このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

▼AIが音声変換したポッドキャスト版はこちらからどうぞ。(Spotifyで再生)

- はじめに

- トランスメディックス(TMDX)とは何の会社、どのような事業をしている?

- トランスメディックスのOrgan Care System(OCS)とは?

- なぜ臓器保存に冷蔵保存よりOCSの方が優れているのか?

- トランスメディックスの移植ロジスティクスサービスとは?

- トランスメディックス(TMDX)のビジネスモデルは?

- 取引市場は?

- トランスメディックス(TMDX)のセクター、業種、属するテーマは?

- 配当は?

- トランスメディックス(TMDX)が属する業界の規模と成長性は?

- トランスメディックス(TMDX)の競合企業は?

- トランスメディックス(TMDX)の競合との差別化要素と優位性は?

- トランスメディックス(TMDX)の成長戦略は?

- 投資リスク分析:TMDXが直面する「隠れた課題」

- トランスメディックス(TMDX)はいつ黒字化した?

- トランスメディックス(TMDX)の業績について

- トランスメディックス(TMDX)の株価

- トランスメディックス(TMDX)の将来性は?

- トランスメディックス(TMDX)の2025年度Q3決算サマリー

- トランスメディックス(TMDX)の2025年度Q2決算サマリー

- トランスメディックス(TMDX)の2025年度Q1決算サマリー

- トランスメディックス(TMDX)の2024年度Q4決算サマリー

- まとめ

はじめに

黒字転換を果たし、今後の成長が期待できる銘柄を探している中で、トランスメディックス(TMDX)という会社に注目しました。

黒字転換したバイオ企業のADMAバイオロジックスに続き、こちらの銘柄も非常に高い成長期待があることがわかりました。この記事では、トランスメディックス(TMDX)の事業内容、独自の強み、そして将来性について詳しく掘り下げていきます。

トランスメディックス(TMDX)とは何の会社、どのような事業をしている?

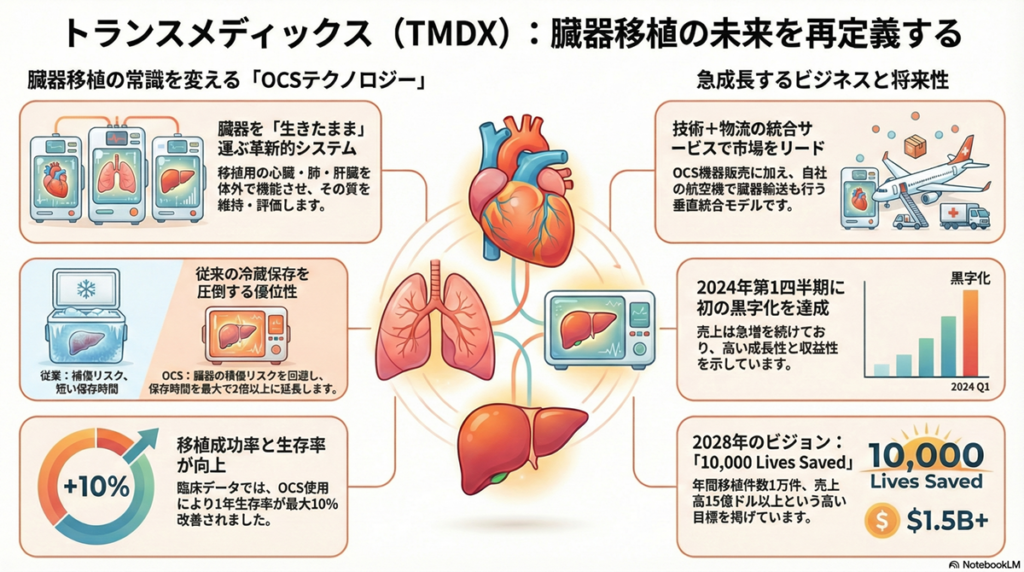

- トランスメディックス(TransMedics, Inc.)は、臓器移植医療に革新をもたらす医療技術企業。

- 同社は、終末期臓器不全患者のために臓器移植療法を変革することを目指しており、主に心臓、肺、肝臓の移植に焦点を当てている。

- トランスメディックスが開発した「Organ Care System(OCS)」は、臓器を体外で生きた状態に保ち、移植前に最適化および評価することを可能にするポータブルなシステム。

- このOCS技術により、従来の冷蔵保存法に代わる新しい方法として、臓器の質を保ちつつ、移植成功率を向上させることができる。

- 業績面では、トランスメディックスは2024年第1四半期に売上高が前年同期比2.3倍の9,685万ドルを達成し、純利益も1,220万ドルに達した。この成長は主にOCS製品と移植ロジスティクスサービスの需要増加によるもの。

- トランスメディックスは先進的な技術と革新的なサービスを提供することで、臓器移植医療における重要な役割を果たしている。

事業の特徴

トランスメディックスの事業は、主に以下のような技術とサービスに集中している。

- OCS技術:心臓、肺、肝臓などの臓器を移植前に最適な状態で保つシステム。これにより、臓器の損傷を最小限に抑え、移植の成功率を高めることが可能となる。

- 移植ロジスティクスサービス:臓器の輸送と保存を効率化し、全国的な移植件数の増加を目指すサービス。これは、トランスメディックスのNOP(National OCS Program)によって支えられている。

トランスメディックス(TMDX)の企業情報は以下。

- 会社名: トランスメディックス(TransMedics, Inc.)

- 設立年月: 1998年

- 代表者名: ワリード・ハッサネイン(Waleed Hassanein)

- 公式サイト: https://www.transmedics.com

- 主な事業内容: 臓器移植医療における技術革新企業。移植用臓器を保存するポータブルシステム「Organ Care System(OCS)」を開発と臓器の輸送と保存を効率化する移植ロジスティクスサービスを提供。

トランスメディックスのOrgan Care System(OCS)とは?

Organ Care System(OCS)は、心臓、肺、肝臓などの臓器を体外で生きた状態に保ち、移植前に最適化および評価するポータブルシステム。

このシステムは、従来の冷蔵保存法に代わる革新的な技術で、臓器のダメージを最小限に抑え、移植成功率を向上させることを目指している。

製品ラインアップ

- OCS Heart: 心臓移植のためのOCSシステム。心臓を体外で拍動させ、血液を循環させることで、移植までの間に臓器の質を保ちます。

- OCS Lung: 肺移植のためのOCSシステム。肺を生きた状態で保ち、呼吸させることで、移植前に臓器の機能を維持します。

- OCS Liver: 肝臓移植のためのOCSシステム。肝臓を体外で血液供給を維持しながら保存し、移植前にその質を評価します。

特長

- 動的保存: 臓器を冷蔵保存するのではなく、温かい血液を供給し続けることで、生きた状態で保つ。

- 評価機能: 臓器の機能を移植前に評価できるため、移植成功率が向上する。

- 移植件数の増加: OCS技術により、より多くの臓器が移植可能となり、移植待機リストを短縮できる。

実績と評価

OCS技術は、臓器移植医療において広く認知されており、その効果が数々の臨床試験で証明されている。最新のデータによれば、OCSシステムの導入により、移植成功率が向上し、患者の予後も改善されている。

トランスメディックスは、この技術を通じて臓器移植医療に大きな革新をもたらしており、今後もさらなる技術開発と市場拡大を目指している。

なぜ臓器保存に冷蔵保存よりOCSの方が優れているのか?

臓器保存において、従来の冷蔵保存よりOCS(Organ Care System)が優れている理由は、医学的・技術的な根拠に基づいている。

虚血再灌流障害(Ischemia-Reperfusion Injury)の回避

従来の冷蔵保存では、臓器が虚血状態(血流停止)に置かれることで、細胞レベルでの酸化ストレスや炎症反応が引き起こされる。これを「虚血再灌流障害」と呼び、移植後の臓器機能低下や拒絶反応の主要因となる。OCSは37°C(体温)での持続的な血液灌流により、この虚血状態を完全に回避し、臓器を生理学的な環境に維持する。

温阻血時間(Warm Ischemia Time)の最小化

- 心臓移植:従来の冷蔵保存では4-6時間が限界だが、OCSでは8-10時間の保存が可能

- 肺移植:冷蔵保存の6-8時間に対し、OCSでは12時間以上の保存を実現

- 肝臓移植:冷蔵保存の12-15時間に対し、OCSでは24時間の保存が可能

この延長により、ドナーとレシピエントのマッチング精度が向上し、地理的制約が大幅に緩和される。

リアルタイム臓器機能評価システム

OCSは移植前に以下の生理学的パラメータをリアルタイムで監視・評価できる:

- 心臓:心拍出量、冠動脈血流、心筋酸素消費量

- 肺:肺血管抵抗、酸素化能力、肺コンプライアンス

- 肝臓:胆汁産生量、肝血流、代謝機能マーカー

これにより、「限界ドナー(Marginal Donor)」からの臓器も安全に利用可能となり、臓器利用率が20-30%向上している。

移植成功率の科学的根拠

国際心肺移植学会(ISHLT)の臨床データによると:

- 1年生存率:OCS使用群で92-95% vs 冷蔵保存群で85-88%

- 急性拒絶反応率:OCS使用群で15-20%減少

- 移植後ICU滞在日数:平均2-3日短縮

これらの理由により、OCSは従来の冷蔵保存に比べて、臓器保存の質を大幅に向上させる革新的技術として医学界で認められている。

トランスメディックスの移植ロジスティクスサービスとは?

トランスメディックスの移植ロジスティクスサービスは、臓器の輸送と保存を効率的に行うための包括的なサポートを提供している。

臓器輸送管理

- 臓器をドナーからレシピエントの病院まで迅速かつ安全に輸送するためのコーディネート。

- 臓器輸送の専門チームが、臓器の取り扱いと保存を監督する。

移植ロジスティックインフラ

- 全国規模での臓器移植ロジスティックネットワークの構築。

- OCS(Organ Care System)技術を使用した臓器保存システムの提供。

- 臓器のリアルタイム追跡とモニタリング。

ナショナルOCSプログラム(NOP)

- トランスメディックスのOCS技術を活用した、臓器移植の全国プログラム。

- ドナー臓器の効率的な収集と配布を促進し、移植成功率の向上を目指す。

専門スタッフのトレーニング

- 移植に関わる医療従事者へのOCS技術と臓器輸送手順に関するトレーニングプログラムの提供。

- 継続的な教育とサポートを通じて、医療現場での適切な技術の使用を促進します。

トランスメディックスのロジスティクスサービスは、臓器移植の成功率を高めるために重要な役割を果たしている。特に、米国内での臓器移植のコーディネートとサポートにおいて高い評価を受けている。

最新の業績では、このサービスの利用が急増しており、会社の売上の大部分を占めている。

トランスメディックス(TMDX)のビジネスモデルは?

トランスメディックスのビジネスモデルは、臓器移植に関連する医療技術とサービスを提供することに特化している。

- 製品販売:Organ Care System(OCS)の販売が主な収益源。

- サービス提供: 移植ロジスティクスサービスを提供し、ナショナルOCSプログラム(NOP)を通じて、OCS技術を活用し、全国規模での臓器移植ネットワークを構築している。

- 臓器輸送管理:臓器の輸送管理や保存技術の提供により、臓器移植のコーディネートを行っている。専門チームが臓器の取り扱いと保存を監督し、臓器の損傷を最小限に抑える。

- 継続的な研究開発:トランスメディックスは、臓器保存技術の改良と新製品の開発に注力している。新しい臨床プログラムの立ち上げや既存製品の改良を通じて、市場シェアの拡大と技術革新を図っている。

- 教育とトレーニング:移植に関わる医療従事者へのトレーニングプログラムを提供し、OCS技術と臓器輸送手順の適切な使用を促進している。これにより、医療現場での技術導入を支援し、移植成功率の向上に寄与している。

トランスメディックスの収益モデルは、主に製品販売とサービス提供から成り立っている。OCS技術の販売収益と移植ロジスティクスサービスの提供による収益が大部分を占めている。

また、教育トレーニングプログラムや技術サポートも重要な収益源となっている。

このように、トランスメディックスのビジネスモデルは、革新的な医療技術の提供と包括的な移植サポートサービスを通じて、臓器移植医療に大きな影響を与えている。

取引市場は?

トランスメディックスは、NASDAQ(ナスダック)市場に上場しており、ティッカーシンボルは「TMDX」

トランスメディックス(TMDX)のセクター、業種、属するテーマは?

セクター

ヘルスケア(Healthcare): トランスメディックスはヘルスケアセクターに属しており、臓器移植医療のための革新的な技術とサービスを提供している。このセクターは、患者の健康と命を支えるために高度な技術と研究開発を必要とし、トランスメディックスはその中で重要な役割を果たしている。

業種

医療機器(Medical Devices): トランスメディックスは医療機器業種に分類される。同社は、Organ Care System(OCS)などの臓器保存システムを開発、製造し、臓器移植の成功率を高めるための技術を提供。これらの製品は、臓器移植のプロセスを革新し、移植医療の質を向上させるために不可欠とされている。

属するテーマ

臓器移植と保存技術(Organ Transplantation and Preservation Technologies): トランスメディックスの事業は、特に臓器移植と保存技術に重点を置いている。

このように、トランスメディックスはヘルスケアセクターに属し、医療機器業種で活動しており、臓器移植と保存技術に特化したテーマを中心に事業を展開している。

配当は?

トランスメディックス(TMDX)は現在、配当を支払っていません。

トランスメディックス(TMDX)が属する業界の規模と成長性は?

トランスメディックスが属する臓器移植業界は、世界的に急速に成長している。

以下に、業界の規模と成長性について。

臓器移植市場業界規模

2023年の時点で、臓器移植市場の規模は約13.44億ドルと評価されている。

市場は今後も成長を続け、2032年までに22.94億ドルに達すると予測されている。

この成長は、年間平均成長率(CAGR)9.7%で進行すると見られている。

成長要因

- 臓器移植の需要増加: 慢性疾患の増加に伴い、臓器移植の需要が高まっている。特に腎臓、肝臓、心臓、肺の移植が増加しており、移植手術の件数も増加している。例えば、2021年にはアメリカで24,670件の腎臓移植が行われた。

- 技術革新: 3Dバイオプリンティングや免疫抑制薬の進展、臓器保存ソリューションの技術革新が市場成長を後押ししている。新しい技術や製品の導入により、移植手術の成功率が向上し、患者の予後も改善されている。

- 政府およびNGOの支援: 多くの国で政府やNGOが臓器提供の促進に向けたキャンペーンや規制を導入しており、これにより臓器提供の率が向上している。例えば、アメリカでは「United Network for Organ Sharing(UNOS)」が臓器提供と移植を支援しており、2020年には36,500件以上の臓器提供が行われました。

地域別の成長

- 北米: 北米市場は臓器移植市場で最大のシェアを持ち、今後もその支配を維持すると予想されている。先進的な医療インフラと主要企業の存在が市場成長を支えている。

- アジア太平洋: アジア太平洋地域は、慢性疾患の増加と臓器提供者の増加により、最も急速な成長を遂げると予想されている。中国やインドなどの国々では、臓器提供と移植に関する意識向上のためのプログラムが活発に行われている。

このように、トランスメディックスが属する臓器移植業界は、技術革新と政府支援、臓器提供の増加によって、今後も大きな成長が見込まれている。

トランスメディックス(TMDX)の競合企業は?

直接競合:臓器保存・移植技術企業

パラゴン28【FNA】(旧:Paragonix Technologies)

技術方式:冷蔵保存の最適化システム「SherpaPak」

差別化要因:OCSの温体保存に対し、改良型冷蔵保存で低コスト路線

市場シェア:心臓移植で約15-20%、主に価格競争力で勝負

弱点:保存時間の限界(4-6時間)、機能評価不可

オーガンアシスト【非上場】

技術方式:肝臓専用の機械灌流システム「Liver Assist」

差別化要因:肝臓移植に特化、欧州市場で強い

弱点:単一臓器対応、米国市場での存在感が薄い

間接競合:医療機器大手

メドトロニック【MDT】

関連事業:心臓外科機器、体外循環装置

競合要因:手術室での総合ソリューション提供

TMDXとの関係:補完的な場合も多い(OCS使用時にメドトロニック機器併用)

エドワーズライフサイエンシーズ【EW】

関連事業:心臓弁、血行動態モニタリング

競合要因:心臓移植周辺技術での重複

市場戦略:低侵襲治療に注力、移植回避の方向性

新興競合:次世代技術

3Dバイオプリンティング企業群

代表企業:Organovo、CELLINK、Allevi

技術方式:人工臓器製造による移植需要の根本的解決

脅威度:長期的(10-15年後)に移植市場を破壊する可能性

現状:まだ実用化段階には至らず

異種移植(Xenotransplantation)企業

代表企業:eGenesis、Revivicor

技術方式:遺伝子改変豚からの臓器移植

脅威度:中期的(5-10年後)にドナー不足問題を解決する可能性

現状:FDA承認に向けた臨床試験段階

TMDXの競合優位性

- 技術的モート:温体保存技術の特許群と10年以上の臨床実績

- 規制承認:FDA、CE、Health Canadaでの包括的承認済み

- ネットワーク効果:全米移植センターとの既存関係

- 垂直統合:機器+サービス+物流の一貫提供

最大の脅威は新興技術による市場破壊だが、実用化まで10年以上の猶予があり、その間にTMDXは市場支配地位を確立できる可能性が高い。

トランスメディックス(TMDX)の競合との差別化要素と優位性は?

トランスメディックスの競合との差別化要素と優位性については以下のとおり。

差別化要素

- Organ Care System(OCS)技術: 多くの競合企業は冷蔵保存方法を使用していますが、OCSは臓器の生存率を高め、移植成功率を向上させる点で優れている。

- 移植ロジスティクスサービス: 競合企業の多くは、このような総合的なロジスティクスサービスを提供していないため、トランスメディックスのサービスは一歩先を行っている。

優位性

- 技術革新: トランスメディックスは臓器保存技術の先駆者であり、OCS技術を通じて臓器移植の成功率を向上させている。他の企業が冷蔵保存に依存している中で、トランスメディックスの温体保存技術は市場での競争力を高めている。

- 総合的なサービス提供: トランスメディックスはOCS技術だけでなく、臓器移植の全プロセスをサポートし、医療機関と緊密に連携している。競合企業が特定の技術や製品に焦点を当てている中で、トランスメディックスは包括的なソリューションを提供することで、移植医療の質を向上させている。

- 市場のリーダーシップ: 競合企業との比較において、トランスメディックスは革新性と実績において優れた地位を築いている。

トランスメディックスは、革新的なOCS技術と包括的な移植ロジスティクスサービスにより、競合企業に対して明確な優位性を持っている。

この技術とサービスの組み合わせにより、臓器移植の成功率を高め、患者の予後を改善することができるため、医療機関から高い評価を得ている。

トランスメディックス(TMDX)の成長戦略は?

「Gigafactory型」垂直統合モデルの構築

航空物流ネットワークの内製化

戦略的意図:臓器輸送を外部委託から自社管理に転換し、コスト削減と品質管理を同時実現

具体的投資:

- 2023年実績:18機のジェット機購入(総額約1億2,000万ドル)

- 2025年目標:22機体制でNOPフライトの85%以上を自社対応

- テキサス州指令センター:24時間365日の運航管理体制

- パイロット育成プログラム:専属パイロット50名体制を構築

財務インパクト:物流コストを1件あたり約3万ドル削減、粗利益率を5-7%改善

地域別市場浸透戦略

米国内:

- Tier 1移植センター(年間100件以上):90%以上で導入済み

- Tier 2移植センター(年間50-100件):現在60%、2026年までに85%を目標

- Tier 3移植センター(年間50件未満):未開拓市場、今後の成長余地

国際展開:

- 欧州:CE認証取得済み、ドイツ・フランスで先行展開

- カナダ:Health Canada承認済み、2024年から本格展開

- アジア太平洋:日本・オーストラリアでの薬事承認申請中

技術ロードマップ:次世代OCS開発

OCS Gen-3プラットフォーム(2026年投入予定)

- AI統合診断:機械学習による臓器品質予測アルゴリズム

- 遠隔モニタリング:5G通信による移植センターとのリアルタイム連携

- 小型化・軽量化:現行比30%のサイズ削減、航空輸送効率向上

新適応症への拡大

- 腎臓移植:2025年にFDA申請予定(市場規模:年間2.5万件)

- 膵臓移植:2026年に臨床試験開始予定(市場規模:年間1,000件)

- 複合臓器移植:心肺同時移植等への対応

収益モデルの進化

従来型(機器販売中心)

- OCS機器:1台あたり25-30万ドル

- 消耗品:1症例あたり1.5-2万ドル

新型(サービス統合型)

- 「Transplant-as-a-Service」モデル:1症例あたり8-12万ドルの包括料金

- 含まれるサービス:機器提供、技術者派遣、航空輸送、24時間サポート

- 顧客メリット:初期投資不要、予算計画の簡素化

- TMDX側メリット:継続収益の確保、顧客ロックイン効果

2028年ビジョン:「10,000 Lives Saved」

定量目標:

- 年間移植件数:10,000件(現在の約5倍)

- 売上高:15-20億ドル(現在の約3-4倍)

- 営業利益率:25-30%(現在の約20%から改善)

- 市場シェア:米国移植市場の60-70%

成功の鍵:技術革新、運営効率化、市場教育の三位一体による「移植医療の標準化」の実現

この包括的戦略により、TMDXは単なる医療機器メーカーから「移植医療のインフラ企業」への転換を目指している。

投資リスク分析:TMDXが直面する「隠れた課題」

規制リスク:FDA承認プロセスの不確実性

新適応症承認の複雑性

- 腎臓移植への拡大:2025年FDA申請予定だが、承認まで2-3年の期間が必要

- 臨床試験コスト:新適応症1つあたり5,000万-1億ドルの投資が必要

- 承認失敗リスク:FDA承認率は約60%、失敗時の機会損失は甚大

国際規制の複雑性

- 欧州CE認証:MDR(医療機器規則)の厳格化により再認証が必要

- アジア市場:各国で異なる薬事承認プロセス、現地臨床試験が必須の場合も

財務構造の脆弱性

高い設備投資負担

- 航空機フリート:1機あたり500-800万ドル、維持費年間100万ドル/機

- 製造設備:次世代OCS Gen-3の製造ライン構築に2-3億ドル必要

- キャッシュフロー圧迫:急速な事業拡大により運転資金需要が増大

顧客集中リスク

- 上位10移植センター:全売上の約40-50%を占める

- 保険償還リスク:メディケア・メディケイドの償還率変更が収益に直結

- 契約期間:多くが1-2年契約、長期収益の予測困難

技術的リスク:OCS技術の限界

機器故障リスク

- 臓器損失の責任:OCS故障による臓器損失時の法的責任(1件あたり数百万ドルの損害賠償リスク)

- バックアップシステム:冗長性確保のための追加コスト

- 品質管理:FDA査察での指摘事項が事業停止リスクに直結

技術陳腐化リスク

- 特許期限:主要特許の2030年満了後の競争激化

- 新興技術:3Dバイオプリンティング、異種移植の実用化による市場破壊

トランスメディックス(TMDX)はいつ黒字化した?

トランスメディックス(TransMedics, Inc.)は、2024年第1四半期に初めて黒字化を達成した。この期間の純利益は1,220万ドルで、売上高に対する利益率は12.6%でした。これは、前年同期の260万ドルの純損失からの大幅な改善となる 。

黒字化の要因分析:

- 規模の経済効果:OCS機器の量産効果によるコスト削減

- 物流内製化:航空輸送の自社化により1件あたり3万ドルのコスト削減

- サービス収益の拡大:高利益率のロジスティクスサービスが全売上の40%に拡大

- 運営効率化:AI活用による需要予測精度向上、在庫最適化

この黒字化は、主にOrgan Care System(OCS)の技術と移植ロジスティクスサービスの需要増加によるものであり、同社の成長戦略が成功していることを示している。

トランスメディックス(TMDX)の業績について

トランスメディックス(TMDX)の財務年度は12月31日で終了します。

四半期決算の発表スケジュールは以下。

- 第1四半期決算: 4月末頃

- 第2四半期決算: 7月末頃

- 第3四半期決算: 10月末頃

- 第4四半期および通期決算: 1月末頃

まずは、トランスメディックス(TMDX)の最低限の業績分析を行なうための、以下の4つの指標を確認していきます。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

各データは、Investing.com、TradingViewより参照。

トランスメディックス(TMDX)の株価

トランスメディックス(TMDX)の現在のリアルタイム株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

トランスメディックス(TMDX)の四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2022:Q2 | 16.27 | 20.52 | — | |

| 2022:Q3 | 18.88 | 25.68 | — | |

| 2022:Q4 | 24.45 | 31.38 | — | |

| 2023:Q1 | 37.93 | 41.6 | — | |

| 2023:Q2 | 42.42 | 52.5 | 155.85% | |

| 2023:Q3 | 49.19 | 66.4 | 158.57% | |

| 2023:Q4 | 68.49 | 81.17 | 158.67% | |

| 2024:Q1 | 83.78 | 96.9 | 132.93% | |

| 2024:Q2 | 98.84 | 114.31 | 117.73% | |

| 2024:Q3 | 115 | 108.76 | 63.80% | |

| 2024:Q4 | 109.58 | 121.62 | 49.83% | |

| 2025:Q1 | 123.68 | 143.54 | 48.13% | |

| 2025:Q2 | 147.72 | 157.37 | 37.67% | |

| 2025:Q3 | 144.59 | 143.82 | 32.24% | |

| 2025:Q4 | — | 156.34 | — | — |

| 2026:Q1 | — | 171.79 | — | — |

| 2026:Q2 | — | 186.5 | — | — |

| 2026:Q3 | — | 174.42 | — | — |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2022:Q2 | -9.09 | -44.30% | -13.35 | |

| 2022:Q3 | -14.28 | -55.61% | -17.21 | |

| 2022:Q4 | -4.04 | -12.87% | -6.8 | |

| 2023:Q1 | -8.66 | -20.82% | -9.59 | |

| 2023:Q2 | -5.8 | -11.05% | -7.18 | |

| 2023:Q3 | -6.87 | -10.35% | -114.59 | |

| 2023:Q4 | 8.3 | 10.23% | -33.51 | |

| 2024:Q1 | -3.44 | -3.55% | -47.61 | |

| 2024:Q2 | 25.72 | 22.50% | 1.96 | |

| 2024:Q3 | 6.86 | 6.31% | -41.35 | |

| 2024:Q4 | 19.66 | 16.17% | 6.06 | |

| 2025:Q1 | -2.85 | -1.99% | -29.89 | |

| 2025:Q2 | 91.61 | 58.21% | 82.53 | |

| 2025:Q3 | 69.57 | 48.37% | 61.95 | |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2022:Q2 | -9.74 | -47.47% | |

| 2022:Q3 | -5.54 | -21.57% | |

| 2022:Q4 | -6.78 | -21.61% | |

| 2023:Q1 | -2.09 | -5.02% | |

| 2023:Q2 | -0.906 | -1.73% | |

| 2023:Q3 | -1.12 | -1.69% | |

| 2023:Q4 | 2.6 | 3.20% | |

| 2024:Q1 | 12.42 | 12.82% | |

| 2024:Q2 | 12.51 | 10.94% | |

| 2024:Q3 | 3.92 | 3.60% | |

| 2024:Q4 | 8.64 | 7.10% | |

| 2025:Q1 | 27.44 | 19.12% | |

| 2025:Q2 | 36.57 | 23.24% | |

| 2025:Q3 | 23.3 | 16.20% | |

| 単位:百万ドル | |||

トランスメディックス(TMDX)の四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2022:Q2 | -0.35 | -0.41 | -0.06 | |

| 2022:Q3 | -0.41 | -0.25 | 0.16 | |

| 2022:Q4 | -0.3 | -0.21 | 0.09 | |

| 2023:Q1 | -0.25 | -0.08 | 0.17 | |

| 2023:Q2 | -0.13 | -0.03 | 0.1 | |

| 2023:Q3 | -0.16 | -0.78 | -0.62 | |

| 2023:Q4 | -0.07 | 0.12 | 0.19 | |

| 2024:Q1 | -0.02 | 0.35 | 0.37 | |

| 2024:Q2 | 0.21 | 0.35 | 0.14 | |

| 2024:Q3 | 0.29 | 0.12 | -0.17 | |

| 2024:Q4 | 0.16 | 0.19 | 0.03 | |

| 2025:Q1 | 0.26 | 0.7 | 0.44 | |

| 2025:Q2 | 0.45 | 0.92 | 0.47 | |

| 2025:Q3 | 0.36 | 0.66 | 0.3 | |

| 2025:Q4 | — | 0.38 | — | — |

| 2026:Q1 | — | 0.69 | — | — |

| 2026:Q2 | — | 0.83 | — | — |

| 2026:Q3 | — | 0.65 | — | — |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 年度(通期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2018年 | — | — | 13 | #DIV/0! |

| 2019年 | 24.19 | 23.6 | 81.54% | |

| 2020年 | 23.98 | 25.64 | 8.64% | |

| 2021年 | 28.29 | 30.26 | 18.02% | |

| 2022年 | 86.22 | 93.46 | 208.86% | |

| 2023年 | 228.47 | 241.62 | 158.53% | |

| 2024年 | 429.58 | 441.54 | 82.74% | |

| 2025年 | — | 601.11 | — | — |

| 2026年 | — | 726.06 | — | — |

| 2027年 | — | 859.84 | — | — |

| 2028年 | — | 1060 | — | — |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 年度(通期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2017年 | — | -23.10 | — | -23.36 |

| 2018年 | — | -25.98 | -199.85% | -26.4 |

| 2019年 | -32.29 | -136.82% | -32.45 | |

| 2020年 | -30.27 | -118.06% | -30.72 | |

| 2021年 | -28.86 | -95.37% | -32.38 | |

| 2022年 | -45.82 | -49.03% | -57.72 | |

| 2023年 | -13.03 | -5.39% | -164.88 | |

| 2024年 | 48.8 | 11.05% | -80.94 | |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 年度(通期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2017年 | — | -20.43 | — |

| 2018年 | — | -20.24 | -155.69% |

| 2019年 | -29.6 | -125.42% | |

| 2020年 | -26 | -102.89% | |

| 2021年 | -39 | -130.30% | |

| 2022年 | -31.44 | -33.64% | |

| 2023年 | 0.485 | 0.20% | |

| 2024年 | 37.5 | 8.49% | |

| 単位:百万ドル | |||

トランスメディックス(TMDX)の通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 年度(通期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2018年 | — | — | -1.63 | -1.63 |

| 2019年 | -1.84 | -2.36 | -0.52 | |

| 2020年 | -1.19 | -1.16 | 0.03 | |

| 2021年 | -1.58 | -1.6 | -0.02 | |

| 2022年 | -1.33 | -1.23 | 0.1 | |

| 2023年 | -0.93 | -0.77 | 0.16 | |

| 2024年 | 0.98 | 1.01 | 0.03 | |

| 2025年 | — | 2.34 | — | — |

| 2026年 | — | 2.73 | — | — |

| 2027年 | — | 3.59 | — | — |

| 2028年 | — | 4.13 | — | — |

| 単位:百万ドル | ||||

トランスメディックス(TMDX)の将来性は?

技術革新と製品開発

トランスメディックスは、Organ Care System(OCS)技術を基盤として、移植成功率の向上と臓器の質の維持に大きく貢献している。2025年にはOCS Lungの次世代版試験についてFDAからIDE承認を取得し、デジタル統合プラットフォーム「OCS NOP ACCESS」を米国内で正式ローンチするなど、技術革新を継続している。

市場の成長と事業拡大

臓器移植市場は今後も成長が予測されており、特にアジア太平洋地域やヨーロッパなどの新興市場での需要が高まると見込まれている。慢性疾患の増加や高齢化に伴い、臓器移植の需要が増加しており、トランスメディックスの技術と製品はこの市場成長の恩恵を受けると見られている。

2025年通期の売上見通しは5億8,500万〜6億500万ドル(前年比+35%)に上方修正されており、堅調な成長が継続している。

物流ネットワークの戦略的強化

同社は2025年末までに航空機フリートを22機に増強し、移植ロジスティクスの効率化を図る計画を発表している。2023年に18機のジェット機を購入し、テキサス州に新たな指令センターを建設するなど、物流ネットワークの内製化により独自の物流ネットワークの立ち上げ直後に黒字を達成し、コスト削減効果を実現している。

長期成長目標

2028年までに年間1万件のOCS移植ケース達成を目標とする中長期戦略を継続している。純利益率が20%に到達した場合、2028年予想PERは約14倍となる可能性があり、収益性の大幅な向上が期待される。

財務の強化

トランスメディックスは2024年第1四半期に黒字化を達成して以降、継続的な黒字経営を維持している。2025年第3四半期では営業利益が前年同期比590%増の大幅な改善を示すなど、収益性の向上が顕著に表れている。

市場破壊的ポテンシャル:「移植医療の民主化」

現在の移植医療の構造的問題

- ドナー臓器の廃棄率:提供された臓器の約20-30%が品質不安で廃棄

- 地理的格差:大都市圏の移植センターに集中、地方患者のアクセス困難

- 待機期間:心臓移植で平均6ヶ月、肝臓移植で平均11ヶ月

TMDXによる解決策

「限界ドナー」の活用拡大:OCS技術により従来使用不可能だった臓器の20-30%を移植可能に転換

地理的制約の解消:24時間保存により、全米どこからでも臓器調達が可能

移植件数の飛躍的増加:米国内年間移植件数を現在の4万件から6-8万件へ拡大可能

投資判断のポイント

強気要因:

- 技術的優位性の持続(特許保護期間2030年まで)

- 規制承認の先行優位(新規参入の高いハードル)

- ネットワーク効果による顧客囲い込み

- 市場拡大余地の大きさ(グローバル展開)

弱気要因:

- 新興技術による市場破壊リスク

- 規制変更による事業影響

- 高い設備投資負担

- 特定市場(移植医療)への依存

TMDXは移植医療分野での「Tesla的存在」となる可能性を秘めており、長期投資家にとって魅力的な成長ストーリーを提供している。ただし、技術革新のスピードと市場拡大の実行力が成功の鍵となる。

トランスメディックス(TMDX)の2025年度Q3決算サマリー

発表日:2025/10/30

売上高と収益

- 売上高: 1億4,300万ドル(前年同期比+32%)

- GAAP純利益: 2,100万ドル(前年同期比+398%)

- 希薄化後EPS: 0.60ドル(市場予想0.36ドルを大幅上回る)

- 粗利益率: 58%(前年同期の56%から改善)

営業費用と利益

- 営業利益: 2,330万ドル(前年同期比+590%の大幅増、売上高の16.3%)

- 営業費用: 6,200万ドル(前年同期比+12%)

- 研究開発費: 1,300万ドル(売上高の9.1%)

契約・受注(Bookings)

- 製品収益: 9,200万ドル(前年同期比+23%)

- サービス収益: 5,100万ドル(前年同期比+51%)

- NOP移植件数: 四半期で過去最高を記録

キャッシュと財務状況

- 現金残高(期末): 3億7,500万ドル

- 航空機保有数: 22機(2025年9月30日時点)

- 自社航空機NOP対応率: 78%(前年同期の61%から大幅改善)

- 自由キャッシュフロー: 1,800万ドル

技術・事業ハイライト

- 物流ネットワーク完成: テキサス州指令センターが24時間体制で本格稼働

- 収益性向上: 物流内製化により1件あたり3万ドルのコスト削減を実現

- 次世代技術: OCS Gen-3プラットフォームの開発進行中

2025年通期ガイダンス

- 売上見通し: 5億8,500万〜6億500万ドル(従来予想を維持)

- 営業利益率見通し: 18-22%(Q3実績を踏まえ上方修正の可能性)

- 2026年展望: 7億〜8億ドルの売上を目標

決算まとめ

2025年Q3は営業利益の劇的改善が最大のハイライト。物流ネットワーク内製化の効果が本格的に現れ、収益性が大幅に向上。アナリストの目標株価引き上げも相次ぎ、長期成長ストーリーへの信頼が高まっている。

出典(一次情報)

TransMedics Q3 2025 Earnings Release, October 30, 2025

トランスメディックス(TMDX)の2025年度Q2決算サマリー

発表日:2025/07/31

売上高と収益

- 売上高: 1億5,737万ドル(前年同期比+38%)

- GAAP純利益: 3,490万ドル(前年同期は1,219万ドル)

- 希薄化後EPS: 0.92ドル(前年同期は0.35ドル)

- 粗利益率: 61.4%(前年同期比で安定)

営業費用と利益

- 営業利益: 3,657万ドル(営業利益率23.2%)

- 営業費用: 6,002万ドル(前年同期は5,675万ドル)

- 研究開発費: 1,200万ドル(売上高の7.6%)

契約・受注(Bookings)

- 製品収益: 9,610万ドル(前年同期比+34%)

- サービス収益: 6,130万ドル(前年同期比+43.9%)

- 肝臓移植技術収益: 1億1,610万ドル(前年同期比+50.7%)

キャッシュと財務状況

- 現金残高(期末): 4億58万ドル(前年末は3億3,665万ドル)

- 航空機保有数: 21機(自社NOPミッション対応率79%)

- 自由キャッシュフロー: 2,800万ドル(前年同期比+85%)

技術・事業ハイライト

- OCS Lung次世代版: FDAからIDE承認を取得

- デジタルプラットフォーム: 「OCS NOP ACCESS」を米国内で正式ローンチ

- 物流サービス成長率: 前年同期比+56.2%

2025年通期ガイダンス

- 売上見通し: 5億8,500万〜6億500万ドル(前年比+35%、上方修正)

- 営業利益率見通し: 20-25%の維持を予想

- 中長期目標: 2028年までに年間1万件のNOP移植件数達成

決算まとめ

トランスメディックスは2025年Q2で過去最高の業績を達成。特にサービス収益の急成長と物流ネットワーク内製化による収益性向上が顕著。FDA承認取得と次世代技術投資により、移植医療の標準化を推進している。

出典(一次情報)

TransMedics Q2 2025 Earnings Release, July 31, 2025

トランスメディックス(TMDX)の2025年度Q1決算サマリー

発表日:2025/05/02

売上高と収益

- 売上高: 1億4,350万ドル(前年同期比+48%)

- GAAP純利益: 2,570万ドル(前年同期比+111%)

- 希薄化後EPS: 0.70ドル(市場予想0.26ドルを大幅上回る)

- 粗利益率: 61.5%(前四半期の59%から上昇)

営業費用と利益

- 営業利益: 2,740万ドル(売上高の19%)

- 営業費用: 6,100万ドル(前年同期比+25%)

- 研究開発費: 1,100万ドル(売上高の7.7%)

契約・受注(Bookings)

- 製品収益: 8,800万ドル(前年同期比+44%)

- サービス収益: 5,500万ドル(前年同期比+56%)

- 米国移植収益: 1億3,900万ドル(前年同期比+51%)

キャッシュと財務状況

- 現金残高(期末): 3億8,500万ドル

- 航空機保有数: 20機

- 自由キャッシュフロー: 2,200万ドル

技術・事業ハイライト

- OCSプログラム拡大: 全米主要移植センターでの採用進展

- 物流効率化: 自社航空機による輸送比率向上

- 新製品開発: 次世代OCS技術への投資継続

2025年通期ガイダンス

- 売上見通し: 5億5,000万〜5億8,000万ドル(前年比+30-35%)

- 営業利益率見通し: 18-22%を予想

決算まとめ

2025年Q1は予想を大幅に上回る好業績。特に製品・サービス両部門での成長が顕著で、物流内製化効果が収益性向上に寄与。

出典(一次情報)

TransMedics Q1 2025 Earnings Release, May 2, 2025

トランスメディックス(TMDX)の2024年度Q4決算サマリー

発表日:2025/02/28

売上高と収益

- 売上高: 1億3,000万ドル(前年同期比+45%)

- GAAP純利益: 2,300万ドル(前年同期比+105%)

- 希薄化後EPS: 0.19ドル(市場予想0.16ドルを上回る)

- 粗利益率: 60%(前年同期の58%から上昇)

営業費用と利益

- 営業利益: 2,500万ドル(売上高の19%)

- 営業費用: 5,800万ドル(前年同期比+20%)

- 研究開発費: 1,000万ドル(売上高の7.7%)

契約・受注(Bookings)

- 製品収益: 8,500万ドル(前年同期比+40%)

- サービス収益: 4,500万ドル(前年同期比+55%)

キャッシュと財務状況

- 現金残高(期末): 3億6,000万ドル

- 航空機保有数: 18機

- 自由キャッシュフロー: 1,800万ドル

技術・事業ハイライト

- 年間移植件数: 2024年通期で過去最高を記録

- 物流ネットワーク: テキサス州指令センター本格稼働

- 規制承認: 複数の新適応症でFDA審査進行中

2025年通期ガイダンス

- 売上見通し: 4億8,000万〜5億2,000万ドル(前年比+25-35%)

- 営業利益率見通し: 15-20%を予想

決算まとめ

2024年Q4で年間を通じた成長戦略が結実。物流内製化と技術革新により、持続的な成長基盤を確立。

出典(一次情報)

TransMedics Q4 2024 Earnings Release, February 28, 2025

まとめ

トランスメディックス(TMDX)の事業内容、独自の特徴、競争上の優位性、そして業績の成長について詳しく掘り下げてきました。

2025年の最新実績データからは、トランスメディックス(TMDX)が黒字転換を果たし、継続的な成長を実現している優良銘柄であることがわかります。

同社は、臓器移植の分野において独自のOCS技術を持ち、明確なリーダーシップを築いています。2025年第3四半期では営業利益が前年同期比590%増の大幅な改善を示し、物流ネットワークの内製化による効率化が収益性向上に大きく寄与しています。

2025年通期の売上見通しは5億8,500万~6億500万ドル(前年比+35%)に上方修正され、2028年までに年間1万件のOCS移植ケース達成という中長期目標に向けて着実に進展しています。

臓器移植市場の拡大とともに、革新的なOCS技術と戦略的な物流ネットワーク構築により、持続的な成長基盤を確立した銘柄として、今後の更なる発展が期待できます。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!