このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

▼AIが音声変換したポッドキャスト版はこちらからどうぞ。(Spotifyで再生)

はじめに

半導体セクターに投資する場合、主要な25銘柄で構成されるSMH(ヴァンエック半導体ETF)がありますが、より大きな利益を追求する場合は、3倍のレバレッジをかけた「SOXL」の選択肢があります。

ただし、レバレッジETFは扱いが難しく、特に長期投資には適していないことを理解する必要があります。

このETFは、通常の半導体セクターのボラティリティに加えて、3倍のレバレッジをかけることで、市場が下落する際の損失も大きくなる可能性があります。

ここでは、レバレッジETFの仕組みを理解し、SOXLの適切な買い時や投資戦略を私なりの分析で深掘りしていきたいと思います。

半導体ETFでどの銘柄に投資しようか検討している場合は、米国株、日本株、投資信託含めた選択肢を「半導体投資のための米国・日本ETFと投資信託おすすめリスト」で紹介しています。

SOXLとはどのような特徴を持つETF?

SOXLは、以下のような特徴を持つETF。

- SOXLの正式名称は「Direxion Daily Semiconductor Bull 3X Shares」

- 日本語では、「Direxion デイリー 半導体株ブル3倍 ETF」

- SOXLは、「ICE Semiconductor Index」の日次パフォーマンスの300%を目指すレバレッジETFで、指数の日々の動きを3倍に増幅して反映することを意味する。

- SOXLは、半導体セクターに特化しており、半導体関連の株価に連動している。これには主要な半導体製造企業や半導体機器メーカーが含まれる。

- レバレッジを使用することにより、SOXLは高いリターンの可能性を持つが、市場の小さな動きが大きく反映されるため、短期的な価格変動が激しくなるという高いリスクがある。

- SOXLは、レバレッジを効かせた戦略のため、短期的な市場の動きを利用した取引戦略に適しており、長期的な投資には向いていない可能性がある 。

これらの特徴から、SOXLは特に市場の動きを細かく追いたい投資家や、大きなリターンを狙いたいが同時にリスク管理もしっかり行う必要がある投資家に適している。

ETFについてはこちらで詳しく解説。

米国連続増配ETF VIGとは?- ETFとは何ですか?

レバレッジETFとは?その仕組は?

レバレッジETFは、通常のETFよりも大きなリターンを提供するように設計された金融商品。

これらのETFは、特定のベンチマーク指数(例えばS&P 500やNasdaq 100)に対して、長期または短期の露出を提供することを目的としている。

レバレッジETFの仕組み

- レバレッジETFは、デリバティブ(金融派生商品)を利用して、ベンチマーク指数の変動を2倍や3倍に増幅する。これにより、指数の動きに対してより大きなリターン(またはその逆)を目指す。

- 通常、レバレッジETFは投資家の資本に加えて、追加の資本を使用して、指数へのより高いレベルの投資露出を提供する。例えば、投資家からの1ドルに対して、2ドルまたは3ドルの指数露出を維持することが一般的。

- レバレッジETFは、基準となる指数の価格変動に応じて、総指数露出を日々調整(リバランス)を行うことで、指数が上昇または下落しても、一定のレバレッジ比率を維持する。

- レバレッジETFは、リバランスに伴う追加コストが発生する可能性がある。また、市場の変動により、期待されるリターンが実現しないリスクもある。

レバレッジETFの注意点

- レバレッジETFは、短期的な市場の動きを利用するためのものであり、長期投資には適していない場合がある。

- マーケットのボラティリティやレバレッジコストにより、長期的には期待されるリターンが得られない可能性があります。

レバレッジETFは、基本的に長期投資に向いていないと言える。

そのため、タイミングと投資期間をある程度予測して保有を検討する必要がある。

SOXLが長期投資に向いていない具体的な理由は?

SOXLが長期投資に向いていない主な理由は、以下の要素による。

レバレッジの影響

SOXLはレバレッジETFであり、指定された指数の日々の変動を3倍に増幅する。

この「3倍」というのは、正確には「毎日」の変動が3倍になるという意味です。

つまり、指数がその日1%上昇すると、SOXLは3%上昇することを目指し、逆に、1%下がれば、3%の下落となる。

コンパウンディング効果

レバレッジETFは、毎日リセットされるため、長期保有に問題を引き起こす。

なぜなら、市場は日によって上がったり下がったりするため、連日同じ方向へ動くことは珍しいから。

たとえば、ある日に大きく上昇した後、次の日に下落すると、全体のリターンは元の指数の動きよりも少なくなる可能性がある。

これは「ボラティリティの拡大」により、利益が期待通りに複利で増えなくなる。

経費率の高さ

SOXLの経費率は0.95%と、通常のETFに比べて高めとなる。

長期投資の場合、この経費率が資産の成長を妨げ、運用成績にネガティブな影響を与える可能性がある。

これらの理由から、SOXLは短期的な投機的取引には適しているが、長期的な資産形成のための投資手段としては推奨されない。

市場の波が大きく利益をもたらす可能性がある一方で、大きな損失のリスクも伴うため、投資戦略とリスク許容度を考慮する必要がある。

SOXLの運用会社は?

- SOXLは、「Direxion」によって運用されている。

Direxionは、レバレッジドとインバースETFを専門とする金融サービス会社。

Direxionの製品は、レバレッジの効いた商品やインバース(逆方向の動きをする)ETFなど、短期的な取引戦略に適しており、市場の日々の変動を利用して利益を得ることを目的としている。

SOXLの経費率は?

- SOXL(Direxion デイリー 半導体株ブル3倍 ETF)の経費率は0.95%

この経費率は、ETFの運用に関連するコストを示しており、投資家の保有資産から年間で差し引かれる。

この比較的高い経費率は、SOXLの運用戦略が積極的であり、高いレバレッジを使用しているために発生する。

SOXLの配当利回りは?

- SOXL(Direxion デイリー 半導体株ブル3倍 ETF)の配当利回りは約0.36%

SOXLの配当利回りは非常に低い。

これは、SOXLが高いレバレッジをかけた成長志向のETFであり、配当再投資よりも資本成長を重視しているため。

SOXLの分配金(配当)の支払い時期は?

- SOXLは、四半期ごとに分配金(配当)を支払う

支払いは、年4回、3月、6月、9月、および12月に行われる。

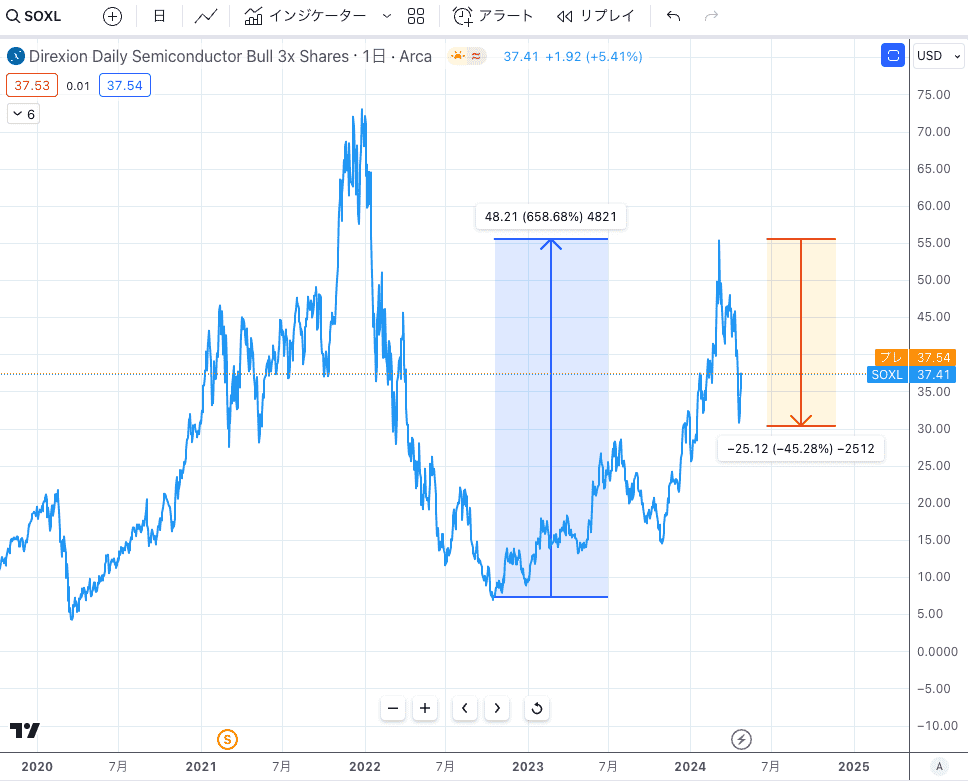

SOXLの現在株価と長期チャート

SOXLは、2010年3月11日から運用されており、比較的運用期間の長いETF。

SOXLの長期の値動きを見ると、以下のような傾向がある。

SOXLの長期の株価チャート

2023年以降、ChatGPTによる生成AIの進展とともに、エヌビディアをはじめとする半導体セクターは顕著な成長を遂げました。

この成長に伴い、SOXLも顕著な価格上昇を見せ、2023年から2024年4月にかけての期間で658%の上昇しています。

ただし、このETFは長期保有には向いておらず、レバレッジによる効果で毎日リセットされるため、市場が連日同じ方向に動かない限り、期待される3倍のパフォーマンスは得られないことが一般的です。

また、SOXLは3倍のレバレッジを採用しているため、市場が下落すると価格も大きく下がるリスクがあります。

特に2024年3月から4月にかけての約1ヶ月間で、SOXLは約45%の価格下落をしています。

このような高い価格ボラティリティのため、SOXLの長期保有は適しておらず、代わりに、市場の動向を細かく分析し、短期的なトレンドを活用する取引戦略が最適となる。

SOXLは高リスクと高リターンを伴うため、特に経験豊富な投資家やプロ向けの銘柄と言えます。

SOXLに投資するメリットは?

SOXLに投資するメリットは以下。

- SOXLは3倍のレバレッジを提供するため、市場が好調なときには、顕著な収益機会を提供する。

- SOXLは日次でリバランスされるため、短期的な市場の動きを利用する戦略に適しており、市場の一時的な動きから利益を得ることができる。

- SOXLはこのセクターに特化しているため、半導体産業の成長に直接的に投資することができる。

SOXLの投資で考えられるデメリットは?

SOXLへの投資には、以下のようなデメリットが考えられる。

- SOXLは3倍のレバレッジを使用しているため、市場が予想と反対に動いた場合、大きな損失を被るリスクがある。

- レバレッジETFは、長期保有するとコンパウンディング(複利効果)により、期待されるリターンと実際のリターンに乖離が生じる可能性があり、特に市場のボラティリティが高い場合、この効果はより顕著になる。

これらのデメリットを考慮した上で、SOXLへの投資を検討することが必要。

なぜ、SOXLが注目されているのか?

SOXLが注目されている理由は、主に以下の点が考えられる。

- AI技術の進化とその影響:最近のAIの進展、特に生成AIの普及が、高性能な演算を要求するため、半導体の需要を大幅に増加させている。生成AIは、大量のデータ処理が必要であり、これには高度な半導体が不可欠です。

- 半導体産業のサイクル:半導体業界は「シリコンサイクル」と呼ばれる需要と供給の波によって影響を受ける。このサイクルの理解は投資家にとって重要であり、特に技術の進歩が市場の動向を左右するため、半導体セクターへの関心が高まってる。

- 電気自動車(EV)と5G技術の普及:電気自動車の増加と5G通信技術の展開は、半導体チップの大量使用を要求しており、これらの技術向けの半導体需要が増加している。

- 国際政治の影響:米中間の技術・貿易摩擦や、各国の半導体に対する戦略的投資も、業界への注目を集める要因となっている。政府の支援による半導体工場の建設など、国家レベルでの動きが市場に影響を与えている。

これらの要因が組み合わさることで、SOXLを含む半導体関連の投資対象が特に注目される背景になっている。

AIの進化や新しい技術の導入、政治的な動向が、半導体市場の成長を牽引している。

SOXLの構成銘柄と組入比率は?

SOXLは、NYSE半導体インデックス (ICESEMIT) を追跡しており、ICESEMITのインデックス構成銘柄は以下のとおり。

| ティッカー | 銘柄名(日本語) | 組入比率 |

|---|---|---|

| AMD | アドバンスト・マイクロ・デバイセズ | 8.67% |

| AVGO | ブロードコム | 8.59% |

| NVDA | エヌビディア | 7.54% |

| INTC | インテル | 6.43% |

| QCOM | クアルコム | 6.41% |

| NXPI | NXPセミコンダクターズ | 4.01% |

| MU | マイクロン・テクノロジー | 3.99% |

| TXN | テキサス・インスツルメンツ | 3.97% |

| ON | ONセミコンダクター | 3.94% |

| LRCX | ラム・リサーチ | 3.90% |

SOXLの買い時、投資するベストなタイミングは?

SOXLの買い時や投資のベストなタイミングを判断するには、いくつかの要因を考慮する必要がある。

半導体業界の市場環境

SOXLは半導体セクターの動きに強く影響を受けるため、業界の景気周期や技術進歩、新製品のリリーススケジュールなど、半導体市場全体の状況を理解することが重要。

特に新しい技術革新や大手企業の業績報告が、市場の動向に大きな影響を与えることがある。

経済指標とマクロ経済状況

米国をはじめとする世界の主要経済の状態は、半導体業界に間接的な影響を与える可能性がある。経済の拡大が見込まれる時期は、半導体製品への需要増加を期待できるため、SOXLへの投資が有利になるかもしれない。

レバレッジの影響を理解する

SOXLは3倍のレバレッジをかけたETFであるため、市場の小さな動きが大きく反映されるため、市場のボラティリティが高い時期には特に注意が必要となる。市場が安定している時、あるいは半導体業界が上昇トレンドにあるときが投資のチャンスとなりやすい。

「SOXLはおすすめしない」という記事、検索も多くみられがその要因は?

SOXLが推奨されない主な理由は、その高いリスク性と投資の特性にある。

- 高いボラティリティとレバレッジ効果:SOXLは3倍レバレッジのため、市場の小さな動きが大きく反映される。このため、下落時の損失が大きくなる。また、日々の価格リセットがあるため、長期保有には不向きのため、初心者にはおすすめできないとされる。

- 運用成績の不安定さ:過去の運用成績を見ると、短期間で大きなリターンを得ることもあるが、その反面で大きな損失リスクもある。たとえば、一定期間で見ると大きなマイナスリターンを記録することがあり、このハイリスクは投資家にとって大きな負担となる。

- 経費率の高さ:SOXLは他の多くのETFと比較しても比較的高い経費率のため、長期にわたる運用でリターンを圧迫する要因となる。

つまり、SOXLは特に市場動向を短期で捉え、高いリスクを取れる経験豊富な投資家に限られるとされる。

SOXLとSOXSとの違いは?

SOXLとSOXSは、どちらも半導体セクターに焦点を当てたDirexion社によるレバレッジETだが、その動きの方向性が逆となる。

- SOXL(Direxion Daily Semiconductor Bull 3X Shares):

これはブル(強気)ETFで、対象となる半導体指数の日々のパフォーマンスを3倍に増幅させることを目指している。つまり、半導体指数が上昇すると、SOXLの価値も3倍の割合で上昇する。

- SOXS(Direxion Daily Semiconductor Bear 3X Shares):

一方でSOXSはベア(弱気)ETFで、対象となる半導体指数のパフォーマンスが下落すると、その下落率の3倍に相当するパフォーマンスを上昇させることを目指している。つまり、半導体指数が下がると、SOXSの価値は3倍の割合で上昇する。

SOXLの株を買える証券会社は?

SOXLの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ✕ | ✕ |

| auカブコム証券 | ◯ | ✕ |

| DMM株 | ✕ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ✕ |

| moomoo証券 | ◯ | ✕ |

まとめ

米国半導体セクターに対して3倍のレバレッジをかけたETF「SOXL」について、その特性、投資のメリットとデメリット、そして投資戦略について見てきました

個人的には、レバレッジETFを頻繁には使用していませんが、市場の見通しが良好でリスクオンなタイミングや、特に主要な半導体企業の決算が良い場合には、一時的に利益を得るための戦略として利用しています。

すべてがうまく進むわけではありませんが、FOMCの会合や雇用統計の発表などの大きな市場イベントの際には、特に市場の動向が大きく変動する可能性があるため、これらのタイミングを避けることでリスクを回避しています。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!