このサイトは、私(@mifsee)が個人的に学びながら企業分析や銘柄分析を進め、その過程を記録としてまとめているものです。

あくまで個人の調査・整理を目的とした内容であり、誤りや実際と異なる情報が含まれる可能性があります。

また、MifseeではAI技術を活用した運用や、技術習得を目的とした実験的な取り組みも行っています。ご覧いただく際には、その点をご理解のうえご利用ください。

- はじめに

- クアルコム(QCOM)はどのような企業ですか?

- クアルコムの主な事業内容は何?

- クアルコムのビジネスモデルは?

- クアルコムの主な製品は?

- Snapdragon(スナップドラゴン)の特徴は?

- クアルコムの無線通信技術は何がすごい?

- クアルコムの5G技術とはどのようなもの? 競合に対する強みはどこ?

- Snapdragon Cockpitプラットフォームとは?

- クアルコムの自動運転技術における強みは?

- 米国の自動運転の市場はこれからどのようになると予想されている?

- AI半導体におけるクアルコムの強みは?

- クアルコムが持つ特許の数は?

- クアルコムの取引主要国の割合は?

- クアルコムの配当は?

- クアルコムのセクター、業種、属するテーマは?

- クアルコムの競合企業は?

- クアルコムの競合との差別化要素と優位性は?

- 特許からみた競合との優位性は?

- クアルコム(QCOM)の現在株価

- クアルコムの業績について

- クアルコムの今後の展開と将来性は?

- クアルコム(QCOM)の2024年通期の決算サマリー

- クアルコム(QCOM)の2024年Q3の決算サマリー

- クアルコム(QCOM)の2024年Q2の決算サマリー

- クアルコム(QCOM)の2024年Q1の決算サマリー

- クアルコム(QCOM)の2023年通期の決算サマリー

- クアルコム(QCOM)の株を買える証券会社は?

- まとめ

はじめに

AI技術の急速な進化に伴い、半導体セクターへの注目が高まっています。

特に、コロナ禍におけるITデバイス関連の需要増加が、半導体業界に新たな動きをもたらしました。

多くの企業が在庫調整や市場変動に対応する中、半導体市況のトレンドを示すシリコンサイクルは、市況サイクルの底を打ち、AI技術の進展に伴い今後大きな成長が期待されています。

これまで、AMDやエヌビディアなどの半導体銘柄に焦点を当てた調査を行ってきましたが、今回はクアルコムにスポットを当てます。

クアルコムは、通信における技術革新の最前線に立ち、市場での競争力を高める独自の強みを持っています。

この記事では、クアルコムの技術革新の背景、市場での競争力、そして自動運転への進出など、彼らが持つ独自の強みを多角的な視点から分析し、その将来性を探ります。

クアルコム(QCOM)はどのような企業ですか?

クアルコム(Qualcomm Incorporated、NASDAQ: QCOM)は、主に無線通信技術の研究開発、製品設計、および市場展開を行うアメリカ合衆国の多国籍企業。

会社概要

- 会社名:Qualcomm Incorporated(クアルコム)

- 設立年:1985年

- 本社所在地:カリフォルニア州サンディエゴ

- 創業者:アーウィン・M・ジェイコブス、アンドリュー・ヴィタービ

- CEO:クリスティアーノ・アモン

- NASDAQ上場: QCOM

クアルコムの主な事業内容は何?

クアルコムの主な事業内容は以下の通り。

チップセットの製造

クアルコムはスマートフォン用のプロセッサーであるSnapdragonシリーズをはじめとするチップセットの開発と製造を行っている。

これらのチップセットは、高性能なCPU、GPU、DSP(デジタル信号プロセッサー)などを統合しており、スマートフォンの性能向上に大きく貢献している。

無線通信技術の研究開発

クアルコムは3G、4G LTE、そして最新の5Gなどの無線通信技術の開発において、業界をリードしている。

特に5G技術に関しては、その先進的な研究開発と広範な特許ポートフォリオにより、市場で大きな影響力を持っている。

ライセンス事業

クアルコムは、自社が保有する無線通信技術に関する特許のライセンス供与を行っており、これが重要な収益源となっている。

他の企業がクアルコムの特許技術を使用する際には、ライセンス料を支払う必要がある。

その他の事業

これに加えて、クアルコムは自動車、ウェアラブルデバイス、ホームエンターテイメントシステムなど、スマートフォン以外の分野への技術提供も行っている。

これらの分野でのIoT(Internet of Things)技術の展開も積極的に進めている。

これらの事業を通じて、クアルコムは世界中の多くのデバイスやシステムに影響を与え、通信技術の進化を牽引している。

クアルコムのビジネスモデルは?

クアルコムのビジネスモデルは、以下の通り。

- クアルコムは自社で半導体製造工場(ファブ)を持たず、チップセットの設計と開発に特化しているファブレス半導体企業。

製造は外部の半導体製造サービス企業(ファウンドリ)に委託している。 - クアルコムは、自社が保有する無線通信技術に関する特許のライセンス供与を行っており、これが重要な収益源となっている。

- クアルコムは、Snapdragonプロセッサーをはじめとするチップセットをスマートフォンメーカーや他のデバイスメーカーに製品販売し、供給している。

これらの製品は、高性能なCPU、GPU、AIエンジンを統合しており、デバイスの性能向上に貢献している。 - クアルコムは研究開発に大きな投資を行っており、新しい通信技術や半導体技術の開発に注力している。

これにより、業界をリードする技術革新を継続している。 - クアルコムは、スマートフォン市場だけでなく、自動車、ウェアラブルデバイス、IoTデバイスなど、多様な市場に技術を提供している。

このビジネスモデルにより、クアルコムは製造設備への大規模な投資を避けつつ、技術開発とイノベーションに集中し、市場の需要の変動に柔軟に対応している。

クアルコムの主な製品は?

クアルコムの主な製品は以下の通り。

Snapdragonプロセッサー

スマートフォンやタブレット用の高性能プロセッサー。CPU、GPU、DSP(デジタル信号プロセッサー)を統合し、高速な処理能力、優れたグラフィックス性能、AI処理能力を提供。

モデムチップ

4G LTEや5Gなどの無線通信規格に対応したモデムチップ。高速なデータ通信と安定した接続を実現。

RFフロントエンドモジュール

スマートフォンや他のモバイルデバイスの無線通信機能をサポートするためのRF(無線周波数)フロントエンドコンポーネント。

Wi-FiとBluetoothチップセット

デバイスの無線LAN(Wi-Fi)接続とBluetooth接続を提供するチップセット。

車載用チップセット

Snapdragon Automotiveプラットフォームを含む、IVI(In-Vehicle Infotainment:車載インフォテインメント)システムや運転支援システム用のチップセット。

※インフォテインメントとは、「インフォメーション(情報)」と「エンターテインメント(娯楽)」を融組み合わせた造語、車載インフォテインメントシステムは、運転中に情報提供と娯楽を提供するシステムを指す。

IoTデバイス用チップセット

家庭用や産業用のIoT(モノのインターネット)デバイス向けのチップセット。省エネルギー性能と接続性を提供。

これらの製品は、クアルコムが無線通信技術と半導体技術の分野でリーダーであることを示し、特に、Snapdragonプロセッサーは、高性能なモバイルデバイスの心臓部として広く知られている。

Snapdragon(スナップドラゴン)の特徴は?

クアルコムのSnapdragon(スナップドラゴン)プラットフォームは、以下の点で特に注目されている

- カメラ技術:Snapdragonは、モバイルデバイスでの写真撮影とビデオ撮影を革新している。

AI強化によるプレミアムなカメラ技術を搭載し、プロレベルの写真やビデオを提供。ユーザーは生活の素晴らしい瞬間を高品質で捉えることができます。 - モバイルゲーミング体験:Snapdragonは、モバイルゲーミングにおいて完全に没入型の体験を提供。

レイトレーシングなどのモバイルゲーミング技術を活用し、リアルなゲーム体験を実現している。 - オーディオシステム: AIを活用したエンドツーエンドのオーディオシステムにより、リッチでスタジオ品質の詳細なサウンドを提供。

ユーザーは最高品質の音響体験を楽しむことができる。 - デバイスの性能向上: Snapdragonは、スマートフォンをはじめとする多くのデバイスの中核をなすプロセッサーであり、高性能なCPU、GPU、AIエンジンを統合し、デバイスの性能を大幅に向上させている。

- パートナーシップ:Samsung Galaxy S23 UltraなどのトップクラスのスマートフォンにSnapdragonが採用されており、ユーザーはより多くの驚異的な体験を享受できる。

Snapdragonは、その高度な技術と革新的な機能により、モバイルデバイスの性能と体験を大きく向上させている。特にカメラ、ゲーミング、オーディオの分野での進歩は、ユーザーにとって顕著なメリットをもたらしている。

クアルコムの無線通信技術は何がすごい?

クアルコムの無線通信技術については、以下の点が特筆される。

- 5G技術のリーダーシップ:クアルコムは5G通信技術の開発において、業界を大きくリードしている。

5Gは、高速データ通信、低遅延、大量のデバイス接続を可能にし、スマートフォン、IoTデバイス、自動車など多岐にわたる分野に革命をもたらす。 - Snapdragonプラットフォーム:Snapdragonは、スマートフォンや他のデバイス向けの高性能プロセッサーで、高度なCPU、GPU、AIエンジンを統合。これにより、デバイスの性能向上、省エネルギー、AI機能の強化が実現されている。

- 自動車分野への進出:クアルコムは、Snapdragon Cockpitプラットフォームを通じて自動車業界に進出。このプラットフォームは、車内のインフォテインメントシステム、デジタルダッシュボード、運転支援システム(ADAS)などを強化。

- C-V2X技術:クアルコムは、車両間通信(V2X)技術の開発に注力しており、車両の安全性向上、自動運転技術の発展、交通効率の最適化が期待される。

- AIとIoTの統合:クアルコムは、AI技術とIoT(モノのインターネット)を統合し、スマートホーム、ウェアラブルデバイス、工業用IoTなどの分野で新しい可能性を開拓している。

これらの技術は、クアルコムが無線通信技術の分野でいかに革新的であり、多様な産業に影響を与えているかを示す。

特に5G技術の普及は、今後のクアルコムの成長と市場影響力をさらに強化する要因となる。

クアルコムの5G技術とはどのようなもの? 競合に対する強みはどこ?

クアルコムの5G技術に関する強みは以下の通り。

- クアルコムは5G技術の基礎となる重要な技術を発明し、5Gの実現を可能にした。これには、超高速接続、高い信頼性、優れたパフォーマンス、低遅延などが含まれる。

- クアルコムの技術は、5Gのグローバルな標準を形成する上で重要な役割を果たしている。同社の革新的な技術は、5Gのスピード、応答性、容量などの利点を定義し、5Gの拡大を加速している。

- 自動車から拡張現実(XR)まで、さまざまなプラットフォーム向けに最先端の5G製品を開発している。これらのプラットフォームは、高速な接続、優れたカバレッジ、省エネルギーを提供する。

- 世界中で100以上の5Gライセンス契約を締結しており、モバイルエコシステムの成長を促進している。

- 強化されたモバイルブロードバンド、ミッションクリティカルな通信、大規模IoTなど、3つの主要な接続サービスタイプに5Gを適用している。スマートフォンの高速化、新しい没入型体験、重要なインフラのリモート制御、スマートホームデバイスからスマートシティまでのシームレスな接続が可能となる。

これらの要素は、クアルコムが5G技術分野で競合他社と差別化し、市場での優位性を保つための基盤となっている。

特に、5G技術の基礎を築いたことと、その技術を多様な産業に応用している点が、クアルコムの強みとなる。

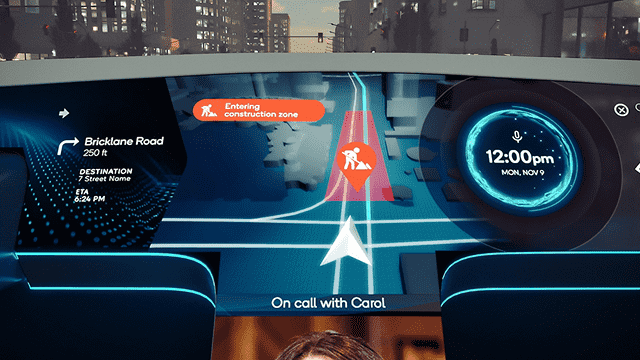

Snapdragon Cockpitプラットフォームとは?

Snapdragon Cockpitプラットフォームは、クアルコムが提供する次世代の車載インフォテインメントシステム向けのソリューション。

出典:第 4 世代 Snapdragon 自動車コックピット プラットフォーム

以下は、Snapdragon Cockpitプラットフォームの主要な特徴。

- 5nmプロセス技術を使用した高性能SoC(System-on-Chip)を搭載し、次世代の車載体験を提供。これにより、自動車業界におけるコネクテッドコックピットソリューションの基準を高める。

- 異なるハイパーバイザーをサポートする統合されたアーキテクチャを備え、インフォテインメントと運転支援システムの領域融合に対応。デジタルクラスターとインフォテインメント領域の統合に伴う複雑さに対応できる。

- 統一されたフレームワークで、異なる車両クラスにわたって拡張可能なアーキテクチャを提供。消費者は車両のクラスに関係なく、統一された高品質な体験が可能。

- 車内バーチャルアシスタント、自然な音声制御、言語理解、適応型人間機械インターフェースをサポート。

- 車内モニタリングや超高解像度サラウンドビューモニタリングを含む、インテリジェントな運転支援システムが特徴。

- 車内の複数のディスプレイをサポートし、超広角パノラマディスプレイ、再構成可能な3Dデジタルインストルメントクラスター、拡張現実ヘッドアップディスプレイ(HUD)、Ultra HDメディアストリーミングなどを提供。

- カスタマイズされたマルチオーディオゾーン、クリアな車内通信、高レベルのノイズ抑制機能をサポート。

Snapdragon Cockpitプラットフォームは、自動車メーカーが消費者の進化するニーズに応えるための多層的なソリューションを提供し、エントリーレベルからプレミアムレベルの車両にわたって、幅広いオプションを提供することが可能。

クアルコムの自動運転技術における強みは?

クアルコムの自動運転市場に対する強みと影響力は、以下のような最新の技術とイニシアチブを通じて顕著です。

Snapdragon Digital Chassis

これは、テレマティクス(車両がインターネットや他の通信ネットワークを介して情報を送受信する技術)と接続性、コンピューティング、運転支援および自動運転のための包括的なクラウド接続型自動車プラットフォーム。

自動車メーカーはこのプラットフォームを使用して、安全でカスタマイズ可能で没入型の新技術機能とデジタルサービスの提供が可能になる。

Snapdragon Ride

低消費電力で高性能を提供するSnapdragon Rideプラットフォームは、高度な運転支援システム(ADAS)機能の開発に使用される。

これには、最先端のローカライゼーション、認識、およびドライブポリシー機能が含まれる。

Snapdragon Auto Connectivity

これは、車両内外での接続性をサポートする包括的なソリューションで、安全性とインフォテインメントを強化する。

最先端の4G/5G自動車モデム、統合されたC-V2XおよびMF-GNSS技術、高度なWi-FiおよびBluetooth、Snapdragon Car-to-Cloudサービスなどが含まれる。

Snapdragon Cockpit

このプラットフォームは、車内の接続性とインテリジェンスを提供し、車内バーチャルアシスタント、コンテキストに基づく安全性のユースケース、高度なオーディオ、グラフィックス、マルチメディアを含む。

C-V2Xソリューション

クアルコムのC-V2X(Cellular Vehicle to Everything)ソリューションは、車両が互いに直接通信し、周囲のすべてと仮想的な通信を支援。

これは、道路安全性の向上と自動運転への道をサポートする。

これらの技術は、クアルコムが自動運転市場において大きな影響力を持ち、自動車のデジタル変革を加速していることを示している。

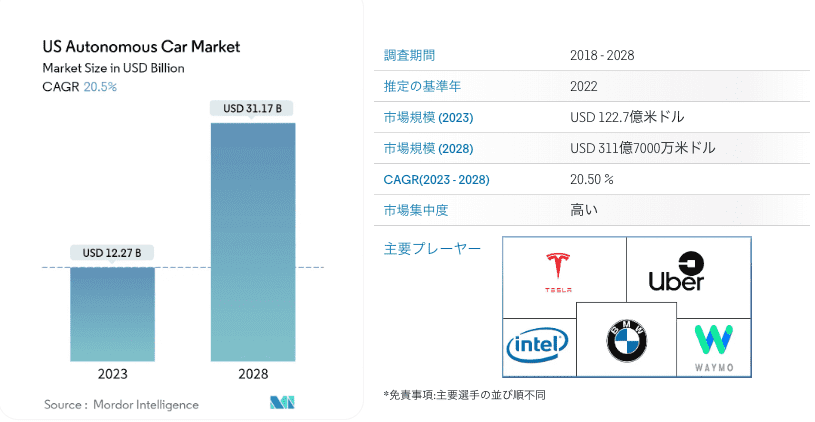

米国の自動運転の市場はこれからどのようになると予想されている?

米国の自動運転車市場に関するMordor Intelligenceのレポートによると、以下のような市場規模と成長予測が示されてる。

自動運転の市場規模(米国)

- 2023年の市場規模:2023年には、米国の自動運転車市場の規模は約122.7億米ドルと推定されている。

- 2028年の市場規模:2028年までに、市場規模は約311.7億米ドルに達すると予測されている。

自動運転市場の成長予測

- 成長率:2023年から2028年の間に、年平均成長率(CAGR)は20.50%と予測されています。

AI半導体におけるクアルコムの強みは?

クアルコムのAI半導体における強みは以下の通り。

- クアルコムは、AI技術の研究開発において長年の経験を持ち、特にモバイルデバイス向けのAI技術においてリーダーシップを発揮している。

- クアルコムは、パワー効率の良いオンデバイスAI技術の開発に注力しており、デバイスがユーザーのプライバシーを保護しながら、高速で応答性の高いAI処理を実現できる。

- クアルコムは、デバイスとクラウド間でのAI処理を分散させるハイブリッドAIアーキテクチャを推進しており、パフォーマンス、個人化、プライバシー、セキュリティの面での利点が得られる。

- クアルコムは5G技術とAIを組み合わせることで、新しい世代のワイヤレスイノベーションを推進している。5Gの高速通信と低遅延は、AIアプリケーションのパフォーマンスを向上させる。

- クアルコムのAI技術は、スマートフォン、PC、IoTや自動車から拡張現実(XR)まで、さまざまなプラットフォーム向けに最先端のAI製品を開発、多岐にわたる産業で応用されている。

これらの強みは、クアルコムがAI半導体市場において競合他社と差別化し、優位性を保つための基盤となっている。

特に、オンデバイスAIと5G技術の組み合わせは、今後の技術革新と市場成長の鍵となる。

クアルコムが持つ特許の数は?

クアルコムは、全世界で合計263,708件の特許を保有しており、そのうち114,046件が既に付与されている。

これらの特許のうち、62%以上が現在も有効。

クアルコムが最も多くの特許を出願している国はアメリカ合衆国で、次いでヨーロッパと中国が続いている。

これらの特許は、クアルコムが無線通信技術分野で革新的なリーダーであることを示しており、3G、4G、5Gスマートフォンにおける基礎技術を提供している。

また、自動車、IoT、コンピューティングなど、新しい産業へのモバイルの利点を拡大。クアルコムは5Gの進化に向けた研究を牽引している。

クアルコムの取引主要国の割合は?

クアルコムの売上高内訳(主要国別)

- 中国(香港を含む):クアルコムにとって最も大きな市場、2023年の売上は約22.38億米ドル。

- ベトナム: 2023年の売上は約4.55億米ドル。

- その他の外国: 2023年の売上は約4.36億米ドル。

- 韓国:2023年の売上は約3.27億米ドル。

- アメリカ合衆国:2023年の売上は約1.26億米ドル。

これらのデータから、クアルコムの売上は主に中国(香港を含む)に依存している傾向があり、他の国々と比較してもその割合が大きいことがわかる。また、ベトナム、その他の外国、韓国、アメリカ合衆国もクアルコムにとって重要な市場であることが示されている。

クアルコムの配当は?

クアルコムの2023年の配当に関する情報は以下の通り。

- 年間配当:クアルコムは年間$3.20の配当を支払っている。

- 配当利回り:配当利回りは2.48%。

- 配当支払い頻度: 配当は四半期ごとに支払われる。

- 配当性向:配当性向は49.84%。

- 配当成長率:配当成長率は7.51%。

クアルコムのセクター、業種、属するテーマは?

セクター

- クアルコムはテクノロジーセクターに分類される。このセクターには、情報技術、ソフトウェア、ハードウェア、および関連サービスを提供する企業が含まれる。

業種

- クアルコムは、特にモバイルデバイス用の半導体チップセットの設計と開発に特化しているため、半導体業種に分類される。この業種には、半導体の製造、設計、および販売を行う企業が含まれる。

属するテーマ

- 5G:クアルコムは5G通信技術の開発において重要な役割を果たしており、5G関連の製品と技術を提供している。

- モバイル通信:スマートフォンやタブレットなどのモバイルデバイス用のチップセットを提供することで、モバイル通信業界に大きな影響を与えている。

- IoT(モノのインターネット): IoTデバイス用のチップセットや技術を提供し、スマートホーム、ウェアラブルデバイス、産業用IoTなどの分野で活動している。

- 自動車技術:車載インフォテインメントシステムや運転支援システム用のチップセットを提供し、自動車業界における技術革新に貢献している。

クアルコムの競合企業は?

- インテル (INTC):パーソナルコンピューターおよびデータセンター向けのプロセッサーを中心に、幅広い半導体製品を提供している。最近では、5G通信技術にも注力している。

- サムスン電子 : スマートフォン、タブレット、その他の電子機器用の半導体チップセットを製造している。特にメモリチップ市場での地位が高い。

- 台湾積体電路製造 (TSMC):世界最大の独立型半導体製造サービス企業(ファウンドリ)。多くの半導体企業に製造サービスを提供。

- ブロードコム(AVGO): ワイヤレス通信、有線インフラ、エンタープライズストレージ、インダストリアルなどの分野で半導体製品を提供。

- エヌビディア(NVDA):GPU(グラフィックス処理ユニット)を中心に、AI、ディープラーニング、自動運転車などの分野で半導体製品を提供。

- アドバンスト・マイクロ・デバイセズ(AMD):パーソナルコンピューターおよびサーバー向けのCPUとGPUを提供。

これらの企業は、半導体業界においてクアルコムと直接競合しているか、または関連する市場で競合している。

特に、スマートフォン、通信技術、自動車技術、AIなどの分野での競争が激しい。

クアルコムの競合との差別化要素と優位性は?

- クアルコムは、CDMA技術の開発者として知られ、3G、4G、そして5G通信技術の基礎を築き、無線通信の世界を大きく変えたことにより業界のリーダーとして位置づけられる。

- クアルコムは5G技術の開発において重要な役割を果たしており、5G NR(New Radio)とmmWave技術の開発において先駆者となる。これにより、クアルコムは5Gの商業化と普及に大きく貢献している。

- クアルコムは、プロセッサー、モデム、RFシステム、接続性ソリューションなど、多様な製品を提供しており、スマートフォン、自動車、IoTデバイスなど、さまざまな分野でのニーズに対応している。

- クアルコムは、30カ国以上に170以上のオフィスを持ち、世界中で事業を展開しており、グローバルな市場での影響力とプレゼンスを確立している。

- クアルコムは研究開発に大きな投資を行い、新しい技術と製品の開発に注力している。これにより、持続的な技術革新と市場での競争力を維持している。

これらの要素は、クアルコムが半導体業界および無線通信技術分野で競合他社と差別化し、優位性を保つための基盤となっている。特に、5G技術の開発と普及におけるリーダーシップは、クアルコムの最大の強みの一つとなる。

特許からみた競合との優位性は?

特許ポートフォリオの観点から見たクアルコムの競合との優位性をまとめると、

- クアルコムは、無線通信技術に関連する広範な特許を保有。これには3G、4G、5G通信技術に関する基本的な特許が含まれており、これらの特許は業界標準の多くに不可欠である。

- クアルコムはCDMA技術の開発者として知られており、その後の3G、4G、5Gの基礎技術に関する重要な特許を多数保有している。これらの特許は、無線通信技術の進化において重要な役割を果たしている。

- クアルコムは、自社の特許を他の企業にライセンスすることで収益を上げている。このビジネスモデルは、クアルコムに安定した収入源を提供し、研究開発への再投資を可能にしている。

- クアルコムの特許は、無線通信の業界標準を形成する上で重要な役割を果たしており、業界の方向性に影響を与えることができる。

- クアルコムは、特許に関する訴訟や交渉においても強みを持っており、競合他社との間で有利な立場を確保し、市場での地位を強化している。

これらの要素は、クアルコムが特許ポートフォリオを通じて競合他社と差別化し、市場での優位性を保つための基盤となっている。

特に、無線通信技術の基礎となる特許の保有は、クアルコムにとって大きな強みとなる。

クアルコム(QCOM)の現在株価

クアルコムの株価チャート(TradingView)を表示しています。

チャートには、RSI(Relative Strength Index)を表示しています。相場の過熱感の指標として参考。

※RSIが70%~80%を超えると買われ過ぎ、反対に20%~30%を割り込むと売られ過ぎの目安。

クアルコムの業績について

まずは、クアルコム(QCOM)の最低限の業績分析を行なうための、以下の4つの指標を確認していきます。

- 売上:企業の業績と成長しているかを見る指標。

- 営業キャッシュフローと営業キャッシュフローマージン:企業がサービスからどれくらい現金を生み出しているかを見る指標。マージンはその比率で15%あると優良とされる。

- 営業利益:企業が主力の事業で稼いだ利益。企業の業績を評価する指標。

- EPS:1株当たり純利益で企業の稼ぐ力「収益力」と「成長性」を見る指標。数値が高いほど収益力が高い。

各データは、Investing.com、TradingViewより参照。

クアルコム(QCOM)の四半期:売上推移

四半期ごとの売上予測と実績値、対前年比の推移です。

| 年度(四半期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2022:Q1 | 10440 | 10700 | — | |

| 2022:Q2 | 10630 | 11160 | — | |

| 2022:Q3 | 10860 | 10930 | — | |

| 2022:Q4 | 11360 | 11390 | — | |

| 2023:Q1 | 9600 | 9460 | -11.59% | |

| 2023:Q2 | 9090 | 9270 | -16.94% | |

| 2023:Q3 | 8510 | 8440 | -22.78% | |

| 2023:Q4 | 8510 | 8670 | -23.88% | |

| 2024:Q1 | 9510 | 9920 | 4.86% | |

| 2024:Q2 | 9350 | 9390 | 1.29% | |

| 2024:Q3 | 9210 | 9390 | 11.26% | |

| 2024:Q4 | 9900 | 10240 | 18.11% | |

| 2025:Q1 | 10910 | 11670 | 17.64% | |

| 2025:Q2 | 10640 | 10840 | 15.44% | |

| 2025:Q3 | — | 10330 | 10370 | 10.44% |

| 2025:Q4 | — | 10760 | — | — |

| 2026:Q1 | — | 11570 | — | — |

| 2026:Q2 | — | 10930 | — | — |

| 2026:Q3 | — | 10760 | — | — |

| 単位:百万ドル | ||||

クアルコム(QCOM)の四半期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

- 営業CF: 本業で稼いだ現金の総額。

- フリーCF: 企業が自由に使えるお金。企業の本当の稼ぐ力。

- 営業CFマージン:稼ぐ効率を示す指標。売上の何%が現金として残るか。(15%以上で優良)

| 年度(四半期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2022:Q1 | 2060 | 19.25% | 1470 | |

| 2022:Q2 | 2700 | 24.19% | 2210 | |

| 2022:Q3 | 2900 | 26.53% | 2340 | |

| 2022:Q4 | 1450 | 12.73% | 812 | |

| 2023:Q1 | 3100 | 32.77% | 2700 | |

| 2023:Q2 | 1460 | 15.75% | 1000 | |

| 2023:Q3 | 2660 | 31.52% | 2350 | |

| 2023:Q4 | 4090 | 47.17% | 3800 | |

| 2024:Q1 | 2950 | 29.74% | 2730 | |

| 2024:Q2 | 3550 | 37.81% | 3370 | |

| 2024:Q3 | 3050 | 32.48% | 2670 | |

| 2024:Q4 | 2650 | 25.88% | 2390 | |

| 2025:Q1 | 4590 | 39.33% | 4310 | |

| 2025:Q2 | 2550 | 23.52% | 2340 | |

| 2025:Q3 | — | 2880 | 27.77% | 2580 |

| 単位:百万ドル | ||||

クアルコム(QCOM)の四半期:営業利益推移

四半期ごとの営業利益と営業利益率の推移です。

- 営業利益: 本業で稼ぐチカラを示す最重要の利益。

| 年度(四半期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2022:Q1 | 3860 | 36.07% | |

| 2022:Q2 | 3860 | 34.59% | |

| 2022:Q3 | 3410 | 31.20% | |

| 2022:Q4 | 3670 | 32.22% | |

| 2023:Q1 | 2540 | 26.85% | |

| 2023:Q2 | 2300 | 24.81% | |

| 2023:Q3 | 1820 | 21.56% | |

| 2023:Q4 | 1990 | 22.95% | |

| 2024:Q1 | 2900 | 29.23% | |

| 2024:Q2 | 2340 | 24.92% | |

| 2024:Q3 | 2300 | 24.49% | |

| 2024:Q4 | 2710 | 26.46% | |

| 2025:Q1 | 3560 | 30.51% | |

| 2025:Q2 | 3120 | 28.78% | |

| 2025:Q3 | — | 2760 | 26.62% |

| 単位:百万ドル | |||

クアルコム(QCOM)の四半期:EPS推移

四半期ごとのEPS予測とEPS実績値の推移です。

| 年度(四半期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2022:Q1 | 3.01 | 3.23 | 0.22 | |

| 2022:Q2 | 2.95 | 3.21 | 0.26 | |

| 2022:Q3 | 2.89 | 2.96 | 0.07 | |

| 2022:Q4 | 3.13 | 3.13 | 0 | |

| 2023:Q1 | 2.36 | 2.37 | 0.01 | |

| 2023:Q2 | 2.15 | 2.15 | 0 | |

| 2023:Q3 | 1.81 | 1.87 | 0.06 | |

| 2023:Q4 | 1.91 | 2.02 | 0.11 | |

| 2024:Q1 | 2.37 | 2.75 | 0.38 | |

| 2024:Q2 | 2.33 | 2.44 | 0.11 | |

| 2024:Q3 | 2.25 | 2.33 | 0.08 | |

| 2024:Q4 | 2.56 | 2.69 | 0.13 | |

| 2025:Q1 | 2.96 | 3.41 | 0.45 | |

| 2025:Q2 | 2.82 | 2.85 | 0.03 | |

| 2025:Q3 | — | 2.71 | 2.77 | 0.06 |

| 2025:Q4 | — | 2.87 | — | — |

| 2026:Q1 | — | 3.3 | — | — |

| 2026:Q2 | — | 2.94 | — | — |

| 2026:Q3 | — | 2.86 | — | — |

| 単位:百万ドル | ||||

クアルコム(QCOM)の通期:売上推移

通期の売上予測と実績値、対前年比の推移です。

| 年度(通期) | 発表日 | 売上予測 | 売上実績 | 対前年比 |

|---|---|---|---|---|

| 2016年 | — | 23210 | 23510 | — |

| 2017年 | 23040 | 23230 | -1.19% | |

| 2018年 | 22450 | 22730 | -2.15% | |

| 2019年 | 19290 | 19400 | -14.65% | |

| 2020年 | 21100 | 21650 | 11.60% | |

| 2021年 | 33020 | 33470 | 54.60% | |

| 2022年 | 44100 | 44170 | 31.97% | |

| 2023年 | 35690 | 35830 | -18.88% | |

| 2024年 | 38600 | 38940 | 8.68% | |

| 2025年 | — | 43660 | — | — |

| 2026年 | — | 44590 | — | — |

| 2027年 | — | 46070 | — | — |

| 2028年 | — | 47160 | — | — |

| 単位:百万ドル | ||||

クアルコム(QCOM)の通期:キャッシュフロー推移

四半期ごとの営業CFと、営業CFマージン、フリーCFの推移です。

| 年度(通期) | 発表日 | 営業CF | 営業CFマージン | フリーCF |

|---|---|---|---|---|

| 2016年 | — | 7400 | 31.48% | 6860 |

| 2017年 | 4690 | 20.19% | 4000 | |

| 2018年 | 3910 | 17.20% | 3120 | |

| 2019年 | 7290 | 37.58% | 6400 | |

| 2020年 | 5810 | 26.84% | 4410 | |

| 2021年 | 10540 | 31.49% | 8650 | |

| 2022年 | 9100 | 20.60% | 6830 | |

| 2023年 | 11300 | 31.54% | 9850 | |

| 2024年 | 12200 | 31.33% | 11160 | |

| 単位:百万ドル | ||||

クアルコム(QCOM)の通期:営業利益推移

通期の営業利益と営業利益率の推移です。

| 年度(通期) | 発表日 | 営業利益 | 営業利益率 |

|---|---|---|---|

| 2016年 | — | 6810 | 28.97% |

| 2017年 | 5080 | 21.87% | |

| 2018年 | 3760 | 16.54% | |

| 2019年 | 8080 | 41.65% | |

| 2020年 | 6230 | 28.78% | |

| 2021年 | 9790 | 29.25% | |

| 2022年 | 14800 | 33.51% | |

| 2023年 | 8650 | 24.14% | |

| 2024年 | 10250 | 26.32% | |

| 単位:百万ドル | |||

クアルコム(QCOM)の通期:EPS推移

通期のEPS予測とEPS実績値の推移です。

| 年度(通期) | 発表日 | EPS予測 | EPS実績 | 差 |

|---|---|---|---|---|

| 2016年 | — | 4.3 | 4.44 | 0.14 |

| 2017年 | 4.16 | 4.28 | 0.12 | |

| 2018年 | 3.61 | 3.69 | 0.08 | |

| 2019年 | 3.47 | 3.54 | 0.07 | |

| 2020年 | 3.92 | 4.19 | 0.27 | |

| 2021年 | 8.29 | 8.54 | 0.25 | |

| 2022年 | 12.52 | 12.53 | 0.01 | |

| 2023年 | 8.31 | 8.43 | 0.12 | |

| 2024年 | 10.08 | 10.22 | 0.14 | |

| 2025年 | — | 11.83 | — | — |

| 2026年 | — | 12.13 | — | — |

| 2027年 | — | 12.72 | — | — |

| 2028年 | — | 13.3 | — | — |

| 単位:百万ドル | ||||

クアルコムの今後の展開と将来性は?

クアルコムの将来性は、以下の要因により非常に有望と考えられる。

スマホ需要の改善

2023年に続いていたスマートフォンの販売低迷が緩和され、スマホ需要が回復傾向となり、見通しは改善。アップルとのチップセット供給の新契約も2026年まで続く。

5G技術のリーダーシップ

クアルコムは5G通信技術の開発において先駆者であり、この分野でのリーダーシップは今後も継続すると予想される。5Gは次世代の通信技術として、スマートフォン、IoTデバイス、自動車産業など幅広い分野に影響を与えるため、クアルコムの成長に大きく貢献すると見られている。

AIと半導体技術の進展

AI技術と半導体の進化により、クアルコムの製品とソリューションはますます重要になっている。特に、オンデバイスAI技術の発展は、スマートフォンやIoTデバイスの性能向上に寄与している。

自動運転技術の成長

自動運転車の市場は急速に成長しており、クアルコムはSnapdragon Ride Platformなどを通じてこの分野で重要な役割を果たしている。自動運転技術の進展は、クアルコムの将来の成長機会を拡大すると予想される。

多様な市場への展開

クアルコムは、スマートフォンだけでなく、自動車、ウェアラブルデバイス、IoTデバイスなど、多様な市場に製品を提供しており、市場の変化に対して柔軟に対応できると同時に、新たな成長機会を探求できる。

強固な特許ポートフォリオ

クアルコムは、通信技術に関連する広範な特許ポートフォリオを持っており、これが同社の競争力と収益源の一つ。

これらの要因を総合すると、クアルコムは技術革新の最前線に立ち、今後も成長を続ける可能性が高いと考えられる。

ただし、市場の変動、競争の激化、政治的・経済的要因など、外部環境の変化による影響も考慮する必要がある。

クアルコム(QCOM)の2024年通期の決算サマリー

売上高と収益

- 年間売上高: 389億6,200万ドルで、前年同期比9%増加。主要収益源であるQCT(Qualcomm CDMA Technologies)とQTL(Qualcomm Technology Licensing)の両部門が成長。

- GAAP純利益: 101億4,200万ドルで、前年同期の72億3,200万ドルから40%増加。1株あたりのGAAP EPSは8.97ドル。

- Non-GAAP純利益: 115億4,500万ドルで、1株あたりのNon-GAAP EPSは10.22ドル。前年の8.43ドルを上回る結果。

部門別の成長

- QCT部門: 売上高は331億9,600万ドルで、前年同期比9%増加。特に自動車向けチップの売上が55%増加し、引き続き成長ドライバー。

- QTL部門: 売上高は55億7,200万ドルで、前年同期比5%増。ライセンス収入が安定的に増加。

キャッシュフローと株主還元

- 営業キャッシュフロー: 122億ドルで、前年同期の約113億ドルから増加。

- 株主還元: 通年で78億ドルを株主に還元し、新たに150億ドルの自社株買いプログラムも承認。

将来ガイダンス

- 第1四半期売上予測: 売上は105億ドルから113億ドルを見込み、QCT部門が主な成長を牽引する見込み。

- EPS予測: GAAPベースで1株あたり2.39ドルから2.59ドル、Non-GAAPベースで2.85ドルから3.05ドルを予想。

クアルコムは、スマートフォンや自動車向けの需要増加とともに、今後もAIおよび次世代通信技術を活用した成長を目指している。

クアルコム(QCOM)の2024年Q3の決算サマリー

売上高と収益

- 売上高: 総売上高は93億9,300万ドルで、前年同期比11%増加。特にスマートフォン用のチップセット(QCT部門)が引き続き主要な収益源。

- GAAP純利益: 21億2,900万ドルで、前年同期の18億300万ドルから18%増加。1株当たりのGAAP EPSは1.88ドル。

- Non-GAAP純利益: 26億4,800万ドル、前年同期比で26%増加。1株当たりのNon-GAAP EPSは2.33ドルと堅調。

セグメント別業績

- QCT(Qualcomm CDMA Technologies)部門: 売上は80億6,900万ドルで前年同期比12%増。特に自動車向け売上が87%増加し、他の業種の成長を大きく上回る。

- QTL(Qualcomm Technology Licensing)部門: 売上は12億7,300万ドルで前年同期比3%増加。ライセンス収入も安定。

事業ハイライト

- スマートフォンと自動車市場での成長: 特にSnapdragon XシリーズのPC向けチップセットが注目され、性能と効率の改善が評価されている。

- 株主還元: 第3四半期には23億ドルの株主還元が実施され、949百万ドルの配当金と13億ドルの自社株買いが含まれる。

キャッシュフローと財務

- 営業キャッシュフロー: 約95億ドルで前年同期比増加。強力なキャッシュフローにより、今後の成長投資と株主還元を支える資金基盤が確保されている。

- 現金及び現金同等物: 77億7,000万ドルの現金を保持し、引き続き安定した財務基盤を示す。

将来ガイダンス

- 第4四半期売上予測: 売上は95億ドルから103億ドルを予測し、引き続き成長見込み。特にQCT部門の成長が期待され、8.1億ドルから8.7億ドルの売上が見込まれる。

- EPS予測: GAAP EPSは2.38ドルから2.58ドル、Non-GAAP EPSは2.45ドルから2.65ドルを予想。

クアルコムは、今後もAIと次世代通信技術を駆使したスマートフォンおよび自動車向け市場での成長を加速する方針を維持。

クアルコム(QCOM)の2024年Q2の決算サマリー

- 売上高:94億ドルで、前年同期比で1%増加。

- 純利益:GAAP(一般に認められた会計原則)基準で23.26億ドル、前年同期比で37%増。非GAAP基準で27.61億ドル、前年同期比で14%増。

- 一株当たり純利益 (EPS):GAAP基準で2.06ドル、前年同期比で36%増。非GAAP基準で2.44ドル、前年同期比で13%増。

事業セグメントのパフォーマンス

- QCT(Qualcomm CDMA Technologies):

- 売上高は80.26億ドルで、前年同期比1%増。

- 自動車部門の売上は前年比35%増の6.03億ドル。

- IoT(モノのインターネット)部門は前年比11%減の12.43億ドル。

- QTL(Qualcomm Technology Licensing):

- 売上高は13.18億ドルで、前年同期比2%増。

その他

- 現金配当を年間3.40ドルに増額。

- 自動車部門の設計勝ち取りパイプラインが約450億ドルに達した。

- 第2四半期には株主への還元として合計16億ドルを実施(配当の支払いと株式の買い戻しを含む)。

今後の展望

- 第3四半期の売上は88億ドルから96億ドルを見込む。

- GAAP基準の一株当たり純利益は1.74ドルから1.94ドル、非GAAP基準で2.15ドルから2.35ドルを予測。

この決算内容から、クアルコムは引き続き自動車部門やその他の分野で成長していることを示しており、特に自動車部門の強化が目立つ。

クアルコム(QCOM)の2024年Q1の決算サマリー

- 売上高:99.35億ドルで、前年同期の94.63億ドルから5%増加。

- 純利益:GAAP(一般に認められた会計原則)基準で27.67億ドル、前年同期の22.35億ドルから24%増。非GAAP基準で31.01億ドル、前年同期の26.84億ドルから16%増。

- 一株当たり純利益 (EPS):GAAP基準で2.46ドル、前年同期の1.98ドルから24%増。非GAAP基準で2.75ドル、前年同期の2.37ドルから16%増。

事業セグメントのパフォーマンス

- QCT(Qualcomm CDMA Technologies):

- 売上高は84.23億ドルで、前年同期の78.92億ドルから7%増。

- 自動車部門の売上は前年比31%増の5.98億ドル。

- IoT(モノのインターネット)部門は前年比32%減の11.38億ドル。

- QTL(Qualcomm Technology Licensing):

- 売上高は14.60億ドルで、前年同期の15.24億ドルから4%減。

その他の情報

- 現金配当と株式の買い戻しで株主に合計17億ドルを還元。

- 第1四半期には記録的な自動車部門の売上を達成。

今後の展望

- 第2四半期の売上は89億ドルから97億ドルを見込む。

- GAAP基準の一株当たり純利益は1.73ドルから1.93ドル、非GAAP基準で2.20ドルから2.40ドルを予測。

この決算内容から、クアルコムが継続的に成長を遂げており、特に自動車部門での顕著な成長が見られることを示している。

クアルコム(QCOM)の2023年通期の決算サマリー

2023年第4四半期の結果

- 収益: $8,631百万ドル(前年同期比24%減)

- 税引前利益 (EBT):GAAPベースで$1,420百万ドル(前年同期比59%減)、非GAAPベースで$2,617百万ドル(前年同期比37%減)

- 純利益:GAAPベースで$1,489百万ドル(前年同期比48%減)、非GAAPベースで$2,277百万ドル(前年同期比36%減)

- 1株当たり利益 (EPS):GAAPベースで$1.32(前年同期比48%減)、非GAAPベースで$2.02(前年同期比35%減)

2023年度の結果

- 年間収益:$35,820百万ドル(前年比19%減)

- 年間税引前利益 (EBT):GAAPベースで$7,443百万ドル(前年比50%減)、非GAAPベースで$11,070百万ドル(前年比33%減)

- 年間純利益:GAAPベースで$7,232百万ドル(前年比44%減)、非GAAPベースで$9,486百万ドル(前年比33%減)

- 年間1株当たり利益 (EPS):GAAPベースで$6.42(前年比44%減)、非GAAPベースで$8.43(前年比33%減)

その他の注目点

- リストラ関連費用:2023年度のGAAP結果には、リストラとリストラ関連の費用として$427百万ドル(四半期)および$723百万ドル(年間)が含まれてる。

- 欧州委員会による罰金の逆転:2022年度のGAAP結果には、欧州委員会による2018年度の罰金の逆転による$1.1億ドルの利益が含まれている。

クアルコム(QCOM)の株を買える証券会社は?

クアルコムの株を取り扱っている主要な証券会社をリストアップしました。これらの証券会社では、外国株として直接の株取引のほか、CFD(差金決済取引)としての投資も選択できます。

私自身はSBI証券を主に使用していますが、取り扱い銘柄によっては購入できない場合があります。その際は、サクソバンク証券やIG証券などでCFDを利用することもあります。

| 人気の証券会社 | 株取引 | CFD取引 |

|---|---|---|

| SBI証券 | ◯ | ✕ |

| 松井証券 | ◯ | ✕ |

| 楽天証券 | ◯ | ✕ |

| マネックス証券 | ◯ | ✕ |

| auカブコム証券 | ◯ | ✕ |

| DMM株 | ◯ | ✕ |

| サクソバンク証券 | ◯ | ◯ |

| IG証券 | ✕ | ◯ |

| GMOクリック証券 | ✕ | ◯ |

| moomoo証券 | ◯ | ✕ |

まとめ

クアルコムの技術革新、市場での競争力、そして特に自動運転市場におけるその役割と将来性について深く掘り下げました。

クアルコムは、半導体業界において重要なプレイヤーであり、特に5G技術とAI半導体の分野でのリーダーシップを確立しています。

これらの技術は、自動運転車の発展に不可欠であり、クアルコムの将来性に大きな影響を与えると考えられます。

自動運転市場は、技術革新、安全性の向上、効率的な交通システムの実現という点で、今後数年間で大きな成長が見込まれています。

クアルコムは、Snapdragon® Digital ChassisやC-V2Xソリューションなど、自動運転技術の分野で重要な製品とソリューションを提供しており、この市場での大きな影響力を持っています。

これらの技術は、自動車メーカーが提供する安全で革新的な運転体験を強化し、自動運転車の普及を加速させる可能性があります。

クアルコムの今後の成長と成功は、自動運転市場の発展と密接に関連しています。

同社の先進的な技術、強固な特許ポートフォリオ、および市場での競争力は、自動運転の未来を形作る上で重要な役割を果たすでしょう。

クアルコムがこのダイナミックな市場でどのように進化し、成長していくかは、今後の注目点です。

私も活用中!moomoo証券の機能を最大限に引き出そう

私がmoomoo証券を使っていて最も気に入っている点は、アプリが使いやすく、投資において重要となる深い情報収集が簡単にできること。

さらに、大口や中口投資家の動向を確認できる機能があり、銘柄の先行きを考える上でとても助かっています。各銘柄のニュースや決算関連情報が豊富で、日本語自動翻訳もサポートしているため、海外の情報を即座にチェックできるのが嬉しいポイント。

米国株取引手数料もmoomoo証券が一番安いです。

興味のある方は、このバナーリンクから簡単に登録できます!