このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

▼AIが音声変換したポッドキャスト版はこちらからどうぞ。(Spotifyで再生)

- はじめに

- FANGとは何ですか?

- FANG+指数とは何ですか?

- FANG+に投資できる投資信託は?

- iFreeNEXT FANG+インデックスの詳細は?

- FANG+インデックスの最新の構成銘柄は?

- FANG+の構成銘柄の入れ替え履歴は?

- FANG+インデックス各銘柄の組入比率は?

- FANG+インデックスのセクター比率は?

- iFreeNEXT FANG+インデックスの運用コストは?

- FANG+とGAFAM、マグニフィセントセブンの違い

- FANG+インデックスも採用銘柄はいつ変更される?

- FANG+採用銘柄の選定基準は?

- FANG+の各構成銘柄の具体的な事業内容は?

- FANG+インデックスに投資するメリットは?

- FANG+インデックスに投資するデメリットは?

- FANG+インデックスのパフォーマンスは?

- FANG+インデックスとS&P500、NASDAQ100と比較すると?

- FANG+インデックスへの投資に向いている人は?

- 「FANG+インデックスはおすすめしない」という記事、検索も多くみられがその要因は?

- iFreeNEXT FANG+インデックスの将来性と今後の見通しは?

- まとめ

はじめに

つみたてNISAで注目を集める投資信託の一つに「大和-iFreeNEXT FANG+インデックス」があります。

GAFAMを含む米国テクノロジー企業への投資に関心がある投資家にとっては、特に魅力的な選択肢です。投資信託の人気ランキングでも上位に位置し、これまで数多くの投資家が注目しています。

私自身、FANGの各個別銘柄への直接投資は行っていませんが、米国のビックテック企業への投資方法を模索している中で、FANG+インデックスは魅力的です。

このインデックスは、優れたパフォーマンスを誇りますが、それに伴うリスクも無視できません。

ハイリスク・ハイリターンのカテゴリーに属するこの銘柄について、S&P 500やナスダック100といった他の人気銘柄と比較しながら、その特徴やパフォーマンスを深掘りしていきます。

つみたてNISAでの銘柄選定を検討中の方々に向けて、「FANG+インデックス」の潜在的な価値とリスク、他の主要なインデックスとの比較を通じて、投資判断の参考にしていただければと思います。

FANGとは何ですか?

FANG(ファング)とは、アメリカの主要テクノロジー企業4社の頭文字を取った略称である。

具体的には以下の4社を指す。

- Facebook(現在の社名はMeta Platforms)

- Amazon

- Netflix

- Google(親会社はAlphabet)

FANGは、テクノロジー業界において革新的なビジネスモデルを展開し、近年のデジタル経済の成長を牽引してきた企業群を象徴する。

これらの企業は株式市場においても圧倒的な存在感を持ち、特に市場全体の動向に大きな影響を及ぼしてきた。その影響力の大きさから、投資家の間でもFANG銘柄への関心は高まり続けている。

FANG+指数とは何ですか?

- FANG+とは、アメリカの主要テクノロジー企業を中心に構成される株式指数。

- Facebook(現Meta Platforms)、Amazon、Netflix、Googleの4社の頭文字を取った「FANG」に加え、さらにテクノロジー企業6銘柄を追加した10銘柄を投資する指数。

- 2024年9月の定期リバランスでは、テスラとスノーフレークが除外され、クラウドストライク・ホールディングスとサービスナウが新たに採用された。

FANG+指数は、これらの成長性の高い企業に投資することで、デジタル経済の拡大とイノベーションの恩恵を受けることを目指している。

これらの企業は、通信、エンターテインメント、小売、サイバーセキュリティ、クラウド技術など 幅広い分野での成長企業を含み、高リターンの可能性があるが、市場変動に伴うリスクも高い。

FANG+に投資できる投資信託は?

FANG+に投資できる主な投資信託は、「iFreeNEXT FANG+インデックス」がある。

このファンドは、米国に上場する企業を対象に投資し、NYSE FANG+指数(円ベース)に連動した投資成果を目指している。

FANG+指数は、テクノロジーおよび関連分野で成長する企業に投資するため、高い成長ポテンシャルとともにリスクも伴う商品である。

iFreeNEXT FANG+インデックスの詳細は?

「iFreeNEXT FANG+インデックス」は、大和アセットマネジメント株式会社が提供する追加型のインデックス型投資信託である。

主にNYSE FANG+指数を構成する全銘柄に投資し、その動きに連動するパフォーマンスを目指す。

ファンドの特徴

- NISA(ニーサ)対象: 2024年からのNISA制度でつみたて投資枠および成長投資枠での投資が可能。

- 投資対象: NYSE FANG+指数の全銘柄。

- 為替ヘッジ: 原則として為替ヘッジは行わない。

FANG+インデックスの最新の構成銘柄は?

2024年の最新構成銘柄は以下の通り。

FANG+インデックスは定期的に銘柄の入れ替えが行われており、直近では2024年9月にリバランスが実施された。

| ティッカー | 銘柄名 | 業種名 |

|---|---|---|

| NVDA | エヌビディア | 情報技術 |

| META | メタ・プラットフォームズ | コミュニケーション・サービス |

| NFLX | ネットフリックス | コミュニケーション・サービス |

| GOOG | アルファベット | コミュニケーション・サービス |

| AVGO | ブロードコム | 情報技術 |

| MSFT | マイクロソフト | 情報技術 |

| AMZN | アマゾン・ドット・コム | 一般消費財 |

| AAPL | アップル | 情報技術 |

| CRWD | クラウドストライク・ホールディングス | 情報技術 |

| NOW | サービスナウ | 情報技術 |

FANG+の構成銘柄の入れ替え履歴は?

2018年の設定当初、iFreeNEXT FANG+インデックスの構成銘柄は以下の通り。

- Facebook(フェイスブック)

- Apple(アップル)

- Amazon.com(アマゾン・ドット・コム)

- Netflix(ネットフリックス)

- Google(グーグル)

- Alibaba(アリババ)

- Baidu(バイドゥ)

- Nvidia(エヌビディア)

- Tesla(テスラ)

- Twitter(ツイッター)

その後、以下の銘柄入れ替えが行われた。

2021年12月のFANG+インデックス銘柄入れ替え

- TwitterからMicrosoft(マイクロソフト)への銘柄変更

2022年12月のFANG+インデックス銘柄入れ替え

- アリババからAMD(アドバンスト・マイクロ・デバイセズ)への銘柄変更

- バイドゥからSnowflake(スノーフレイク)への銘柄変更

2023年9月のFANG+インデックス銘柄入れ替え

- AMDからBroadcom(ブロードコム)への銘柄変更

2024年9月のFANG+インデックス銘柄入れ替え

- テスラ・スノーフレイクを除外し、サービスナウ(NOW)とクラウドストライク(CRWD)を新規採用。

これらの銘柄入れ替えを経て、現在の構成銘柄の10銘柄となっている。

FANG+インデックス各銘柄の組入比率は?

FANG+インデックスに採用されている各銘柄は、「等ウェイト」で投資される。

現在、この指数は10銘柄で構成されているため、各銘柄に対しては理論上、ちょうど10%ずつの投資が行われる。

しかし、各銘柄の日々の値動きは異なるため、時間が経過すると各銘柄の比率は変動する。一部の銘柄は10%以上に増加することもあれば、10%未満に減少することもあるが、これらの比率を日々調整することはない。

したがって、基本的には10銘柄が各10%ずつ等配分で運用されると理解しておくと良い。

FANG+インデックスのセクター比率は?

FANG+インデックスの2024年9月の最新セクター比率は以下の通り。

| 業種名 | 比率 |

|---|---|

| 情報技術 | 60.0% |

| コミュニケーション・サービス | 30.0% |

| 一般消費財・サービス | 10.0% |

iFreeNEXT FANG+インデックスの運用コストは?

大和-iFreeNEXT FANG+インデックスの運用コストは以下の通り。

- 信託報酬(税込)/年: 0.7755%

この信託報酬0.7755%は、他のつみたてNISAで人気の銘柄「オール・カントリー(オルカン)」の0.05775%などと比較すると、比較的高め。

信託報酬は、投資信託の運用にかかる費用であり、これが高いほど長期的な投資成果に与えるマイナスの影響が大きくなる。

特に長期間にわたる投資では、わずかな報酬率の差が複利効果により大きな差となって現れるため、投資前には運用コストをしっかりと確認することが重要。

FANG+とGAFAM、マグニフィセントセブンの違い

FANG+、GAFAM、そして「マグニフィセントセブン」は、いずれも米国のテクノロジー関連株に焦点を当てた異なる銘柄群。

これらはテクノロジー業界の大手企業を中心に構成されてるが、それぞれに特徴がある。

構成銘柄の違い

- FANG+は10銘柄で構成され、GAFAMは5銘柄。

- マグニフィセントセブンは、GAFAMに「テスラ、エヌビディア」を加えた7銘柄。

- FANG+には、マグニフィセントセブンに、「ネットフリックス、スノーフレイク、ブロードコム」を加えた10銘柄となる。

カバー範囲の違い

- GAFAMは、米国の大手テクノロジー企業に限定される。

- マグニフィセントセブンは、GAFAMにテスラ、エヌビディアを加え、時価総額が高く、世界を席巻する巨大企業を指す7社。

- FANG+は、マグニフィセントセブンに加えて、より広範なイノベーションを牽引する企業群をカバーしている。

過去には中国の大手企業(アリババ、バイドゥ)も含まれていたが、銘柄の入れ替えにより現在は含まれていない。

FANG+、GAFAM、そして「マグニフィセントセブン」は、いずれも米国のテクノロジー関連株に焦点を当てた異なる銘柄群。

これらはテクノロジー業界の大手企業を中心に構成されてるが、それぞれに特徴がある。

| GAFAM銘柄 | マグニフィセントセブン銘柄 | FANG+銘柄 |

|---|---|---|

| Google(グーグル) | ||

| Apple(アップル) | ||

| Facebook(フェイスブック:メタ) | ||

| Amazon(アマゾン) | ||

| Microsoft(マイクロソフト) | ||

| ✕ | Nvidia(エヌビディア) | |

| ✕ | Tesla(テスラ) | ✕ |

| ✕ | ✕ | Netflix(ネットフリックス) |

| ✕ | ✕ | Broadcom(ブロードコム) |

| ✕ | ✕ | CrowdStrike Holding(クラウドストライク) |

| ✕ | ✕ | ServiceNow(サービスナウ) |

FANG+インデックスも採用銘柄はいつ変更される?

FANG+インデックスの構成銘柄の変更は、3月、6月、9月、12月の第3金曜日に行われる可能性がある。

このタイミングで、ガバナンス委員会がインデックスの品質と性格を維持するために必要と判断した場合、銘柄の追加や除外が行われる。

現在、FANG+インデックスは10銘柄で構成されているが、将来的に11銘柄以上に増える可能性もある。

FANG+採用銘柄の選定基準は?

FANG+インデックスの採用銘柄は、次世代テクノロジーを有するインターネットやメディア関連企業から選定される。

選定基準では、革新的な技術やビジネスモデルを活用している企業に焦点を当てており、「伝統的な技術・サービスを提供する企業」とは明確に区別されている。

この選定基準により、デジタル経済やインターネット分野における成長ポテンシャルの高い企業が採用されることが特徴である。

FANG+の各構成銘柄の具体的な事業内容は?

各構成銘柄の強みなど、わかりやすくポイントを押さえて説明すると以下。

- エヌビディア(NVDA):エヌビディアは、高性能コンピューターグラフィックスを生成するGPU(グラフィック処理ユニット)の先駆者です。ゲーム、プロフェッショナルデザイン、そしてAI技術の進展に欠かせない企業で、その技術はデータセンターから自動運転車まで幅広く応用されています。

- メタ・プラットフォームズ(META):メタ・プラットフォームズ、旧名Facebookは、世界最大のソーシャルネットワーキングサイトを運営しています。人々がオンラインで繋がり、情報を共有するプラットフォームとして、広告を主な収益源としています。

- ネットフリックス(NFLX): ネットフリックスは、映画やドラマなどのエンターテインメントコンテンツをインターネット経由で提供する世界的なストリーミングサービスです。独自のオリジナルコンテンツの制作にも力を入れており、視聴者に新しい視聴体験を提供しています。

- アルファベット(GOOGL):アルファベットは、Googleの親会社で、検索エンジン、YouTube、Androidなどのプラットフォームを運営しています。情報技術とデジタル広告の分野で世界をリードし、イノベーションを続けています。

- ブロードコム(AVGO):ブロードコムは、通信機器やデータセンター向けの半導体を提供する大手企業です。高速通信技術の発展に貢献し、世界中のデータ通信の基盤を支えています。

- マイクロソフト(MSFT): マイクロソフトは、WindowsオペレーティングシステムやOfficeスイートなどのソフトウェアを提供する世界的企業。近年ではAzureを中心としたクラウドサービスやAI技術、ゲーミング事業にも注力している。

- アマゾン・ドット・コム(AMZN): アマゾンは、オンラインショッピングの最大手企業。eコマース事業に加え、AWS(Amazon Web Services)によるクラウドコンピューティング事業も急成長しており、世界的なインフラ企業としての地位を確立している。

- アップル(AAPL): アップルは、iPhoneやMacなどのハードウェア製品を中心に、ソフトウェアやサービス事業を展開している企業。特にエコシステムの強固さが特徴で、ハードウェアとソフトウェアの連携が強み。

- クラウドストライク・ホールディングス(CRWD): クラウドストライクは、サイバーセキュリティのリーダー的企業であり、クラウドベースのエンドポイントセキュリティソリューションを提供している。AIを活用した高度な防御システムで、企業のサイバー攻撃防止に貢献している。

- サービスナウ(NOW):サービスナウは、クラウドベースのワークフロープラットフォームを提供する企業。IT運用管理や人事、顧客サービス、自動化などのビジネスプロセスを効率化するソリューションを展開している。

FANG+インデックスに投資するメリットは?

FANG+インデックスに投資するメリットには、以下のようなポイントがある。

次世代テクノロジーへのアクセス

FANG+インデックスは、次世代テクノロジーを活用し、グローバル社会に大きな影響を与える米国上場企業で構成されているため、テクノロジー分野の成長ポテンシャルを持つ企業群に効率的に分散投資できる。

クラウド、AI、サイバーセキュリティといった革新的分野に対するアクセスを提供する。

少数精鋭の銘柄群への投資

FANG+インデックスは、Meta Platforms(Facebook)、Amazon、Netflix、Google(Alphabet)、Nvidiaなど、世界的に知名度と影響力を持つ少数精鋭の銘柄で構成されている。

これらの企業は、イノベーションの最前線に立ち、デジタル経済の発展を牽引している。

投資家は、これらの高成長企業に一括して投資することができる。

優れたパフォーマンスの可能性

過去のデータから、FANG+インデックスはS&P500やNASDAQ100と比較して、成長性の高いパフォーマンスを示している。

テクノロジー分野の成長が株価に強く反映されるため、長期的な資産形成においても高いリターンを期待できる。

積立投資の利用

FANG+インデックスに連動する投資信託を通じて、日々の積立投資も可能なため、市場の短期的な変動に左右されず、長期的な資産形成を目指すことができる。

少額からの積立で、時間をかけてポートフォリオを成長させる戦略がとれる。

FANG+インデックスへの投資は、テクノロジー分野の成長に賭ける戦略の一つであり、特に次世代のテクノロジー企業に興味を持つ投資家にとって、魅力的な選択肢となる。

FANG+インデックスに投資するデメリットは?

FANG+インデックスへの投資へ考えられるデメリットは以下。

- 高ボラティリティ:FANG+インデックスは、テクノロジー大手企業に集中しているため、市場の変動により価格が大きく変動する可能性がある。

これは、短期間での価格の急騰や急落を意味し、投資リスクを高める可能性がある。 - 集中リスク:FANG+インデックスは特定のテクノロジー企業に集中して投資しているため、これらの企業が直面する業界特有の問題や規制の変更が投資全体に大きな影響を与える可能性がある。

- 市場環境の変化への感応性:テクノロジー業界は急速に進化しており、新しい技術や競合他社の出現によって、今日のリーダー企業が将来も同じ成功を保証されているわけではない。市場環境の変化により、投資の価値が減少するリスクがある。

- 過度の期待:FANG+インデックスへの過度の期待は、現実との乖離を生み出し、投資家が現実的なリターンを見積もることを難しくする可能性がある。過去の高いパフォーマンスが将来も続くとは限らない。

投資を検討する際には、これらのデメリットを理解し、自身の投資目的、リスク許容度、そして市場の状況を総合的に考慮することが重要。

FANG+インデックスのパフォーマンスは?

FANG+インデックスのベンチマーク指数の2018年の設定来のパフォーマンスは約350%となっている。

FANG+インデックスのベンチマーク指数のパフォーマンスグラフ

FANG+インデックスとS&P500、NASDAQ100と比較すると?

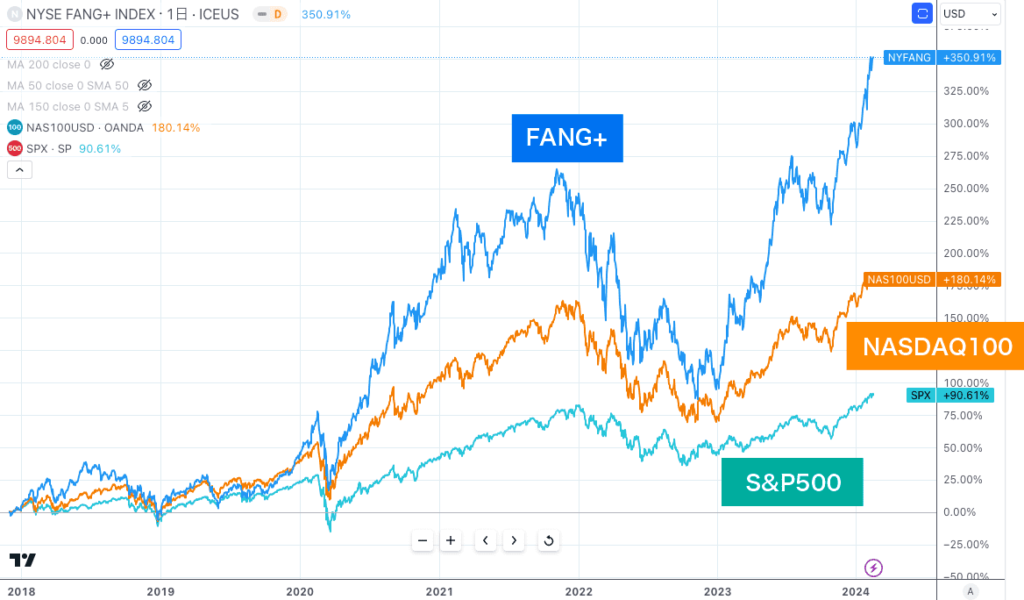

FANG+と良く比較されるS&P500とNASDAQ100のパフォーマンスを比較したグラフは以下。

2018年のFANG+設定当初からのパフォーマンスを比較すると、以下となっている。

- FANG+: 約350%

- NASDAQ100:約180%

- S&P500:約90%

FANG+のパフォーマンスはずば抜けているが、2022年の下落相場では、下落幅が非常に大きくなっている。

FANG+インデックスとS&P500、NASDAQ100のパフォーマンス比較グラフ

FANG+インデックスへの投資に向いている人は?

FANG+インデックスの投資が特に向いている人は、以下のような特徴や目的を持つ人。

- テクノロジー業界への強い関心を持つ人:FANG+インデックスは、テクノロジー関連の大手企業や革新的なビジネスモデルを持つ企業に集中してる。このセクターの成長ポテンシャルに興味がある人に適している。

- 長期的な成長を目指す投資家: FANG+に含まれる企業は、将来的な成長が期待される企業が多い。長期的な視点で投資を考え、市場の短期的な変動に動じない人に向いている。

- リスク許容度が高い人: FANG+インデックスは高ボラティリティを示すことがある。市場の変動によるリスクを受け入れられる、ある程度のリスク許容度を持つ投資家に適している。

- 分散投資を求める人:FANG+インデックスは、複数のテクノロジー関連企業に分散投資することを可能にする。一つの企業や業界に依存しない投資を求める人に適している。

これらの特徴や目的にあう人は、FANG+インデックスの投資を検討する価値がある。

「FANG+インデックスはおすすめしない」という記事、検索も多くみられがその要因は?

FANG+インデックスに対する一部の批判的な意見は、主に以下の点によると考えられる。

- FANG+インデックスは、市場の変動に敏感で、ボラティリティ(価格変動の激しさ)が高いとされる。

これは、テクノロジー関連企業が多くを占めるため、市場の変化によって価格が大きく上下しやすい。 - テクノロジー関連企業は、革新的で成長力が高い一方で、長期投資におけるリスクも高いとされる。

業界の急速な変化や新技術の出現により、現在のリーダー企業が将来も同じ地位を保持しているとは限らない。 - FANG+インデックスに含まれる企業は現在、高い成長力を示していますが、これが数十年後も続くとは限らない。

市場環境や技術の進化によっては、成長のペースが鈍化する可能性もある。 - つみたてNISAを含む長期投資では、リスク分散を通じて安定した資産形成を目指すことが推奨される。FANG+インデックスは特定のセクターに集中しているため、リスク許容度が低い投資家には適さないと考えられる。

長期投資において、分散投資を行わずに特定の銘柄群に集中して投資することはリスクを伴う。

10年後にFANG銘柄が依然として業界をリードしている保証はないが、FANG+インデックスでは定期的に銘柄の見直しが行われており、FANG銘柄以外にもパフォーマンスを維持している銘柄がサポート役となる。

これは投資家にとって一定の安心材料となり得る。

iFreeNEXT FANG+インデックスの将来性と今後の見通しは?

iFreeNEXT FANG+インデックスは、テクノロジー分野のリーダー企業に分散投資することで、デジタル経済の成長を直接享受することを目指したファンドである。

2024年9月のリバランスでは、テスラ・スノーフレイクが除外され、クラウドスタライクやサービスナウが新たに採用されるなど、指数の構成が成長を持続する企業に適応する形で調整されている。

このようなリバランスは、次世代テクノロジーの進化や市場の変化に柔軟に対応し、iFreeNEXT FANG+インデックスが持続的なパフォーマンスを目指すための重要なプロセスとなっている。

将来性の鍵となる要因

- テクノロジー分野の持続的成長:FANG+インデックスに含まれる企業は、AI、クラウドコンピューティング、サイバーセキュリティ、ソーシャルメディアなど、次世代テクノロジーの中心に位置している。

エヌビディアのAI半導体や、クラウドストライク、サービスナウのサイバーセキュリティ・クラウドサービスは、これらの分野で急速に需要が増加しており、今後も成長が見込まれる。

このようなリバランスにより、FANG+インデックスはこれからも高い成長ポテンシャルを維持する可能性がある。 - 世界経済のデジタル化の加速:グローバル経済は、パンデミック後もデジタル化が加速している。クラウドサービスやリモートワーク、eコマースの需要は引き続き増加しており、FANG+インデックスに含まれる企業はこのデジタルトレンドの中心に位置している。

アマゾンのオンラインショッピングとクラウドサービス、メタのメタバース開発、ネットフリックスのストリーミングサービスなど、デジタル分野での成長は引き続き期待されている。 - リスク要因:テクノロジー企業の成長性が大きなメリットである一方、FANG+インデックスはその集中性ゆえに特定のリスクも伴う。

例えば、規制強化や金利の上昇、テクノロジー分野における競争激化などが成長に影響を与える可能性がある。特に、政府の反トラスト法やデータプライバシー規制の影響は、これらの大手企業にとって大きなリスク要因となる。

今後のiFreeNEXT FANG+インデックスの見通し

FANG+インデックスの将来は、テクノロジー分野の成長次第であり、今後数年にわたって引き続き高いパフォーマンスが期待されている。

特にAIやクラウド関連企業は、2020年代後半に向けてさらに重要な役割を果たすと予想される。

加えて、企業の持続的な収益力と、リバランスによる柔軟な銘柄選定は、インデックス全体の安定性を高める要因となる。

総じて、iFreeNEXT FANG+インデックスは、テクノロジー分野に賭ける長期的な投資戦略として引き続き有望であるが、投資家は成長の可能性とリスクをしっかり理解した上で判断することが求められる。

まとめ

FANG+インデックスとそれに連動する投資信託「iFreeNEXT FANG+インデックス」について詳しく見てきました。

パフォーマンスを最優先に考える場合、ナスダック100に投資するのが一般的に良い選択とされています。しかし、ナスダック100の中でも特に優れたパフォーマンスを示す銘柄に焦点を当てたFANG+は、パフォーマンス面で非常に魅力的です。

ある意味最強ですね。

つみたてNISAの投資信託銘柄としても人気が高いFANG+ですが、20年から30年という長期投資を考えた場合は、やはり一定のリスクを伴います。

ほったらかしで投資したい場合は、より分散された投資信託、例えば世界分散型のオルカンなどを選ぶことをお勧めします。

個人的には、つみたてNISAでの投資銘柄として「大和-iFreeNEXT FANG+インデックス」を選択しました。

私自身は、NISAの税制優遇を最大限に活用するためには、高いパフォーマンスを追求する運用が望ましいと考えています。

10年後にFANG+がどのような状況にあるかは未知数ですが、パフォーマンスを重視しながら積極的に投資を進めていきたいと思います。