組入比率: 4.24%

- Exxon Mobil(XOM): エネルギーセクター。組入比率: 3.27%

- Merck & Co(MRK): ヘルスケアセクター。組入比率: 1.96%

- Elevance Health(ELV): ヘルスケアセクター。組入比率: 0.80%

- Zoetis(ZTS): ヘルスケアセクター。組入比率: 0.56%

セクターの変動は以下。

- エネルギー: +3.3% (主にXOMの追加による)

- 金融: +2.1%

- ヘルスケア: +1.0% (MRK, ELV, ZTSの追加による)

- 公益: +0.2%

- 資本財: -0.4%

- 素材: -0.5%

- 生活必需品: -0.6%

- 通信: -0.6%

- 一般消費財: -2.0%

- 情報技術: -2.5% (AAPLが組み込まれましたが、全体としては縮小)

総銘柄数は「288」から「315」に増加。

特に新たに組み入れられた銘柄の中で、Apple、Exxon Mobil、Merck & Coは組入比率が高く、今後のVIGのパフォーマンスに大きく影響を与えることが予想される。また、エネルギーセクターはExxon Mobilの組み入れにより大幅に強化。

ヘルスケアセクターも3つの新銘柄の組み入れにより強化されている。

VIGのセクター比率は?

上位3セクターで、56%の比率を占めており、情報技術、ヘルスケア、金融の3つのセクターに大きく投資していることがわかる。

| セクター | 比率 | |

|---|---|---|

| 1 | Information Technology(情報技術) | 22.50% |

| 2 | Financials(金融) | 18.00% |

| 3 | Health Care(ヘルスケア) | 15.40% |

| 4 | Industrials(資本財) | 13.10% |

| 5 | Consumer Staples(生活必需品) | 12.00% |

| 6 | Consumer Discretionary(一般消費財) | 7.20% |

| 7 | Materials(素材) | 4.50% |

| 8 | Energy(エネルギー) | 3.00% |

| 9 | Utilities(公益事業) | 3.00% |

| 10 | Communication Services(通信) | 1.30% |

VIGへの組入条件は?

- VIGは、S&P U.S. Dividend Growers Indexに連動するETF。

- この指数は、S&P 500(アメリカの大手上場企業500社を対象とした株価指数)の中で連続して10年以上の増配を行っている企業を対象。

- この指数は、各銘柄を均等にウェイトしており、大手企業の動きに左右されにくい、安定したパフォーマンスを目指している。

VIGは、この「S&P US Dividend Growers指数」をベースにしており、連続増配を行っている企業に投資することで、安定した収益を目指している。

VIGの配当利回りは?

VIG(バンガード米国増配株式ETF)の配当利回りは、現時点ではそれほど高くない。

- 過去10年の平均利回りは約1.9%。

- 現在の利回りはその平均的な範囲。

- 利回りのレンジは1.5~2.3%。

配当利回りは、投資家がETFや株式から受け取る配当の金額を、そのETFや株式の価格で割ったもの。

この数字は、投資家がそのETFや株式からどれだけの収益を期待できるかを示す指標。

VIGの分配金推移

分配金とは、投資信託やETF(上場投資信託)、株式などの投資商品から投資家に支払われる利益のこと。

VIGの分配金は、順調に増えている。

これは、10年連続増配企業を対象としているため成長性が高く、安定したビジネスを行っている企業が多いことが理由。

単位:ドル

| 権利落ち日 | 分配金金額 |

|---|---|

| 2016/9/13 | 0.390 |

| 2016/12/22 | 0.580 |

| 2017/3/29 | 0.420 |

| 2017/6/21 | 0.520 |

| 2017/9/20 | 0.430 |

| 2017/12/21 | 0.550 |

| 2018/3/26 | 0.400 |

| 2018/6/28 | 0.570 |

| 2018/9/26 | 0.500 |

| 2018/12/17 | 0.580 |

| 2019/3/28 | 0.510 |

| 2019/6/17 | 0.470 |

| 2019/9/24 | 0.550 |

| 2019/12/18 | 0.600 |

| 2020/3/26 | 0.470 |

| 2020/6/29 | 0.600 |

| 2020/9/29 | 0.560 |

| 2020/12/21 | 0.660 |

| 2021/3/22 | 0.510 |

| 2021/6/21 | 0.680 |

| 2021/9/20 | 0.700 |

| 2021/12/20 | 0.770 |

| 2022/3/21 | 0.690 |

| 2022/6/21 | 0.690 |

| 2022/9/19 | 0.710 |

| 2022/12/20 | 0.870 |

| 2023/3/24 | 0.750 |

| 2023/6/29 | 0.770 |

| 2023/9/28 | 0.771 |

| 2023/12/21 | 0.916 |

VIGは下落相場に強いのは本当か?

VIG(バンガード米国増配株式ETF)が下落相場において強いとされる理由は以下。

- VIGは、連続して増配を行っている企業を対象としているため、財務的に健全であり、安定したビジネスモデルを持っていることが多い。

- VIGの構成銘柄には高PER銘柄が少ないため、他のETFと比べて下落相場でも安定したパフォーマンスを維持できる。

- VIGは300を超える企業に投資しているため、特定の企業の業績が低迷しても、全体としてのパフォーマンスに大きな影響を受けにくい。

コロナショック時の下落幅は?

コロナショック時のVIGと他のETFの下落幅の違いについては以下。

- VIGの下落率: -12.28%

- SPYの下落率: -15.42%

- QQQの下落率: -24.11%

QQQは、NASDAQ100に連動するハイテク企業のETFのため、VIGの2倍の下落幅となっている。

これらの要因とデータから、VIGは下落相場においても比較的強いパフォーマンスを示す。

VIGは今後高配当が期待できるのか?

- VIGは、連続して増配を行っている企業を対象としているため、安定した業績を維持し、配当金の増加が期待できる。

- VIGは、過去にも増配を続けてきた実績があり今後も増配を続ける能力を持っていることを示している。

これらの要因から、VIGは今後も高配当が期待できる可能性があると言える。

「VIGはおすすめしない」という記事、検索も多くみられがその要因は?

「VIGをおすすめしない」という記事や検索ニーズが多く見られる理由については以下が考えられる。

- VIGは「増配を続けることが株価の成長要因」と考える人に向いており、この特徴に魅力を感じない人にはおすすめとは言えない。

- VIGは長期投資に向いているETFと言えるため、短期投資で検討している人には向いていない。

- VIGはパッシブ運用のETF(特定の指数に追従する運用方法)であり、投資を積極的に運用したい人には適していない可能性がある。

これらの要因から、VIGは特定の投資目的や期間、運用スタイルに合わせて選択する必要があり、一概にすべての投資家におすすめできるわけではないと考えられる。

VIGの構成銘柄では上位25%の高利回り企業は除外されている理由は?

VIGは、連続して増配を行っている企業を対象としているが、上位25%の高利回り企業を除外している。この理由は以下。

- 高い配当利回りを持つ企業は、その利回りを維持することが難しい場合がある。特に、業績が悪化しているにも関わらず高い配当を維持しようとする企業は、将来的に配当を削減するリスクが高まるため、このようなリスクを避けるために高利回り企業を除外している。

- 高い配当利回りだけを追求すると、質の低い企業や一時的な業績の変動によって利回りが高まっている企業を選定するリスクがある。VIGは、質の高い、安定した業績を持つ企業を選定することを目的としているため、単に利回りが高いだけの企業を避けるためにこのような除外基準を設けている。

- 高い配当利回りを持つ企業は、その収益を再投資する余裕が少なくなる場合があるため、企業の成長性が低下するリスクがある。VIGは、増配を続けることができる、成長性のある企業を選定することを目的としているため、高利回り企業を除外している。

これらの理由から、VIGは上位25%の高利回り企業を除外することで、質の高い、安定した業績を持つ、成長性のある企業を選定することを目指している。

投資初心者がVIGと比較検討する他のETFは?

VIGは、VYM、VOOと比較検討されることが多い。その特徴とパフォーマンスについて。

- VYM:高い配当利回りを持つ米国企業を対象としたETF。追跡する指数は「FTSE High Dividend Yield Index」。

- VOO:米国の大型株500社を対象としたETF。追跡する指数は「S&P 500 Index」。

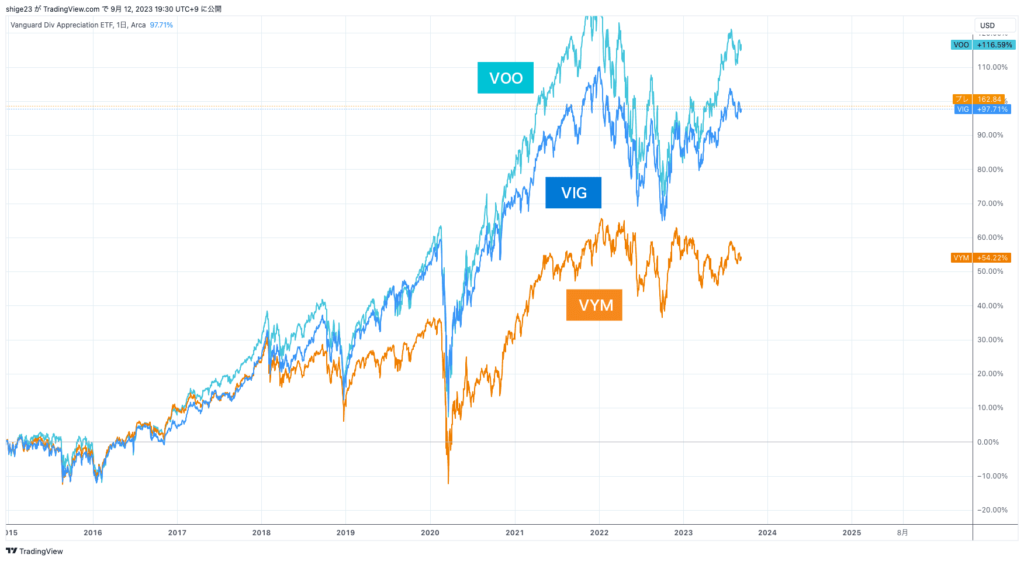

2015年からのパフォーマンスは以下のとおり。

VIG,VYM、VOOとのパフォーマンス比較チャート

パフォーマンスにおいて、それぞれのETFの特徴が鮮明にあらわれている。

VOOは、S&P500に連動しているため、GAFAMや、現在高い成長率を見せているエヌビディアなどが含まれており、VIGに比べ、株価成長率が高い。

VYMは高配当高配当利回りの企業を追跡しているため、テック企業は少ない分株価成長は低め。

VIGは、安定企業に加え、マイクロソフトやアップルなどの情報技術セクター比率も高いため、非常にバランスの取れたETFと言える。

それぞれの特徴を踏まえて、投資目的に沿った適切なETFの選択が重要。

VIGはニーサの対象として選べるのか?

- 一般的なNISAの枠内での取引は可能だが、つみたてNISA(積立NISA)を使ってVIGに投資することはできないため、つみたてNISAの特典を享受することはでない。

- つみたてNISAで投資できるのは、一定の要件を満たした国内投資信託(及び一部の国内ETF)に限られるため、海外ETFであるVIGには投資できない。

VIGの特徴をまとめると

- 10年以上連続で増配している企業を対象としている。

- 経費率はETFの平均0.4%に対し、0.06%と非常に低く、長期投資に適している。

- 高い配当利回り企業はリスクが高いため、上位25%の高配当企業を除外している。

- 安定した企業を中心とした構成のため下落相場に強い。

- アップルが構成銘柄に追加され、価格上昇の期待値も高くなっている。

- 配当利回りは高くないが順調に配当金は順調増えており、将来的に高配当ETFとして期待できる。

VIG投資に向いている人は?

- VIGは長期的な視点での安定したリターンを求める投資家に適している。

- VIGは高すぎる配当利回りの企業を除外しており、過度なリスクを避けたい投資家に適している。

- VIGは多様なセクターに投資しているため、セクターの偏りを避けて投資を行いたい人に向いている。

- VIGの経費率は0.06%と低く、長期間の投資においてもコストが抑えられるため、低い経費率を重視する投資家に適している。

- VIGは下落相場においても比較的安定したパフォーマンスを示す傾向があるため、市場の変動に強いETFを求める投資家に向いている。

VIGの株を買える証券会社は?

VIGの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| auカブコム証券 | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

米国のETF「VIG」の特徴や投資のメリット・デメリットを詳しく解説しました。さらに、他の人気ETF「VOO」と「VYM」との比較を通じて、VIGの独自性や投資適性についても触れています。

私自身は、コロナショック時にVIGを購入し始めました。

それが初めての米国投資であり、現在ではVIGは私のポートフォリオの中心となっています。

特に、アップルが構成銘柄に追加されたことで、VIGはさらに魅力的な投資先となっています。

ただし、VIGは高配当を重視する投資家には必ずしも最適ではないかもしれません。しかし、VIGは価格上昇のパフォーマンスが良好であり、下落相場に対する耐性も強いため、安心して長期投資を行うことができると魅力的なETFと言えるでしょう。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!