このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- はじめに

- パランティアとは何の会社?

- パランティア・テクノロジーズの主力製品は?

- パランティアのビジネスモデル

- パランティア・テクノロジーズの顧客層は?

- パランティア・テクノロジーズ(PLTR)は何がすごい?

- パランティアの「Rule of 40」- ソフトウェア業界史上最高レベルの114%達成の凄さ

- ティッカーシンボルは?

- 取引市場は?

- パランティア・テクノロジーズのセクター、業種、属するテーマは?

- 会社の設立と上場したのはいつ?

- 配当は?

- パランティアが属する業界の規模と成長性は?

- パランティアテクノロジーズ設立の経緯は?

- パランティア・テクノロジーズの競合企業は?

- パランティアの競合との差別化要素と優位性は?

- 1. 統合プラットフォーム:「AI Operating System」

- 2. Ontology(オントロジー):企業のデジタルツイン

- 3. Apollo:マルチ環境対応によるセキュアな配信能力

- 4. 20年以上の政府機関実績:最高レベルのセキュリティと信頼性

- 5. AIP Bootcamp:圧倒的な顧客獲得効率とエンゲージメント

- 6. セキュアなAI実行環境:機密データの保護

- 7. デュアルエンジン・ビジネスモデル:政府+商業

- 8. オペレーショナルレバレッジ:規模の経済の最大活用

- 9. 専門的な非構造データの統合と解析能力

- 10. カスタマイズ可能なプラットフォーム

- 総括:Rule of 40 = 114%が証明する圧倒的優位性

- パランティアが黒字化したのはいつ?

- パランティア・テクノロジーズの現在株価

- パランティア・テクノロジーズの業績について

- パランティア・テクノロジーズの将来性は?今後の見通しは?

- パランティアテクノロジーズの業界への影響

- パランティア・テクノロジーズ(PLTR)の2025年度通期決算サマリー

- パランティア・テクノロジーズ(PLTR)の2025年度Q3決算サマリー

- パランティア・テクノロジーズ(PLTR)の2025年度Q2決算サマリー

- パランティア・テクノロジーズ(PLTR)の2025年度Q1決算サマリー

- パランティアの主要戦略的契約・提携(2025-2026年)

- パランティア・テクノロジーズの決算まとめ

- まとめ

はじめに

AI(人工知能)の進化と共に、半導体やAI関連銘柄の成長が目覚ましい中、パランティアテクノロジーズ(PLTR)はその独自のアプローチで注目を集めています。

マイクロソフトやエヌビディアといった他のAI銘柄と一線を画すこの企業は、ビッグデータ分析をAIで革新し、特に政府機関に対して意思決定を支援する高度な分析と独自のAI技術を提供しています。

AI需要が高まる中で、民間企業からの関心も急速に高まり、その結果、パランティアは顕著な成長と黒字化を実現し、投資家の期待を上回る業績を発表しています。

ここでは、投資や財務、決算に関する専門知識がない方々にも分かりやすく、パランティアテクノロジーズの企業分析を通じて、情報分析ソフトウェアの重要性とその将来性について掘り下げます。

AI関連銘柄として一際異彩を放つパランティアテクノロジーズは注目すべき存在です。

パランティアとは何の会社?

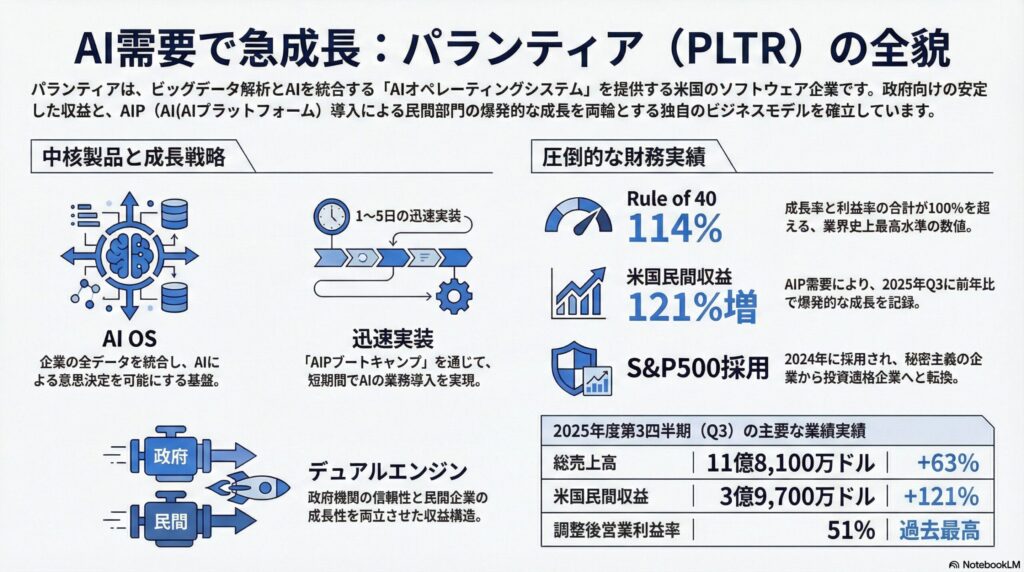

パランティア・テクノロジーズ(Palantir Technologies Inc.)は、ビッグデータ解析とAI技術を統合し、組織の意思決定を革新する米国のソフトウェア企業である。2003年にPayPalの共同創業者ピーター・ティールらによって設立され、現在は「AI Operating System(AIオペレーティングシステム)」として、政府機関と民間企業の両方にミッション・クリティカルなソリューションを提供している。

企業の歩みと現在の立ち位置

- 名前の由来は、J.R.R. トールキンの『指輪物語』に登場する魔法の見通し石「パランティーア(Palantír)」に由来する。遠くを見通す力を持つこの石のように、データから未来を洞察する能力を企業に提供するという理念を体現している。

- 設立当初から米軍、国防総省、FBI、CIA、国土安全保障省などの政府機関に対して、国家安全保障・防衛・テロ対策分野でのデータ分析サービスを提供しており、20年以上にわたる信頼関係を構築してきた。

- 2020年9月にニューヨーク証券取引所に直接上場(ダイレクトリスティング)を果たし、2024年9月にはS&P 500指数に採用された。これは同社が秘密主義のインテリジェンス契約企業から、主流の投資適格企業へと転換したことを象徴している。

- 2023年以降、Artificial Intelligence Platform(AIP)の登場により、民間企業からの需要が爆発的に拡大。特に米国商業部門の収益が2025年Q3に前年同期比121%成長を記録し、政府依存から脱却した「デュアルエンジン型ビジネスモデル」を確立している。

- 2026年時点では、南米のHD Hyundaiや、欧州・中東・アフリカ地域のSovereign AIなどとの大型戦略的パートナーシップを通じて、グローバルAIインフラストラクチャの中核企業としての地位を固めている。

事業領域と顧客

政府セクター(Government):

- 米国防総省、諸情報機関、同盟国政府機関

- 国家安全保障、軍事作戦計画、サイバーセキュリティ、災害対応

商業セクター(Commercial):

- 製造業、金融、ヘルスケア、エネルギー、小売、建設、保険など多様な業界

- サプライチェーン最適化、リスク管理、資産管理、オペレーション効率化

最新顧客事例(2025-2026年):

- Heineken、Walgreens、R1 RCM、RaceTrac、Ripcord(新規顧客、2025年AIPCon発表)

- AT&T、Delta Air Lines、KKR(既存大手顧客)

- Ursa Major(AI統合製造実行システム導入、2025年10月)

- HD Hyundai(造船、建設、ロボティクス、電気システム全社導入、2026年1月拡大)

パランティア・テクノロジーズ(PLTR)の企業情報は以下。

- 会社名:Palantir Technologies Inc.

- 設立年:2003年

- 本社所在地:コロラド州デンバー

- 代表者:Alexander C. Karp(共同創業者・CEO)、Peter Thiel(共同創業者・会長)

- 公式サイト:https://www.palantir.com

- 主な事業内容:ビッグデータ統合・分析プラットフォーム、AI駆動型意思決定支援ソフトウェア、エンタープライズAIオペレーティングシステム

パランティアのミッション・ステートメント

「世界で最も重要な機関がデータを活用して、最も困難な問題を解決できるようにする」(Enable the world’s most important institutions to use their data to solve their hardest problems)

パランティアは単なるソフトウェアベンダーではなく、顧客組織のデータインフラストラクチャ全体を統合するAI Operating Systemを提供することで、これまで不可能だったレベルのデータ駆動型意思決定を実現することを目指している。膨大で複雑なデータを統合・分析し、組織が直面する困難な問題を解決し、より多くの価値を引き出せるようにすることを使命としている。

パランティア・テクノロジーズの主力製品は?

パランティアの製品ラインナップは、4つのコアプラットフォームで構成されており、これらが統合されて「AI Operating System(AI OS)」として機能している。

1. Gotham(ゴッサム)- 政府機関向けプラットフォーム

できること:国家安全保障、軍事作戦支援、犯罪捜査、インテリジェンス分析

- 概要:主に政府機関・国防部門向けに提供されているデータ統合・分析プラットフォームで、テロ対策、犯罪捜査、国防関連の機密データを統合し、迅速かつ正確な意思決定をサポートする。

- 主な機能:

- 複数の機密データソースの統合と可視化

- リアルタイムでの状況認識(Situational Awareness)

- オペレーション計画立案と実行支援

- 脅威検知と予測分析

- 主な用途:軍事作戦の計画、犯罪捜査、情報分析、サイバーセキュリティ、災害対応

- 顧客事例:米国防総省、CIA、FBI、国土安全保障省、英国防省、同盟国諸情報機関

2. Foundry(ファウンドリー)- 民間企業向けプラットフォーム

できること:事業運営最適化、サプライチェーン管理、資産管理、データドリブン意思決定支援

- 概要:民間企業向けのプラットフォームで、企業が自社内の複雑なデータを統合・管理し、ビジネスインテリジェンスを強化することを目的としている。

- 主な機能:

- エンタープライズデータの統合と標準化

- ノーコード/ローコードでのデータアプリケーション構築

- デジタルツイン(Digital Twin)の作成と運用

- クロスファンクショナルなコラボレーション環境

- 主な用途:資産管理、サプライチェーン管理、製造オペレーション、医療サービス、金融リスク管理、エネルギー資源最適化

- 顧客事例:AT&T、Delta Air Lines、HD Hyundai、Walgreens、Heineken、KKR、SOMPOホールディングス

3. Apollo(アポロ)- ソフトウェア配信・管理プラットフォーム

できること:セキュアなソフトウェア配信、バージョン管理、マルチ環境対応

- 概要:GothamやFoundry、AIPを含むパランティアのソフトウェアスタック全体を、顧客の複雑な環境(クラウド、オンプレミス、エアギャップド環境、エッジデバイス)に継続的かつセキュアに配信・更新するプラットフォーム。

- 主な機能:

- 継続的デリバリーとアップデート(週次以上の頻度)

- セキュアな環境(機密ネットワーク含む)への配信

- 複数環境の一元管理

- ゼロダウンタイムのアップグレード

- 戦略的重要性:Apolloにより、パランティアは顧客環境を問わず最新のAI機能を迅速に展開でき、これが競合に対する大きな差別化要素となっている。

4. Palantir AIP(Artificial Intelligence Platform)- AI統合プラットフォーム ★最重要製品★

できること:大規模言語モデル(LLM)の企業データへの統合、AI駆動型ワークフロー自動化、生成AIアプリケーション開発

概要と戦略的位置づけ

Palantir AIP(Artificial Intelligence Platform)は、2023年4月に発表されたパランティアの最先端AIプラットフォームであり、同社の成長を牽引する最も重要な製品である。

AIPは、OpenAIのGPTやGoogle Gemini、Meta Llamaなどの大規模言語モデル(LLM)を、顧客の機密データと安全に統合し、企業のオペレーションに直接組み込むことを可能にする。これにより、単なる「ChatGPTでの質問応答」を超えた、実行可能なAI駆動型業務プロセスを実現している。

主な機能と特徴

- Ontology(オントロジー)統合

- 企業のデータ、プロセス、ビジネスロジックを構造化されたオントロジーとして定義

- LLMが企業の「デジタルツイン」を理解し、適切に操作できるようにする

- データガバナンスとアクセス制御を維持しながらAIを活用

- マルチモーダルLLM対応

- 複数のLLM(OpenAI GPT-4、Claude、Llama、Gemini等)を同時に活用

- タスクに応じて最適なLLMを自動選択

- プライベートLLMのホスティングとファインチューニング

- AI駆動型ワークフロー自動化

- 自然言語での指示により、複雑な業務プロセスを自動実行

- 例:「先月の在庫データを分析し、来月の需要予測を行い、発注推奨を作成してサプライヤーに送信」

- 人間の承認プロセスを組み込んだAI意思決定フロー

- セキュアなAI実行環境

- 機密データがLLMベンダーに送信されないアーキテクチャ

- 役割ベースのアクセス制御(RBAC)とデータガバナンス

- 監査ログとAI判断の説明可能性

AIP Bootcamp(ブートキャンプ)- 圧倒的な顧客獲得手法

AIPの爆発的な普及を支えているのが、AIP Bootcampという独自の顧客獲得・導入支援プログラムである。

Bootcampの特徴:

- 期間:1〜5日間の集中トレーニングセッション

- 成果:「ゼロからユースケース実装まで」を数日で達成

- 参加者:顧客企業の実務担当者、エンジニア、経営層

- プロセス:

- 顧客の実際のデータを使用

- パランティアのエンジニアと顧客チームが協働

- 具体的なAIユースケースを即座に実装

- 実際の業務プロセスへの統合まで完了

実績と効果:

- 需要急増:2025年時点でBootcamp申込バックログが積み上がり続けている

- 成約率向上:参加企業の多くが実際の契約に至る

- セールスサイクル短縮:従来の長期営業プロセスを劇的に短縮

- 顧客の自律化:Bootcamp後、顧客自身が新たなAIユースケースを独自に開発できるようになる

パートナー企業の声:

- 「何年も解決できなかった問題を、数日で解決できた」

- 「AIPユースケースを独自に特定・実行できる能力を獲得した」

最新顧客事例(2025-2026年)

製造業:

- Ursa Major(航空宇宙・防衛):AI統合製造実行システム(MES)を導入(2025年10月AIPCon 8で発表)

小売・消費財:

- Heineken(新規発表、2025年3月AIPCon)

- Walgreens(新規発表、2025年3月AIPCon)

- RaceTrac(新規発表、2025年3月AIPCon)

ヘルスケア:

- R1 RCM(医療収益サイクル管理、新規発表2025年3月AIPCon)

物流・保管:

- Ripcord(新規発表、2025年3月AIPCon)

既存大手顧客のAIP拡大:

- AT&T、Delta Air Lines、KKR(プライベートエクイティ)

重工業:

- HD Hyundai(造船、建設、ロボティクス、電気システム全社導入、2026年1月グループ全体に拡大)

収益インパクト

AIPの導入により、パランティアの米国商業部門収益は爆発的に成長している。

- 2025年Q3実績:米国商業収益3億9,700万ドル(前年同期比+121%)

- 2025年通年見通し:米国商業収益14億3,300万ドル以上(前年比+104%以上)

- 契約価値(TCV):2025年Q3に米国商業TCV が13億1,000万ドルを記録(前年同期比+342%)

なぜAIPが重要なのか

- 市場タイミング:生成AIブームと企業のAI導入ニーズが重なる最適なタイミングで投入

- 差別化:単なるLLMラッパーではなく、企業のオペレーションに深く統合されたAI OS

- 商業部門の転換:政府依存からの脱却を実現し、「デュアルエンジン」ビジネスモデルを確立

- 成長エンジン:Bootcampモデルにより、従来のエンタープライズソフトウェアにはない速度で顧客を獲得

- 競合優位性:Foundry/Gotham/Apolloという既存プラットフォームとの統合により、競合が模倣困難な総合力を発揮

AIPは商業および政府部門での成長を推進しており、その需要は急速に拡大している。

多くの企業がAIPを利用して、業務の自動化やプロセスの最適化、データ駆動型AIアプリケーションの展開を行っており、特に米国内の商業収益が大きく増加している。

パランティアのCEO Alex Karpは、「AIPは単なる製品ではなく、企業がAIを実際のオペレーションに統合するためのオペレーティングシステムである」と述べている。この戦略が、2024年9月のS&P 500採用、2025-2026年の爆発的成長につながっている。

パランティアのビジネスモデル

パランティア・テクノロジーズのビジネスモデルは、主に以下の要素で構成されている。

サブスクリプションベースのソフトウェアライセンス

パランティアは、顧客に対してソフトウェアプラットフォームの使用ライセンスを提供し、定期的な使用料を収益の一部としている。

プロフェッショナルサービスとサポート

パランティアは、ソフトウェア導入やカスタマイズ、運用サポートを含むプロフェッショナルサービスを提供しており、顧客がより効果的に製品を活用できるように支援し、収益を得ている。

長期契約

特に政府機関との契約は長期にわたることが多く、安定した収益源となっており、リスク管理や業務効率化など、重要な領域でのデータ解析を継続的に提供している。

データ駆動型ソリューション

パランティアは、ビッグデータとAI技術を駆使して顧客がデータから洞察を得ることを支援しており、顧客はデータに基づいた意思決定を迅速に行えるようになる。

パランティアのビジネスモデルは、これらの要素を通じて、顧客に対する高付加価値のサービスを提供し、長期的なパートナーシップを築くことを目指している。

パランティア・テクノロジーズの顧客層は?

政府機関

パランティアは、米国の国防総省やCIA、FBIなどの政府機関にデータ分析ソリューションを提供している。これらの機関は、国防や安全保障、法執行などの分野で、パランティアの技術を利用してデータの統合と分析を行い、重要な意思決定を支援している。

また、英国やドイツなど他国の政府機関も顧客に含まれている。

民間企業

商業セクターでは、金融、ヘルスケア、エネルギー、製造業などの大手企業がパランティアのデータ分析プラットフォームを利用しており、企業は業務効率化やリスク管理、マーケットインサイトの取得などを行っている。

具体的な導入例として、保険業界のSOMPOホールディングスや、金融機関などが挙げられる。

パランティアは、これらの顧客に対して、データ駆動型の意思決定支援を提供することで、様々な業界における課題解決をサポートしている。

パランティアは、データ駆動型の意思決定支援を提供し、様々な業界における課題解決をサポートしている。

パランティア・テクノロジーズ(PLTR)は何がすごい?

パランティア・テクノロジーズは、その革新的なデータ分析技術とAI活用によって際立っている。

まず、同社は複雑で多様なデータを統合し、それを基に顧客が迅速かつ正確な意思決定を行えるようにする能力に優れている。

これは、主力製品である「Gotham」や「Foundry」を通じて実現されており、これらのプラットフォームは、政府機関や民間企業の多様なニーズに応えることができ、国防や安全保障、リスク管理、業務効率化などの分野で活用されている。

さらに、パランティアはデータの可視化と解析に特化し、特に非構造データの処理能力に強みがある。

文書、画像、音声など、さまざまな形式のデータを効果的に処理し、それを基に新たな洞察を引き出すこの技術は、顧客にとって非常に価値があり、戦略的なビジネスインサイトを提供する役割を果たしている。

また、パランティアは、政府機関や商業セクター向けに長期的かつ信頼性の高いパートナーとしての地位を築いており、特に、米国政府機関との関係が強固であり、これが同社の安定した収益基盤の一部となっている。

さらに、商業セクターへの進出を加速し、金融、医療、製造業など幅広い分野でその技術を応用している。

このように、パランティアはその技術革新力と幅広い顧客基盤により、データ分析業界において独自の存在感を示しており、多くの企業や政府機関にとって不可欠なパートナーとなっている。

パランティアの「Rule of 40」- ソフトウェア業界史上最高レベルの114%達成の凄さ

Rule of 40とは何か?

Rule of 40(ルール・オブ・40)は、SaaS(Software as a Service)企業およびソフトウェア企業の健全性を測る重要な財務指標である。

計算式:

Rule of 40 = 売上成長率(%)+ 営業利益率(%)この指標は、成長性と収益性のバランスを一つの数値で表現する。

評価基準:

- 40%以上:健全なビジネス(”Rule of 40″の名前の由来)

- 50%以上:優れたパフォーマンス

- 60%以上:極めて優秀

- 70%以上:業界トップクラス

- 100%以上:歴史的にほとんど例がない

多くのSaaS企業は30%台前半に留まっており、50%を超える企業は限られている。

なぜRule of 40が重要なのか?

Rule of 40は、成長と利益のトレードオフを可視化する。

一般的に、ソフトウェア企業は以下のいずれかに偏りがちである。

- 高成長・低利益:スタートアップや急成長企業(例:売上成長率50%、利益率▲10% = Rule of 40: 40%)

- 低成長・高利益:成熟企業(例:売上成長率10%、利益率30% = Rule of 40: 40%)

Rule of 40が40%を超えていれば、どちらのパターンでも健全とされる。

しかし、高成長かつ高利益を両立する企業は稀であり、Rule of 40が70%を超えると「成長しながら利益も出せる理想的なビジネスモデル」として高く評価される。

パランティアの驚異的な114% Rule of 40達成(2025年Q3)

2025年第3四半期(Q3)、パランティアは以下の実績を発表した。

- 売上成長率:63%(前年同期比)

- 調整後営業利益率:51%

- Rule of 40スコア:114%

この114%という数値は、「ソフトウェア業界でほとんど見られないレベル」「おそらくソフトウェア企業が達成した中で最高の数値」と評されている。

114%の内訳と意味

63%の売上成長率:

- 総売上:11億8,100万ドル(前年同期比+63%、前四半期比+18%)

- 米国商業収益:3億9,700万ドル(前年同期比+121%)

- 米国政府収益:4億8,600万ドル(前年同期比+52%)

これは、高い成長率を維持していることを示している。通常、企業が大規模になるほど成長率は鈍化するが、パランティアはAIPの爆発的な需要により、むしろ成長が加速している。

51%の調整後営業利益率:

- 過去最高水準の利益率

- 前年同期(38%)から大幅改善

- GAAP営業利益率も33%に達している

これは、高い収益性を実現していることを示す。通常、急成長企業は営業赤字や低利益率に苦しむが、パランティアは成長しながら利益率を拡大している。

他のRule of 40スコアとの比較

パランティアの歴史的推移:

- Q4 2024:Rule of 40 = 81%(売上成長率36% + 営業利益率45%)

- Q3 2025:Rule of 40 = 114%(売上成長率63% + 営業利益率51%)

1年間で33ポイント改善しており、これは異例の加速である。

他のソフトウェア企業の参考値(概算):

- Snowflake:約40-50%程度

- Databricks:非上場のため公開情報なし、推定50%前後

- ServiceNow:約50-60%程度

- Microsoft(クラウド部門):約60-70%程度(推定)

パランティアの114%は、これらの優良企業の2倍近い水準である。

なぜパランティアは114%を達成できたのか?

1. AIPによる爆発的な商業部門成長

- 米国商業収益が前年同期比+121%と、従来の倍以上の成長率を記録

- AIP Bootcampによる効率的な顧客獲得と短いセールスサイクル

- TCV(Total Contract Value)が過去最高の27億6,000万ドル(前年同期比+151%)を記録

2. オペレーショナルレバレッジ(規模の経済)

- ソフトウェアビジネスの特性上、売上増加に対して営業費用の増加が緩やか

- 調整後フリーキャッシュフローが5億4,000万ドル(Q3単独)、TTM(過去12ヶ月)で20億ドルを達成

- 粗利益率が81%という高水準を維持

3. プラットフォーム効果

- Gotham、Foundry、Apollo、AIPという4つのプラットフォームが相互に補完

- 顧客の「Land(初期導入) and Expand(拡大)」パターンが確立

- 既存顧客のNet Dollar Retention(NDR)が高水準を維持

4. デュアルエンジン・ビジネスモデル

- 政府部門(安定収益)と商業部門(高成長)の両輪

- 一方がスローダウンしても、他方がカバーする安定性

Rule of 40が投資家にとって意味すること

Rule of 40が40%を超える企業は、一般的に12〜15倍の売上倍率(Price/Sales Ratio)で評価される。

パランティアのように114%という極めて高いRule of 40を達成している企業は、持続的な成長と収益性を両立できる稀有なビジネスモデルを持つと評価され、プレミアム・バリュエーションが正当化される。

2026年1月時点で、パランティアの株価は約167ドル、P/E比率は約364倍と高い水準にあるが、Rule of 40の114%という実績は、この高いバリュエーションを支える重要な根拠の一つとなっている。

Rule of 40の持続可能性と今後の見通し

2025年通期ガイダンス(2025年11月時点):

- 売上成長率:53%(前年比)

- 調整後営業利益率見通し:37-38%程度(通期ベース)

- 推定Rule of 40:90%前後(通期ベース)

Q3の114%は季節性やタイミングの影響もあるが、通期でも90%前後という極めて高水準を維持する見込みである。

2026年以降の見通し:

- AIPの需要拡大が継続

- 米国商業部門の成長加速(2025年通期で+104%以上の見通し)

- オペレーショナルレバレッジのさらなる向上

CEOのAlex Karpは、「パランティアはまだ成長の初期段階にある」と述べており、Rule of 40の高水準維持、さらには100%超の継続的な達成も視野に入れている。

まとめ:Rule of 40が示すパランティアの凄さ

パランティアの114% Rule of 40達成は、単なる一時的な好業績ではなく、以下を証明している。

- 持続可能な高成長:AIPという革新的製品による構造的な需要拡大

- 高収益ビジネスモデル:ソフトウェアの規模の経済を最大限活用

- オペレーショナルエクセレンス:効率的な顧客獲得(Bootcamp)と高い顧客維持率

- 戦略的優位性:競合が模倣困難な統合プラットフォーム

Rule of 40という客観的指標で見ると、パランティアはソフトウェア業界史上最高レベルのパフォーマンスを発揮しており、「AI Operating System」としての地位を確固たるものにしている。

この驚異的な数値が、パランティアの株価上昇(2025年に+122%)とS&P 500採用という評価につながっている。

ティッカーシンボルは?

パランティアテクノロジーズのティッカーシンボル(株式の識別コード)は「PLTR」

取引市場は?

パランティアテクノロジーズは、NYSE(ニューヨーク証券取引所)市場で取引されている。

パランティア・テクノロジーズのセクター、業種、属するテーマは?

セクター

テクノロジー(Technology):パランティア・テクノロジーズはテクノロジーセクターに属している。このセクターは、データ解析やAI技術を駆使し、ビジネスや政府機関における意思決定を支援するためのソリューションを提供しており、パランティアは、これらの技術を用いて、顧客の戦略的な課題解決を支える重要な役割を果たしている。

業種

ソフトウェア&サービス(Software & Services):パランティアは、ソフトウェア&サービス業種に分類される。主にデータ統合、解析、可視化を行うソフトウェアプラットフォームを提供し、顧客のビジネスインテリジェンスを強化し、顧客はより効率的にデータ駆動型の意思決定を行うことができる。

属するテーマ

ビッグデータとAI(Big Data and AI):パランティアは、ビッグデータとAIをテーマに活動している。これらの技術を組み合わせることで、顧客が膨大なデータから価値ある洞察を引き出すことを可能にし、データドリブンの戦略的意思決定を支援。また、特に非構造データの分析能力において強みを持ち、多様な業界での応用を進めている。

会社の設立と上場したのはいつ?

2003年に設立され、2020年9月30日に米国の株式市場で公開(IPO)され、ニューヨーク証券取引所(NYSE)に上場

配当は?

実施せず

パランティアが属する業界の規模と成長性は?

パランティアが属する業界は、エンタープライズAIソフトウェア市場およびAIプラットフォーム市場であり、2026年時点で世界で最も高い成長性を示している分野の一つである。

エンタープライズAI市場の規模と成長性(2026年最新)

市場規模の推移:

- 2024年:130億ドル(エンタープライズAIプラットフォーム市場)

- 2025年:148億ドル

- 2026年:1,148億7,000万ドル(エンタープライズAI市場全体、サービス・ハードウェア含む)

- 2030年予測:503億ドル(エンタープライズAIプラットフォーム市場)

年間成長率(CAGR):

- エンタープライズAIプラットフォーム:27.7% CAGR(2025-2030年)

- AI市場全体:20-30% CAGR

注意:市場規模の数値に幅があるのは、定義の違いによる(ソフトウェアのみ vs サービス・ハードウェア含む)。

AIプラットフォーム市場の規模

- 2026年:721億8,000万ドル

- 2031年予測:1,500億ドル以上

これは、企業がAIを実際のオペレーションに統合する需要が爆発的に拡大していることを示している。

市場成長の主要ドライバー

1. 生成AI革命とエンタープライズ導入の本格化

2023年以降、ChatGPT等の登場により生成AIが一般化し、企業のAI導入が実験段階から本格導入段階に移行している。

- 自動化への強い需要

- AIリテラシーの向上

- バイヤーエコシステムの成熟

2. クラウドネイティブAI-as-a-Serviceプラットフォームの普及

- クラウド展開が市場の64-67%を占有

- オンプレミスソリューションも重要(特に政府・金融で)

- ハイブリッド・マルチクラウド対応の需要拡大

3. 専用コンピューティングハードウェアの進化

- GPU/TPU等の専用ハードウェアによるAI処理高速化

- エッジAIの普及

4. データ主権(Sovereign AI)要求の高まり

- 各国政府が自国データの管理を重視

- 地域別AIインフラの需要拡大

- パランティアのSovereign AIプロジェクト(EMEA地域)はこのトレンドに対応

地域別市場動向

北米:

- 市場シェア:39-68%(定義により変動)

- 最大市場であり、パランティアの主要収益源

- 米国商業部門が特に急成長(パランティア:2025年Q3に+121%)

アジア太平洋:

- 最も高いCAGRを示す地域

- 中国、インド、東南アジアでの需要拡大

- パランティアのHD Hyundai契約(韓国)はこの地域での本格展開の開始

欧州:

- データプライバシー規制(GDPR等)への対応需要

- Sovereign AIプロジェクト(パランティア)による地域別AIインフラ構築

パランティアの市場ポジション

パランティアは、このエンタープライズAI市場において独自のポジションを確立している。

主要競合:

- Databricks(非上場)

- Snowflake(SNOW)

- C3.ai(AI)

- ハイパースケーラー(Microsoft Azure、AWS、Google Cloud)

パランティアの差別化:

- 「AI Operating System」としての統合プラットフォーム(Gotham、Foundry、Apollo、AIP)

- 政府機関との20年以上の実績によるセキュリティ信頼性

- AIP Bootcampによる圧倒的な顧客獲得効率

- Apolloによるマルチ環境対応(クラウド、オンプレミス、機密ネットワーク、エッジ)

市場シェア拡大の証拠:

- 2025年Q3:総売上11億8,100万ドル(前年同期比+63%)

- 米国商業収益:3億9,700万ドル(前年同期比+121%)

- TCV(Total Contract Value):27億6,000万ドル(前年同期比+151%)

- Rule of 40スコア:114%(業界最高レベル)

今後の市場展望とパランティアの機会

2026年以降の市場トレンド:

- エンタープライズAI導入の本格化:実験から本番環境への移行

- 業種別AI特化:製造、小売、ヘルスケア等、各業種特有のAIソリューション需要

- AIガバナンスとセキュリティ:規制対応と安全なAI実行環境の需要拡大

- Sovereign AI:各国・地域別のAIインフラ構築

- オペレーショナルAI:単なる分析を超えた、実行可能なAI統合

パランティアの成長機会:

- AIPの継続的な需要拡大

- グローバル展開の深化(アジア、EMEA)

- 新業種への浸透(製造、小売、ヘルスケア等)

- Sovereign AIプロジェクトによるインフラレイヤーでの価値提供

- パートナーエコシステム(Accenture等)を通じた販売チャネル拡大

パランティアは、この急成長する市場において、Rule of 40 = 114%という業界最高レベルの実績により、成長性と収益性を両立する稀有な企業として、市場シェアを拡大し続けている。

CEOのAlex Karpが述べる「パランティアはまだ成長の初期段階にある」という言葉は、2030年に500億ドルを超えると予測されるエンタープライズAIプラットフォーム市場における、同社の長期的な成長ポテンシャルを示唆している。

AIは特に、製造、金融、医療、エネルギーなどの分野で革新的な変化をもたらしている。

このように、パランティアが属する業界は、デジタルトランスフォーメーションの進展に伴い、非常に高い成長性を示し、パランティアの技術とサービスは、この成長を支える重要な要素となり、多くの企業や政府機関がデータ解析とAIを活用して競争力を強化している。

パランティアテクノロジーズ設立の経緯は?

- 2003年にピーター・ティール、アレックス・カープ、ジョー・ロンズデール、スティーブン・コーエン、ナサン・ゲッティングスによって共同で設立された。

- ピーター・ティールはPayPalの共同設立者として知られ、ペイパルマフィアとして有名な存在。

- 設立の背景には、9/11テロ攻撃後の情報収集と解析の必要性があり、テロリストの活動を早期に発見し、防止することを目指した。

- 初期の製品は、特に政府機関や防衛関連の組織が、大量のデータを集め、分析し、視覚化するためのソフトウェア。潜在的な脅威を特定し、適切な対策を講じることが可能となる。

- その後、製品を民間企業向けにも展開、現在では金融サービス、ヘルスケア、法執行機関など、さまざまな産業の企業がパランティアのソフトウェアを利用している。

パランティア・テクノロジーズの競合企業は?

パランティア・テクノロジーズの主要な競合企業は、エンタープライズAIプラットフォーム市場およびデータ分析市場において以下の通りである。

1. Databricks(非上場)

概要:

データレイクハウス・プラットフォームを提供し、データエンジニアリング、データサイエンス、機械学習を統合する企業。Apache Sparkの開発元として知られる。

競合関係:

- データ統合・分析の領域で直接競合

- 大規模データ処理とMLOpsに強み

- MicrosoftおよびSnowflakeとの緊密な連携を深めている

差別化ポイント(パランティア視点):

- Databricksはデータエンジニア向け、パランティアはビジネスユーザー・オペレーション向け

- パランティアはセキュアな実行環境と政府実績で優位

2. Snowflake(SNOW)

概要:

クラウドベースのデータウェアハウスサービスを提供する企業で、データストレージ、処理、分析を容易にする。Cortex AIスイートにより、AI機能を統合している。

競合関係:

- データプラットフォームとして直接競合

- データの集約と分析において強力

- Snowflake CortexがAI機能を強化し、パランティアのAIPと競合領域が拡大

差別化ポイント(パランティア視点):

- Snowflakeは「データウェアハウス」、パランティアは「AI Operating System」

- パランティアはOntology(オントロジー)とオペレーション統合で優位

- AIP BootcampによるエンゲージメントがSnowflakeにない強み

3. C3.ai(AI)

概要:

企業向けAIソフトウェアを提供する企業で、予測分析や機械学習ソリューションを通じて業務最適化を支援。特にエネルギーや製造業に強み。

競合関係:

- エンタープライズAI市場で直接競合

- 業界特化型AIアプリケーションを提供

差別化ポイント(パランティア視点):

- パランティアは統合プラットフォーム、C3.aiは業界特化アプリ

- パランティアの政府実績と規模(売上11億8,100万ドル vs C3.aiの約3億ドル)で大きく優位

- Rule of 40: パランティア114% vs C3.aiはマイナス領域

4. Microsoft Azure AI(MSFT)

概要:

Microsoftは、クラウドプラットフォームAzureを通じて、データ解析とAIサービスを包括的に提供。OpenAIとの戦略的パートナーシップにより、GPT-4等の最先端LLMを統合。

競合関係:

- Azure AI、Azure ML、Fabric等がエンタープライズAI市場で競合

- 広範なエンタープライズ顧客基盤を持つ

- OpenAI統合により生成AI領域で強力

差別化ポイント(パランティア視点):

- Microsoftは「インフラ・プラットフォームプロバイダー」、パランティアは「AI Operating System with Ontology」

- パランティアは顧客の具体的オペレーションへの深い統合で差別化

- Apolloによるマルチ環境対応(Azure含む)で共存も可能

5. Google Cloud AI(GOOGL)

概要:

Googleは、データ解析とAI技術のリーディングカンパニーであり、Google CloudプラットフォームとVertex AIを通じて、エンタープライズAIソリューションを提供。

競合関係:

- BigQuery(データウェアハウス)、Vertex AI(MLプラットフォーム)がパランティアと競合

- Gemini(LLM)の統合により生成AI領域で競争

- 世界的な技術力と影響力

差別化ポイント(パランティア視点):

- Googleは「AIインフラ」、パランティアは「AI Operating System with Ontology」

- パランティアの政府・機密環境での実績がGoogleにない優位性

- セキュアなデータガバナンスとオンプレミス対応

6. AWS AI/ML(Amazon)

概要:

Amazon Web Servicesは、SageMaker等のML/AIサービスを通じて、エンタープライズAI市場で強力なプレゼンスを持つ。

競合関係:

- AWS SageMaker、Bedrock(生成AI)がパランティアと競合領域

- 最大のクラウドプロバイダーとしての規模

差別化ポイント(パランティア視点):

- AWSは「AI/MLインフラ」、パランティアは「統合オペレーショナルAIプラットフォーム」

- パランティアのOntologyとオペレーション統合が差別化要素

7. IBM Watson(IBM)

概要:

IBMは、Watson AIをはじめとするデータ解析とAIソリューションで知られる。長年の企業向けサービスの提供実績と、医療、金融、製造業などの多様な業界におけるデータ活用で強み。

競合関係:

- エンタープライズAI市場で歴史的に競合

- 業界特化型ソリューションに強み

差別化ポイント(パランティア視点):

- IBMはレガシーからの転換期、パランティアはクラウドネイティブ

- パランティアの成長率(+63%)とRule of 40(114%)がIBMを大きく上回る

8. Salesforce Einstein AI(CRM)

概要:

Salesforceは、顧客関係管理(CRM)を中心に、AIとデータ分析を活用したクラウドソリューションを提供。Einstein AIで顧客データの活用を支援。

競合関係:

- CRM領域でのAI活用において部分的に競合

- エンタープライズ顧客基盤が重複

差別化ポイント(パランティア視点):

- Salesforceは「CRM中心」、パランティアは「全社横断オペレーションAI」

- 適用領域が異なり、補完関係も可能

競合環境の総括

市場構造:

エンタープライズAI市場は、以下の3つのレイヤーで競争が展開されている。

- インフラレイヤー:AWS、Azure、Google Cloud(クラウドインフラとML/AIサービス)

- プラットフォームレイヤー:Palantir、Databricks、Snowflake(データ統合・AI統合プラットフォーム)

- アプリケーションレイヤー:C3.ai、業界特化ソリューション

パランティアの独自ポジション:

パランティアは、単一レイヤーではなく、「AI Operating System」として複数レイヤーにまたがる統合プラットフォームを提供している点が独自である。

- Gotham/Foundry:データ統合・分析(プラットフォームレイヤー)

- Apollo:ソフトウェア配信(インフラレイヤー)

- AIP:AI統合とオペレーション実行(アプリケーションレイヤー)

- Ontology:企業のデジタルツイン(独自レイヤー)

競合優位性の証明:

Rule of 40 = 114%という実績は、競合と比較してパランティアが圧倒的に高い成長率と収益性を両立していることを示している。

- Snowflake:Rule of 40 約40-50%

- C3.ai:Rule of 40 マイナス領域

- Databricks:非上場のため不明、推定50%前後

- ハイパースケーラー(Microsoft、Google、AWS):クラウド部門で50-70%程度(推定)

パランティアの114%は、これらの優良企業の2倍近い水準であり、競合に対する強力な優位性を客観的に示している。

これらの企業は、それぞれ異なる強みを持ちつつ、データ解析とAI技術を活用したソリューションで市場をリードしているが、パランティアは、Ontologyベースの統合プラットフォーム、政府機関との強固な関係、AIP Bootcampによる圧倒的な顧客獲得効率という独自の競争優位性により、競合と差別化している。

パランティアの競合との差別化要素と優位性は?

パランティア・テクノロジーズは、2026年時点でRule of 40 = 114%という歴史的実績により、競合に対する圧倒的な優位性を客観的に証明している。以下は、その差別化要素と優位性の詳細である。

1. 統合プラットフォーム:「AI Operating System」

差別化要素:

パランティアは、単一製品ではなく、4つのプラットフォーム(Gotham、Foundry、Apollo、AIP)が統合された「AI Operating System」を提供している。

- Gotham:政府・国防向けデータ統合

- Foundry:商業向けデータ統合・分析

- Apollo:セキュアなソフトウェア配信・管理

- AIP:AI統合とオペレーション実行

競合との違い:

- Snowflake:データウェアハウスに特化

- Databricks:データエンジニアリングとMLに特化

- C3.ai:業界特化AIアプリケーション

- Microsoft/Google/AWS:インフラ・プラットフォームプロバイダー

パランティアは、これら全てのレイヤーを統合した「AI OS」として機能し、競合が模倣困難な総合力を発揮している。

2. Ontology(オントロジー):企業のデジタルツイン

差別化要素:

パランティア独自のOntologyテクノロジーにより、企業のデータ、プロセス、ビジネスロジックを構造化されたデジタルツインとして定義できる。

競合優位性:

- LLMが企業の「デジタルツイン」を理解し、適切に操作できる

- データガバナンスとアクセス制御を維持しながらAIを活用

- 単なる「データ分析」ではなく、「オペレーション実行」が可能

競合との違い:

競合他社(Snowflake、Databricks等)は主にデータレイヤーに注力しているが、パランティアはオペレーションレイヤーまで統合している。これにより、「ChatGPTでの質問応答」を超えた、実行可能なAI駆動型業務プロセスを実現している。

3. Apollo:マルチ環境対応によるセキュアな配信能力

差別化要素:

Apolloプラットフォームにより、パランティアは顧客の複雑な環境(クラウド、オンプレミス、エアギャップド環境、エッジデバイス、機密ネットワーク)を問わず、最新のAI機能を継続的かつセキュアに展開できる。

競合優位性:

- 週次以上の頻度での継続的アップデート

- セキュアな環境(機密ネットワーク含む)への配信

- ゼロダウンタイムのアップグレード

- 複数環境の一元管理

競合との違い:

- Snowflake:主にクラウドベース、オンプレミス対応は限定的

- Databricks:クラウドネイティブ、機密環境対応は困難

- ハイパースケーラー:自社クラウドに依存

Apolloにより、パランティアはどの環境でも最新AI機能を迅速展開でき、これが競合に対する大きな差別化要素となっている。特に政府・金融・防衛など、セキュリティが最重要な領域で圧倒的優位性を持つ。

4. 20年以上の政府機関実績:最高レベルのセキュリティと信頼性

差別化要素:

2003年設立以来、米国防総省、CIA、FBI、国土安全保障省等との継続的な契約により、最高レベルのセキュリティ実績を構築している。

競合優位性:

- 政府機関との20年以上の信頼関係

- 機密情報を扱う最高水準のセキュリティ認証

- この実績が商業顧客への信頼に転換

競合との違い:

- Snowflake、Databricks、C3.ai:政府機関での実績が限定的

- Microsoft、Google、AWS:インフラプロバイダーとしての実績はあるが、オペレーションレイヤーでのミッション・クリティカルな実績では劣る

特に、金融機関、ヘルスケア、重要インフラなど、セキュリティが最重要視される商業顧客にとって、政府機関での実績は強力な差別化要素となっている。

5. AIP Bootcamp:圧倒的な顧客獲得効率とエンゲージメント

差別化要素:

AIP Bootcampという独自の顧客獲得・導入支援プログラムにより、「1〜5日間でゼロからユースケース実装まで」を実現している。

実績と効果:

- 2025年時点でBootcamp申込バックログが積み上がり続けている

- 参加企業の多くが実際の契約に至る(高い成約率)

- セールスサイクルの劇的な短縮

- 顧客自身が新たなAIユースケースを独自に開発できるようになる

パートナー企業の声:

- 「何年も解決できなかった問題を、数日で解決できた」

- 「AIPユースケースを独自に特定・実行できる能力を獲得した」

競合との違い:

- 従来のエンタープライズソフトウェア販売:長期の営業プロセス、PoC、導入に数ヶ月〜数年

- Snowflake、Databricks:トレーニングプログラムはあるが、実データでの即時実装モデルではない

- ハイパースケーラー:技術トレーニングは提供するが、顧客の具体的ビジネス問題への深いエンゲージメントは限定的

Bootcampモデルは、圧倒的な顧客獲得効率と深いエンゲージメントを同時に実現し、米国商業収益+121%(2025年Q3)という爆発的成長の原動力となっている。

6. セキュアなAI実行環境:機密データの保護

差別化要素:

パランティアのAIPは、機密データがLLMベンダー(OpenAI、Google等)に送信されないアーキテクチャを採用している。

競合優位性:

- 役割ベースのアクセス制御(RBAC)とデータガバナンス

- 監査ログとAI判断の説明可能性

- プライベートLLMのホスティングとファインチューニング

競合との違い:

多くの競合ソリューションでは、顧客データをLLMベンダーのAPIに送信する必要があるが、パランティアは顧客環境内でセキュアにAIを実行できる。これは、金融、ヘルスケア、政府など、規制が厳しい業界で決定的な優位性となっている。

7. デュアルエンジン・ビジネスモデル:政府+商業

差別化要素:

政府部門(安定収益)と商業部門(高成長)の両輪により、リスク分散と持続的成長を実現している。

2025年Q3実績:

- 政府収益:4億8,600万ドル(前年同期比+52%)

- 商業収益:3億9,700万ドル(前年同期比+121%)

- 特に米国商業収益の爆発的成長が全体を牽引

競合との違い:

- Snowflake、Databricks:商業のみ

- 従来のガバメントコントラクター:政府のみ

- ハイパースケーラー:商業が主、政府は限定的

デュアルエンジンにより、一方がスローダウンしても他方がカバーする安定性と、両方が成長する加速性を両立している。

8. オペレーショナルレバレッジ:規模の経済の最大活用

差別化要素:

ソフトウェアビジネスの特性上、売上増加に対して営業費用の増加が緩やかである(規模の経済)。パランティアはこれを最大限活用している。

2025年Q3実績:

- 調整後粗利益率:81%

- 調整後営業利益率:51%(過去最高)

- 調整後フリーキャッシュフロー:5億4,000万ドル(Q3単独)、TTMで20億ドル

- Rule of 40:114%(売上成長率63% + 営業利益率51%)

競合との違い:

- Snowflake:Rule of 40 約40-50%

- C3.ai:Rule of 40 マイナス領域(赤字継続)

- Databricks:非上場のため不明、推定50%前後

パランティアの114%は、これらの優良企業の2倍近い水準であり、オペレーショナルエクセレンスを客観的に証明している。

9. 専門的な非構造データの統合と解析能力

差別化要素:

パランティアは、文書、画像、音声など、さまざまな形式の非構造データを効果的に処理し、それを基に新たな洞察を引き出す技術に強みがある。

競合優位性:

この能力は、顧客にとって非常に価値があり、戦略的なビジネスインサイトを提供する役割を果たしている。特に、諸情報機関や複雑なオペレーション環境でのデータ統合において、他社にない優位性を発揮している。

10. カスタマイズ可能なプラットフォーム

差別化要素:

パランティアのプラットフォームは、特定の顧客ニーズに合わせてカスタマイズが可能であり、顧客が独自のビジネス要件に基づいてデータを活用できる。

競合優位性:

- 金融、医療、製造、エネルギーなど多岐にわたる業界でその技術を応用

- 顧客のニーズに対して柔軟に対応できる点が強み

- この多様な業界への対応力が、他の専門分野に特化した競合と比べて優位性を持っている

総括:Rule of 40 = 114%が証明する圧倒的優位性

これらの差別化要素と優位性により、パランティアはRule of 40 = 114%という、ソフトウェア業界史上最高レベルのパフォーマンスを達成している。

Rule of 40スコア比較:

- Palantir:114%(売上成長率63% + 営業利益率51%)

- Snowflake:約40-50%

- C3.ai:マイナス領域

- 業界標準:40%が健全、50%が優秀、70%以上が極めて優秀

パランティアの114%は、競合の2倍以上の水準であり、高成長と高収益性を同時に実現する稀有なビジネスモデルを客観的に証明している。

この圧倒的な優位性が、2024年9月のS&P 500採用、2025年の株価+122%上昇、2026年のグローバル展開加速につながっている。

パランティアはその技術革新力と幅広い顧客基盤により、データ分析とAI業界において独自のポジションを築いており、多くの企業や政府機関にとって不可欠な「AI Operating System」となっている。

パランティアが黒字化したのはいつ?

パランティア・テクノロジーズは2022年に初めて黒字化を達成した。

同社は2022年の第4四半期において、予想を上回る収益と利益を記録し、2022年の通年で調整後の1株当たり利益が6セントを達成、年間収益は19億ドルに達した。

この黒字化は、特に商業部門の成長とAIプラットフォームの需要の増加により実現し、その後、さらなる成長を見せている

パランティア・テクノロジーズの現在株価

パランティアのの現在株価がわかるリアルタイム株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

パランティア・テクノロジーズの業績について

まずは、最低限の業績分析を行なうための、以下の3つの指標を確認していきます。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

パランティア(PLTR)の四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2021:Q1 | 332.24 | 341.23 | — | |

| 2021:Q2 | 360.3 | 375.64 | — | |

| 2021:Q3 | 385.02 | 392.15 | — | |

| 2021:Q4 | 417.67 | 432.87 | — | |

| 2022:Q1 | 443.42 | 446.36 | 30.81% | |

| 2022:Q2 | 469.09 | 473.01 | 25.92% | |

| 2022:Q3 | 474.76 | 477.88 | 21.86% | |

| 2022:Q4 | 502.58 | 508.62 | 17.50% | |

| 2023:Q1 | 505.82 | 525.19 | 17.66% | |

| 2023:Q2 | 533.38 | 533.32 | 12.75% | |

| 2023:Q3 | 555.51 | 558.16 | 16.80% | |

| 2023:Q4 | 602.88 | 608.35 | 19.61% | |

| 2024:Q1 | 615.4 | 634.34 | 20.78% | |

| 2024:Q2 | 653.23 | 678.13 | 27.15% | |

| 2024:Q3 | 705.11 | 725.52 | 29.98% | |

| 2024:Q4 | 775.78 | 827.52 | 36.03% | |

| 2025:Q1 | 862.17 | 883.86 | 39.34% | |

| 2025:Q2 | 937.7 | 1000 | 47.46% | |

| 2025:Q3 | 1090 | 1180 | — | |

| 2025:Q4 | 1340 | 1410 | — | |

| 単位:百万ドル | ||||

パランティア(PLTR)の四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2021:Q1 | 116.88 | 34.25% | 116.17 | |

| 2021:Q2 | 22.75 | 6.06% | 22.05 | |

| 2021:Q3 | 100.79 | 25.70% | 95.42 | |

| 2021:Q4 | 93.43 | 21.58% | 87.58 | |

| 2022:Q1 | 35.48 | 7.95% | 20.26 | |

| 2022:Q2 | 62.43 | 13.20% | 56.97 | |

| 2022:Q3 | 47.07 | 9.85% | 32.63 | |

| 2022:Q4 | 78.76 | 15.49% | 73.84 | |

| 2023:Q1 | 187.38 | 35.68% | 182.62 | |

| 2023:Q2 | 90.19 | 16.91% | 86.26 | |

| 2023:Q3 | 133.44 | 23.91% | 131.88 | |

| 2023:Q4 | 301.17 | 49.51% | 296.31 | |

| 2024:Q1 | 129.58 | 20.43% | 126.92 | |

| 2024:Q2 | 144.19 | 21.26% | 141.31 | |

| 2024:Q3 | 419.77 | 57.86% | 415.79 | |

| 2024:Q4 | 460.33 | 55.63% | 457.22 | |

| 2025:Q1 | 310.26 | 35.10% | 304.08 | |

| 2025:Q2 | 539.25 | 53.93% | 531.62 | |

| 2025:Q3 | 507.66 | — | 500.87 | |

| 2025:Q4 | 777.29 | — | 764.02 | |

| 単位:百万ドル | ||||

パランティア(PLTR)の四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2021:Q1 | -114.01 | -33.41% | |

| 2021:Q2 | -146.15 | -38.91% | |

| 2021:Q3 | -91.94 | -23.45% | |

| 2021:Q4 | -58.94 | -13.62% | |

| 2022:Q1 | -39.44 | -8.84% | |

| 2022:Q2 | -41.74 | -8.82% | |

| 2022:Q3 | -62.19 | -13.01% | |

| 2022:Q4 | -17.83 | -3.51% | |

| 2023:Q1 | 4.12 | 0.78% | |

| 2023:Q2 | 10.07 | 1.89% | |

| 2023:Q3 | 39.98 | 7.16% | |

| 2023:Q4 | 65.79 | 10.81% | |

| 2024:Q1 | 80.88 | 12.75% | |

| 2024:Q2 | 105.34 | 15.53% | |

| 2024:Q3 | 113.14 | 15.59% | |

| 2024:Q4 | 11.04 | 1.33% | |

| 2025:Q1 | 176.05 | 19.92% | |

| 2025:Q2 | 269.32 | 26.93% | |

| 2025:Q3 | 393.26 | — | |

| 2025:Q4 | 575.39 | — | |

| 単位:百万ドル | |||

パランティア(PLTR)の四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2021:Q1 | 0.04 | 0.04 | 0 | |

| 2021:Q2 | 0.04 | 0.04 | 0 | |

| 2021:Q3 | 0.04 | 0.04 | 0 | |

| 2021:Q4 | 0.04 | 0.02 | -0.02 | |

| 2022:Q1 | 0.04 | 0.02 | -0.02 | |

| 2022:Q2 | 0.03 | -0.01 | -0.04 | |

| 2022:Q3 | 0.02 | 0.01 | -0.01 | |

| 2022:Q4 | 0.03 | 0.04 | 0.01 | |

| 2023:Q1 | 0.04 | 0.05 | 0.01 | |

| 2023:Q2 | 0.05 | 0.05 | 0 | |

| 2023:Q3 | 0.06 | 0.07 | 0.01 | |

| 2023:Q4 | 0.08 | 0.08 | 0 | |

| 2024:Q1 | 0.08 | 0.08 | 0 | |

| 2024:Q2 | 0.08 | 0.09 | 0.01 | |

| 2024:Q3 | 0.09 | 0.1 | 0.01 | |

| 2024:Q4 | 0.11 | 0.14 | 0.03 | |

| 2025:Q1 | 0.13 | 0.13 | 0 | |

| 2025:Q2 | 0.14 | 0.16 | 0.02 | |

| 2025:Q3 | 0.17 | 0.21 | 0.04 | |

| 2025:Q4 | 0.23 | 0.25 | 0.02 | |

| 単位:百万ドル | ||||

パランティア(PLTR)の通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 年度(通期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2020年 | 1070 | 1090 | — | |

| 2021年 | 1530 | 1540 | 41.28% | |

| 2022年 | 1900 | 1910 | 24.03% | |

| 2023年 | 2220 | 2230 | 16.75% | |

| 2024年 | 2810 | 2870 | 28.70% | |

| 2025年 | 4390 | 4480 | 56.10% | |

| 2026年 | — | 7080 | — | — |

| 2027年 | — | 10060 | — | — |

| 2028年 | — | 14340 | — | — |

| 単位:百万ドル | ||||

パランティア(PLTR)の通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 年度(通期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2020年 | -296.61 | -27.21% | -308.84 | |

| 2021年 | 333.85 | 21.68% | 321.22 | |

| 2022年 | 223.74 | 11.71% | 183.71 | |

| 2023年 | 712.18 | 31.94% | 697.07 | |

| 2024年 | 1150 | 40.07% | 1140 | |

| 2025年 | 2130 | 47.54% | 2100 | |

| 単位:百万ドル | ||||

パランティア(PLTR)の通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 年度(通期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2020年 | -1170 | -107.34% | |

| 2021年 | -411.05 | -26.69% | |

| 2022年 | -161.2 | -8.44% | |

| 2023年 | 119.97 | 5.38% | |

| 2024年 | 310.4 | 10.82% | |

| 2025年 | 1410 | 31.47% | |

| 単位:百万ドル | |||

パランティア(PLTR)の通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 年度(通期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2020年 | 0.07 | 0.19 | 0.12 | |

| 2021年 | 0.15 | 0.13 | -0.02 | |

| 2022年 | 0.05 | 0.06 | 0.01 | |

| 2023年 | 0.25 | 0.25 | 0 | |

| 2024年 | 0.37 | 0.41 | 0.04 | |

| 2025年 | 0.72 | 0.75 | 0.03 | |

| 2026年 | — | 1.23 | — | — |

| 2027年 | — | 1.79 | — | — |

| 2028年 | — | 2.56 | — | — |

| 単位:百万ドル | ||||

パランティア・テクノロジーズの将来性は?今後の見通しは?

パランティア・テクノロジーズの将来性は、2026年時点で「AI Operating System」としてのグローバル展開の本格化という新たな成長ステージに入っており、以下の複数の要因に基づいて極めて高いと評価される。

1. エンタープライズAI市場の爆発的成長とパランティアのポジション

市場環境:

- エンタープライズAI市場:2026年の1,148億ドルから2030年には500億ドル以上(プラットフォーム市場)へ成長(CAGR 27.7%)

- 生成AI革命により、企業のAI導入が実験段階から本格導入段階に移行

パランティアの優位性:

- Rule of 40 = 114%という業界最高レベルの実績により、市場成長の恩恵を最大限享受できる立ち位置

- AIPによる爆発的な需要拡大(米国商業収益:2025年Q3に+121%)

- 2025年通期見通し:売上43億9,600万〜44億ドル(前年比+53%)

2. AIP(Artificial Intelligence Platform)の継続的な需要拡大

現状:

AIP Bootcamp申込のバックログが積み上がり続けており、需要が供給を大きく上回っている状態が継続。

成長ドライバー:

- 生成AIブームの継続とエンタープライズ導入の本格化

- Bootcampモデルによる効率的な顧客獲得と短いセールスサイクル

- 既存顧客の「Land and Expand」パターン(初期導入→全社展開)

収益インパクト:

- TCV(Total Contract Value):2025年Q3に27億6,000万ドル(前年同期比+151%)

- 米国商業TCV:13億1,000万ドル(前年同期比+342%)

2026年以降もAIPの需要拡大が継続し、米国商業部門の100%超成長が当面続くと予想される。

3. グローバル展開の本格化:アジア・EMEA市場への進出

アジア市場:

- HD Hyundaiとのグループ全体戦略的パートナーシップ拡大(2026年1月)

- 造船、建設、ロボティクス、電気システム全社導入

- 韓国を拠点に東アジア市場への本格進出

EMEA市場:

- Sovereign AI・Accentureとの欧州AIインフラ構築(2026年1月)

- EMEA地域全域での次世代AIデータセンター

- パランティアのChain Reactionソフトウェアがインフラのオペレーティングシステムとして機能

- データ主権(Sovereign AI)トレンドへの対応

戦略的意義:

従来の米国中心(2025年Q3時点で米国収益が全体の75%)から、真のグローバル企業への転換。アジア、EMEA地域での本格展開により、市場機会が数倍に拡大する。

課題:

2025年Q3の国際商業収益は1億5,200万ドル(前年同期比わずか+10%)と停滞。経営陣も「欧州は米国の勢いと比較して停滞している」と認識。Sovereign AIプロジェクトがこの課題への対応策となる。

4. 新業種への浸透:製造業・小売・ヘルスケアの再工業化(Re-industrialization)

最新顧客事例(2025-2026年):

製造業:

- Ursa Major(航空宇宙・防衛):AI統合製造実行システム(MES)導入(2025年10月)

- 「Warp Speed」顧客群による製造業の再工業化を推進

小売・消費財:

- Heineken(グローバルビール)

- Walgreens(米国大手薬局チェーン)

- RaceTrac(石油・コンビニエンスストア)

ヘルスケア:

- R1 RCM(医療収益サイクル管理)

物流:

- Ripcord(倉庫自動化)

戦略的意義:

これまでパランティアは政府・金融が主力だったが、AIPにより製造、小売、ヘルスケアなど全業種に急速に浸透している。これらの業種は市場規模が大きく、長期的な成長余地が極めて大きい。

5. 戦略的パートナーシップによるリーチ拡大

主要パートナーシップ:

Accenture(グローバルコンサルティング大手)

- Sovereign AIプロジェクトで協業(2026年1月)

- エンタープライズ顧客へのリーチとコンサルティング連携

- グローバル展開の加速

Oracle(2024年継続中)

- ミッション・クリティカルなAIソリューションの共同提供

- エンタープライズ顧客基盤の相互活用

bp(エネルギー大手)

- 5年間の戦略的関係を延長

- 新たなAI機能を導入する計画

戦略的意義:

- 直販に加え、パートナー経由の販売チャネル拡大

- グローバルリーチの強化

- 業種別専門知識の補完

6. 財務パフォーマンスと持続可能な成長モデル

2024-2025年の実績:

- 2024年通年:売上25億ドル以上、初のGAAP通年黒字達成

- 2025年Q2:米国商業収益1億5,900万ドル(前年同期比+55%)

- 2025年Q3:総売上11億8,100万ドル(前年同期比+63%)、米国商業収益3億9,700万ドル(+121%)

- 2025年通期ガイダンス:売上43億9,600万〜44億ドル(前年比+53%)

Rule of 40の持続:

- Q3 2025:114%

- 通期2025見通し:約90%前後

- 2026年以降も100%超の継続的達成が視野に入る

キャッシュフロー:

- 調整後フリーキャッシュフロー:TTMで20億ドル

- 強固なキャッシュ創出能力により、さらなる成長投資が可能

7. AIインフラストラクチャ企業としての地位確立

Sovereign AIプロジェクト:

パランティアのChain Reactionソフトウェアが、EMEA地域の次世代AIデータセンターのオペレーティングシステムとして採用された。

戦略的意義:

- 単なるソフトウェアベンダーから、AIインフラストラクチャの中核企業へ

- 電力生成からコンピュート配備まで、データセンター運用全体を統合管理

- 主権AI(Sovereign AI)トレンドに対応し、各国・地域のAIインフラ構築に関与

長期的インパクト:

数百億ドル規模のAIインフラ市場への参入により、安定的な長期収益基盤を構築。

8. リスク要因と課題

高いバリュエーション:

- 2026年1月時点:株価約167ドル、P/E比率約364倍

- Simply Wall Stの分析では、推定公正価値より75.6%高い水準

- ソフトウェア業界平均P/E比率30倍と比較して12倍以上

- Rule of 40 = 114%がこの高評価を支えているが、期待値が既に織り込まれている可能性

国際商業部門の停滞:

- 2025年Q3の国際商業収益:1億5,200万ドル(前年同期比わずか+10%)

- 経営陣も「欧州は米国の勢いと比較して停滞している」と認識

- Sovereign AIプロジェクトがこの課題への対応策

競争激化:

- Snowflake、Databricks、ハイパースケーラーとの激しい競争

- AI市場の急成長により、新規参入も増加

技術変化のスピード:

- AI技術の急速な進化に継続的に対応する必要

- LLMの進化、新たなAIパラダイムへの適応

9. 株価見通しと投資判断のポイント

短期見通し(2026年):

- AIPの需要拡大が継続

- HD Hyundai、Sovereign AIという大型契約の収益化開始

- 2025年Q4および通期決算発表(2026年2月頃と予想)での2026年ガイダンスが重要

- Rule of 40スコアの高水準維持(90-100%以上)

中長期見通し(2027年以降):

- エンタープライズAI市場の構造的成長(CAGR 27.7%)の恩恵

- グローバル展開の本格化による市場機会の数倍拡大

- Rule of 40 = 100%超の継続的達成による収益性の持続

- AIインフラストラクチャ企業としての地位確立

投資判断のポイント:

- Rule of 40 = 114%という客観的指標が示す、高成長と高収益の両立

- 短期的にはバリュエーションの高さがリスク

- 長期的には市場成長とパランティアの優位性により、さらなる成長が期待される

- CEOのAlex Karpが述べる「パランティアはまだ成長の初期段階」という見解

総括

パランティアは、Rule of 40 = 114%という歴史的実績により、競合に対する圧倒的な優位性を客観的に証明している。

AI技術の進展に伴い、さらなる市場拡大が期待されるが、競合他社との激しい競争や市場の変動にも直面している。

持続的な成長を維持するためには、技術革新と顧客基盤の拡充が不可欠であり、これらが将来の成功の鍵となる。

生成AI革命、エンタープライズAI市場の爆発的成長、グローバル展開の本格化、新業種への浸透という複数の成長ドライバーが重なる2026年は、同社にとって「グローバルAIインフラストラクチャ企業」としての転換期である。

高いバリュエーションというリスクはあるものの、市場の構造的成長とパランティアの革新的技術・ビジネスモデル・オペレーショナルエクセレンス(Rule of 40 = 114%)の組み合わせは、長期的に極めて魅力的な投資機会を提供する可能性がある。

パランティアは、非常に収益性の高い成長要因と戦略により、今後もデータ分析とAI業界でさらなる成長を遂げることが期待されている。

パランティアテクノロジーズの業界への影響

最新の情報に基づくパランティアの業界への影響については以下。

- 企業経営: パランティアのソフトウェアは、企業の経営戦略の立案や業績管理において不可欠なツールとなっている。企業は、データに基づく意思決定を行うことで、競争力を強化し、市場での地位を向上させている。パランティアのプラットフォームは、データの可視化と分析を通じて、経営陣がより効果的な戦略を策定するのを支援している。

- サイバーセキュリティ: 同社の技術は、サイバーセキュリティの分野でも重要な役割を果たしている。パランティアのソリューションは、異常検知やリスク分析を行い、企業や組織のネットワークを保護し、サイバー攻撃からの防御を強化し、重要なデータの安全を確保している。

- 犯罪捜査: パランティアの技術は、法執行機関の犯罪捜査においても大きな貢献をしている。大量のデータを迅速に分析し、犯罪のパターンを特定することで、捜査の効率化と犯罪の予防に寄与しており、警察や諜報機関が迅速に対応策を講じることが可能になっている。

- 医療・バイオテクノロジー: 医療やバイオテクノロジー分野では、パランティアのソフトウェアがデータ解析を通じて疾患の早期発見や新しい治療法の開発をサポートしている。患者の治療プランの改善や医療の質の向上に寄与しており、パランティアの技術は、医療業界において革新的なデータ活用を促進している。

- 商業セクターの成長: パランティアは、政府機関だけでなく商業セクターでも成長を続けており、特に、金融、製造、物流などの分野では、データ分析を通じて業務効率化やリスク管理などのニーズに応えている。

商業セクターでの収益は急速に増加しており、企業がよりデータ駆動型の戦略を採用するための基盤を提供している。 - AI技術の活用: パランティアは、AI技術を駆使してデータ解析の精度と効率を向上させている。AIプラットフォームの需要の増加によりパランティアは新たな顧客を獲得し、既存の顧客に対しても価値を提供している。

AIを活用したソリューションは、特に予測分析や自動化された意思決定プロセスにおいて、その効果を発揮している。 - デジタルトランスフォーメーションの推進: 多くの企業がデジタルトランスフォーメーションを進める中で、パランティアのソリューションはデータの活用方法を根本的に変える手助けをしている。パランティアは、企業がデータをより戦略的に活用できるよう支援し、ビジネスプロセスの革新を促進している。

これにより、競争力の向上と市場での優位性を確立することが可能となっている

これらの要素により、パランティア・テクノロジーズは多くの業界で重要な役割を果たし、データ分析の可能性を広げ続けている。

パランティア・テクノロジーズ(PLTR)の2025年度通期決算サマリー

発表日:2026/02/02

売上高と収益(2025年通期)

- 総売上高: 44億ドル(前年比+53%)、ガイダンス上限達成

- 米国売上高: 約33億ドル(推定、前年比+70%以上)

- 米国商業収益: 約14億5,000万ドル(前年比+104%超)

- 米国政府収益: 約18億5,000万ドル(推定)

- 2024年通期売上高(比較): 28億7,000万ドル

Q4 2025四半期業績

- Q4総売上高: 約13億3,000万ドル(前年同期比+61%)、ガイダンス範囲内

- Q4米国商業収益: 前年同期比+121%の成長を維持(推定)

営業費用と利益(通期)

- 通期調整後営業利益: 約22億4,000万ドル超(ガイダンス範囲)

- 通期調整後営業利益率: 約51%(推定、Q3実績から推測)

- GAAP通年黒字: 2年連続達成

- Rule of 40スコア(通期推定): 約100%超(売上成長率53% + 調整後営業利益率50%前後)

キャッシュと財務状況

- 通期調整後フリーキャッシュフロー: 20億〜21億ドル(ガイダンス上方修正後)

- フリーキャッシュフロー率: 約48%(推定)

- 現金・現金同等物および短期米国債: 40億ドル超(推定)

技術・事業ハイライト(2025年)

- AIPの爆発的普及: 米国商業部門が年間+104%成長を達成

- Rule of 40: 通年で100%前後を維持、業界最高水準

- グローバル展開: HD Hyundai(韓国)、Sovereign AI(EMEA)など大型契約締結

- S&P 500企業: 主流投資適格企業としての地位確立(2024年9月採用)

- 顧客拡大: 商業・政府両部門で顧客数大幅増加

決算まとめ

パランティアの2025年通期は、売上44億ドル(+53%)、Rule of 40スコア約100%超という、驚異的な成長と収益性の両立を達成した歴史的な年となった。

特に米国商業部門の+104%成長は、AIPによる「企業AI革命」の本格化を象徴しており、パランティアが「政府依存企業」から「高成長AI Operating System企業」への完全な転換を遂げたことを示している。

グローバル展開(アジア、EMEA)の本格化、製造業・小売・ヘルスケアなど新業種への浸透により、2026年以降もさらなる成長が期待される。

出典(一次情報)

Palantir Investor Relations – Q4 & FY 2025 Earnings

パランティア・テクノロジーズ(PLTR)の2025年度Q3決算サマリー

発表日:2025/11/03

売上高と収益

- 総売上高: 11億8,100万ドル(前年同期比+63%、前期比+10%)、市場予想を大幅に上回る

- 米国売上高: 8億8,300万ドル(前年同期比+77%)

- 米国商業収益: 3億9,700万ドル(前年同期比+121%、前期比+14%)

- 米国政府収益: 4億8,600万ドル(前年同期比+52%、前期比+7%)

- 国際商業収益: 1億5,200万ドル(前年同期比+10%)

- 国際政府収益: 1億5,200万ドル(前年同期比+20%)

営業費用と利益

- GAAP営業利益: 4億9,100万ドル(営業利益率42%)

- GAAP純利益: 4億7,600万ドル(純利益率40%、前年同期の7,200万ドルから大幅増加)

- 調整後営業利益: 6億0,600万ドル(調整後営業利益率51%、過去最高)

- 調整後EPS: 0.24ドル(前年同期比+100%)

- 調整後粗利益率: 81%

契約・受注(Bookings)

- 総TCV(Total Contract Value): 27億6,000万ドル(前年同期比+151%、四半期最高記録)

- 米国商業TCV: 13億1,000万ドル(前年同期比+342%、四半期最高記録)

- 100万ドル以上の契約: 104件締結

- 1,000万ドル以上の契約: 36件締結

- 顧客数: 前年同期比+39%増加

キャッシュと財務状況

- 営業活動によるキャッシュフロー: 6億6,100万ドル(キャッシュフロー率56%)

- 調整後フリーキャッシュフロー: 5億4,000万ドル(フリーキャッシュフロー率46%)

- TTM調整後フリーキャッシュフロー: 20億ドル

- 現金・現金同等物および短期米国債: 41億ドル(前期40億ドル)

技術・事業ハイライト

- Rule of 40スコア: 114%(売上成長率63% + 調整後営業利益率51%)、ソフトウェア業界史上最高レベル

- AIP Bootcamp: 需要継続、バックログが積み上がる

- 米国商業部門: 2四半期連続で100%以上の成長率を達成

- S&P 500採用: 2024年9月に採用済み、主流投資適格企業としての地位確立

2025年度ガイダンス

Q4 2025ガイダンス:

- 総売上高: 13億2,700万〜13億3,100万ドル(前年同期比+61%)

- 米国商業収益: 前年同期比+121%の成長を継続見込み

通期2025ガイダンス(上方修正):

- 総売上高: 43億9,600万〜44億ドル(前年比+53%)、コンセンサス予想を大幅に上回る

- 米国商業収益: 14億3,300万ドル超(前年比+104%)

- 調整後営業利益: 22億4,100万〜22億4,500万ドル

- 調整後フリーキャッシュフロー: 19億〜21億ドル(従来ガイダンスから上方修正)

決算まとめ

パランティアの2025年Q3決算は、過去最高の成長率と収益性を達成した。特に米国商業部門の121%成長、Rule of 40スコア114%という歴史的実績は、同社が「高成長SaaS企業」かつ「高収益企業」という稀有なポジションを確立していることを示している。

CEOのAlex Karpは「AIPを活用してAIレバレッジを複合的に活用する変革的インパクト」を強調し、Q4ガイダンスは「会社史上最高の四半期連続売上成長率」と述べた。

出典(一次情報)

パランティア・テクノロジーズ(PLTR)の2025年度Q2決算サマリー

発表日:2025/08/04

売上高と収益

- 総売上高: 10億7,800万ドル(前年同期比+48%、前期比+7%)

- 米国売上高: 7億3,300万ドル(前年同期比+68%、前期比+17%)

- 米国商業収益: 3億4,900万ドル(前年同期比+93%、前期比+37%)

- 米国政府収益: 3億8,400万ドル(前年同期比+51%、前期比+3%)

- 国際売上高: 3億4,500万ドル(前年同期比+20%)

営業費用と利益

- GAAP純利益: 3億4,200万ドル(純利益率32%)

- 調整後営業利益: 5億1,300万ドル(調整後営業利益率48%)

- GAAP EPS: 0.16ドル(市場予想0.1382ドルを上回る)

- 調整後EPS: 0.21ドル

- 調整後粗利益率: 81%

契約・受注(Bookings)

- 総TCV: 23億ドル

- 100万ドル以上の契約: 96件締結

- 1,000万ドル以上の契約: 33件締結

- 顧客数: 前年同期比+41%増加

キャッシュと財務状況

- 営業活動によるキャッシュフロー: 3億0,600万ドル

- 調整後フリーキャッシュフロー: 3億1,200万ドル

- 現金・現金同等物および短期米国債: 40億ドル

技術・事業ハイライト

- Rule of 40スコア: 94%(売上成長率48% + 調整後営業利益率46%)

- AIP Bootcamp: 引き続き高い需要

- 米国商業部門: 93%成長で爆発的拡大継続

2025年度ガイダンス

Q3 2025ガイダンス:

- 総売上高: 前年同期比+50%成長見込み

通期2025ガイダンス(上方修正):

- 総売上高: 前年比+45%成長

- 米国商業収益: 前年比+85%成長

決算まとめ

CEOのAlex Karpは「驚異的な四半期」と評し、「AIレバレッジの驚異的インパクト」を強調。同社は「会社史上最高の四半期連続売上成長率」のガイダンスを示した。

出典(一次情報)

パランティア・テクノロジーズ(PLTR)の2025年度Q1決算サマリー

発表日:2025/05/05

売上高と収益

- 総売上高: 8億8,390万ドル(前年同期比+39%、前期比+7%)

- 米国売上高: 6億2,800万ドル(前年同期比+55%、前期比+13%)

- 米国商業収益: 2億5,500万ドル(前年同期比+71%、前期比+19%)、年間ランレート10億ドル超

- 米国政府収益: 3億7,300万ドル(前年同期比+45%、前期比+9%)

営業費用と利益

- GAAP純利益: 2億1,400万ドル(純利益率24%)

- 調整後営業利益: 3億9,100万ドル(調整後営業利益率44%)

- 調整後EPS: 0.13ドル

契約・受注(Bookings)

- 100万ドル以上の契約: 139件締結

- 500万ドル以上の契約: 51件締結

- 1,000万ドル以上の契約: 31件締結

- 米国商業TCV: 8億1,000万ドル(前年同期比+183%)

- 米国商業RDV(Remaining Deal Value): 23億2,000万ドル(前年同期比+127%)

- 顧客数: 前年同期比+39%、前期比+8%増加

キャッシュと財務状況

- 調整後フリーキャッシュフロー: 3億7,000万ドル(フリーキャッシュフロー率42%)

技術・事業ハイライト

- Rule of 40スコア: 83%(売上成長率39% + 調整後営業利益率44%)

- AIPの影響: CEOのAlexander Karpは「当社ソフトウェア採用における地殻変動」と評価

- 「AI時代における現代企業のオペレーティングシステム」としての地位確立

2025年度ガイダンス(当時)

通期2025ガイダンス(上方修正):

- 総売上高: 38億9,000万〜39億200万ドル(前年比+36%)

- 米国商業収益: 11億7,800万ドル超(前年比+68%以上)

- 調整後営業利益: 17億1,100万〜17億2,300万ドル

- 調整後フリーキャッシュフロー: 16億〜18億ドル

決算まとめ

2025年Q1は、パランティアがAIPによる「地殻変動的な採用拡大」を実現した四半期。米国商業部門の年間ランレートが10億ドルを突破し、商業TCV成長率183%という驚異的な契約拡大を達成した。

出典(一次情報)

Palantir Reports Q1 2025 Revenue Growth of 39% Y/Y, U.S. Revenue Growth of 55% Y/Y, May 5, 2025

パランティアの主要戦略的契約・提携(2025-2026年)

パランティアは2025年から2026年にかけて、グローバル展開を加速する複数の大型戦略的パートナーシップを締結している。これらの契約は、同社が単なる米国中心の企業から、真のグローバルAIインフラストラクチャ企業へと転換していることを示している。

1. HD Hyundaiとのグループ全体戦略的パートナーシップ拡大(2026年1月)

概要:

韓国の重工業グループHD Hyundaiとの複数年にわたる戦略的パートナーシップをグループ全体に拡大することを発表。

対象事業領域:

- 造船(HD Hyundai Heavy Industries)

- 建設(HD Hyundai Construction Equipment)

- ロボティクス(HD Hyundai Robotics)

- 電気システム(HD Hyundai Electric)

導入製品・技術:

- Palantir Foundry(データ統合・分析プラットフォーム)

- Palantir AIP(AI駆動型業務最適化)

- デジタルツイン技術による製造・建設プロセスの最適化

戦略的意義:

- アジア市場での存在感強化:韓国を拠点とする世界的重工業グループへの深い浸透

- 重工業のAI化リーダーシップ:造船、建設、ロボティクスといった伝統的産業のデジタルトランスフォーメーションを主導

- グループ全体展開のモデルケース:単一事業部門から全社展開への成功パターン確立

収益インパクト:

HD Hyundaiは売上高数兆円規模のグループであり、全社展開による長期的な収益貢献が期待される。

2. Sovereign AI・Accentureとの欧州AI data centerインフラ構築(2026年1月)

概要:

英国拠点のSovereign AIおよびAccentureと提携し、EMEA地域(欧州、中東、アフリカ)全域における次世代AIデータセンターインフラを構築する大型プロジェクトを開始。

プロジェクト内容:

- Sovereign AIデータセンターの設計・構築・運用

- 商業セクターおよび政府セクター向けのAIインフラ提供

- パランティアのChain Reactionソフトウェアがインフラ全体のオペレーティングシステムとして機能

Chain Reactionの役割:

- 電力生成からコンピュート配備まで、データセンター運用全体を統合管理

- AI/MLワークロードの最適化とリソース配分

- セキュリティとガバナンスの一元管理

戦略的意義:

- EMEA地域での大規模展開:従来の米国中心から、欧州・中東・アフリカへの本格進出

- インフラレイヤーでの地位確立:単なるソフトウェアベンダーから、AIインフラストラクチャの中核企業へ

- 主権AI(Sovereign AI)トレンドへの対応:各国のデータ主権要求に対応した地域別AIインフラの提供

- Accentureとの協業:大手コンサルティングファームとの連携により、エンタープライズ顧客へのリーチ拡大

収益インパクト:

数百億ドル規模のAIインフラ市場への参入であり、長期的な安定収益とプラットフォーム効果が期待される。

3. 米国防総省・政府機関との継続的契約拡大(2025年継続中)

概要:

米国防総省、諸情報機関との長期契約を継続的に更新・拡大。

最新動向(2025年):

- 米国政府収益:2025年Q3に4億8,600万ドル(前年同期比+52%)

- 米軍向けAI導入:Project Maven等、軍事作戦へのAI統合が加速

- 同盟国への展開:NATO諸国、Five Eyes諸国への展開拡大

戦略的意義:

- 安定収益基盤:長期契約による予測可能な収益

- 最高レベルのセキュリティ実績:政府機関向け実績が商業顧客への信頼に転換

- 地政学リスクへの対応:各国の国家安全保障ニーズに対応

4. 主要商業顧客の拡大(2025年)

新規顧客発表(2025年3月AIPCon):

- Heineken(グローバル消費財)

- Walgreens(米国大手薬局チェーン)

- R1 RCM(ヘルスケア収益サイクル管理)

- RaceTrac(米国石油・コンビニエンスストア)

- Ripcord(物流・倉庫自動化)

既存大手顧客の深化:

- AT&T(通信)

- Delta Air Lines(航空)

- KKR(プライベートエクイティ)

- SOMPOホールディングス(保険)

製造業での実績:

- Ursa Major(航空宇宙・防衛):AI統合製造実行システム(MES)導入(2025年10月発表)

戦略的意義:

- 業種の多様化:製造、小売、ヘルスケア、金融、エネルギーなど全業種へ展開

- AIP Bootcampモデルの成功:短期間での顧客獲得と深い関係構築

- ランド・アンド・エクスパンド:初期導入から全社展開へのパターン確立

5. パートナーエコシステムの拡大

主要パートナー:

- Accenture:エンタープライズ顧客へのリーチとコンサルティング連携

- AWS、Microsoft Azure、Google Cloud:マルチクラウド対応による柔軟な展開

- システムインテグレーター各社:顧客導入支援とカスタマイゼーション

戦略的意義:

- 販売チャネルの多様化:直販に加え、パートナー経由の拡大

- グローバルリーチ:各地域の主要パートナーとの連携

- エコシステム効果:パートナーがパランティアを推奨する循環

契約・提携戦略の総括

これらの契約・提携は、パランティアの以下の戦略転換を示している。

- 地理的拡大:米国→アジア(HD Hyundai)→EMEA(Sovereign AI)へのグローバル展開

- 垂直統合:ソフトウェア→AIインフラストラクチャへのレイヤー拡大

- 業種の深化:重工業、小売、ヘルスケア、製造など全業種へのAI浸透

- パートナー活用:直販モデルからパートナーエコシステムへの進化

- 主権AI対応:各国のデータ主権要求に応える地域別展開

2026年は、これらの契約が本格的に収益化される「グローバルAI Operating System企業」としての転換期となる。

パランティア・テクノロジーズの決算まとめ

過去から現在までのパランティアの決算内容をサマリー形式でまとめています。

https://mifsee.com/pltr_finance/

まとめ

パランティア・テクノロジーズ(PLTR)は、2026年時点で「AI Operating System」として、政府機関と民間企業の両方にミッション・クリティカルなAIソリューションを提供する、世界有数のソフトウェア企業へと成長を遂げている。

パランティアの現在地と転換点

事業の核心:

Gotham(政府)、Foundry(商業)、Apollo(配信)、AIP(AI)という4つのプラットフォームが統合され、顧客の複雑なデータを統合・分析し、AI駆動型の意思決定を実現する「AI OS」として機能している。

デュアルエンジン・ビジネスモデルの確立:

- 政府部門:米国防総省等との長期契約により安定収益(2025年Q3: 4億8,600万ドル、前年同期比+52%)

- 商業部門:AIPの爆発的需要により急成長(2025年Q3: 3億9,700万ドル、前年同期比+121%)

特に米国商業部門の121%成長は、従来の「政府依存企業」から「高成長SaaS企業」への転換を象徴している。

AIP(Artificial Intelligence Platform)の革命的インパクト

2023年4月に発表されたAIPは、大規模言語モデル(LLM)を企業の機密データと安全に統合し、実際のオペレーションに組み込むプラットフォームとして、パランティアの成長を牽引している。

AIP Bootcampという独自の顧客獲得手法により、「1〜5日間で顧客の実データを使ってAIユースケースを実装」という驚異的なスピードでの導入を実現。これが、従来のエンタープライズソフトウェアにはない速度での顧客獲得につながっている。

主要顧客事例:

- 製造:Ursa Major(AI統合製造実行システム)

- 小売・消費財:Heineken、Walgreens、RaceTrac

- ヘルスケア:R1 RCM

- 重工業:HD Hyundai(造船、建設、ロボティクス、電気システム全社展開)

- 金融:KKR、大手銀行・保険

- 通信・航空:AT&T、Delta Air Lines

Rule of 40 = 114%:ソフトウェア業界史上最高レベルの実績

2025年Q3、パランティアはRule of 40スコア114%を達成した(売上成長率63% + 営業利益率51%)。

これは「ソフトウェア業界でほとんど見られないレベル」「おそらくソフトウェア企業が達成した中で最高の数値」と評されており、高成長と高収益性を同時に実現する稀有なビジネスモデルを証明している。

Rule of 40が40%を超える企業は健全、50%以上は優秀とされる中、114%という数値は、パランティアの持続可能な成長力とオペレーショナルエクセレンスを客観的に示している。

グローバル展開の加速(2025-2026年)

アジア:HD Hyundaiとのグループ全体戦略的パートナーシップ拡大

EMEA:Sovereign AI・Accentureとの欧州AI data centerインフラ構築

米国:商業部門の爆発的成長と政府部門の安定拡大

従来の米国中心から、真のグローバルAIインフラストラクチャ企業へと転換している。

S&P 500採用と投資適格企業への転換

2024年9月、パランティアはS&P 500指数に採用された。これは、「秘密主義のインテリジェンス契約企業」から「主流の投資適格企業」への象徴的な転換である。

2026年1月時点の株価は約167ドル(2025年に+122%上昇)、P/E比率は約364倍と高いバリュエーションだが、Rule of 40の114%実績、持続的な高成長、高収益性がこの評価を支えている。

競争優位性の源泉

- 統合プラットフォーム:Gotham、Foundry、Apollo、AIPが相互補完し、競合が模倣困難な総合力

- Apolloによる配信能力:顧客環境を問わず(クラウド、オンプレミス、機密ネットワーク)最新AI機能を迅速展開

- セキュアなAI実行環境:機密データがLLMベンダーに送信されないアーキテクチャ

- 20年以上の政府機関実績:最高レベルのセキュリティと信頼性の証明

- AIP Bootcamp:圧倒的な顧客獲得効率とエンゲージメント

- オペレーショナルレバレッジ:ソフトウェアビジネスの規模の経済を最大限活用

今後の展望

CEOのAlex Karpは「パランティアはまだ成長の初期段階にある」と述べており、以下の成長ドライバーが期待される。

- AIPの継続的な需要拡大:生成AIブームとエンタープライズAI導入の本格化

- グローバル展開の深化:アジア、EMEA地域での存在感拡大

- 新業種への浸透:製造、小売、ヘルスケアなど全業種でのAI化推進

- Rule of 40の高水準維持:2025年通期で90%前後、長期的に100%超の継続的達成も視野

- AIインフラストラクチャ企業としての地位確立:Sovereign AIプロジェクトなど、インフラレイヤーでの価値提供

パランティアは、その技術革新力、幅広い顧客基盤、財務的卓越性により、データ分析・AI業界において独自の存在感を示しており、多くの企業や政府機関にとって不可欠な「AI Operating System」となっている。

2026年は、同社が「グローバルAIインフラストラクチャ企業」として新たな成長ステージに入る転換期である。Rule of 40 = 114%という歴史的実績が示すように、パランティアは高成長と高収益性を両立する、極めて稀有なビジネスモデルを確立している。

私は9ドル台からパランティアの株を買い始めましたが、100ドルを超え成長しつづけています。Rule of 40 = 114%という客観的指標が示す実力を踏まえ、長期的に大きな期待を持っています。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!